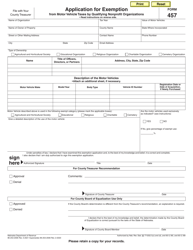

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 15

for the current year.

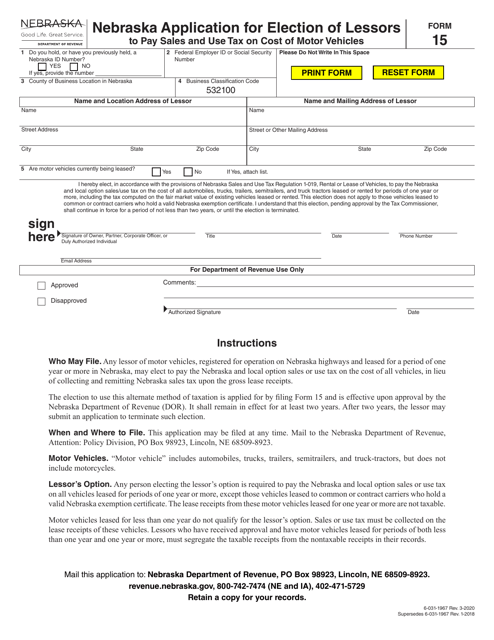

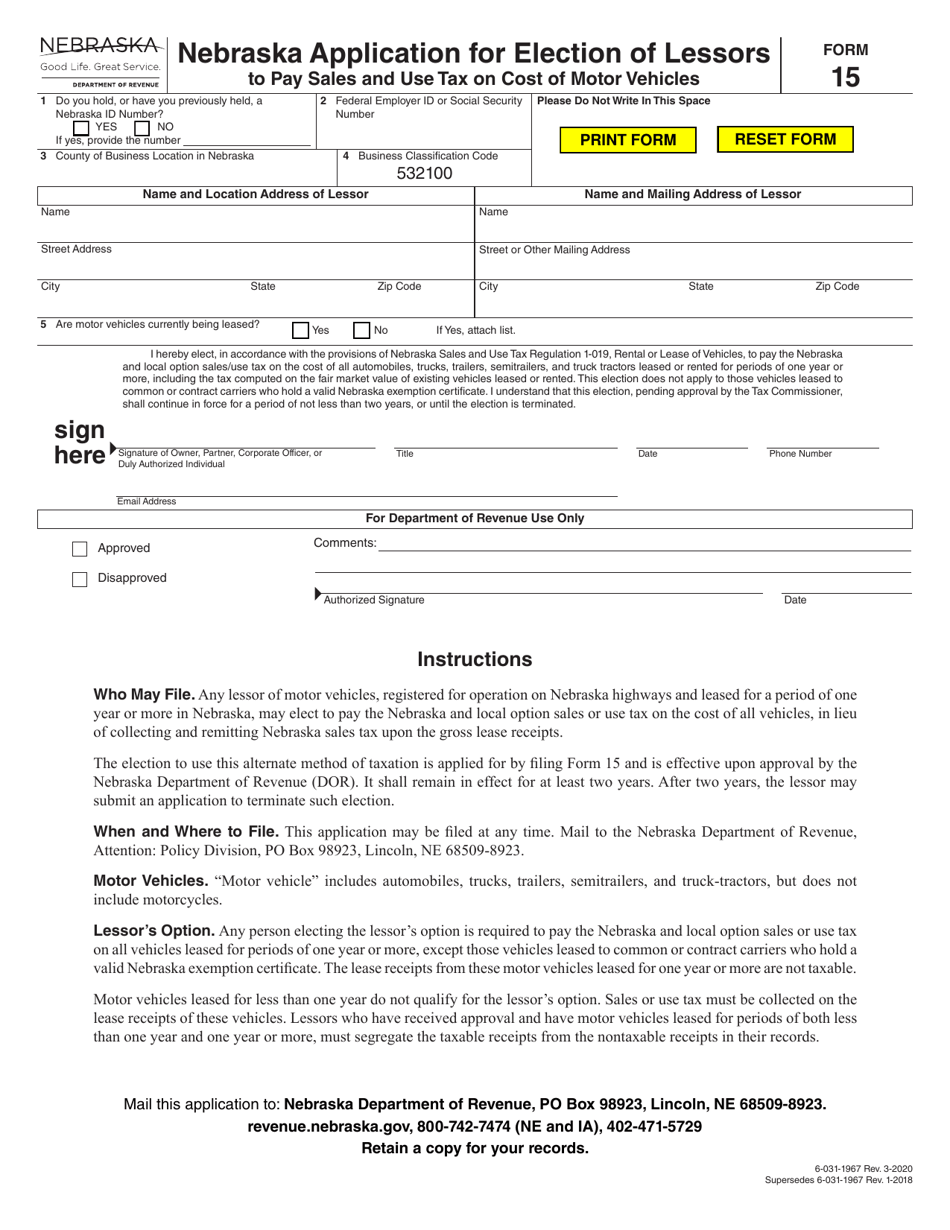

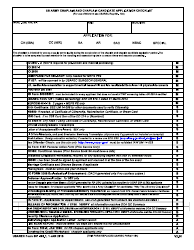

Form 15 Nebraska Application for Election of Lessors to Pay Sales and Use Tax on Cost of Motor Vehicles - Nebraska

What Is Form 15?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 15?

A: Form 15 is the Nebraska Application for Election of Lessors to Pay Sales and Use Tax on Cost of Motor Vehicles.

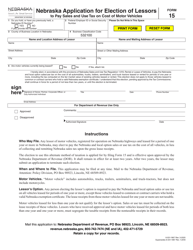

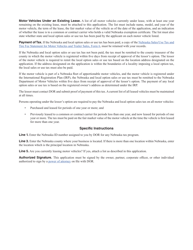

Q: What is the purpose of Form 15?

A: The purpose of Form 15 is to allow lessors to elect to pay sales and use tax on the cost of motor vehicles instead of collecting and remitting the tax from lessees.

Q: Who should use Form 15?

A: Lessors in Nebraska who want to elect to pay sales and use tax on the cost of motor vehicles should use Form 15.

Q: Is there a deadline to submit Form 15?

A: Form 15 should be submitted to the Nebraska Department of Revenue within 30 days of the date the motor vehicle lease starts.

Q: Are there any fees or payments associated with Form 15?

A: Yes, there is a $15 fee for each motor vehicle listed on Form 15.

Q: Can I make changes to Form 15 after submitting it?

A: No, you cannot make changes to Form 15 after it has been submitted. You will need to submit a new Form 15.

Q: What supporting documents should be included with Form 15?

A: You should include a copy of the lease agreement and a completed Schedule D – Motor Vehicle Information form with your Form 15.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 15 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.