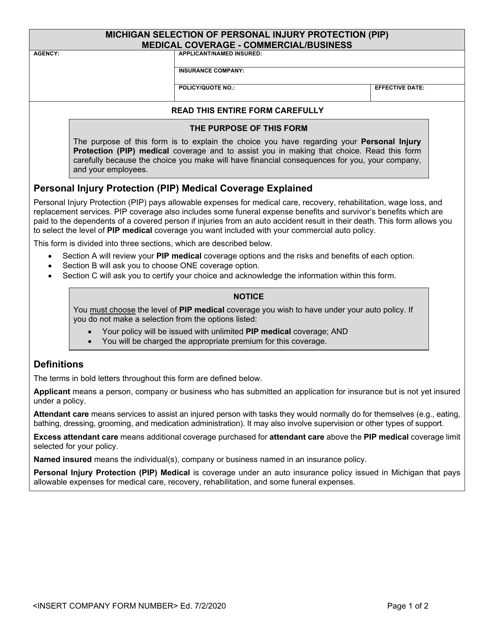

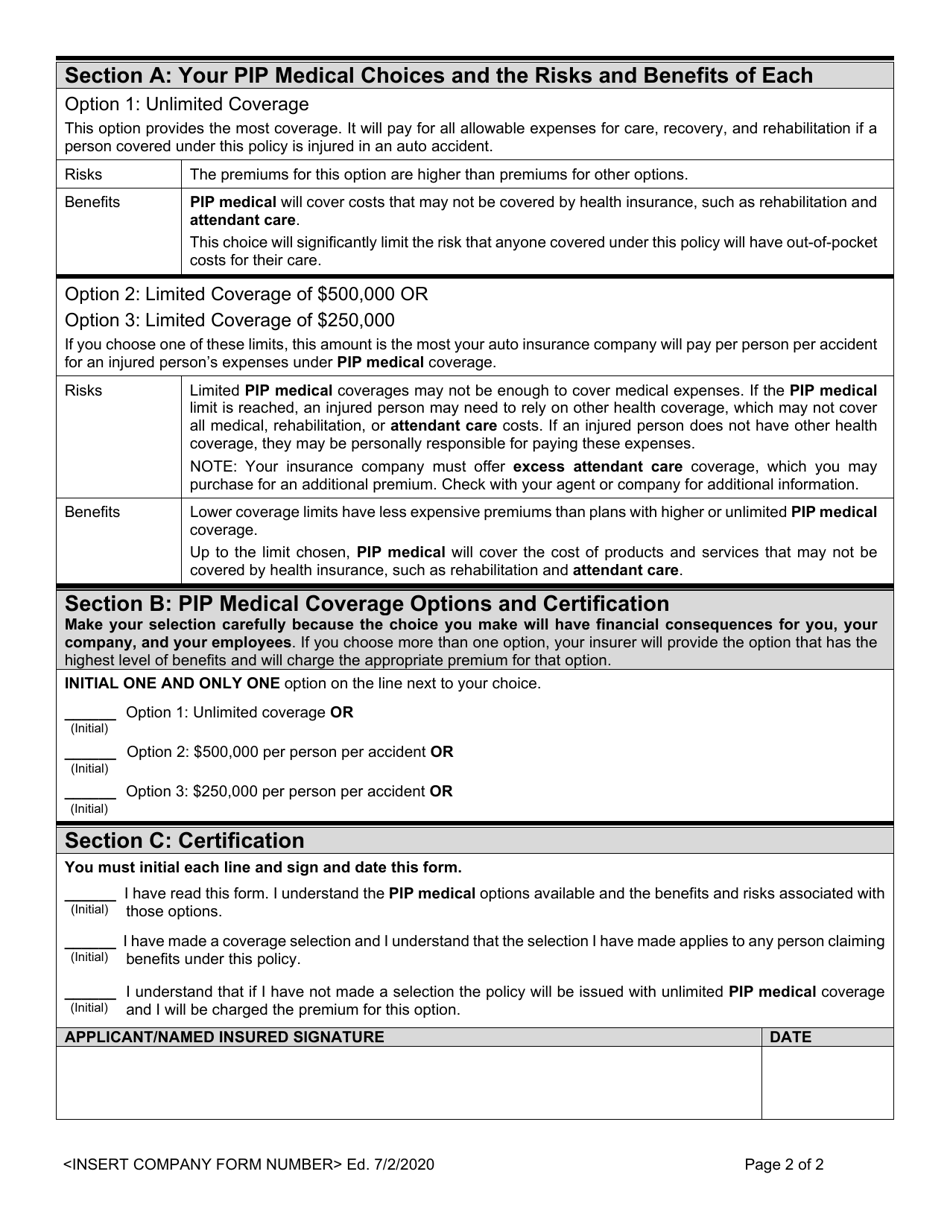

Michigan Selection of Personal Injury Protection (Pip) Medical Coverage - Commercial / Business - Michigan

Michigan Selection of Personal Injury Protection (Pip) Medical Coverage - Commercial/Business is a legal document that was released by the Michigan Department of Insurance and Financial Services - a government authority operating within Michigan.

FAQ

Q: What is Personal Injury Protection (PIP) medical coverage?

A: Personal Injury Protection (PIP) medical coverage is an insurance coverage that pays for medical expenses resulting from a car accident.

Q: Is Personal Injury Protection (PIP) medical coverage mandatory in Michigan?

A: Yes, Personal Injury Protection (PIP) medical coverage is mandatory in Michigan for all drivers.

Q: What does Personal Injury Protection (PIP) medical coverage cover?

A: PIP medical coverage covers medical expenses, rehabilitation costs, lost wages, and other related expenses resulting from a car accident.

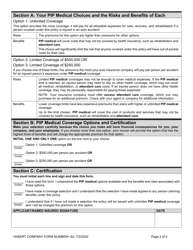

Q: Are there limits to the amount of Personal Injury Protection (PIP) medical coverage in Michigan?

A: Michigan has unlimited PIP medical coverage, which means there is no maximum limit on the amount paid for medical expenses.

Q: Can I opt out of Personal Injury Protection (PIP) medical coverage in Michigan?

A: No, drivers in Michigan are not allowed to opt out of PIP medical coverage.

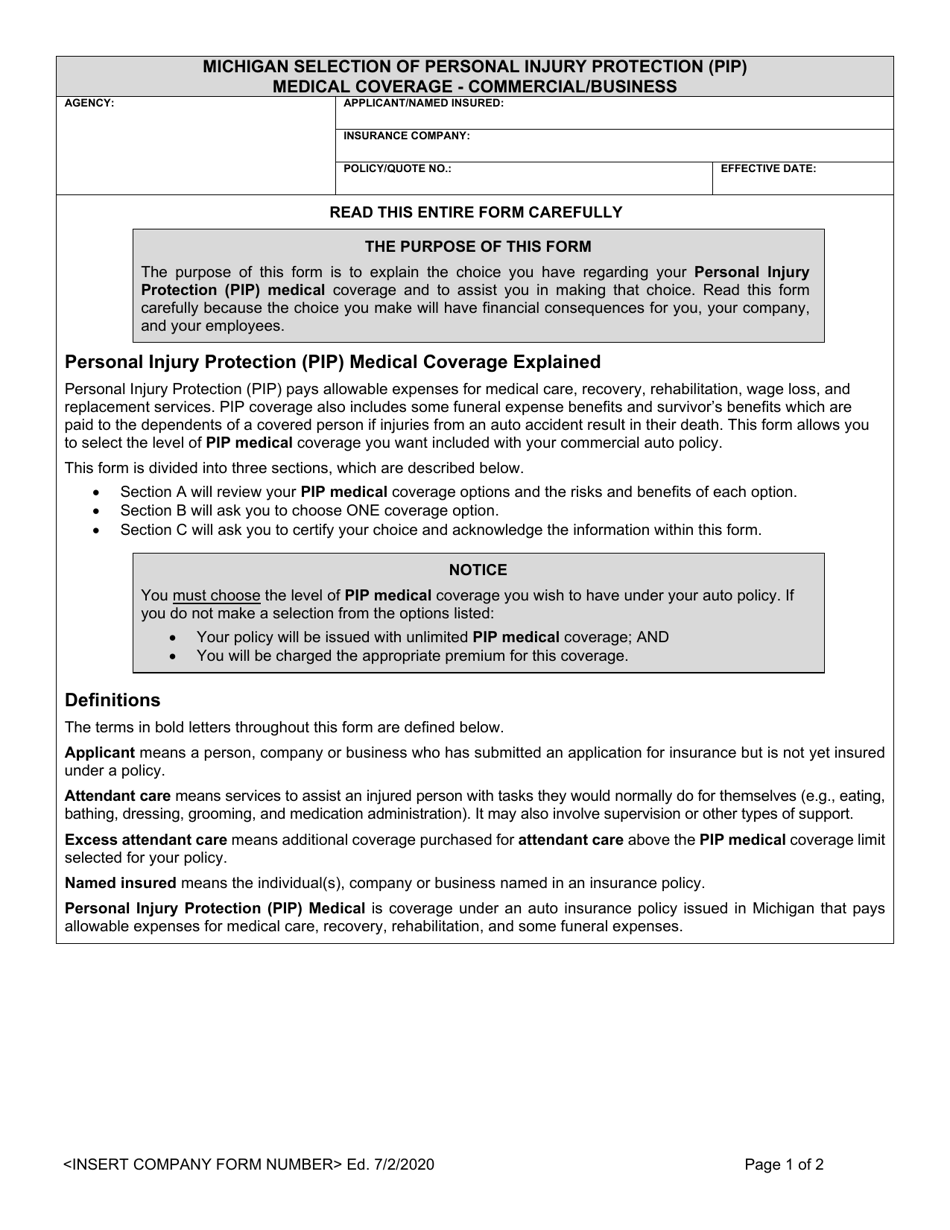

Form Details:

- Released on February 7, 2020;

- The latest edition currently provided by the Michigan Department of Insurance and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Michigan Department of Insurance and Financial Services.