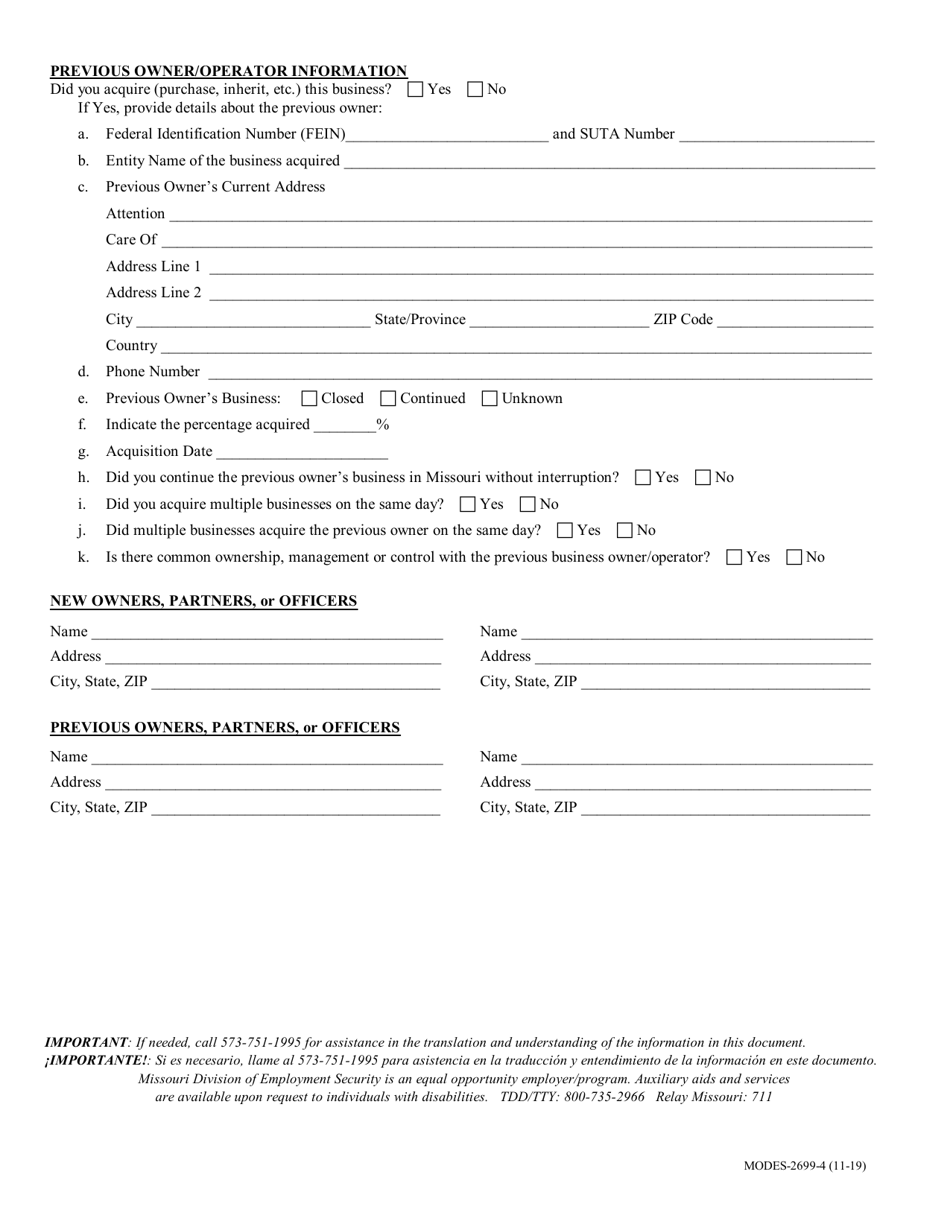

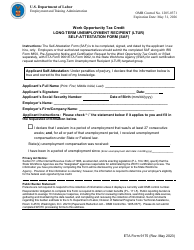

This version of the form is not currently in use and is provided for reference only. Download this version of

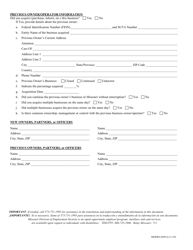

Form MODES-2699

for the current year.

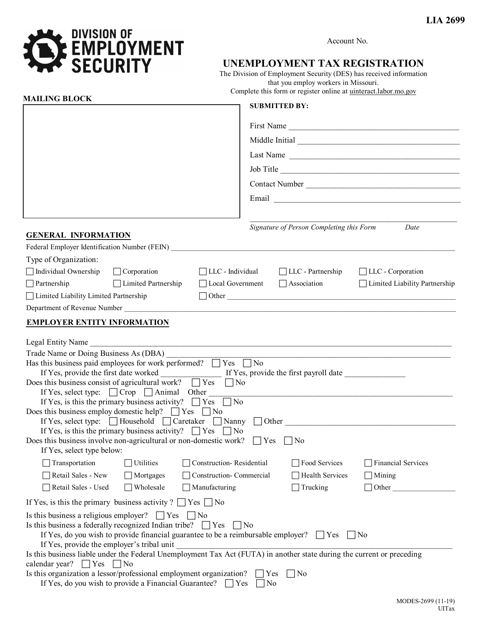

Form MODES-2699 Unemployment Tax Registration - Missouri

What Is Form MODES-2699?

This is a legal form that was released by the Missouri Department of Labor and Industrial Relations - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MODES-2699?

A: Form MODES-2699 is the Unemployment Tax Registration form for the state of Missouri.

Q: Why do I need to fill out Form MODES-2699?

A: You need to fill out Form MODES-2699 to register for unemployment tax in Missouri if you are an employer.

Q: Who needs to fill out Form MODES-2699?

A: Employers in Missouri who have employees working in the state need to fill out Form MODES-2699.

Q: Are there any deadlines for submitting Form MODES-2699?

A: Yes, Form MODES-2699 must be submitted within 20 days of becoming an employer or acquiring employees in Missouri.

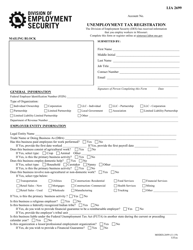

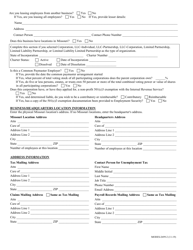

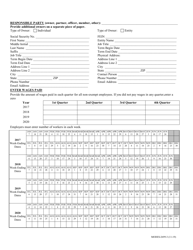

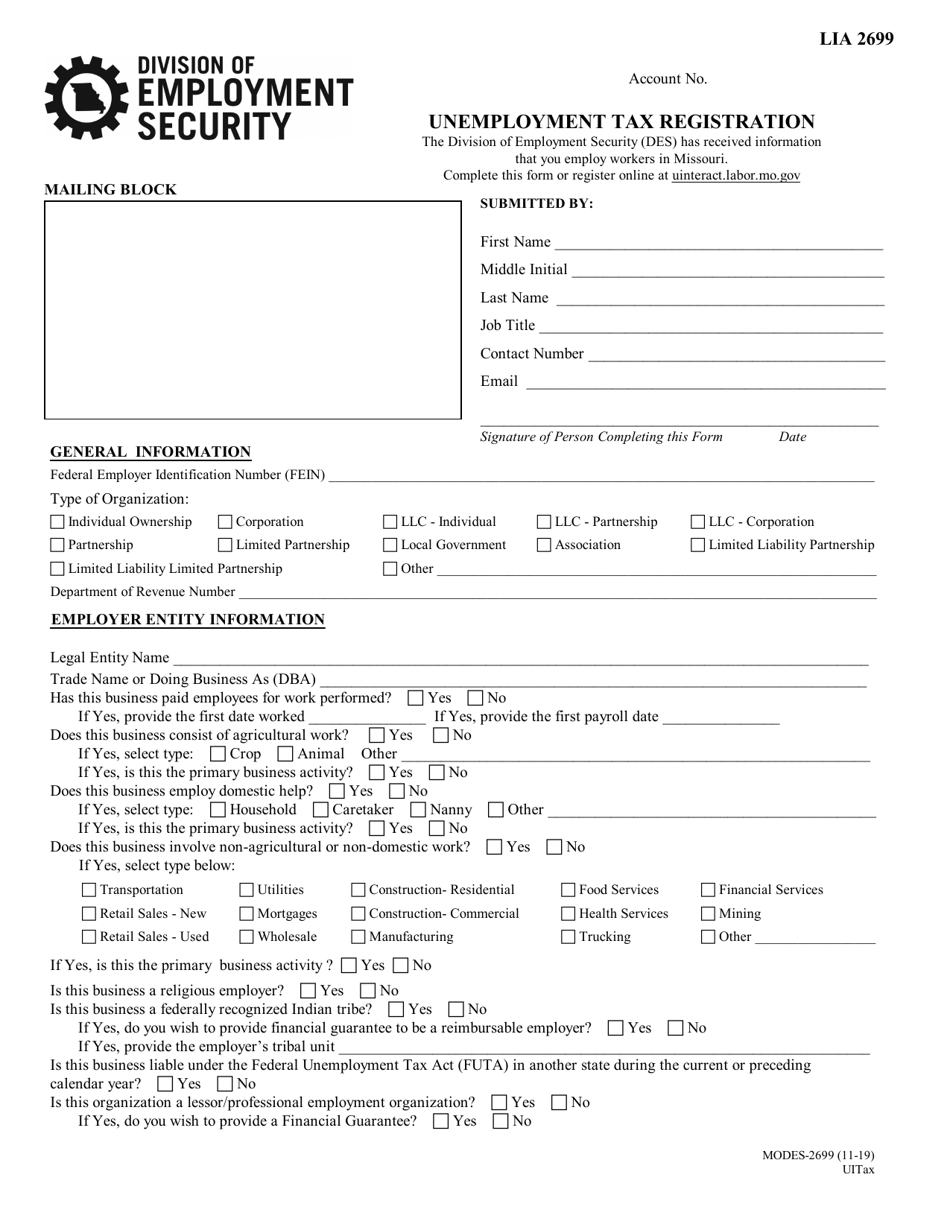

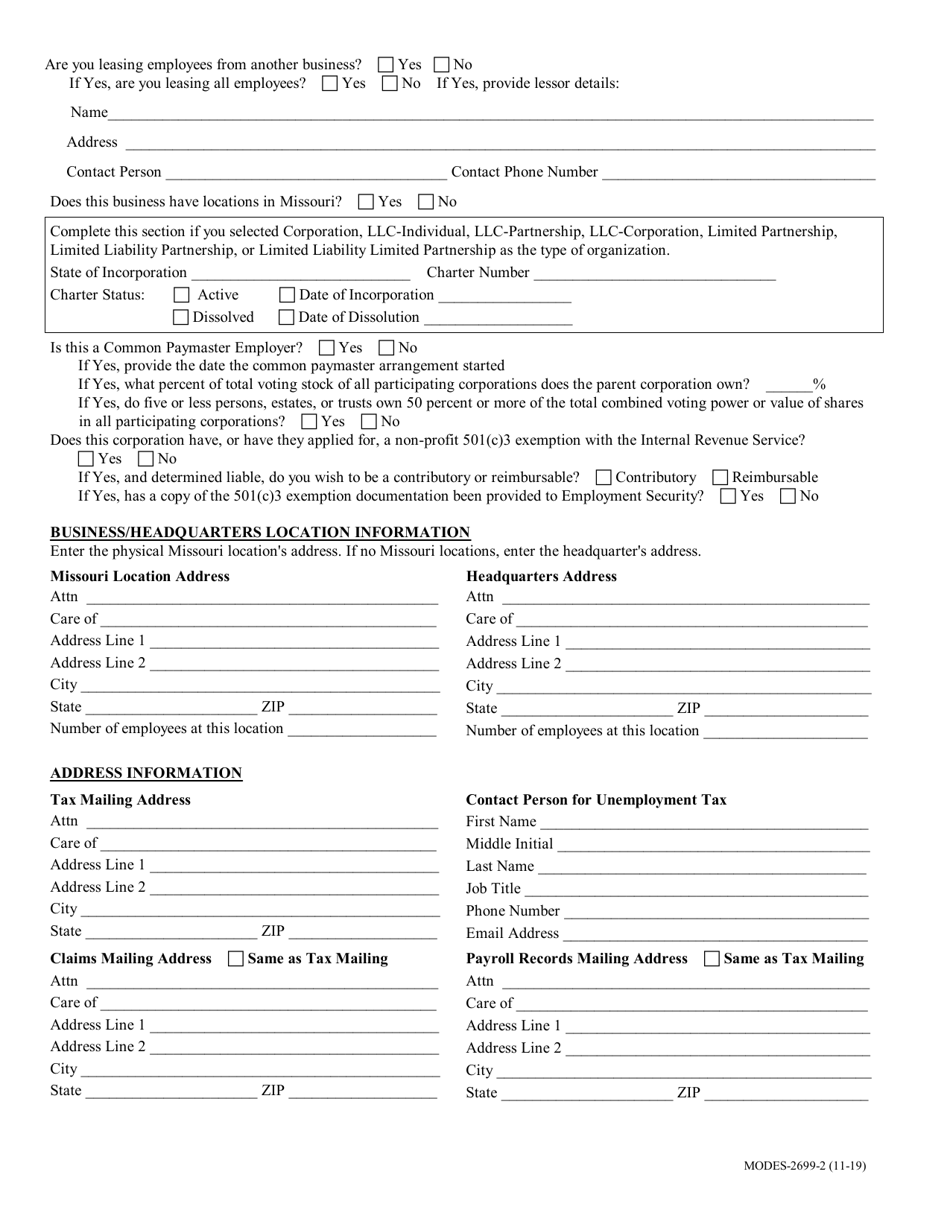

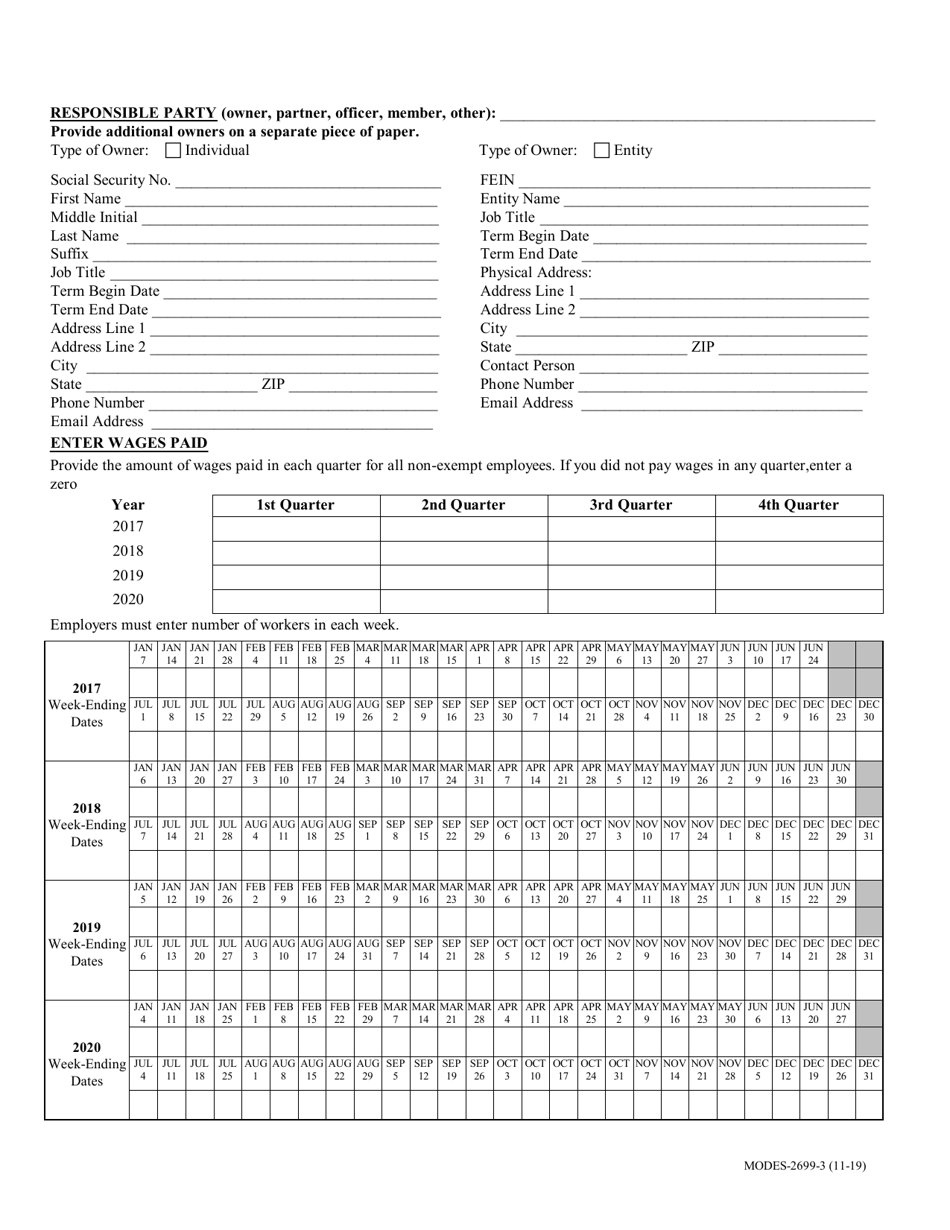

Q: What information do I need to provide on Form MODES-2699?

A: You will need to provide information such as your business name, address, federal employer identification number (FEIN), and the number of employees you have.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Missouri Department of Labor and Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MODES-2699 by clicking the link below or browse more documents and templates provided by the Missouri Department of Labor and Industrial Relations.