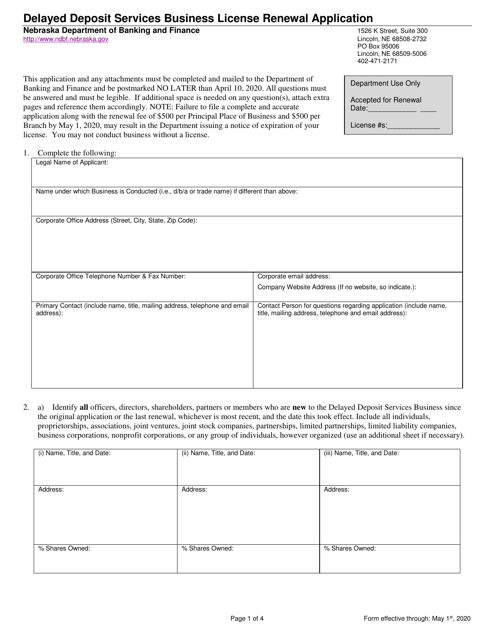

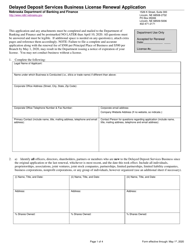

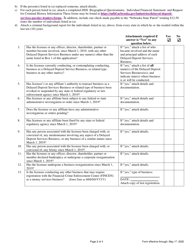

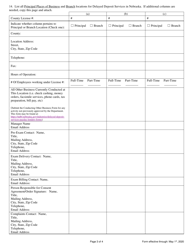

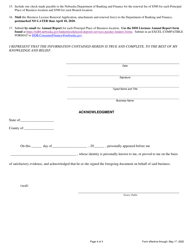

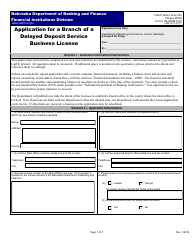

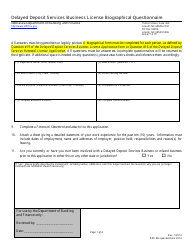

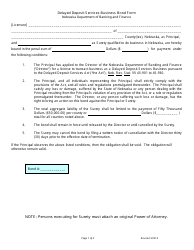

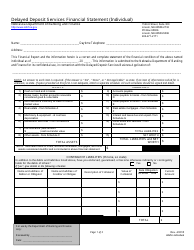

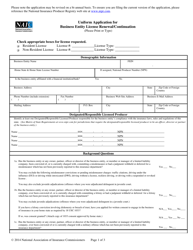

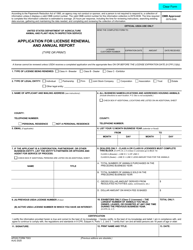

Delayed Deposit Services Business License Renewal Application - Nebraska

Delayed Deposit Services Business License Renewal Application is a legal document that was released by the Nebraska Department of Banking and Finance - a government authority operating within Nebraska.

FAQ

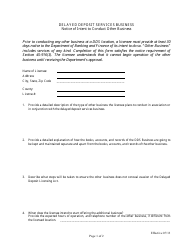

Q: What is a Delayed Deposit Services Business License?

A: A Delayed Deposit Services Business License is a license required to operate a business that provides short-term loans, commonly known as payday loans, in Nebraska.

Q: Who needs to renew their Delayed Deposit Services Business License?

A: Businesses providing short-term loans in Nebraska need to renew their Delayed Deposit Services Business License.

Q: When should I renew my Delayed Deposit Services Business License?

A: You should renew your Delayed Deposit Services Business License by the expiration date stated on the license.

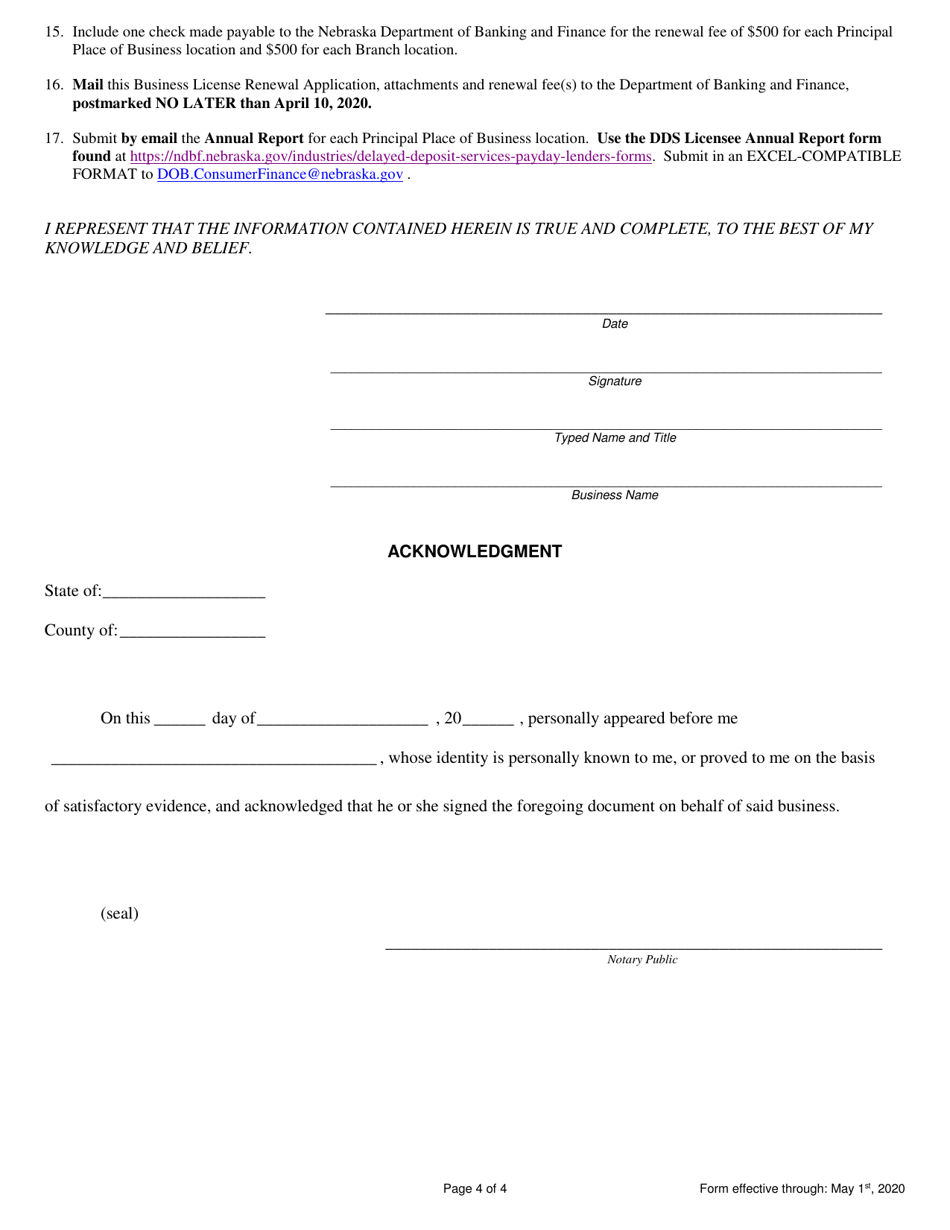

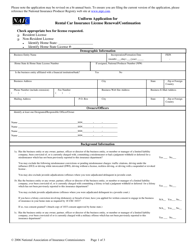

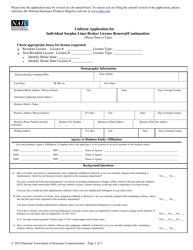

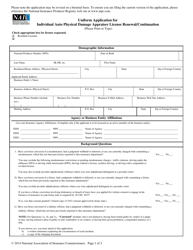

Q: How do I renew my Delayed Deposit Services Business License?

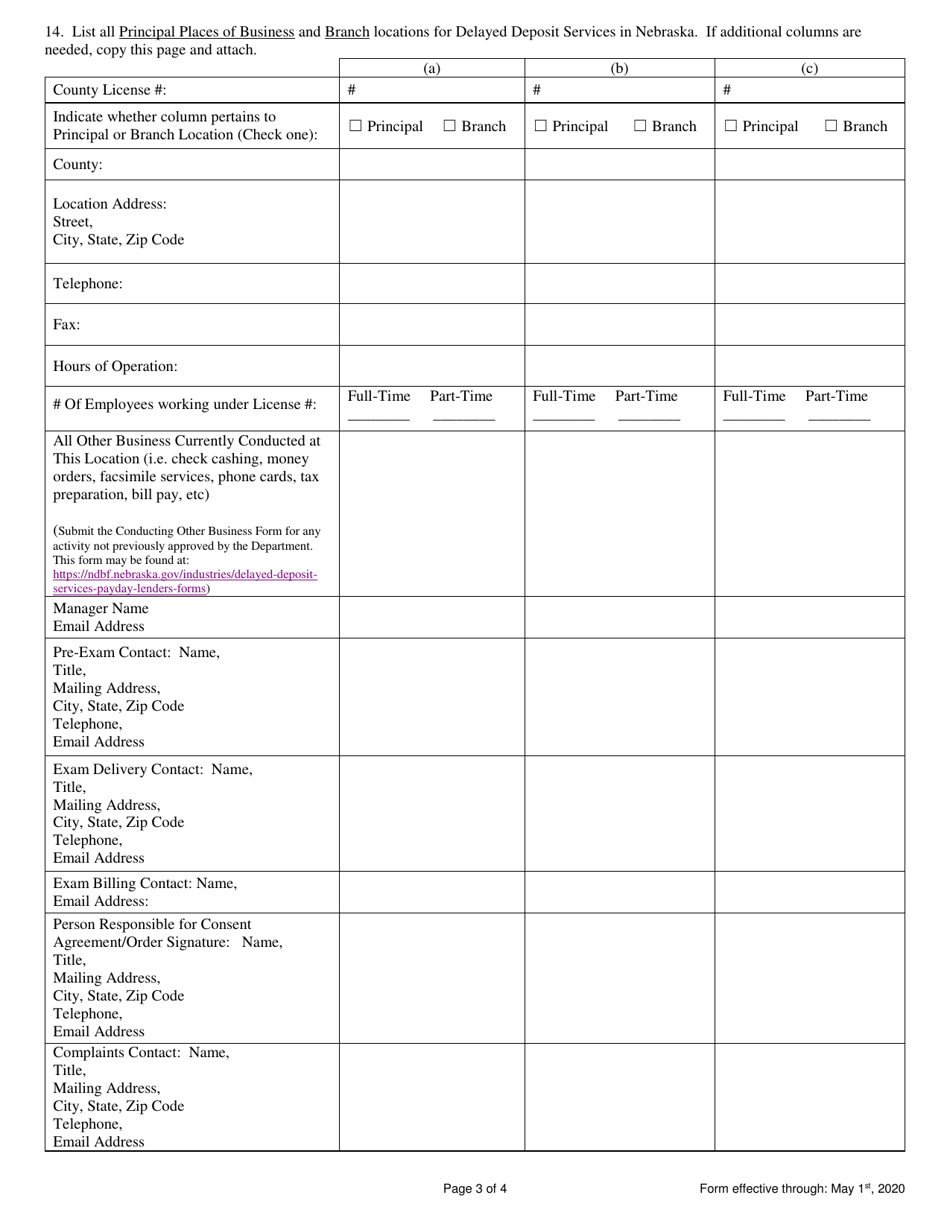

A: To renew your Delayed Deposit Services Business License, you need to submit a completed application form, along with the required fees and any supporting documents, to the Nebraska Department of Banking and Finance.

Q: What fees are involved in renewing a Delayed Deposit Services Business License?

A: The fees for renewing a Delayed Deposit Services Business License can vary, so it is recommended to check the fee schedule provided by the Nebraska Department of Banking and Finance.

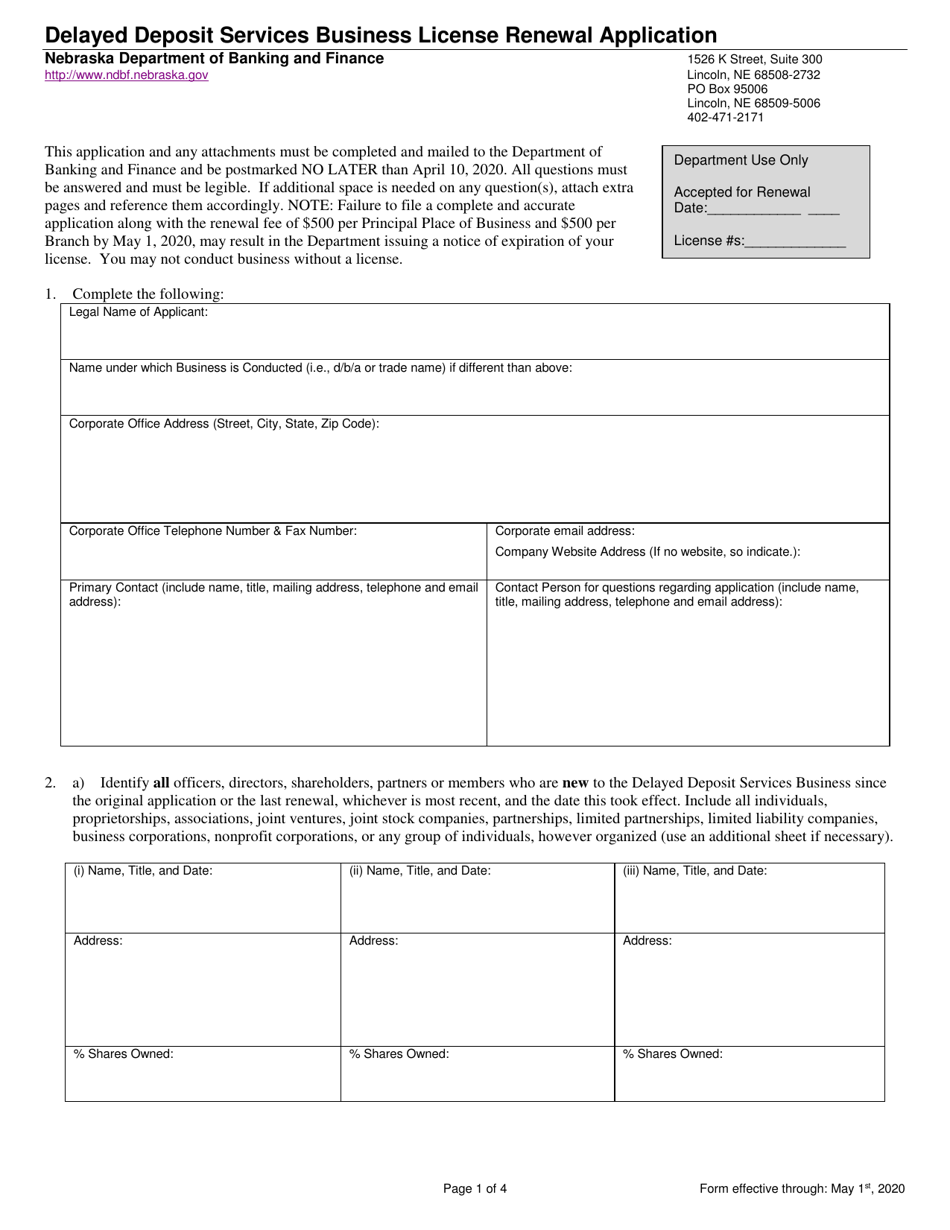

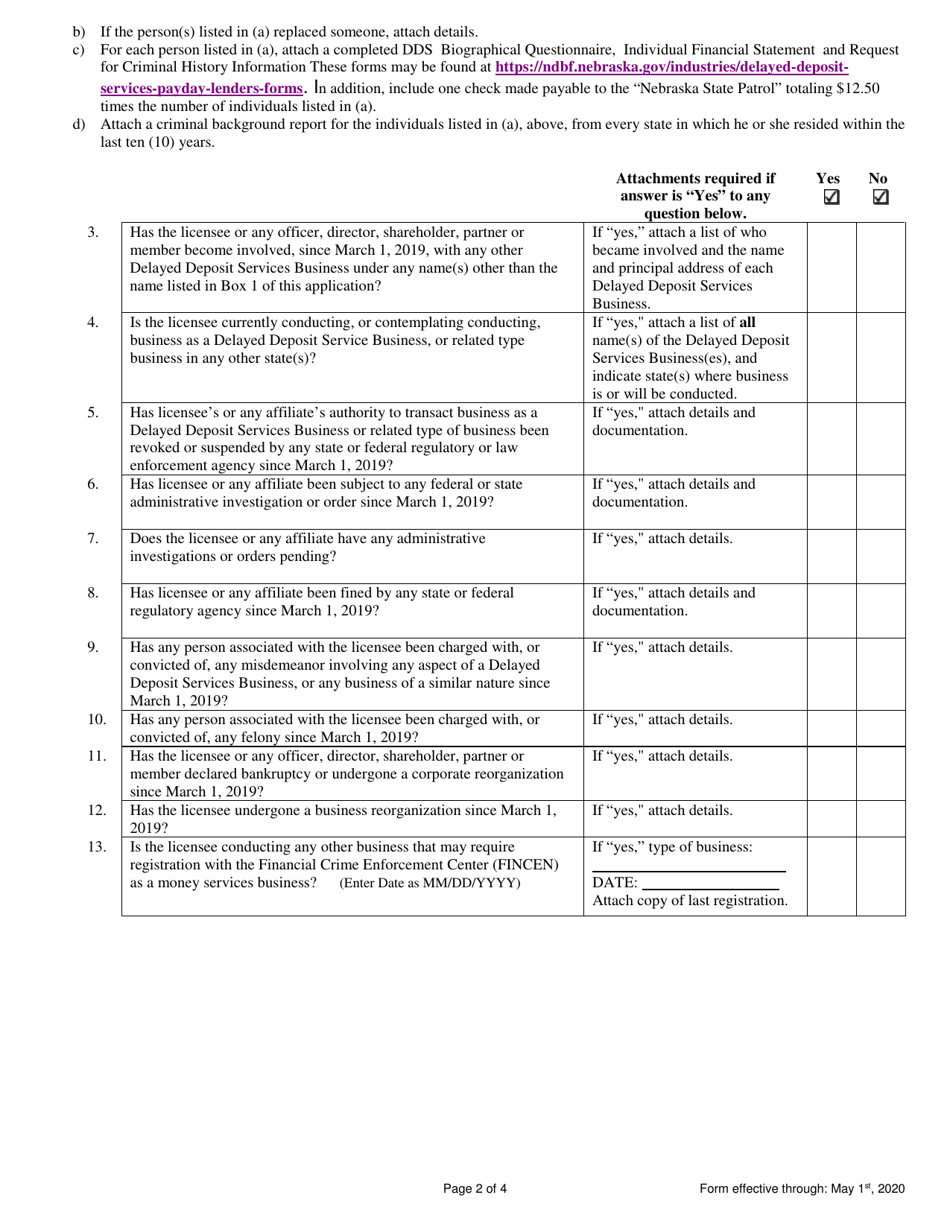

Q: What supporting documents do I need to submit with my Delayed Deposit Services Business License renewal application?

A: The specific supporting documents required for Delayed Deposit Services Business License renewal may vary, so it is important to review the application instructions and contact the Nebraska Department of Banking and Finance for a complete list of required documents.

Form Details:

- Released on May 1, 2020;

- The latest edition currently provided by the Nebraska Department of Banking and Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Banking and Finance.