This version of the form is not currently in use and is provided for reference only. Download this version of

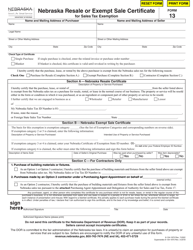

Form 9

for the current year.

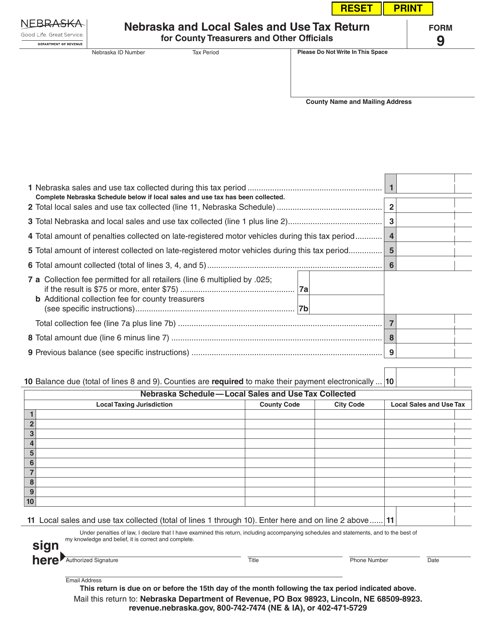

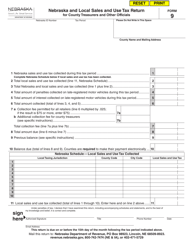

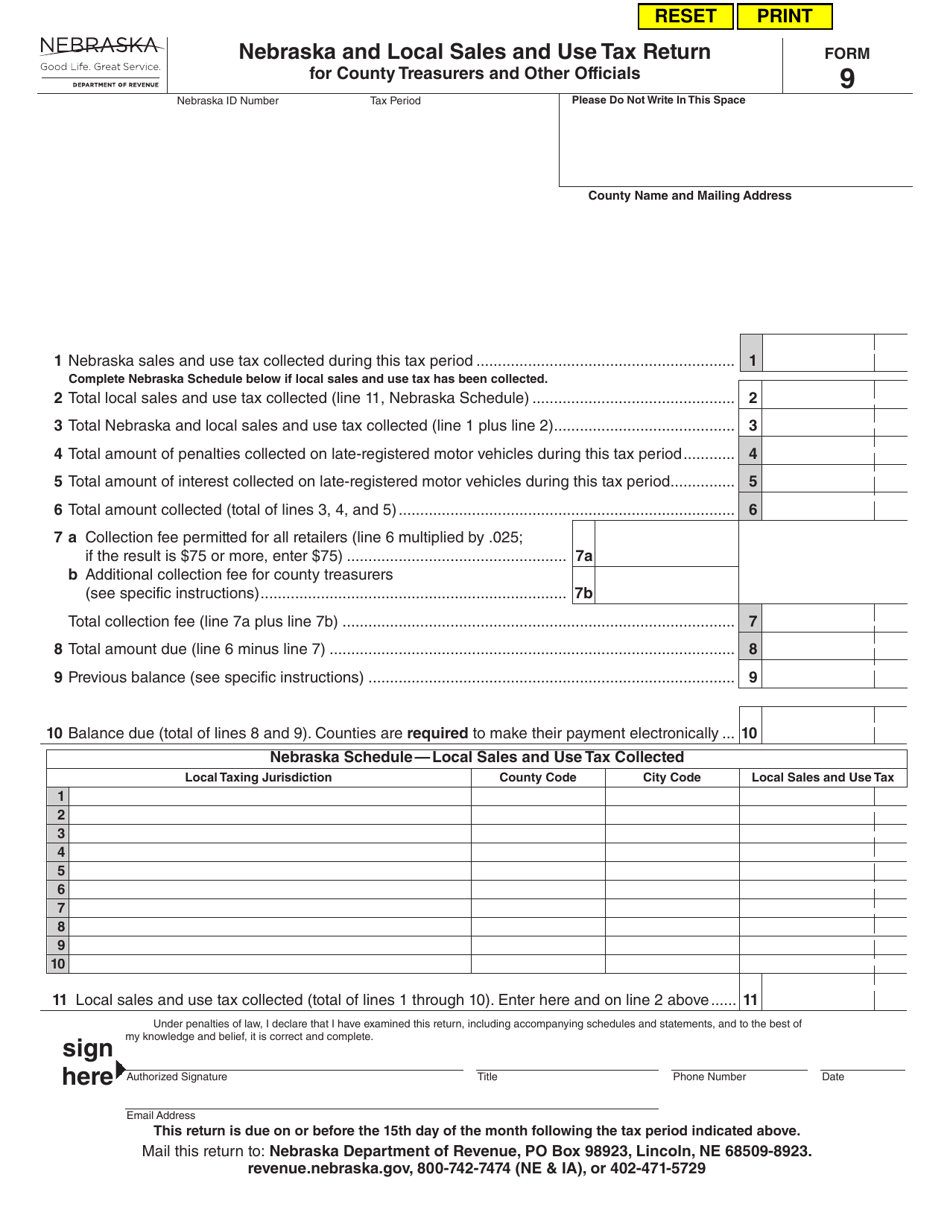

Form 9 Nebraska and Local Sales and Use Tax Return for County Treasurers and Other Officials - Nebraska

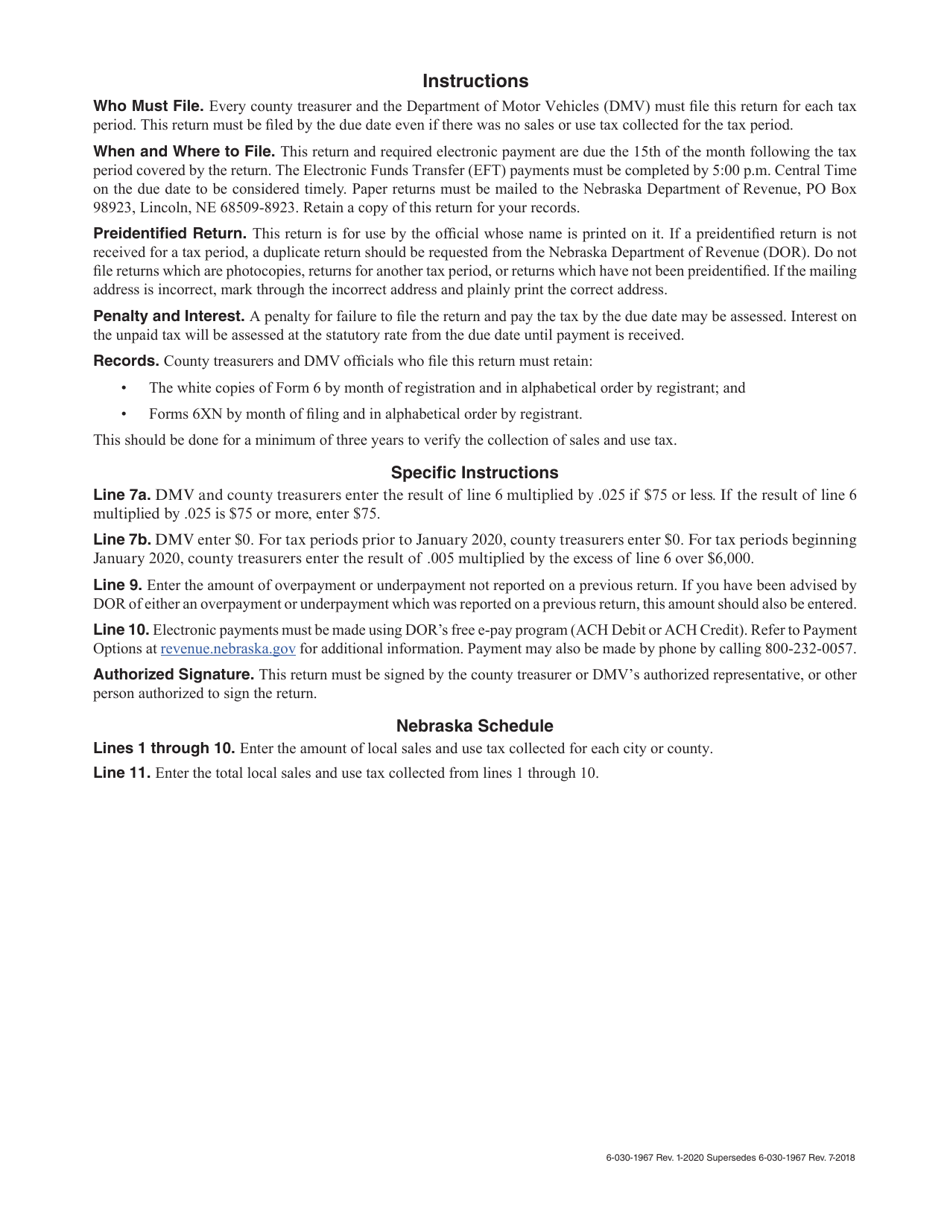

What Is Form 9?

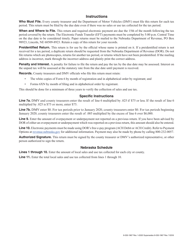

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 9?

A: Form 9 is the Nebraska and Local Sales and Use Tax Return for County Treasurers and Other Officials.

Q: Who needs to file Form 9?

A: Form 9 needs to be filed by County Treasurers and Other Officials in Nebraska.

Q: What is the purpose of Form 9?

A: The purpose of Form 9 is to report sales and use tax collected by County Treasurers and Other Officials.

Q: What information is required on Form 9?

A: Form 9 requires information about the total sales and use tax collected.

Q: When is Form 9 due?

A: Form 9 is due on or before the 25th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form 9?

A: Yes, there may be penalties for late filing of Form 9.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 9 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.