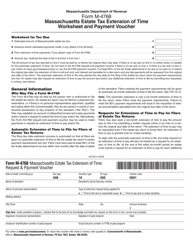

This version of the form is not currently in use and is provided for reference only. Download this version of

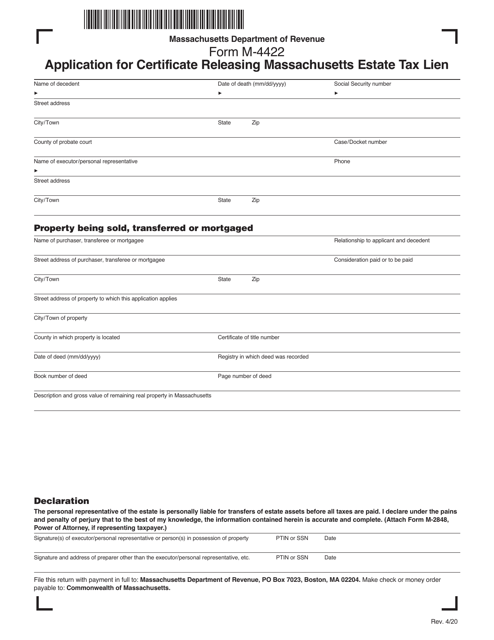

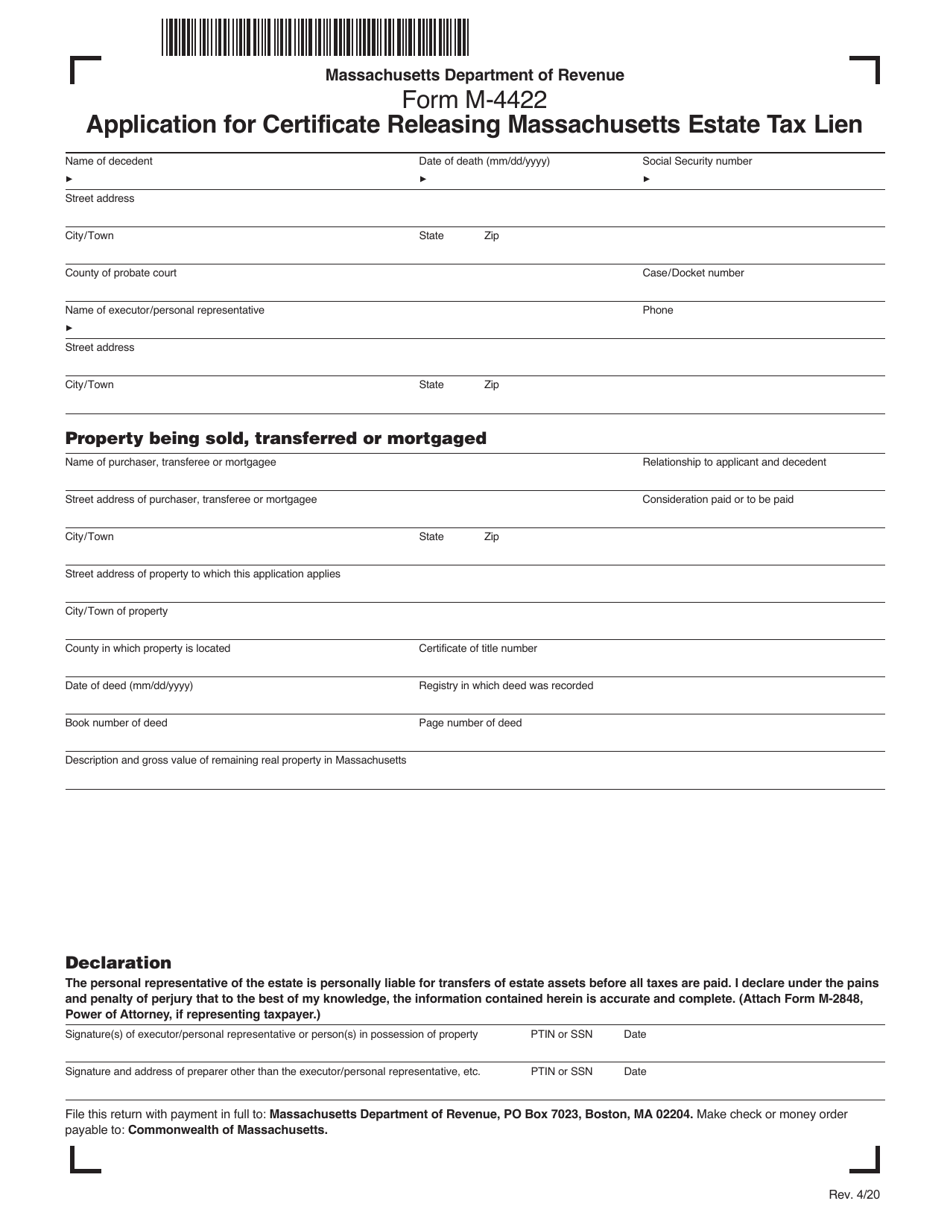

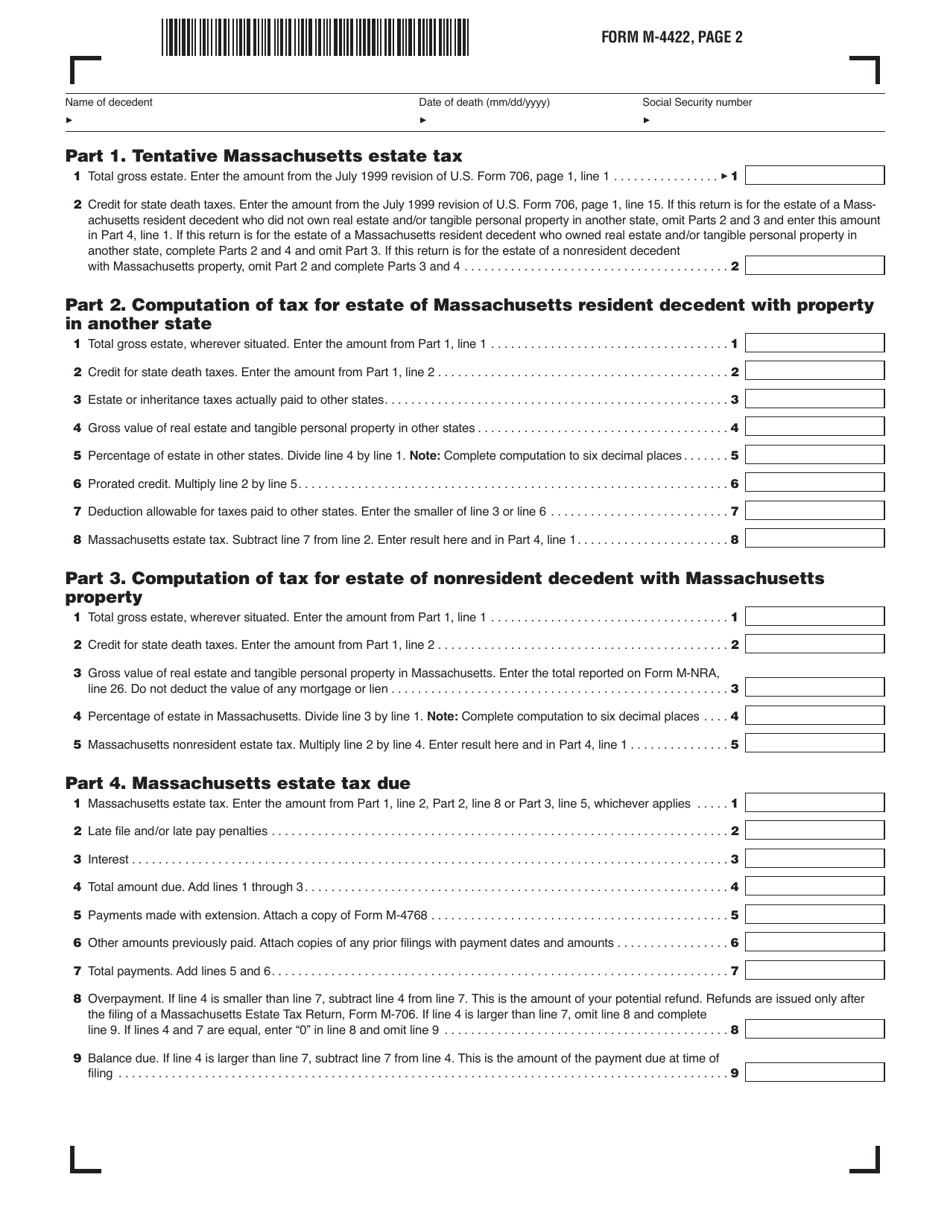

Form M-4422

for the current year.

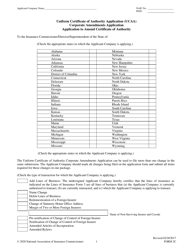

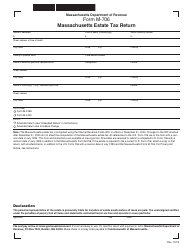

Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien - Massachusetts

What Is Form M-4422?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-4422?

A: Form M-4422 is an application for a Certificate Releasing Massachusetts Estate Tax Lien.

Q: What is a Massachusetts Estate Tax Lien?

A: A Massachusetts Estate Tax Lien is a claim against the property of a deceased person for unpaid estate taxes.

Q: Who needs to use Form M-4422?

A: Anyone who wants to release a Massachusetts Estate Tax Lien on a property needs to use Form M-4422.

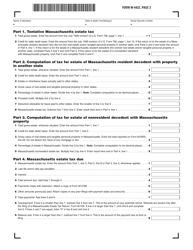

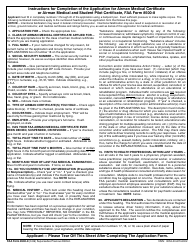

Q: What information is required on Form M-4422?

A: Form M-4422 requires information about the deceased person, the property, and the estate tax lien.

Q: Is there a fee for submitting Form M-4422?

A: Yes, there is a fee for submitting Form M-4422. The fee amount is specified on the form.

Q: How long does it take to process Form M-4422?

A: The processing time for Form M-4422 can vary. It is best to contact the Massachusetts Department of Revenue for an estimate.

Q: What happens after I submit Form M-4422?

A: After you submit Form M-4422 and the fee, the Massachusetts Department of Revenue will review your application and issue a Certificate Releasing Massachusetts Estate Tax Lien, if approved.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-4422 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.