This version of the form is not currently in use and is provided for reference only. Download this version of

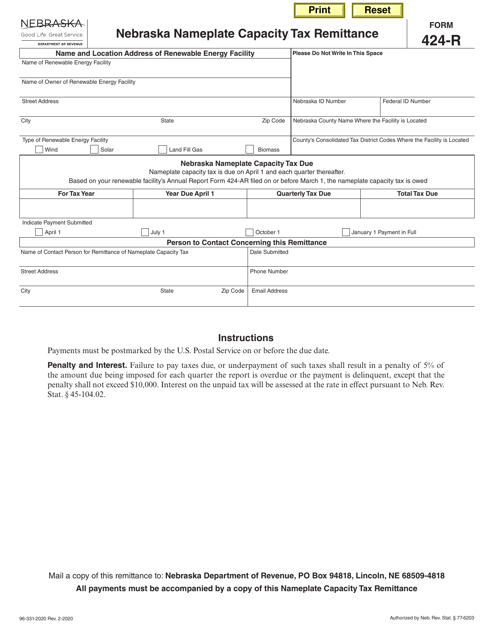

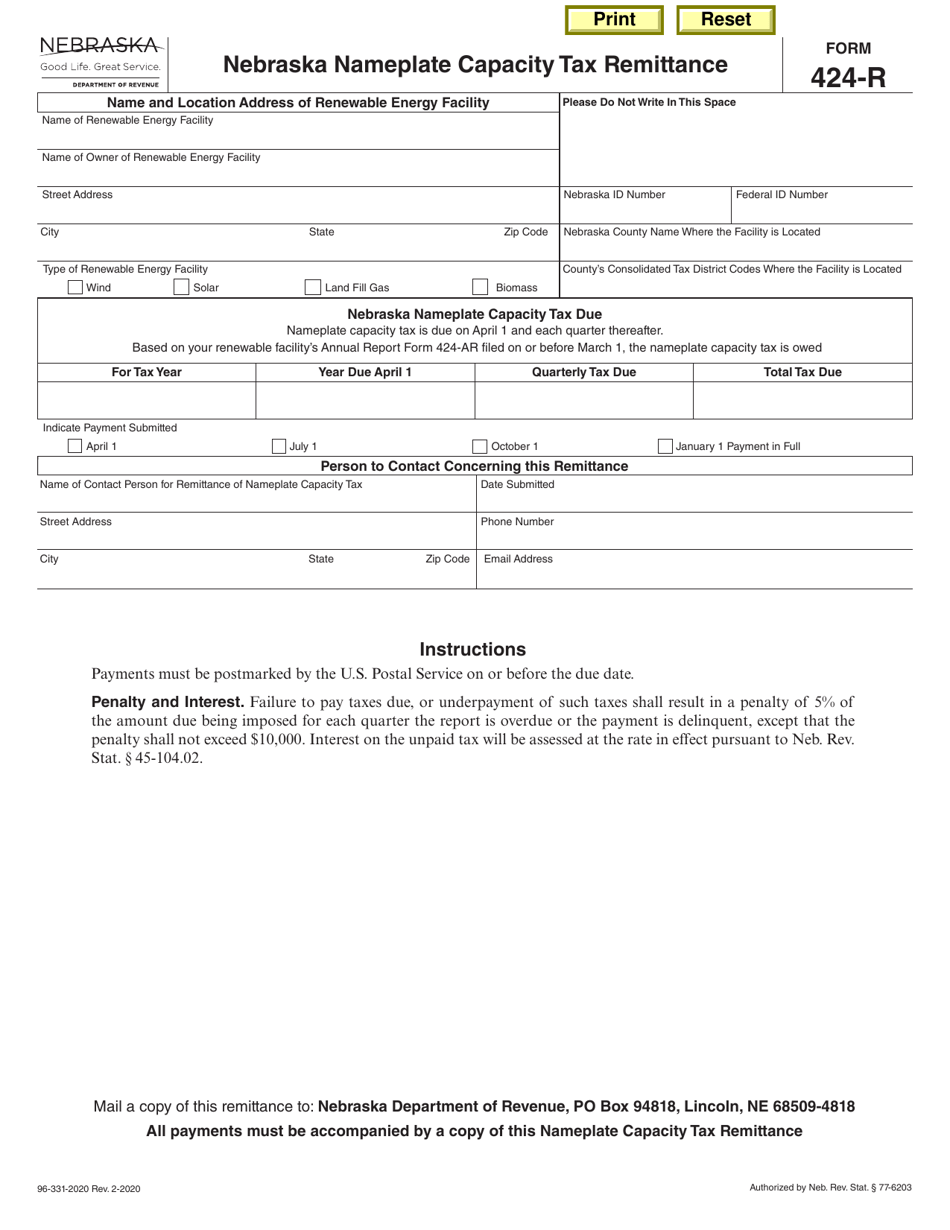

Form 424-R

for the current year.

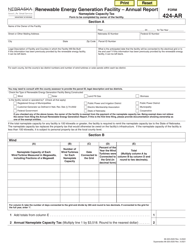

Form 424-R Nebraska Nameplate Capacity Tax Remittance - Nebraska

What Is Form 424-R?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 424-R?

A: Form 424-R is the Nebraska Nameplate Capacity Tax Remittance form.

Q: What is the purpose of Form 424-R?

A: The purpose of Form 424-R is to remit the Nebraska Nameplate Capacity Tax.

Q: Who needs to file Form 424-R?

A: Anyone in Nebraska who owns a power generation facility that has a nameplate capacity of at least one megawatt needs to file Form 424-R.

Q: When is Form 424-R due?

A: Form 424-R is due on or before February 1st of each year.

Q: Is there a penalty for late filing of Form 424-R?

A: Yes, there is a penalty for late filing of Form 424-R. The penalty is 10% of the tax due per month, up to a maximum of 100% of the tax due.

Q: What should I do if I need help filling out Form 424-R?

A: If you need help filling out Form 424-R, you can contact the Nebraska Department of Revenue for assistance.

Q: What information do I need to complete Form 424-R?

A: To complete Form 424-R, you will need information about your power generation facility, including its nameplate capacity, type, and location.

Q: Is there a fee for filing Form 424-R?

A: No, there is no fee for filing Form 424-R.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 424-R by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.