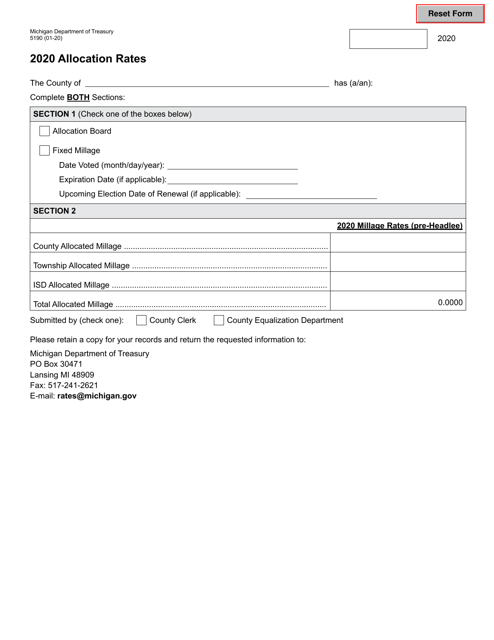

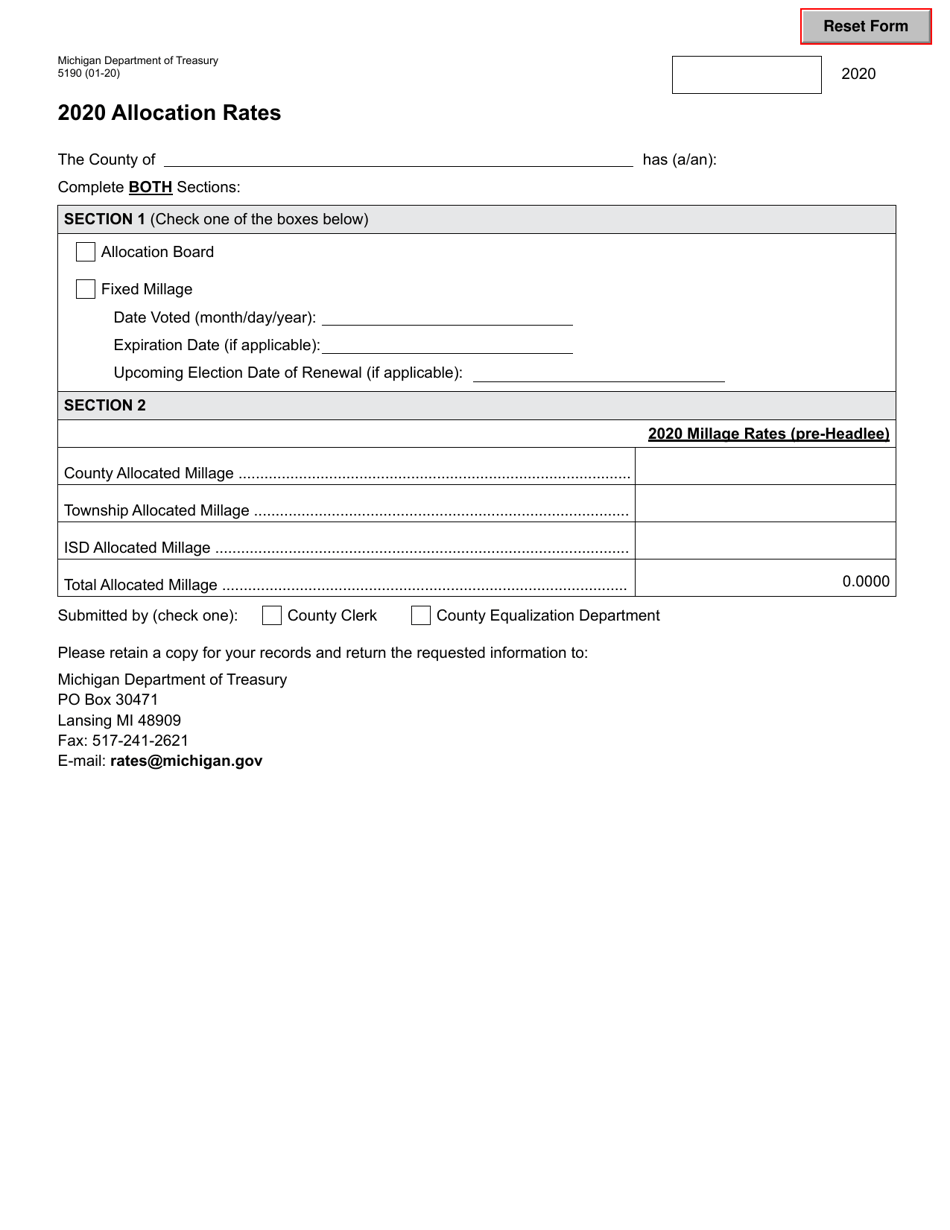

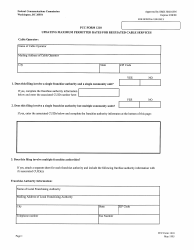

Form 5190 Allocation Rates - Michigan

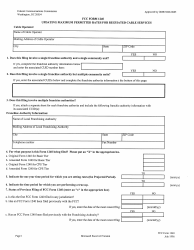

What Is Form 5190?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5190?

A: Form 5190 is a document used to determine allocation rates.

Q: What are allocation rates?

A: Allocation rates are rates used to allocate costs to specific areas or departments.

Q: Why are allocation rates important?

A: Allocation rates are important because they help determine how costs are distributed among different areas or departments.

Q: How are allocation rates determined?

A: Allocation rates are typically determined based on factors such as the usage of resources or the proportion of activities in each area or department.

Q: What is the purpose of Form 5190?

A: The purpose of Form 5190 is to provide a standardized method for determining allocation rates in Michigan.

Q: Who uses Form 5190?

A: Form 5190 is used by organizations in Michigan that need to determine allocation rates.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5190 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.