This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2

for the current year.

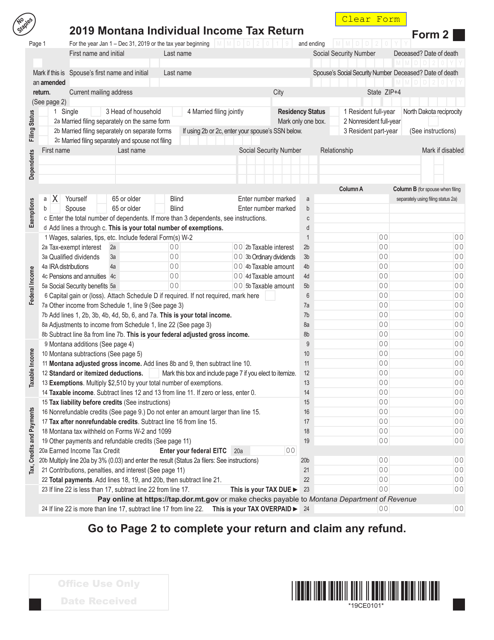

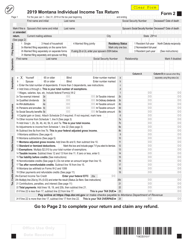

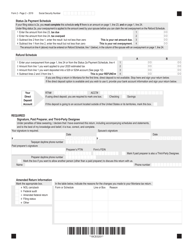

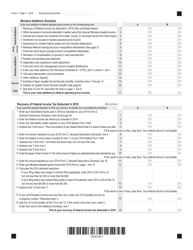

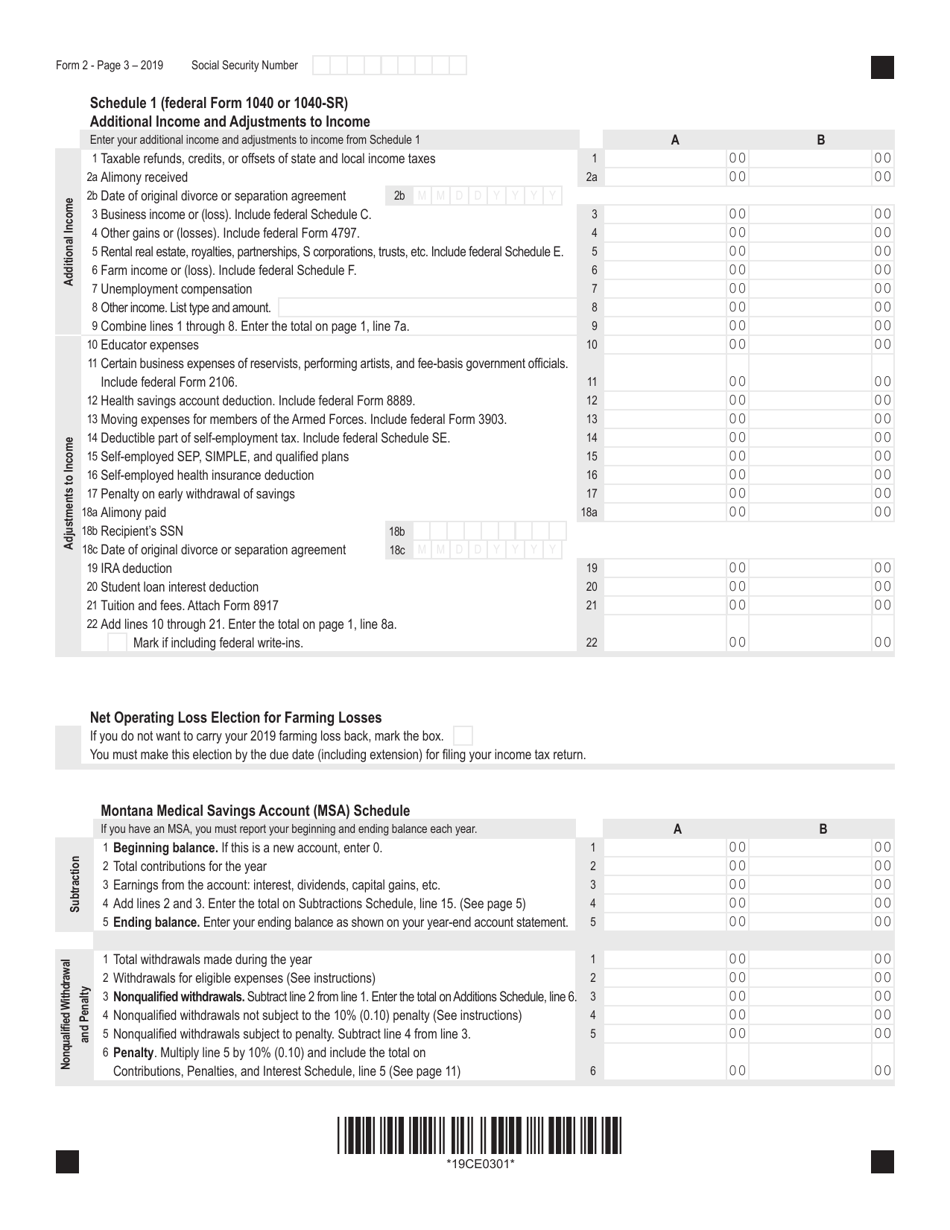

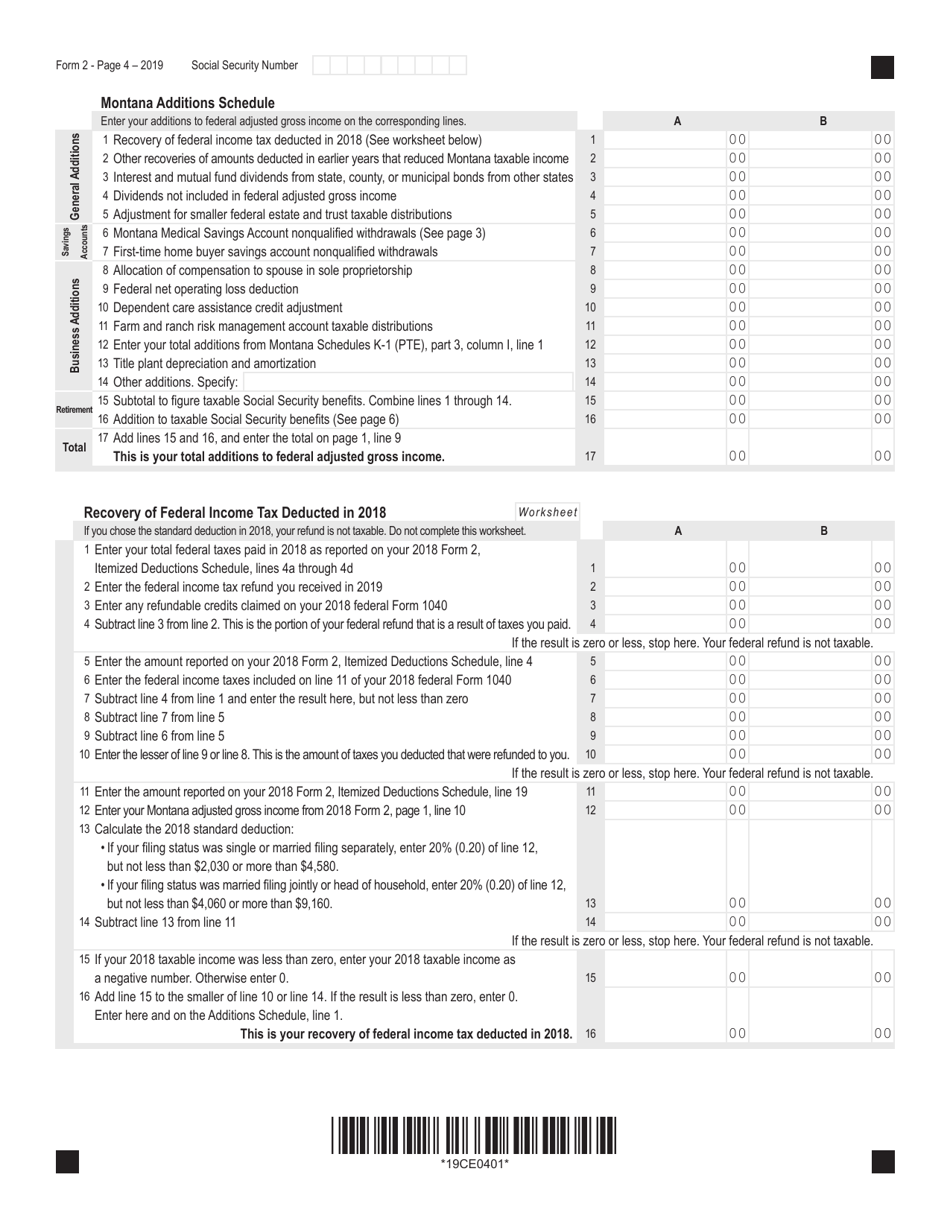

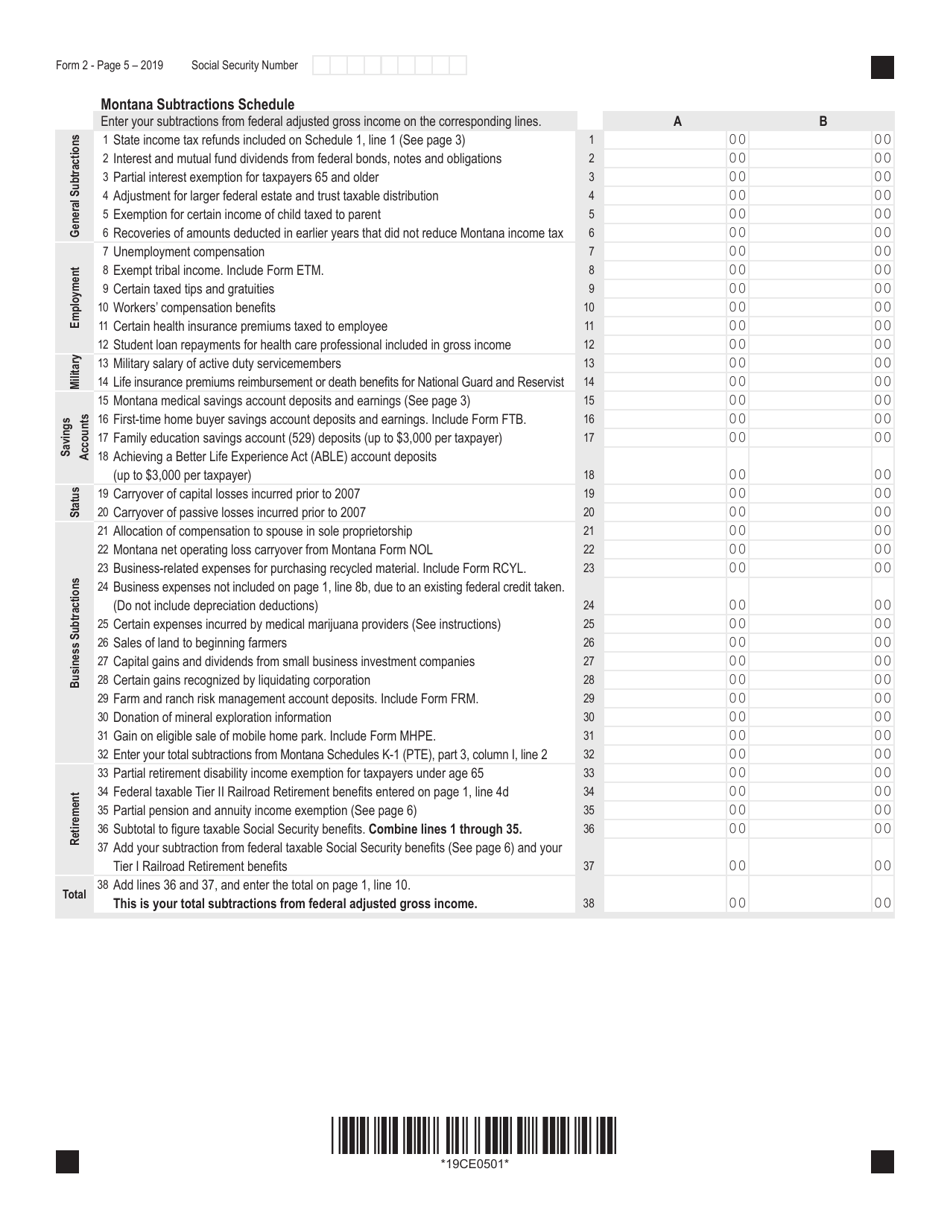

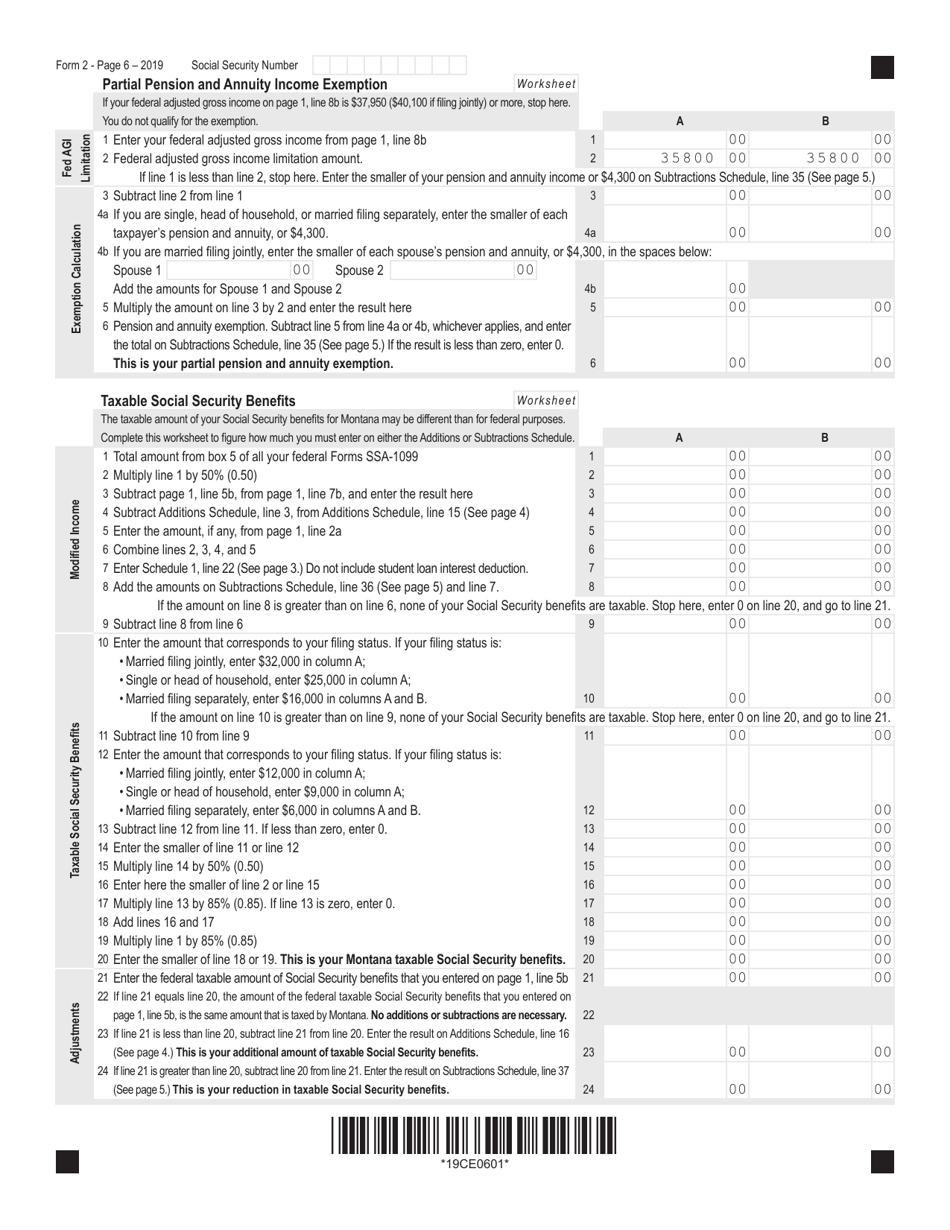

Form 2 Montana Individual Income Tax Return - Montana

What Is Form 2?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

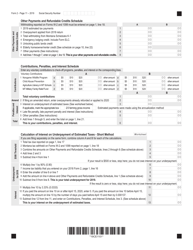

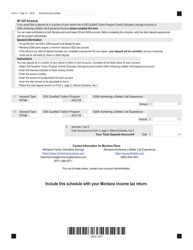

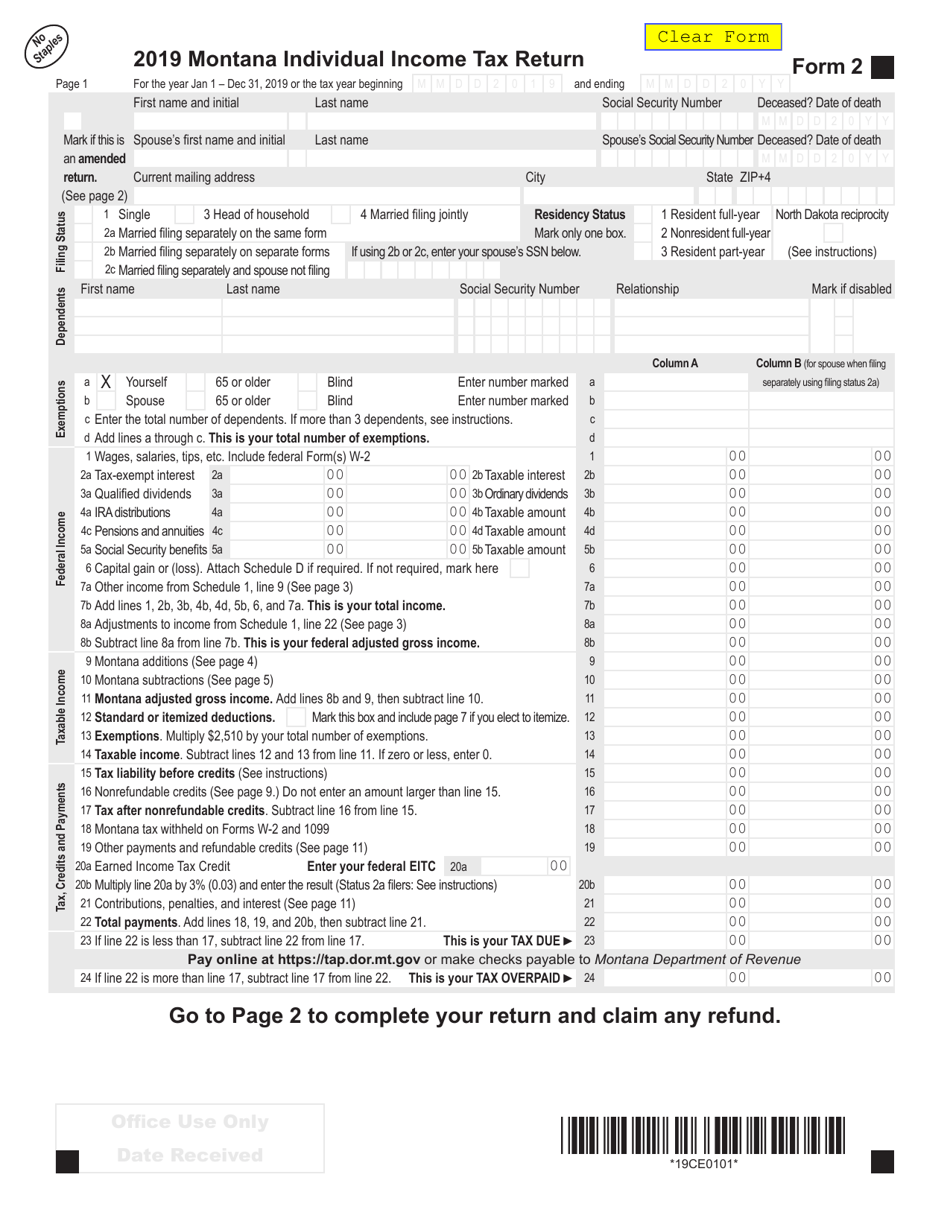

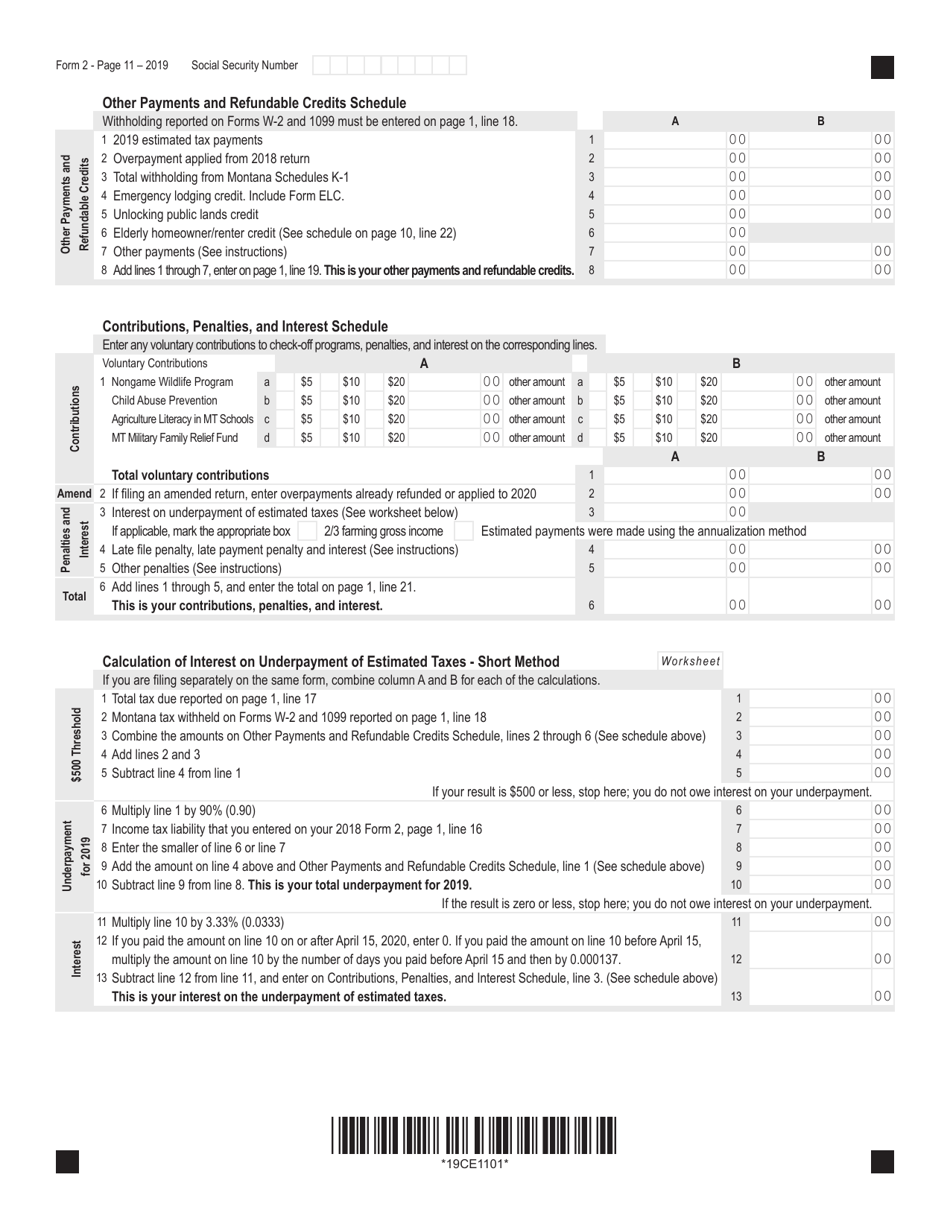

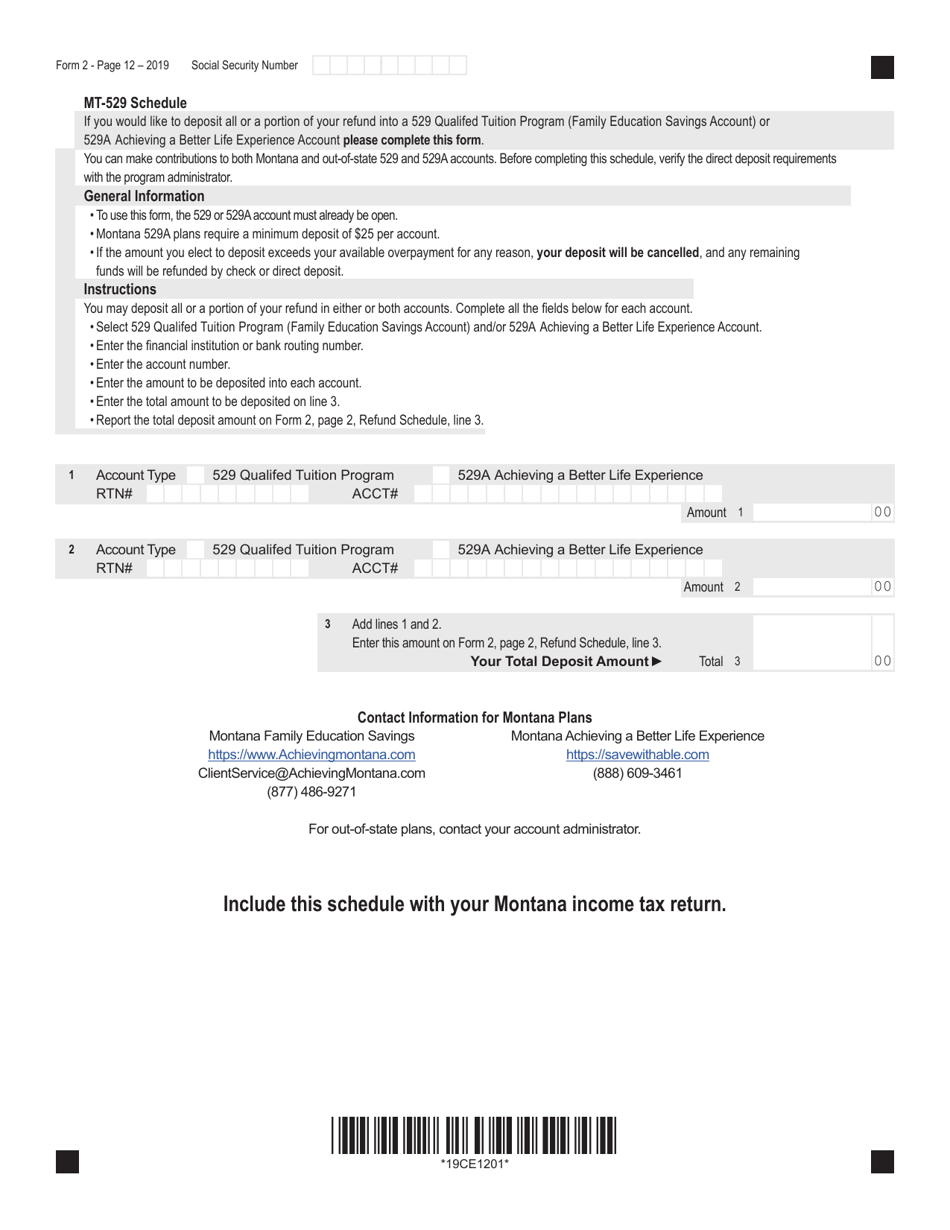

Q: What is Form 2 Montana Individual Income Tax Return?

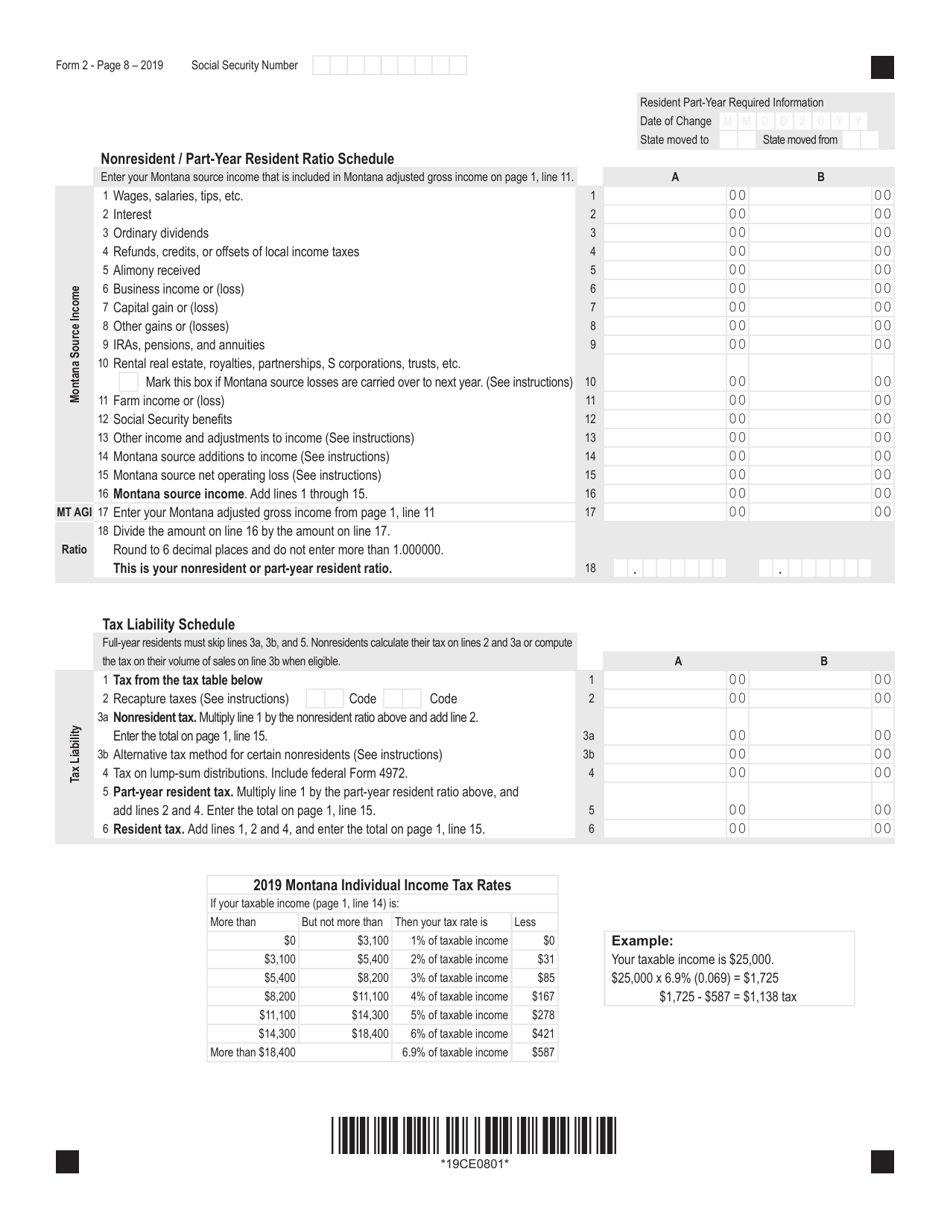

A: Form 2 Montana Individual Income Tax Return is a tax form used by residents of Montana to report their individual income and calculate their state income tax liability.

Q: Who needs to file Form 2 Montana Individual Income Tax Return?

A: Residents of Montana who have earned income or received certain types of income (such as dividends or capital gains) during the tax year need to file Form 2 Montana Individual Income Tax Return.

Q: What information do I need to complete Form 2 Montana Individual Income Tax Return?

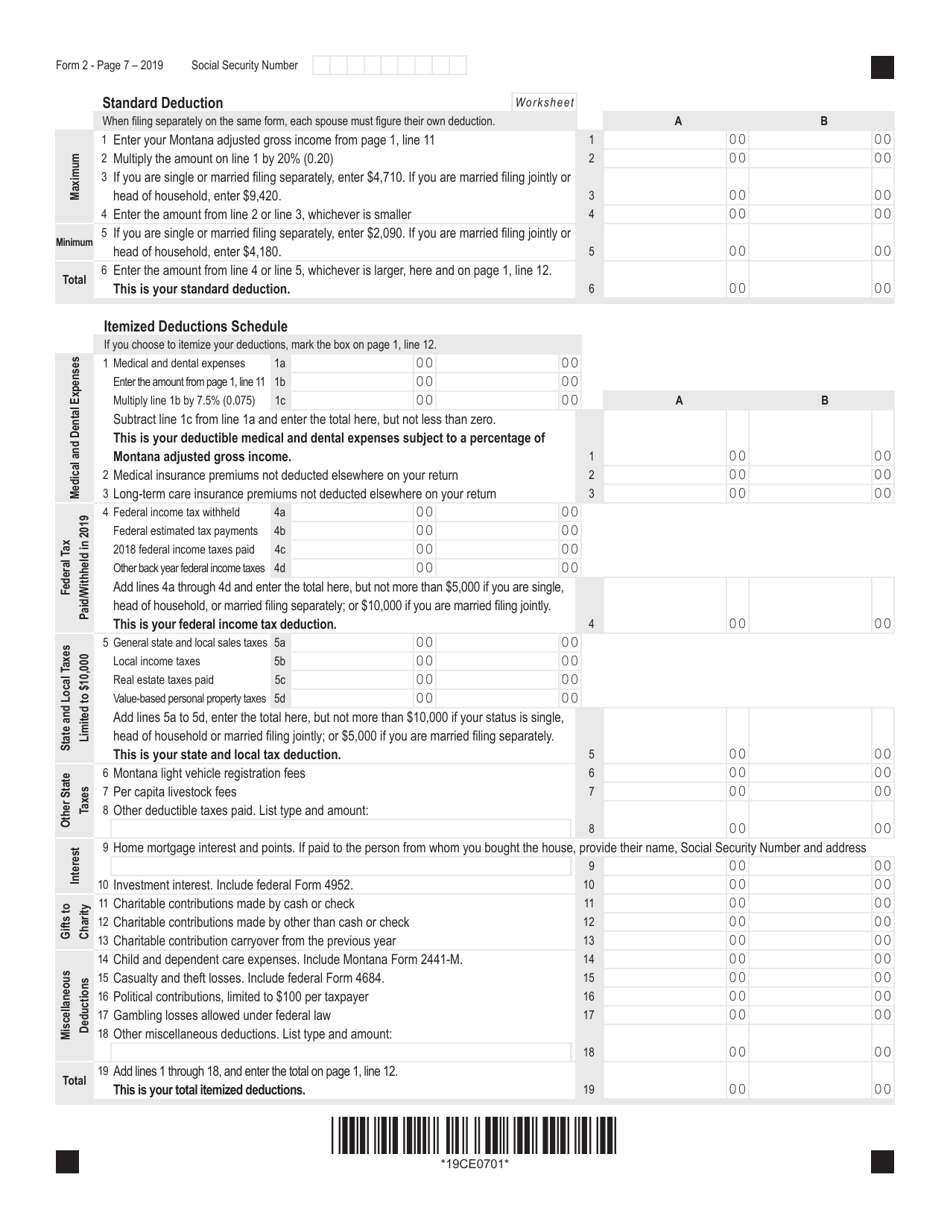

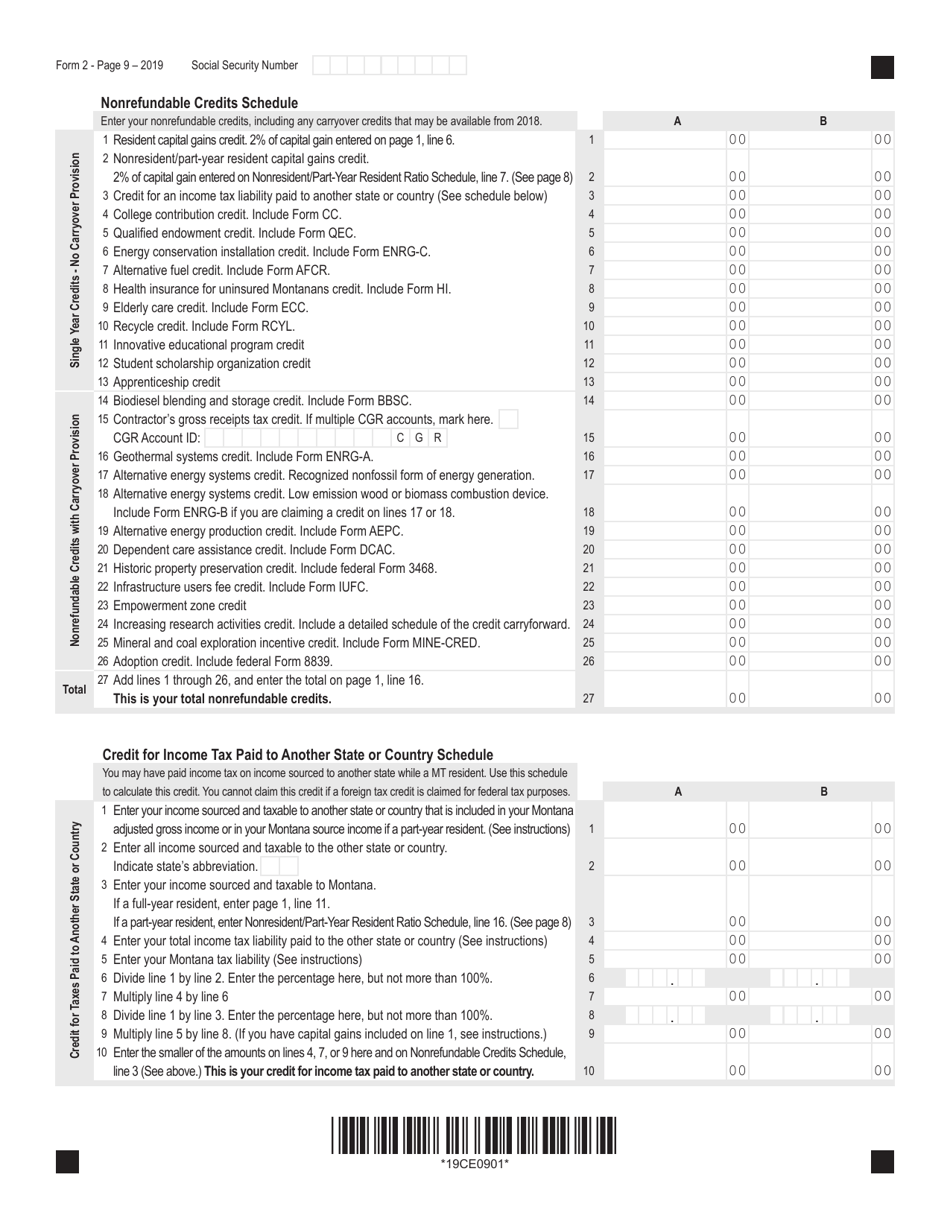

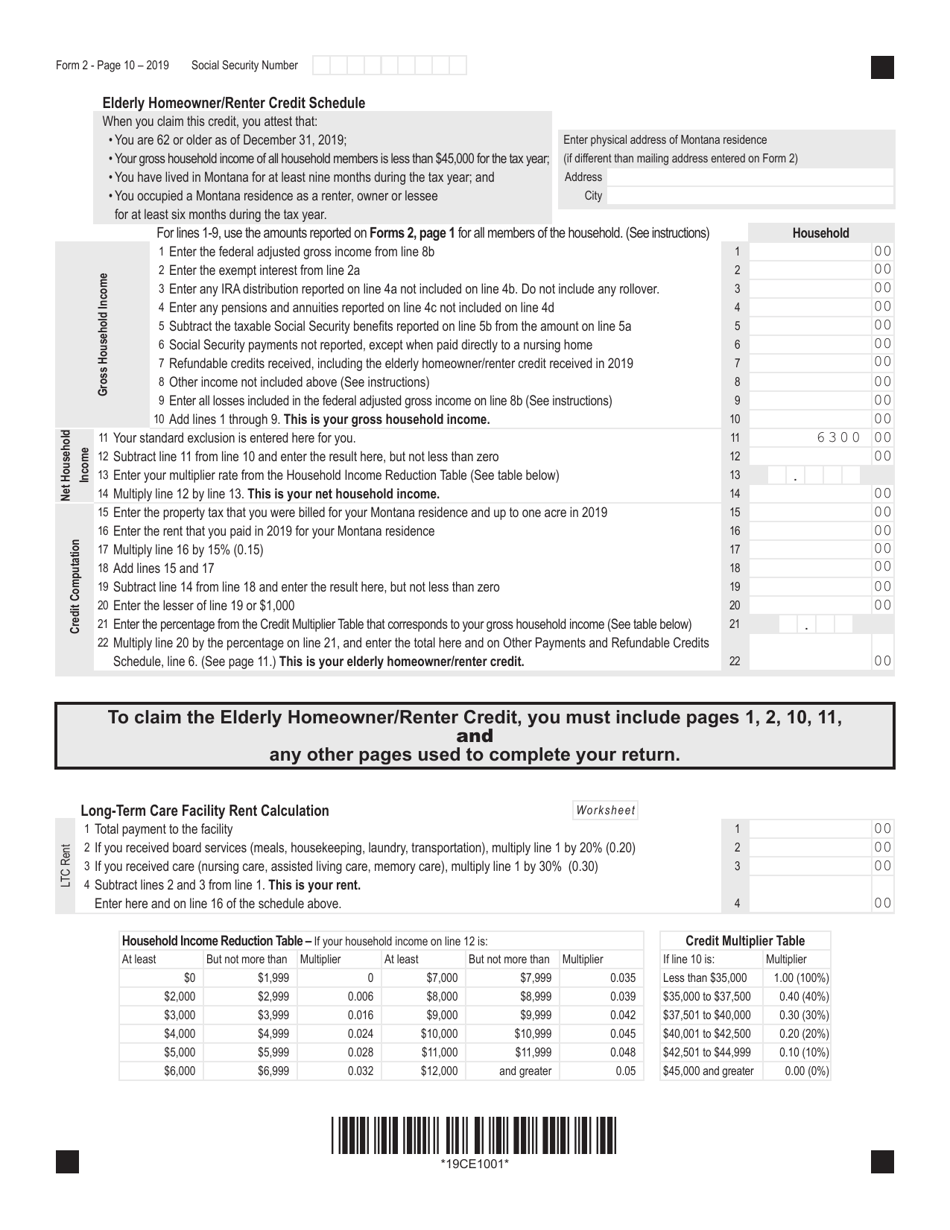

A: To complete Form 2 Montana Individual Income Tax Return, you will need information such as your total income, deductions, credits, and any taxes already paid.

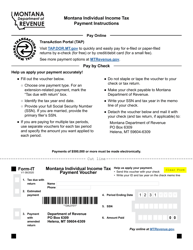

Q: When is the deadline to file Form 2 Montana Individual Income Tax Return?

A: The deadline to file Form 2 Montana Individual Income Tax Return is typically April 15th, unless it falls on a weekend or holiday, in which case the deadline is extended to the next business day.

Q: Can I file Form 2 Montana Individual Income Tax Return electronically?

A: Yes, you can file Form 2 Montana Individual Income Tax Return electronically using the Montana Department of Revenue's eFile system.

Q: What if I can't pay the full amount of tax owed when filing Form 2 Montana Individual Income Tax Return?

A: If you cannot pay the full amount of tax owed when filing Form 2 Montana Individual Income Tax Return, you can request a payment plan or explore other payment options with the Montana Department of Revenue.

Q: What happens if I don't file Form 2 Montana Individual Income Tax Return?

A: If you are required to file Form 2 Montana Individual Income Tax Return and fail to do so, you may be subject to penalties and interest on any unpaid taxes.

Q: Are there any deductions or credits available on Form 2 Montana Individual Income Tax Return?

A: Yes, there are various deductions and credits available on Form 2 Montana Individual Income Tax Return, such as the standard deduction, itemized deductions, and credits for child and dependent care expenses.

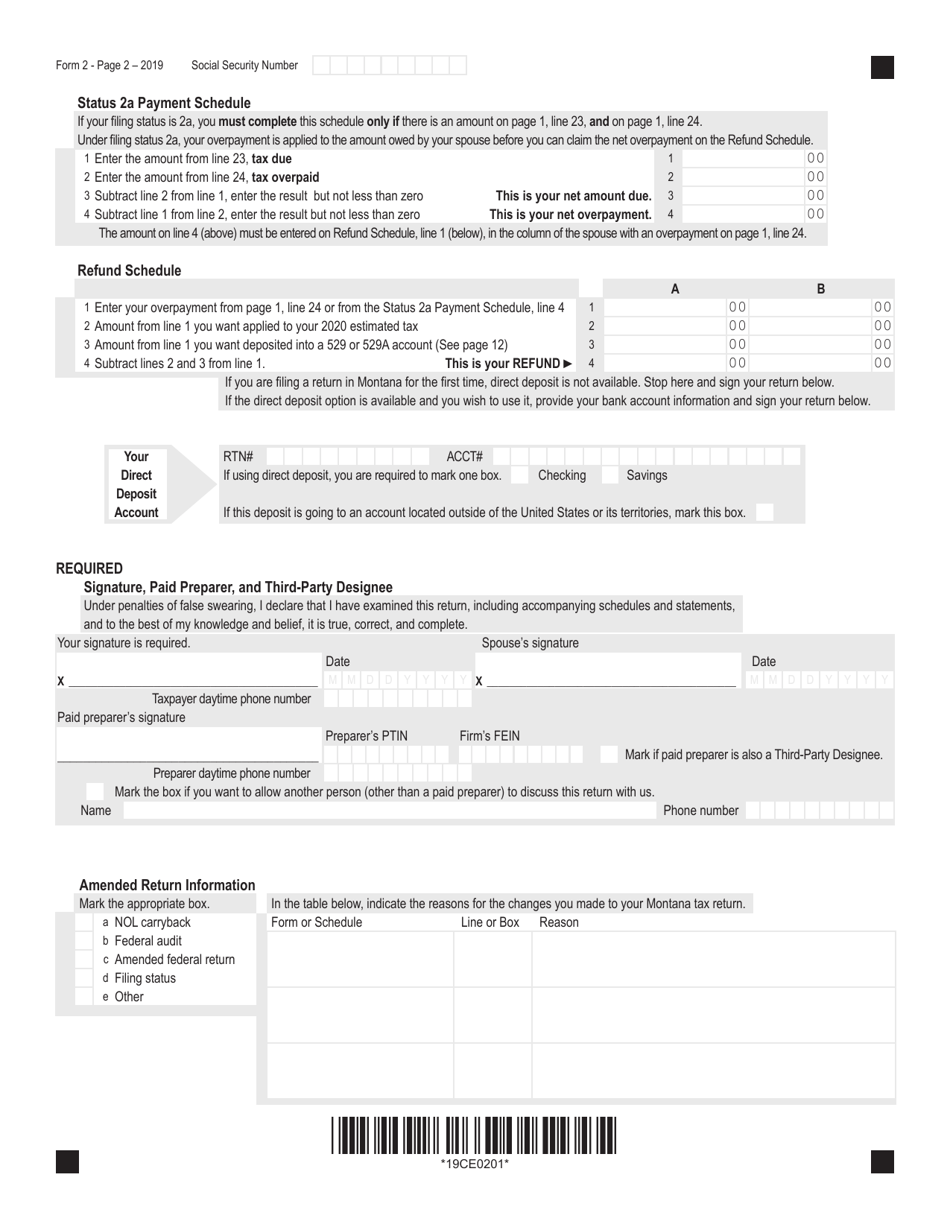

Q: Can I amend Form 2 Montana Individual Income Tax Return if I made a mistake?

A: Yes, if you made a mistake on your filed Form 2 Montana Individual Income Tax Return, you can file an amended return using Form 2X and provide the correct information.

Form Details:

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2 by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.