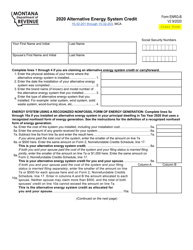

This version of the form is not currently in use and is provided for reference only. Download this version of

Form AEPC

for the current year.

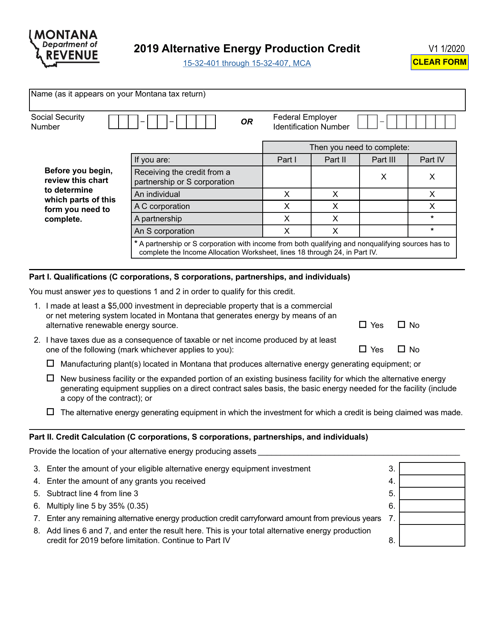

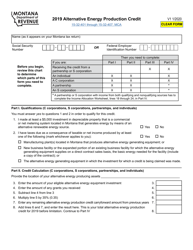

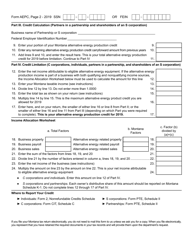

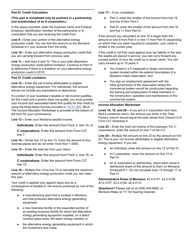

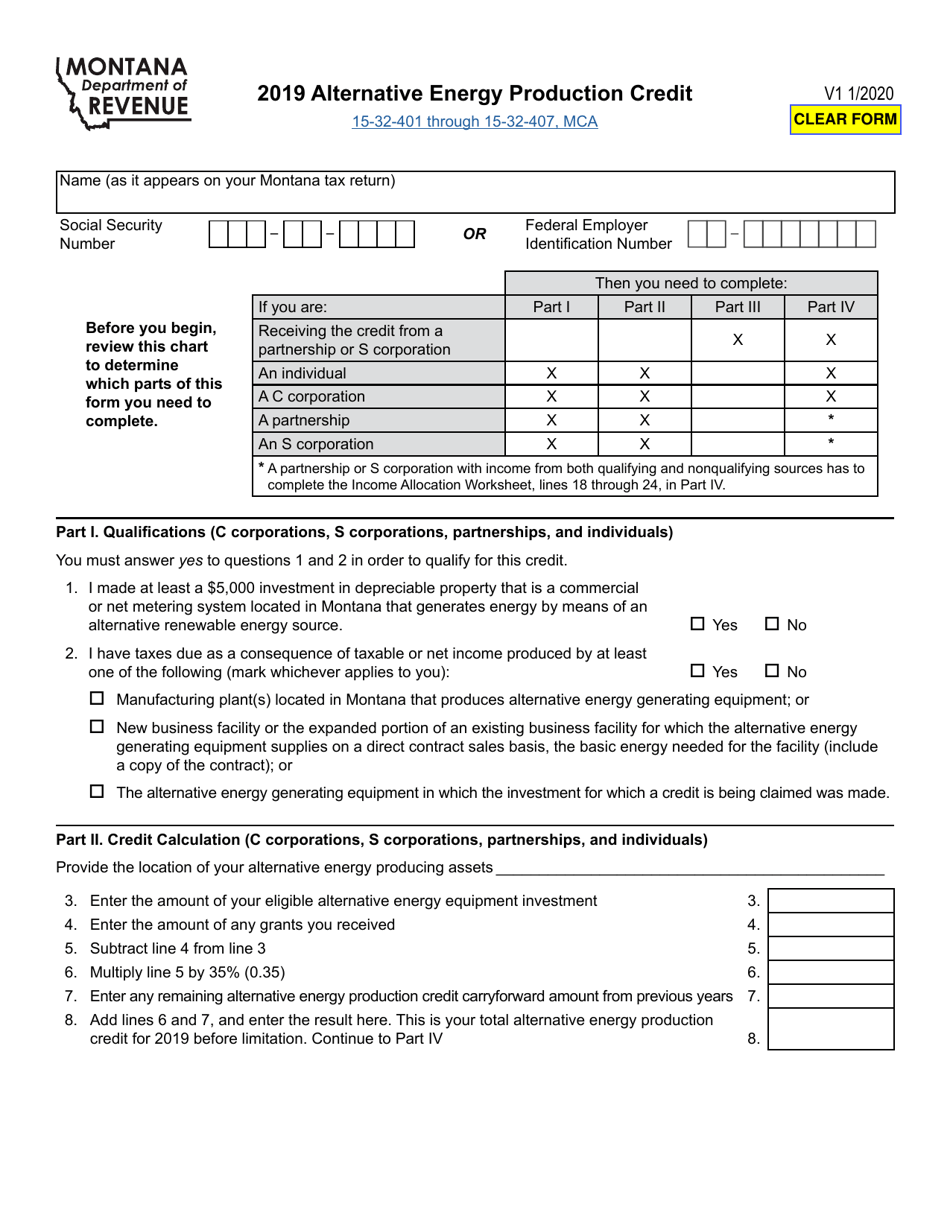

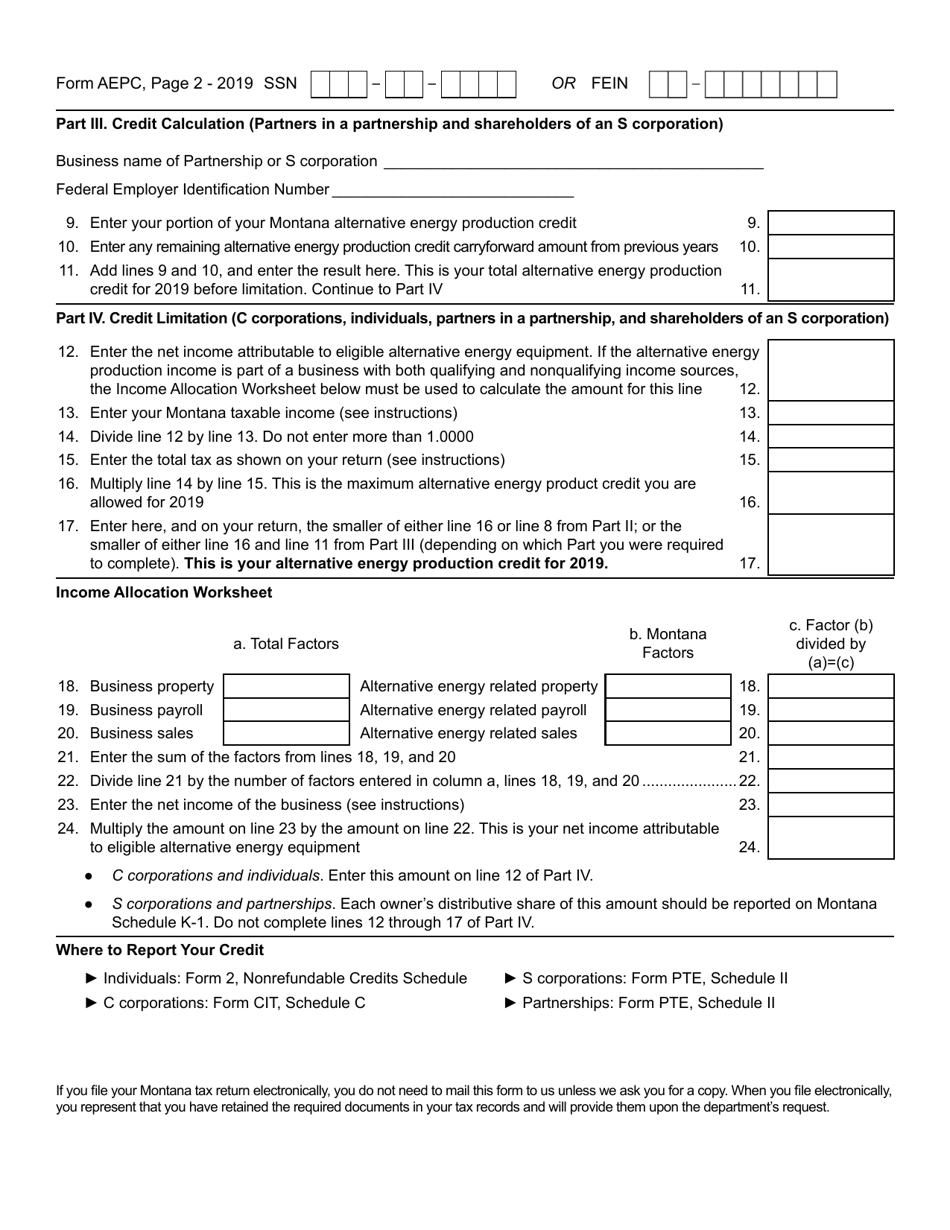

Form AEPC Alternative Energy Production Credit - Montana

What Is Form AEPC?

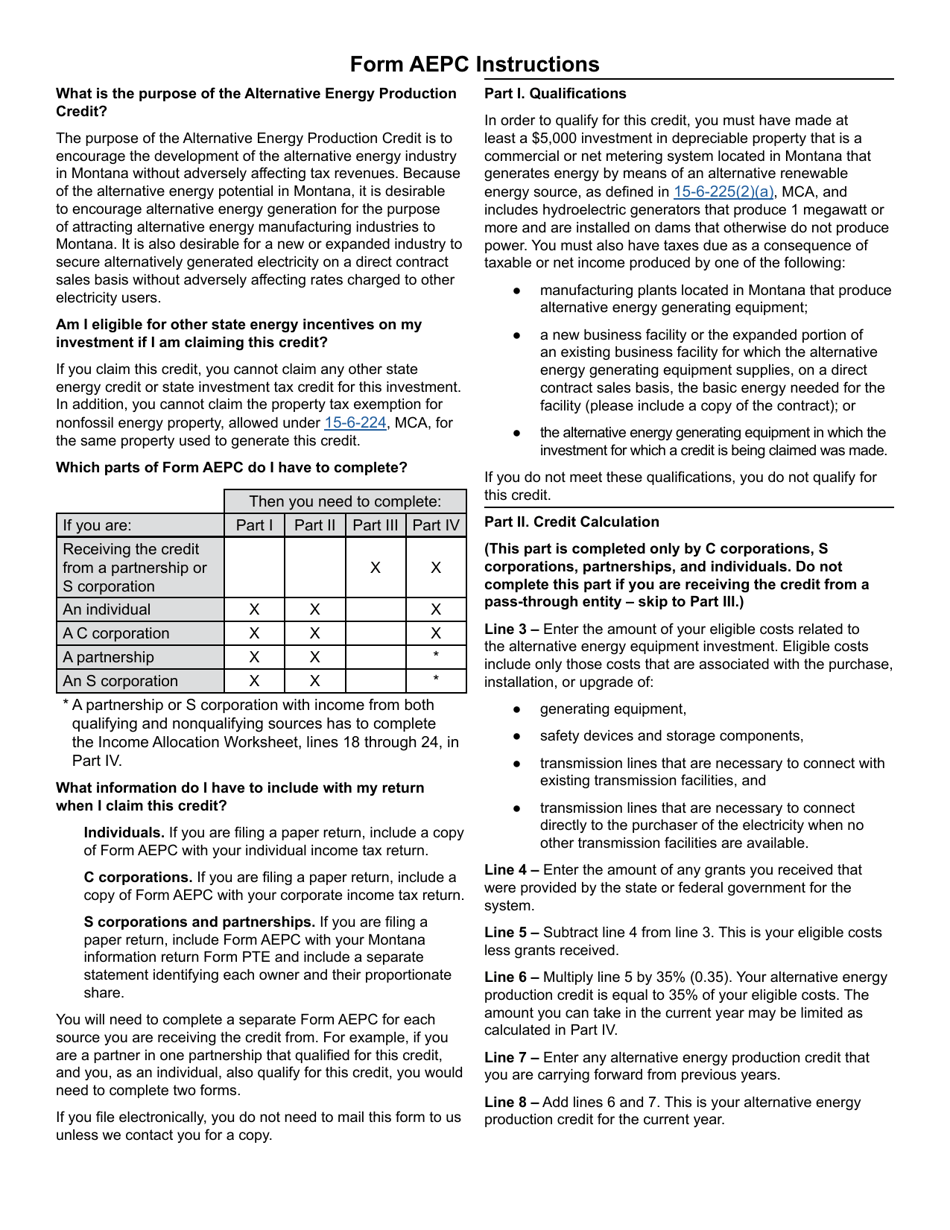

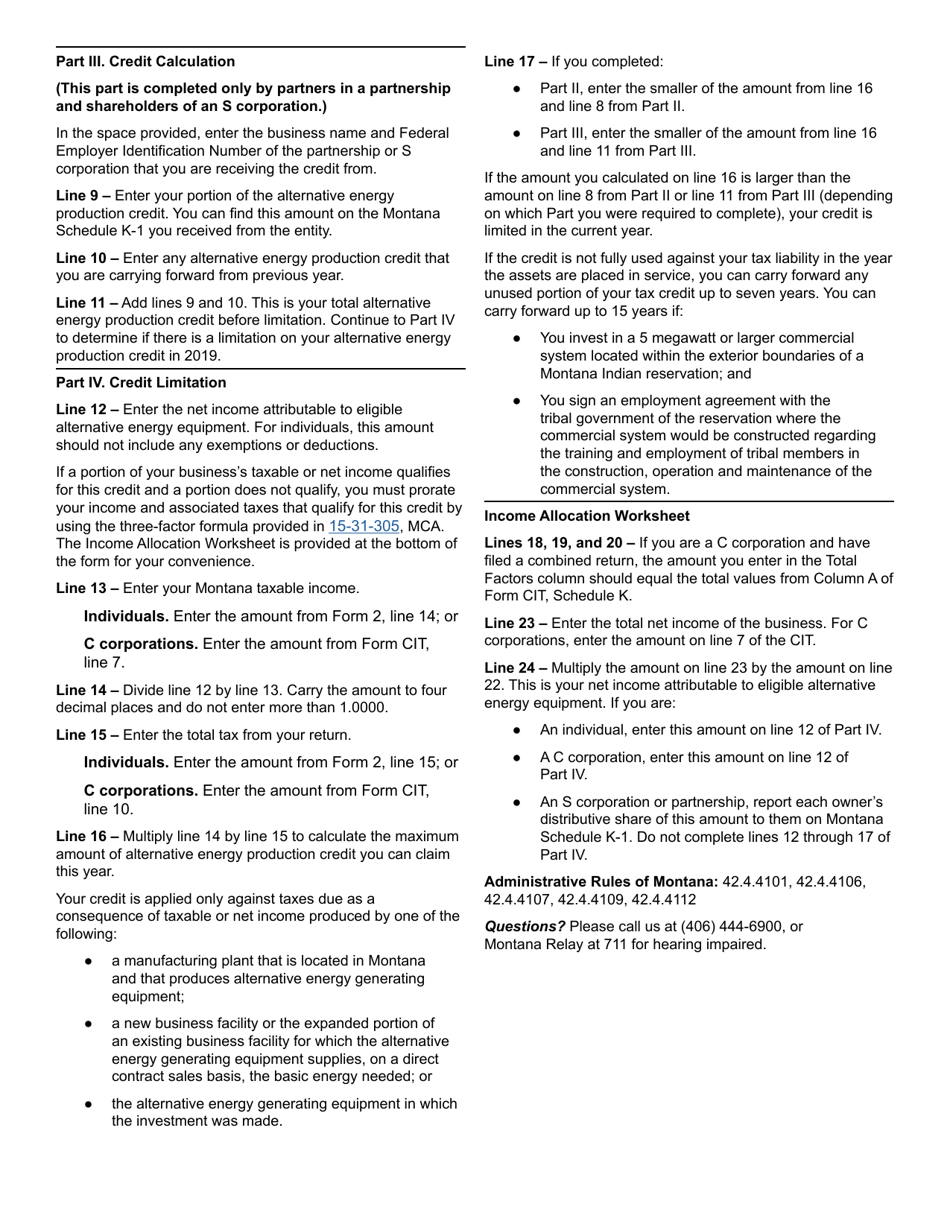

This is a legal form that was released by the Montana Department of Revenue - a government authority operating within Montana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AEPC?

A: Form AEPC stands for Alternative Energy Production Credit.

Q: What is the Alternative Energy Production Credit?

A: The Alternative Energy Production Credit is a tax credit offered by the state of Montana for the production of alternative energy.

Q: Who is eligible for the Alternative Energy Production Credit?

A: Eligibility for the Alternative Energy Production Credit depends on the type of alternative energy produced and the specific requirements set by the state of Montana.

Q: What are some examples of alternative energy?

A: Some examples of alternative energy include solar power, wind power, biomass energy, and geothermal energy.

Q: How can I claim the Alternative Energy Production Credit?

A: To claim the Alternative Energy Production Credit, you must complete Form AEPC and submit it to the Montana Department of Revenue.

Q: Is the Alternative Energy Production Credit refundable?

A: Yes, the Alternative Energy Production Credit is refundable, which means that if the credit exceeds your tax liability, you may be eligible to receive a refund.

Q: Are there any limitations on the Alternative Energy Production Credit?

A: Yes, there may be limitations on the Alternative Energy Production Credit, such as a maximum credit amount or a cap on the total credits issued each year. These limitations can vary depending on the specific requirements set by the state of Montana.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Montana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AEPC by clicking the link below or browse more documents and templates provided by the Montana Department of Revenue.