This version of the form is not currently in use and is provided for reference only. Download this version of

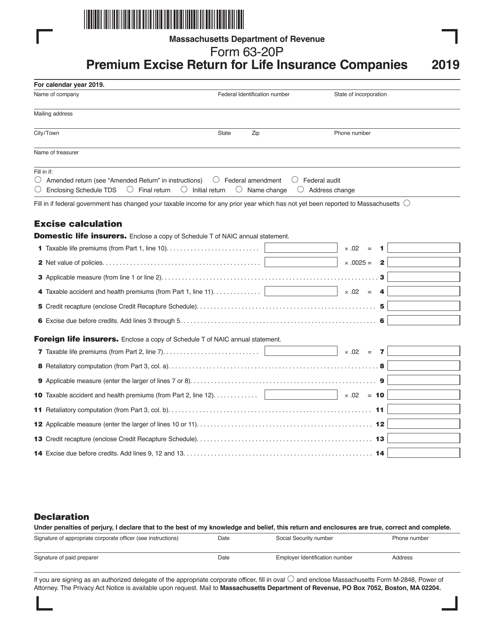

Form 63-20P

for the current year.

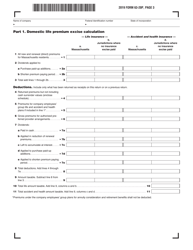

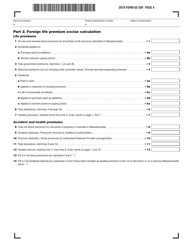

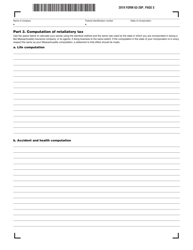

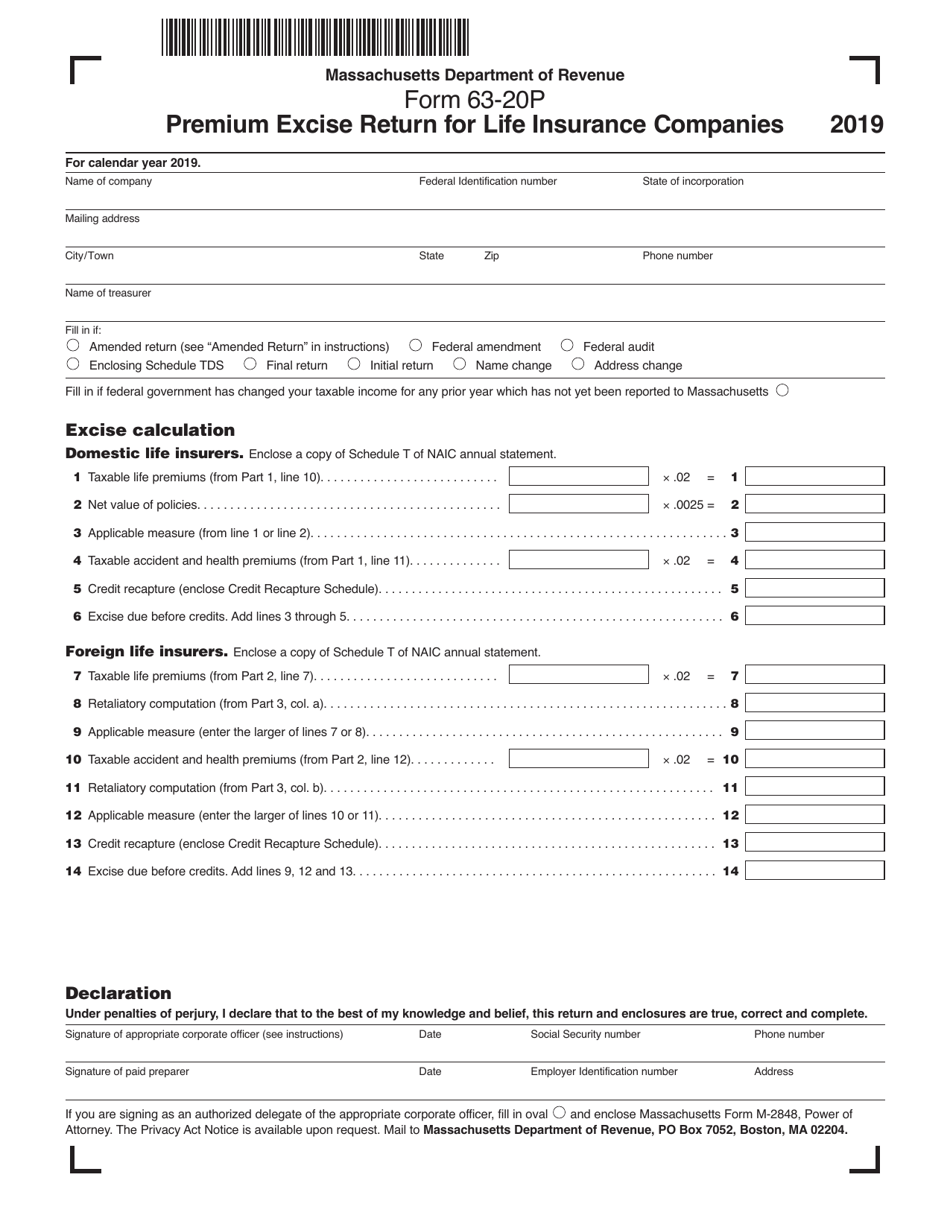

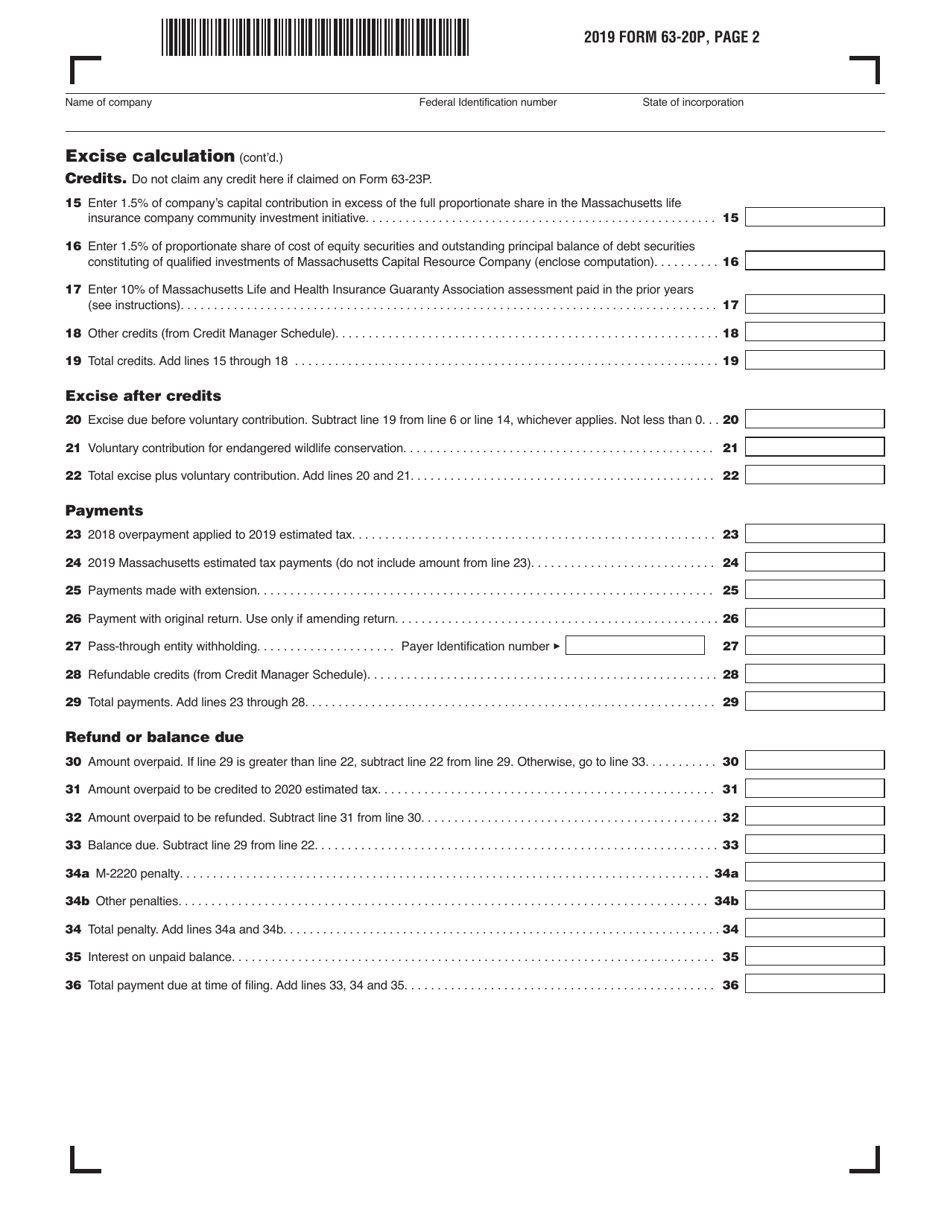

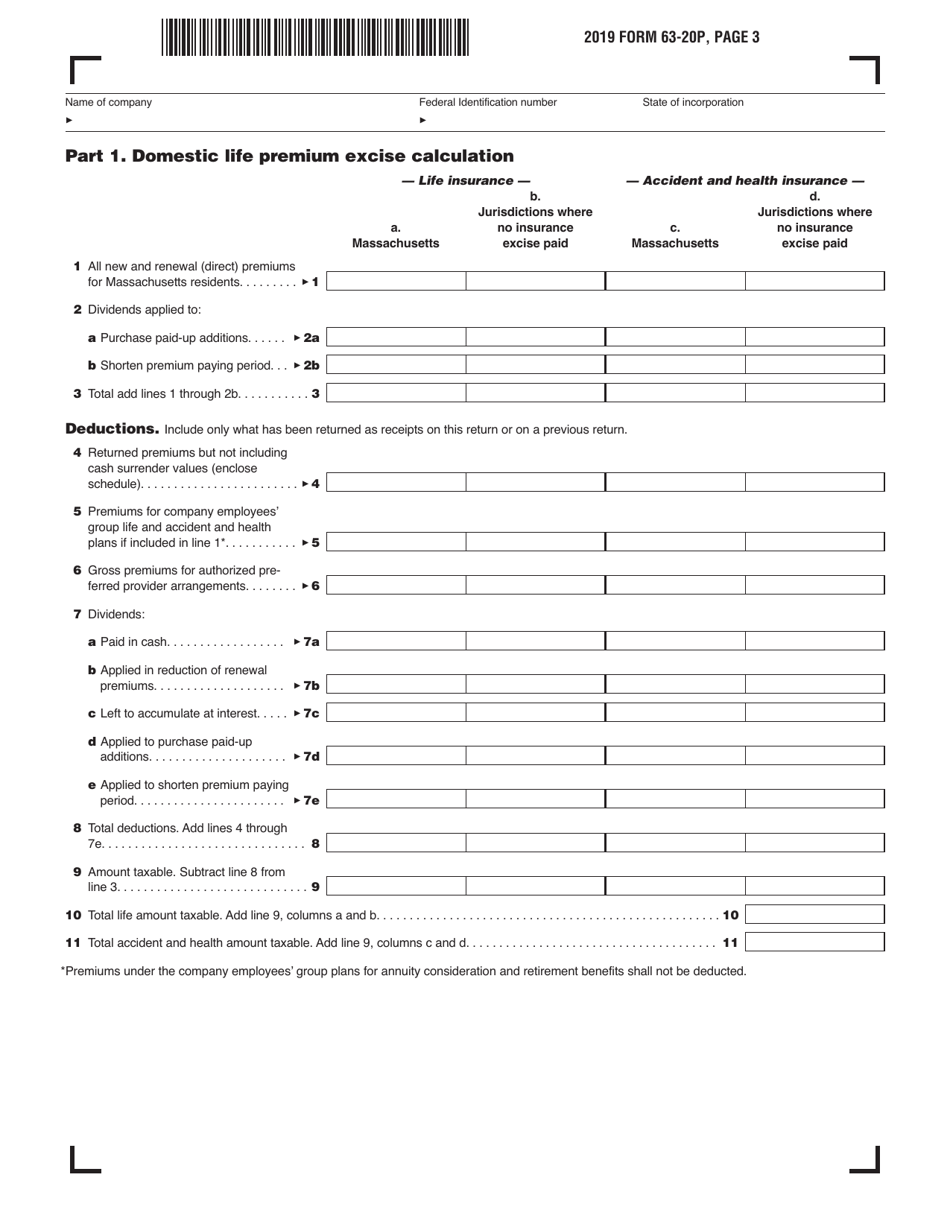

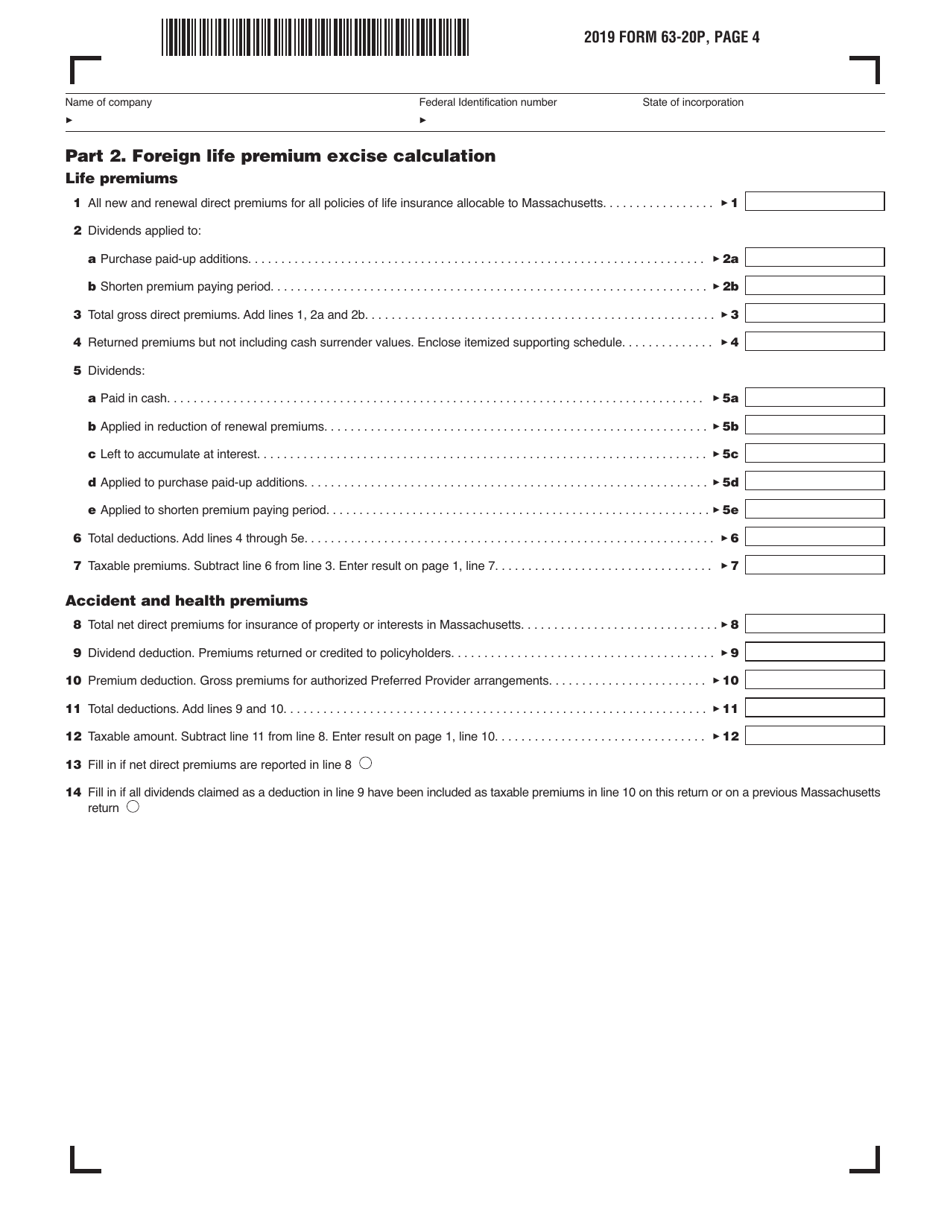

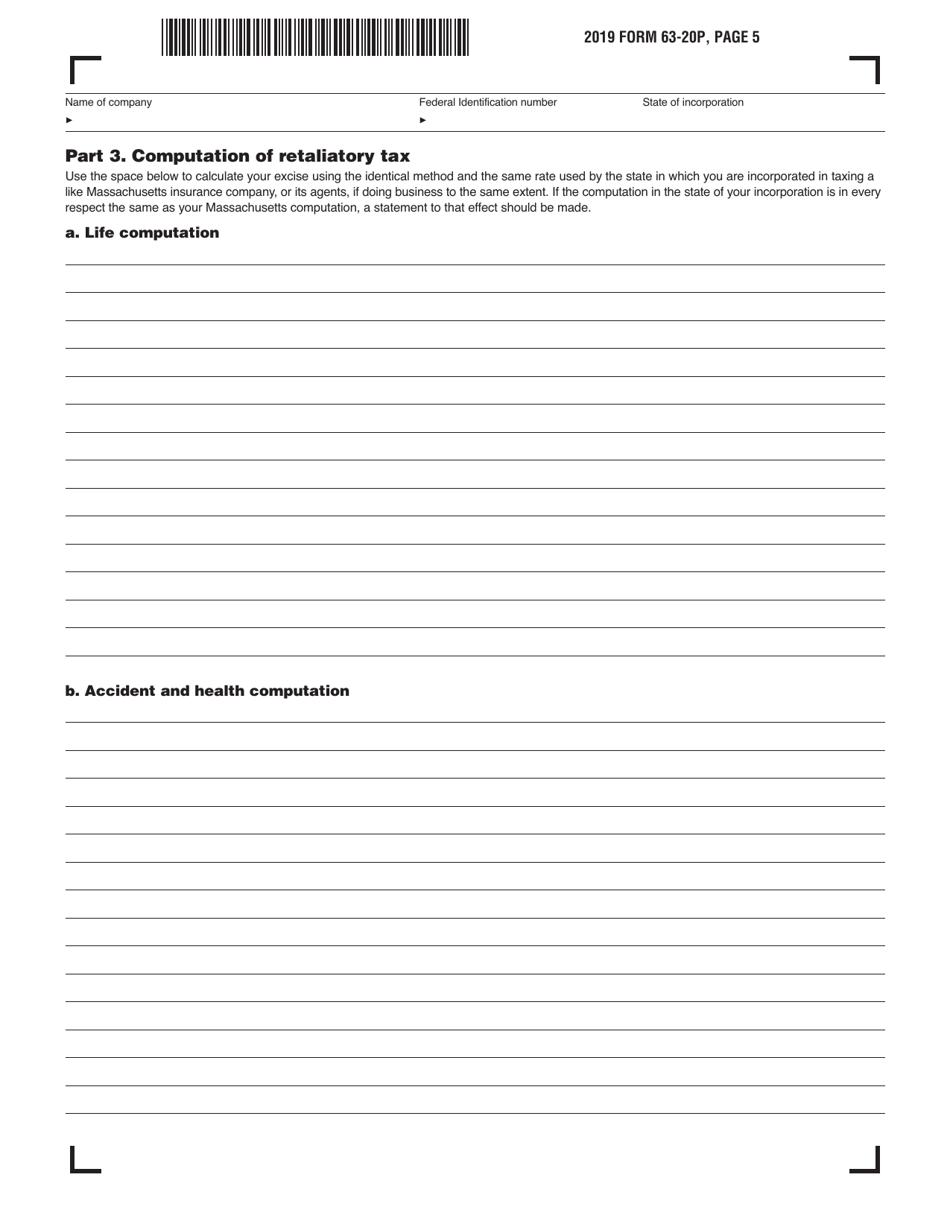

Form 63-20P Premium Excise Return for Life Insurance Companies - Massachusetts

What Is Form 63-20P?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 63-20P?

A: Form 63-20P is the Premium Excise Return specifically for Life Insurance Companies in Massachusetts.

Q: Who needs to file Form 63-20P?

A: Life insurance companies operating in Massachusetts are required to file Form 63-20P.

Q: What is the purpose of Form 63-20P?

A: Form 63-20P is used to report and pay the premium excise tax by life insurance companies in Massachusetts.

Q: When is Form 63-20P due?

A: Form 63-20P is generally due on or before the 15th day of the third month following the end of the tax year.

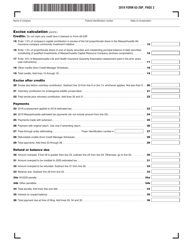

Q: What information is required to complete Form 63-20P?

A: Form 63-20P requires information about the life insurance company's premium income, deductions, and credits.

Q: Are there any penalties for late or incorrect filing of Form 63-20P?

A: Yes, there may be penalties for late or incorrect filing of Form 63-20P, such as interest charges and monetary penalties.

Q: Can Form 63-20P be filed electronically?

A: Yes, Form 63-20P can be filed electronically through the Department of Revenue's e-file system.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63-20P by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.