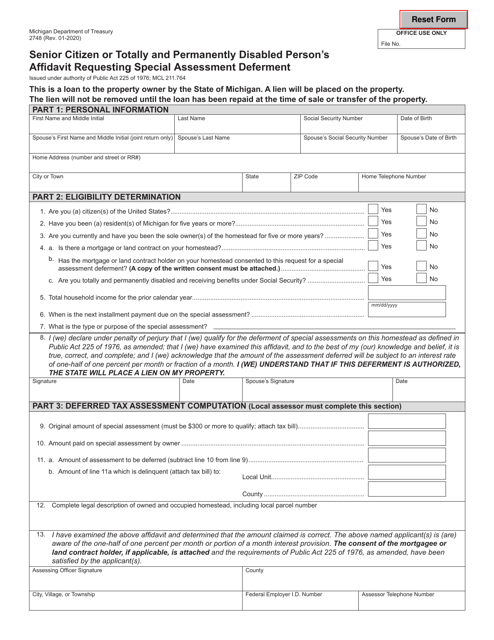

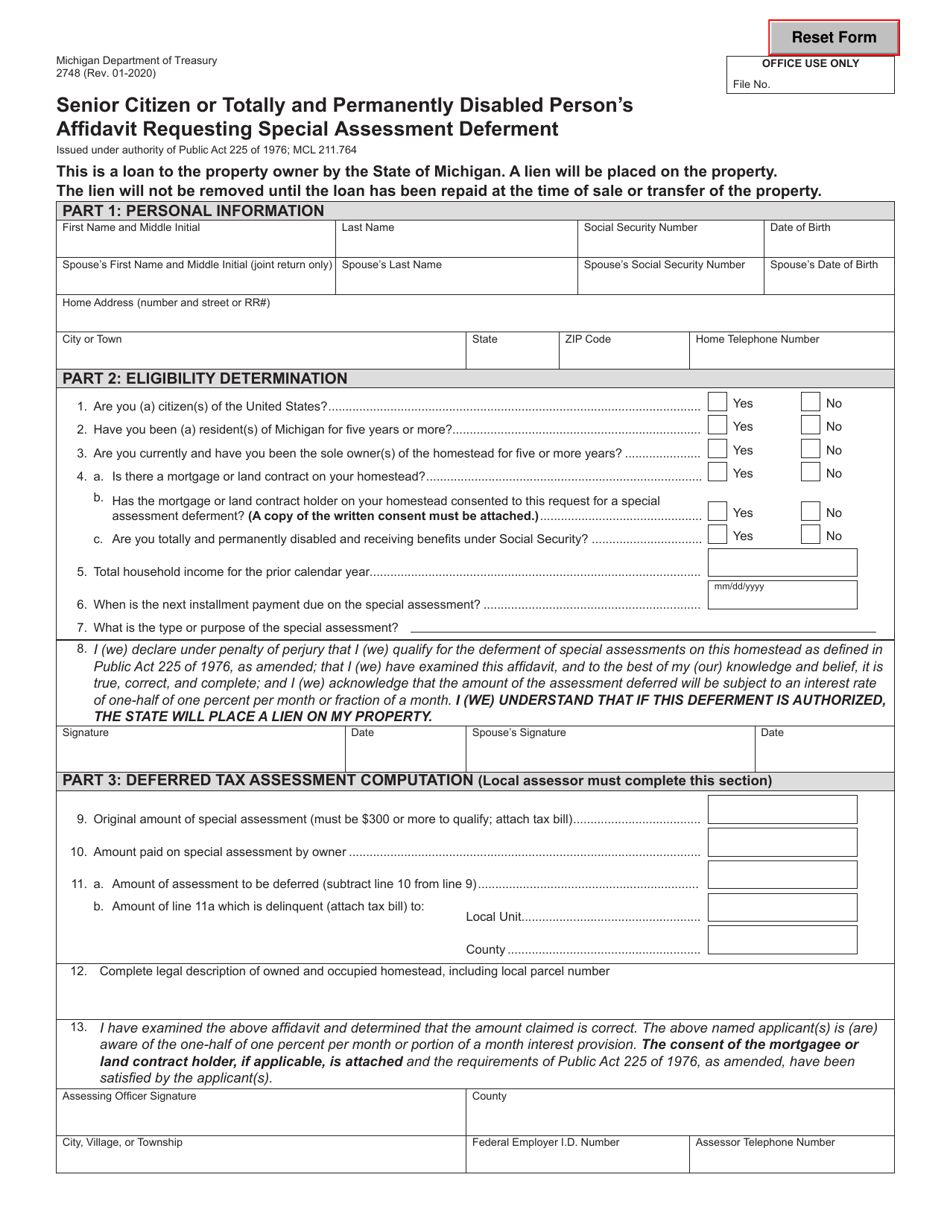

Form 2748 Senior Citizen or Totally and Permanently Disabled Person's Affidavit Requesting Special Assessment Deferment - Michigan

What Is Form 2748?

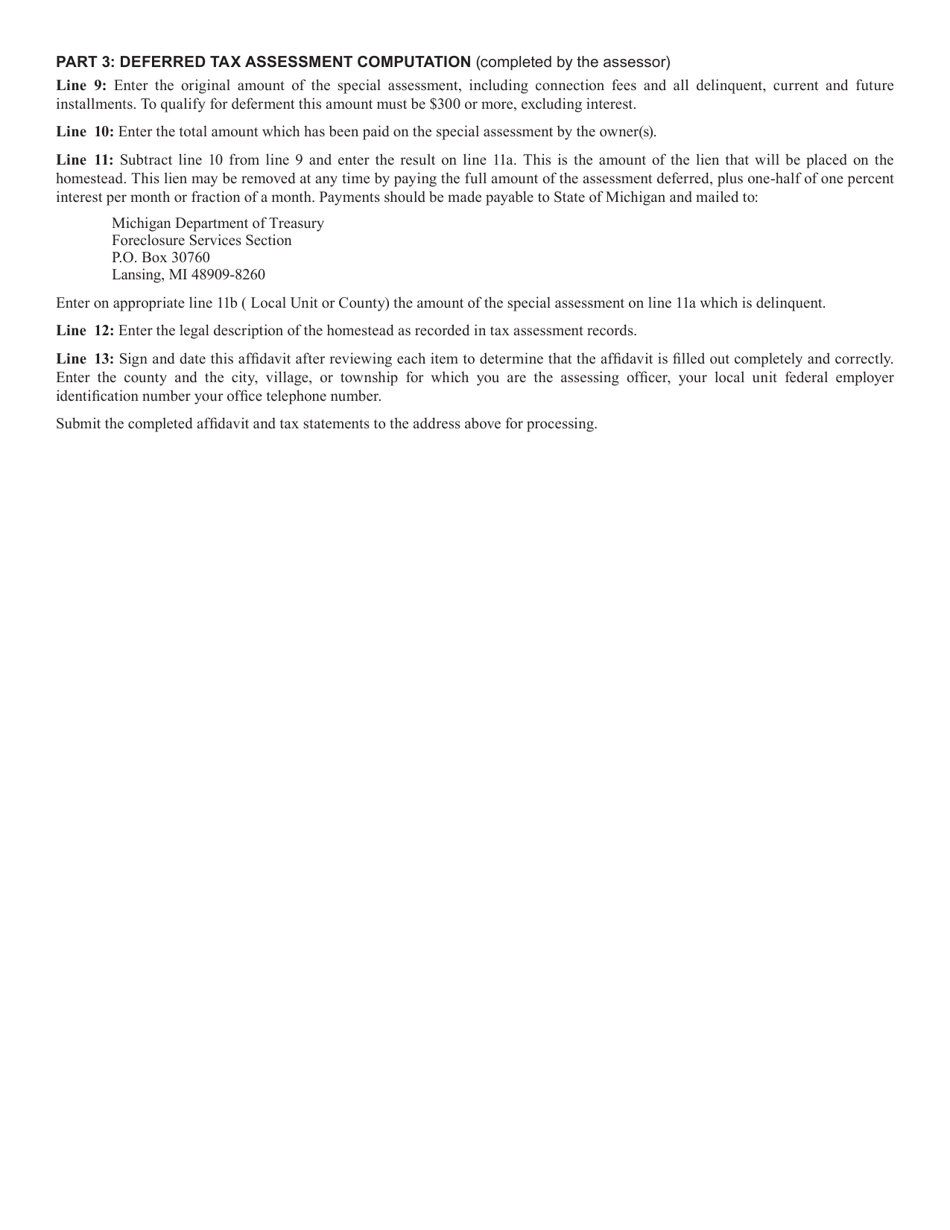

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2748?

A: Form 2748 is a Senior Citizen or Totally and Permanently Disabled Person's Affidavit used in Michigan.

Q: Who can use Form 2748?

A: Senior citizens or totally and permanently disabled individuals in Michigan can use Form 2748.

Q: What is the purpose of Form 2748?

A: The purpose of Form 2748 is to request special assessment deferment for property taxes in Michigan.

Q: What is special assessment deferment?

A: Special assessment deferment is a program that allows eligible individuals to defer paying property taxes.

Q: What are the eligibility requirements for using Form 2748?

A: To be eligible, an individual must be a senior citizen (age 62 or older) or totally and permanently disabled.

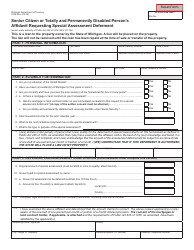

Q: What information is required on Form 2748?

A: Form 2748 requires personal information, such as name, address, and social security number, as well as proof of age or disability.

Q: What is the deadline for submitting Form 2748?

A: The deadline for submitting Form 2748 is typically May 1st of the tax year, but it may vary.

Q: What happens after submitting Form 2748?

A: After submitting Form 2748, the assessor's office will review your application and notify you of the decision.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2748 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.