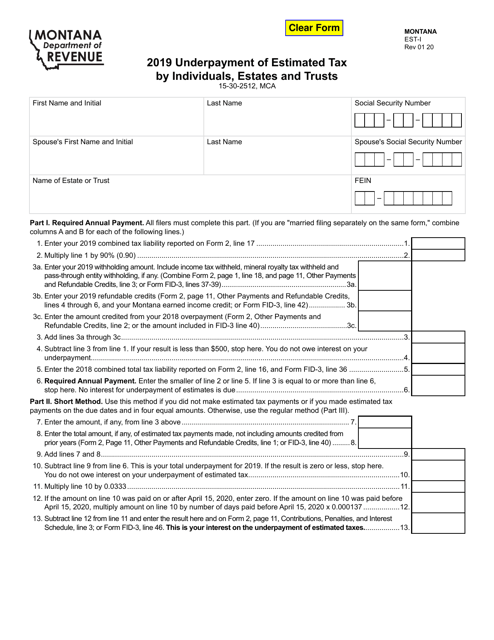

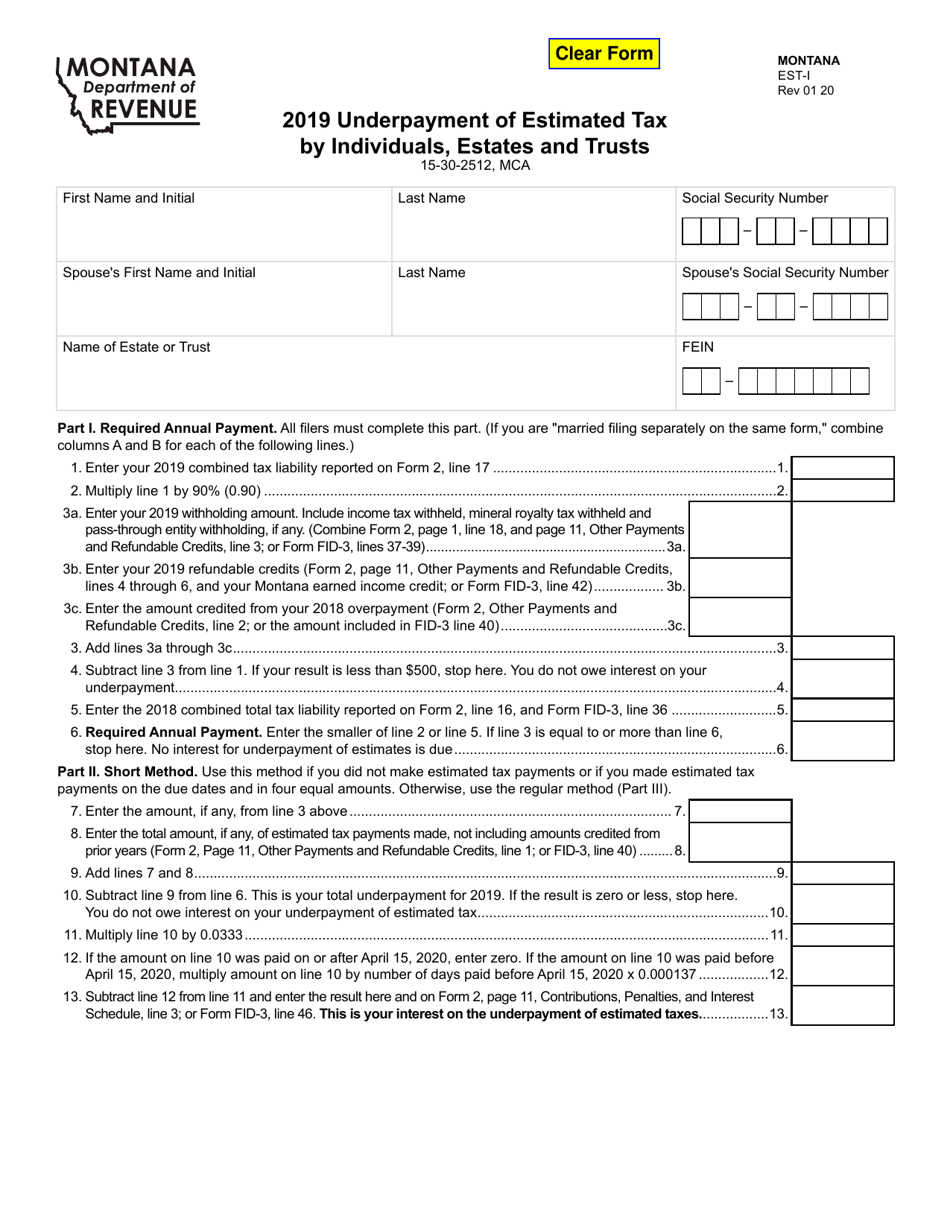

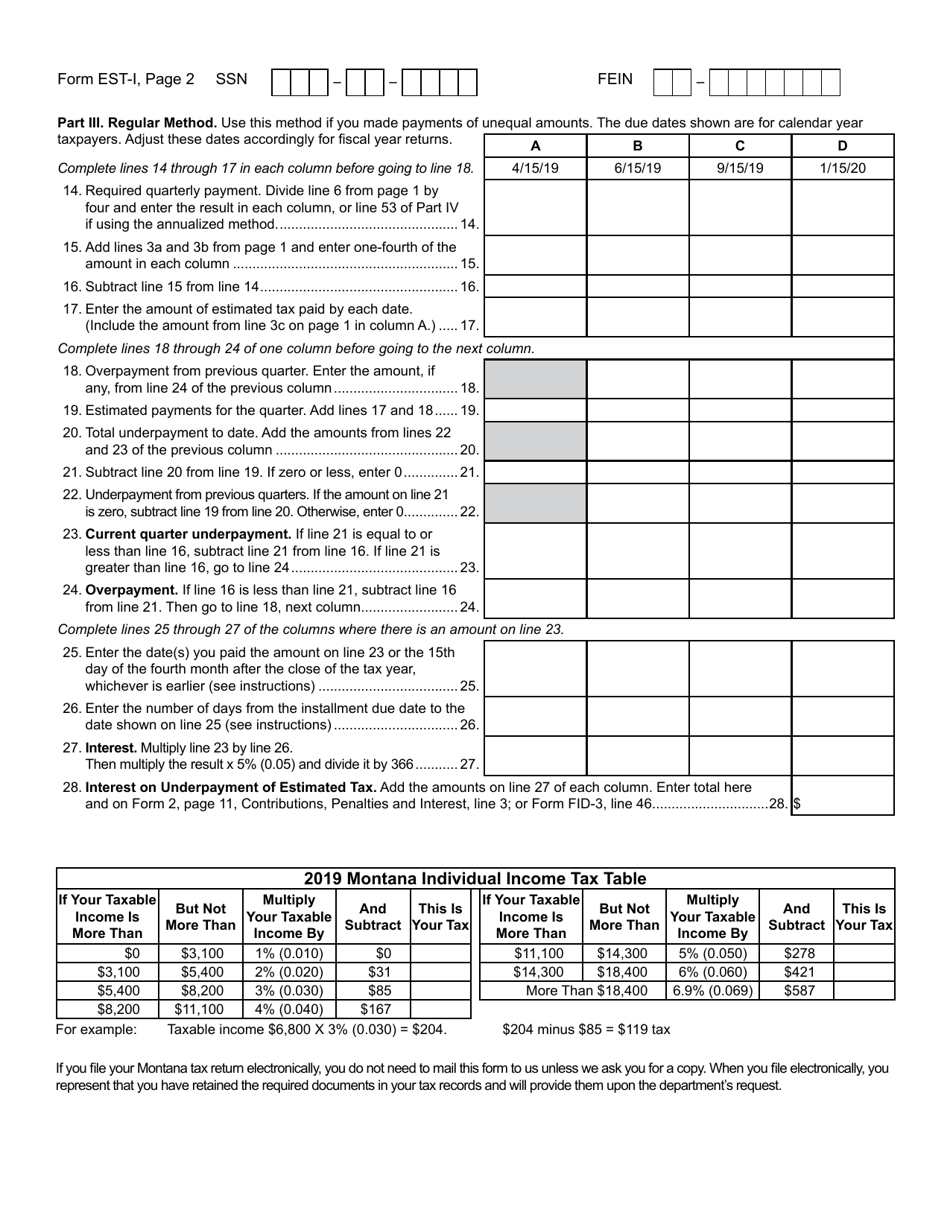

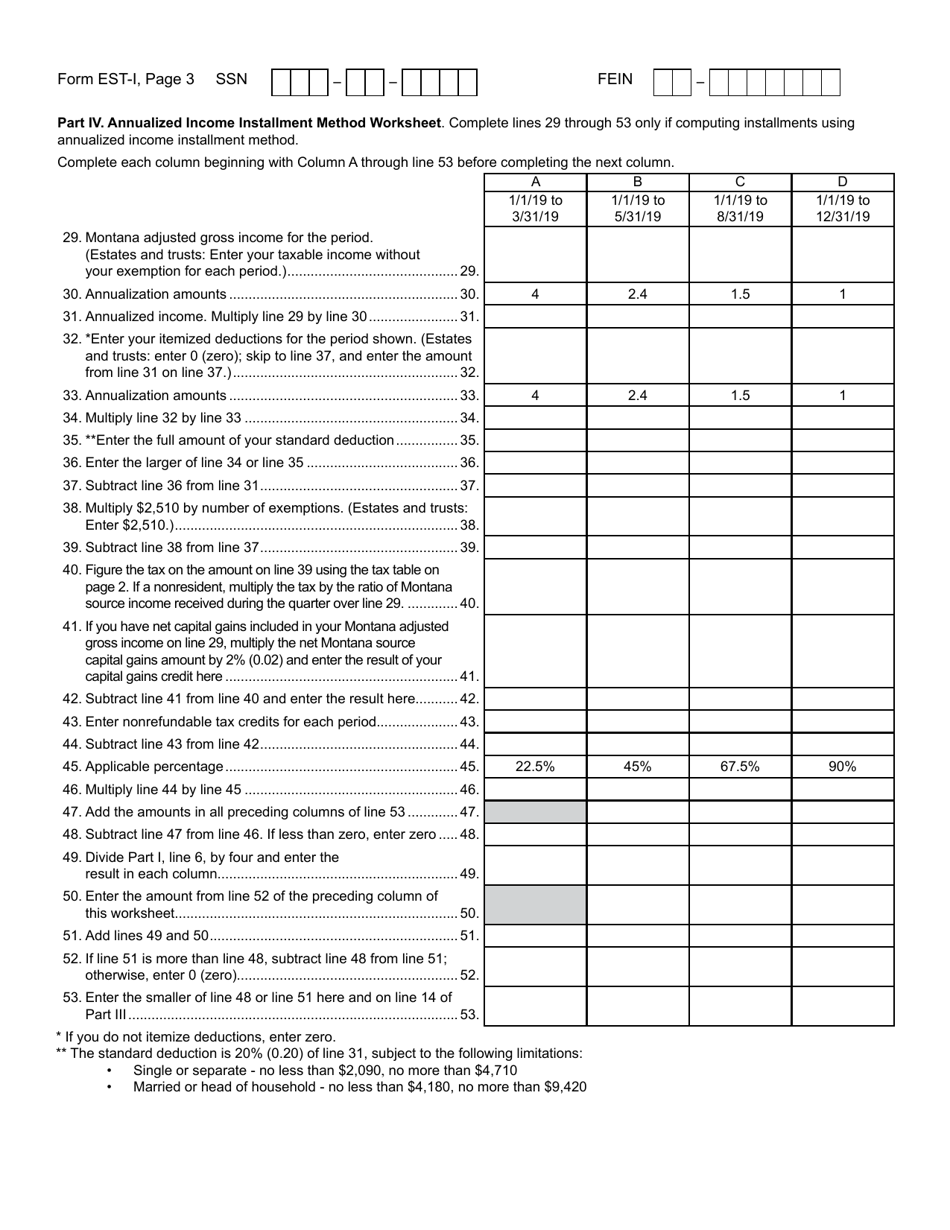

Form EST-I Underpayment of Estimated Tax by Individuals, Estates and Trusts - Montana

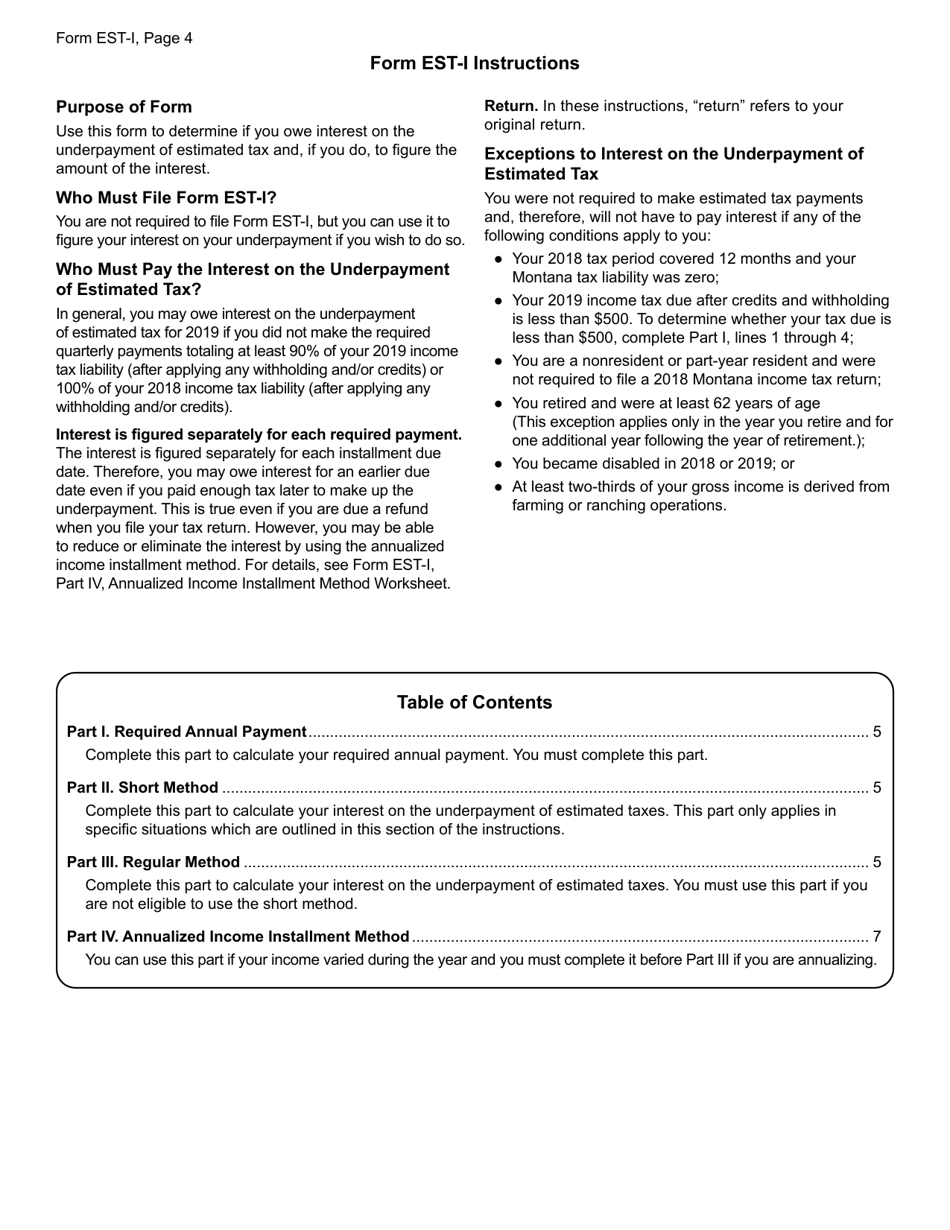

What Is Form EST-I?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is EST-I?

A: EST-I is a form for reporting underpayment of estimated tax by individuals, estates, and trusts in Montana.

Q: Who needs to file Form EST-I?

A: Anyone who has underpaid their estimated tax in Montana, including individuals, estates, and trusts, needs to file Form EST-I.

Q: What is the purpose of Form EST-I?

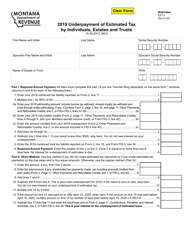

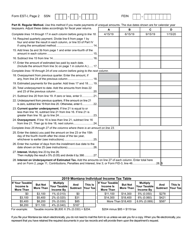

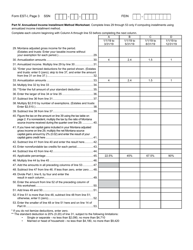

A: The purpose of Form EST-I is to calculate and report any underpayment of estimated tax in Montana.

Q: How do I fill out Form EST-I?

A: To fill out Form EST-I, you need to calculate the amount of underpayment, provide your personal information, and include any required attachments.

Q: When is Form EST-I due?

A: Form EST-I is due on or before the original due date of your Montana tax return, which is typically April 15th for individuals.

Q: What happens if I don't file Form EST-I?

A: If you fail to file Form EST-I and pay the underpayment penalty, you may be subject to penalties and interest on the amount owed.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form EST-I by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.