This version of the form is not currently in use and is provided for reference only. Download this version of

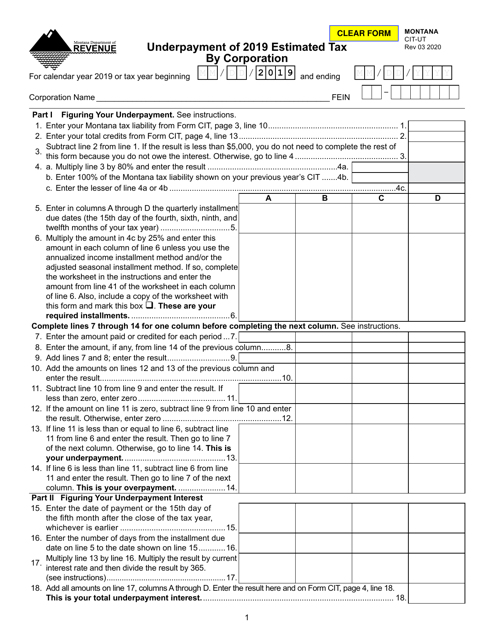

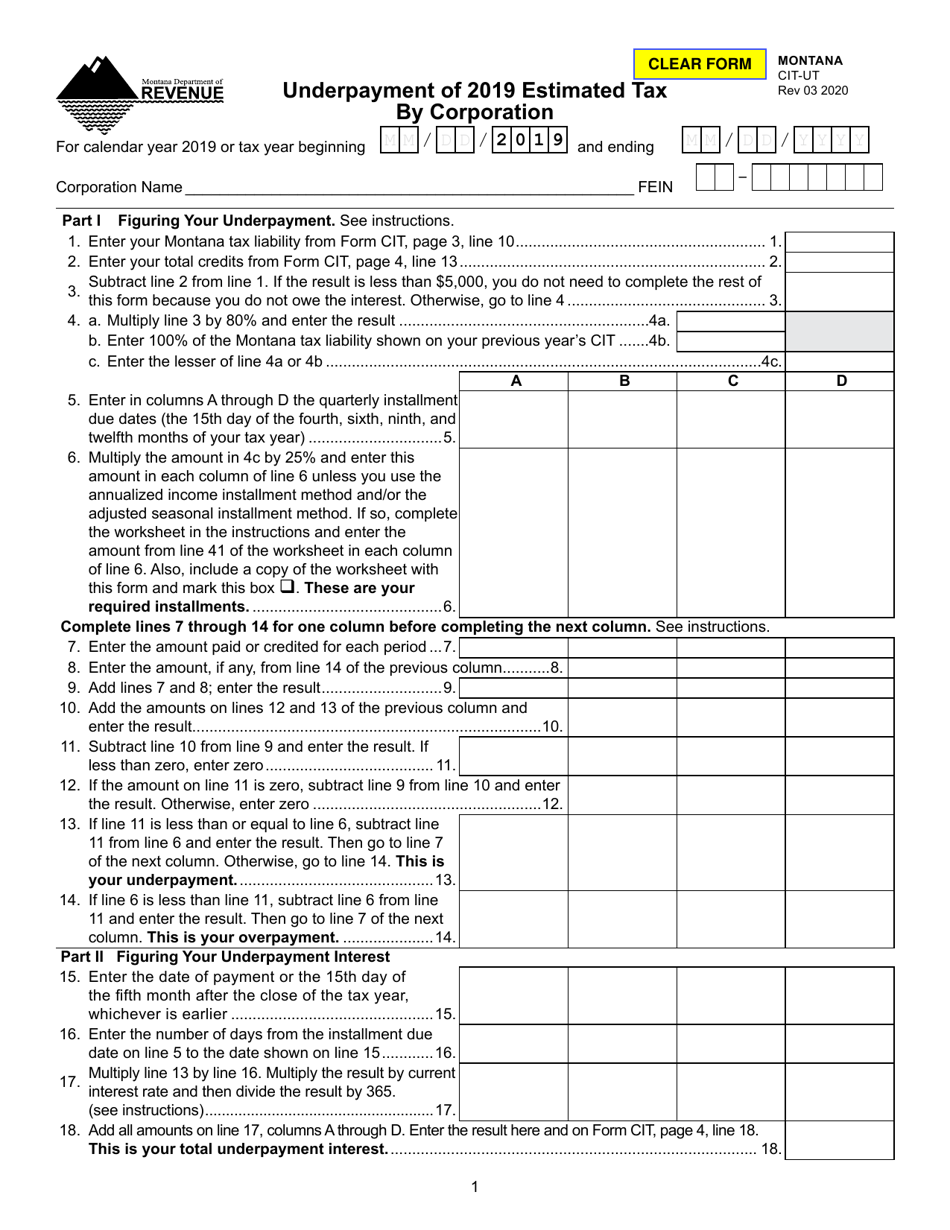

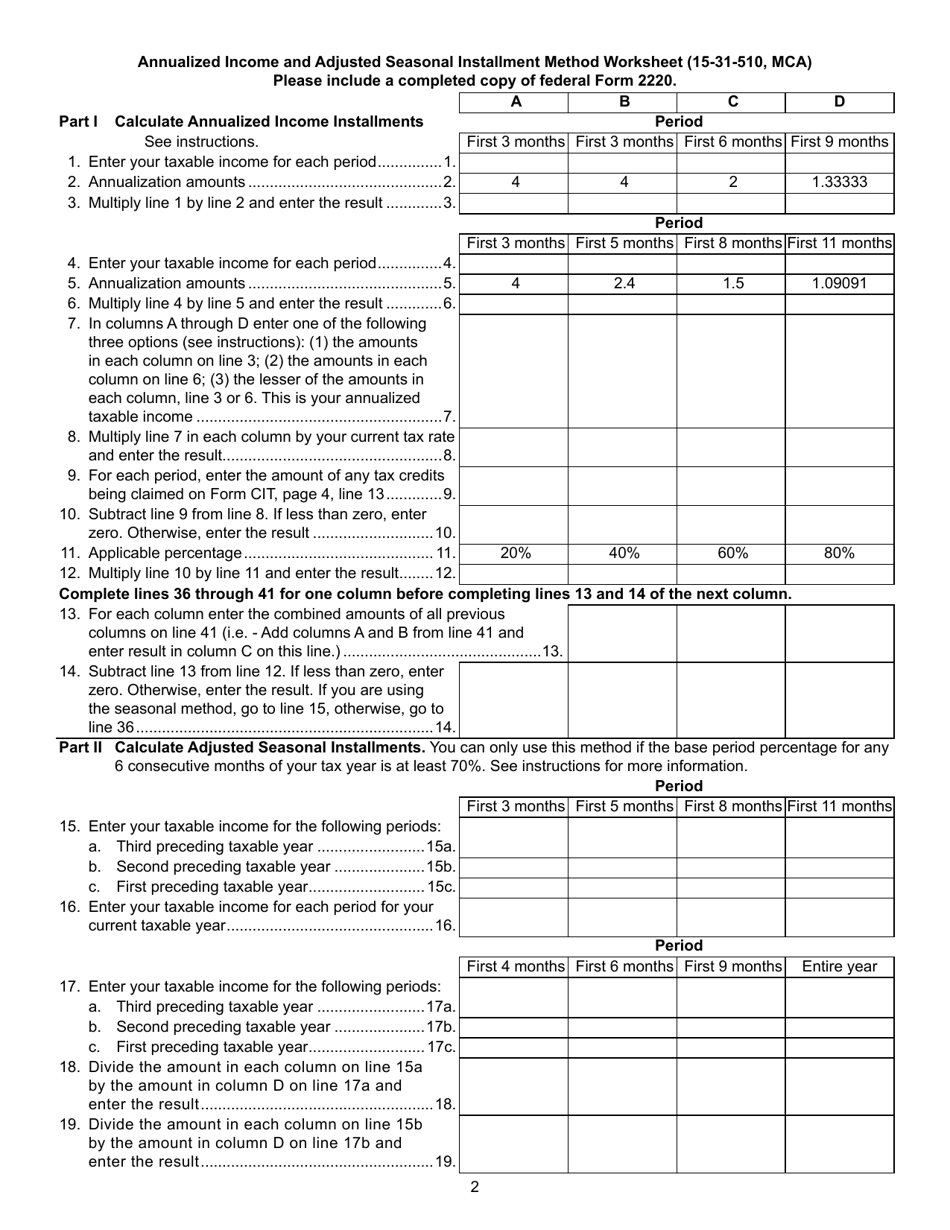

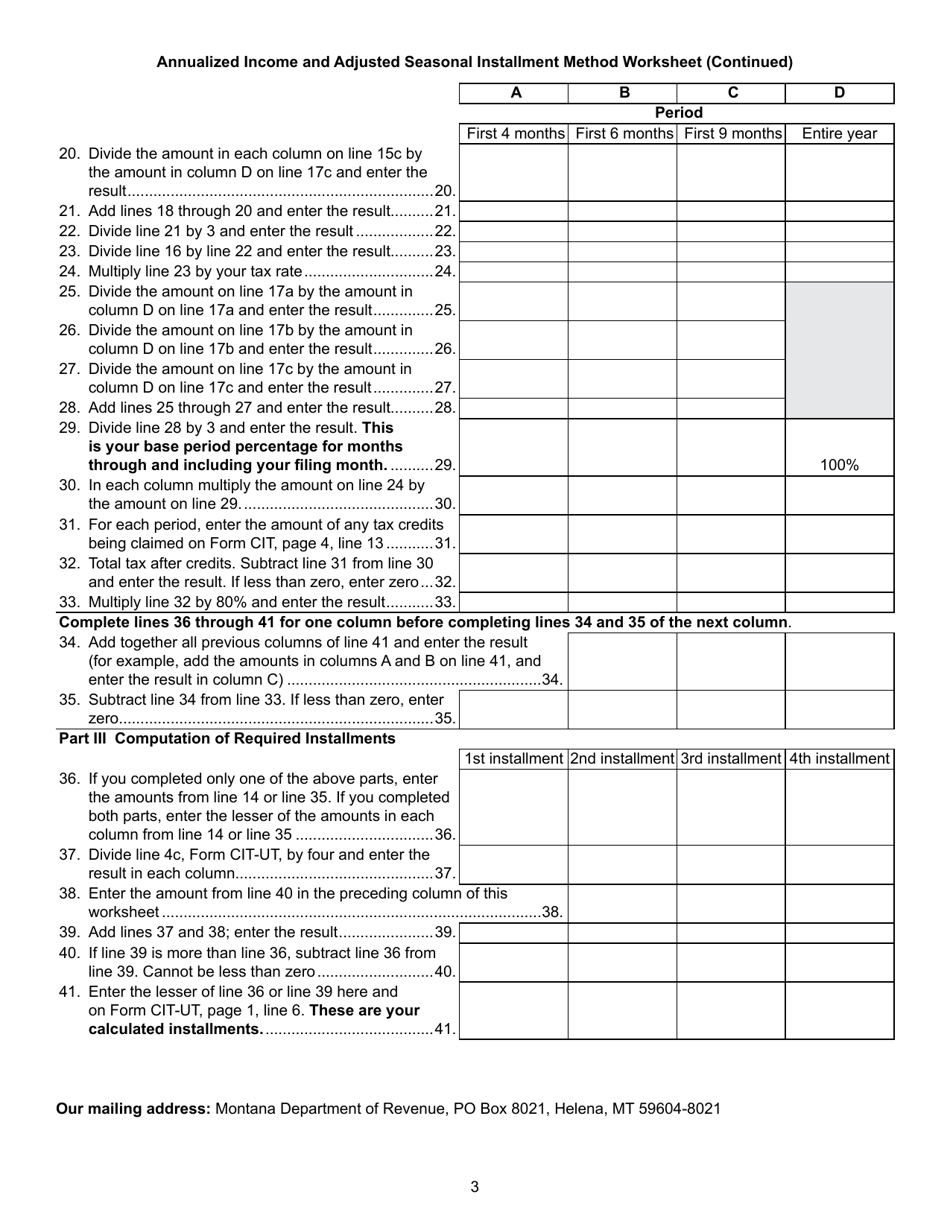

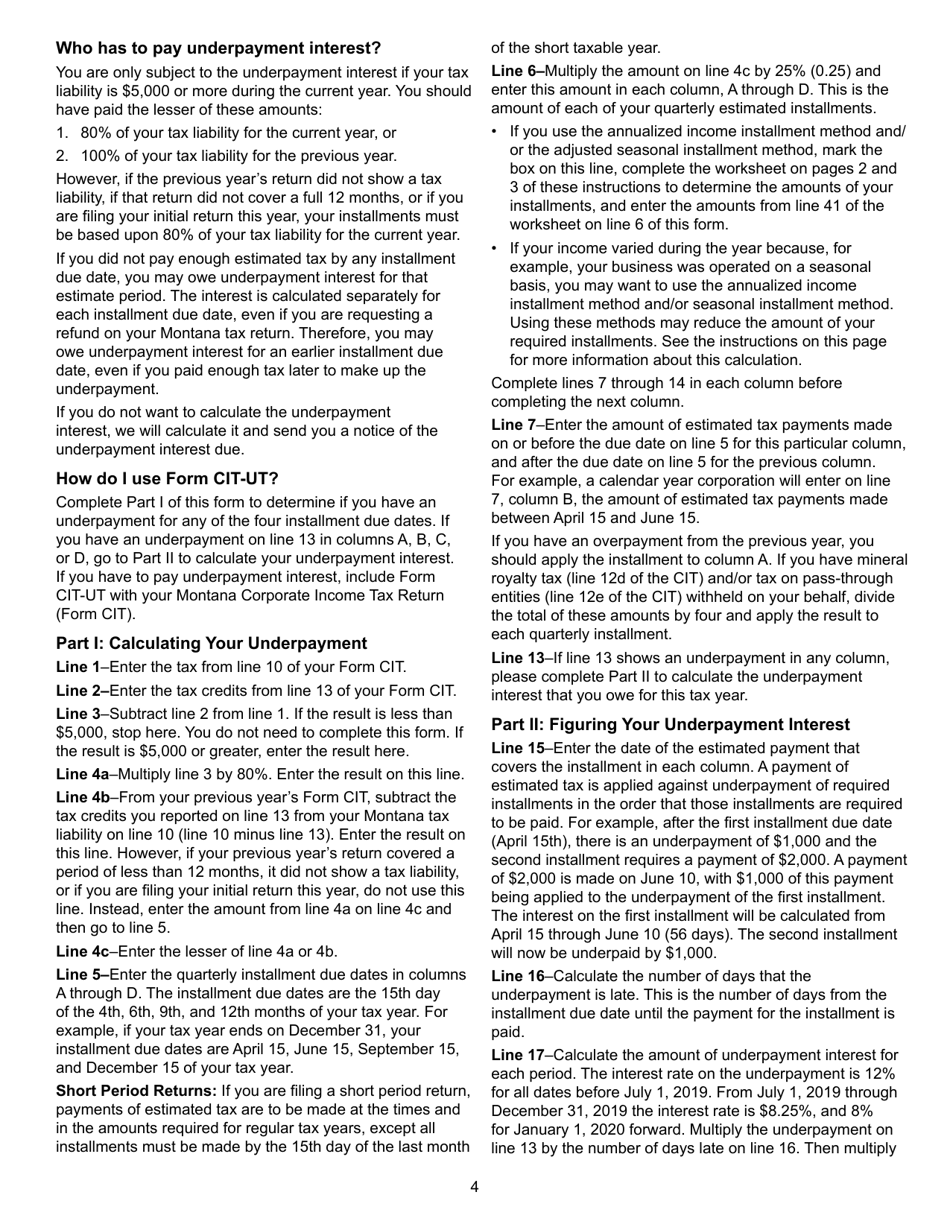

Form CIT-UT

for the current year.

Form CIT-UT Underpayment of Estimated Tax by Corporation - Montana

What Is Form CIT-UT?

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CIT-UT?

A: CIT-UT stands for Underpayment of Estimated Tax by Corporation.

Q: Who should file Form CIT-UT?

A: Corporations in Montana who have underpaid their estimated tax should file Form CIT-UT.

Q: What is the purpose of Form CIT-UT?

A: The purpose of Form CIT-UT is to calculate the penalty for underpayment of estimated tax by a corporation.

Q: Is Form CIT-UT specific to Montana?

A: Yes, Form CIT-UT is specific to corporations in Montana.

Q: When should Form CIT-UT be filed?

A: Form CIT-UT should be filed when a corporation has underpaid its estimated tax.

Q: Are there any penalties for underpayment of estimated tax?

A: Yes, there may be penalties for underpayment of estimated tax by a corporation.

Q: How can I calculate the penalty for underpayment of estimated tax?

A: You can use Form CIT-UT to calculate the penalty for underpayment of estimated tax by a corporation.

Q: What should I do if I have underpaid my estimated tax?

A: If you have underpaid your estimated tax, you should file Form CIT-UT and pay the penalty amount.

Q: Are there any exceptions or waivers for the penalty?

A: Yes, there may be exceptions or waivers for the penalty for underpayment of estimated tax based on certain circumstances.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIT-UT by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.