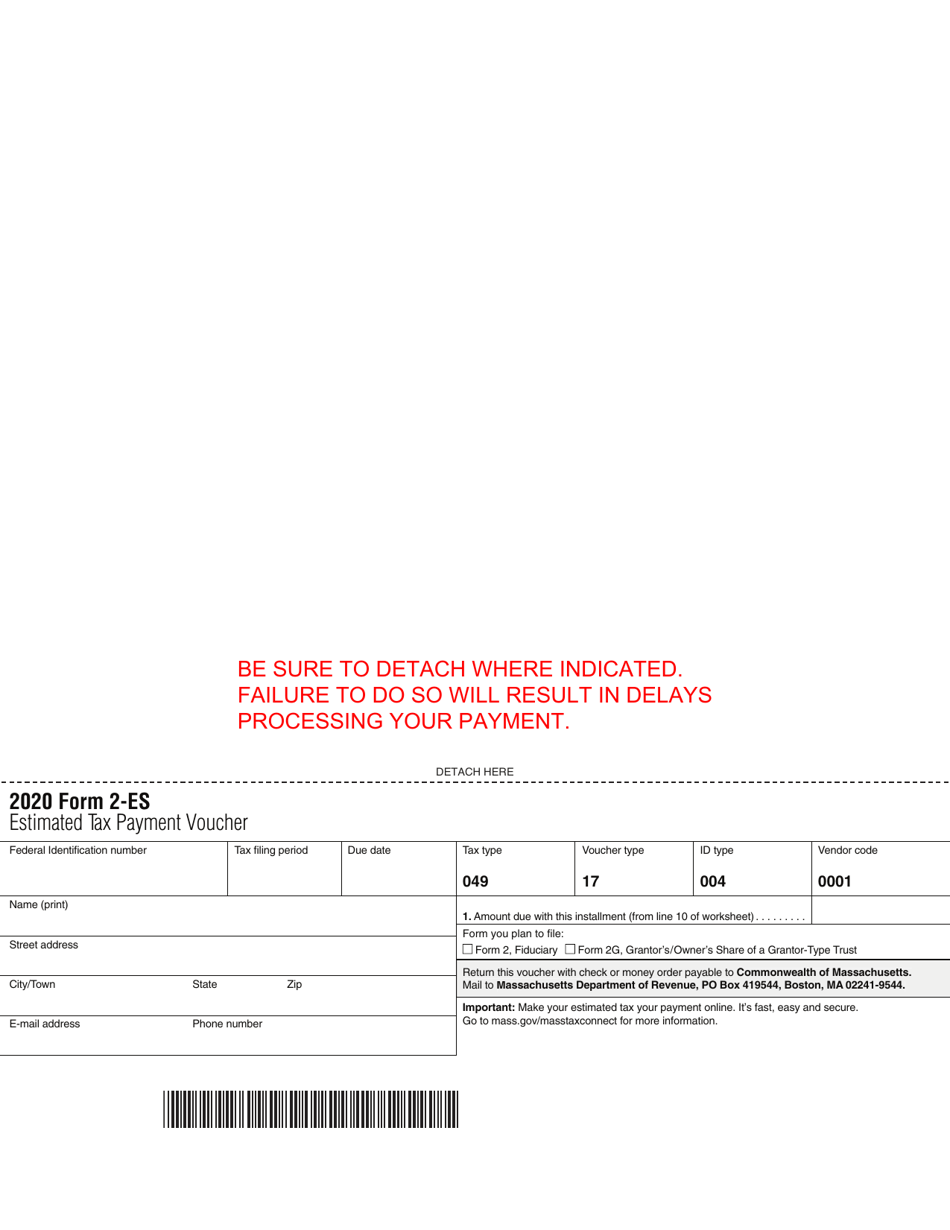

This version of the form is not currently in use and is provided for reference only. Download this version of

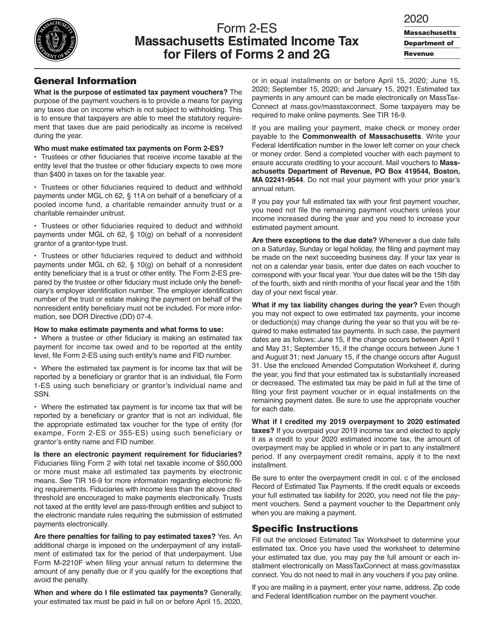

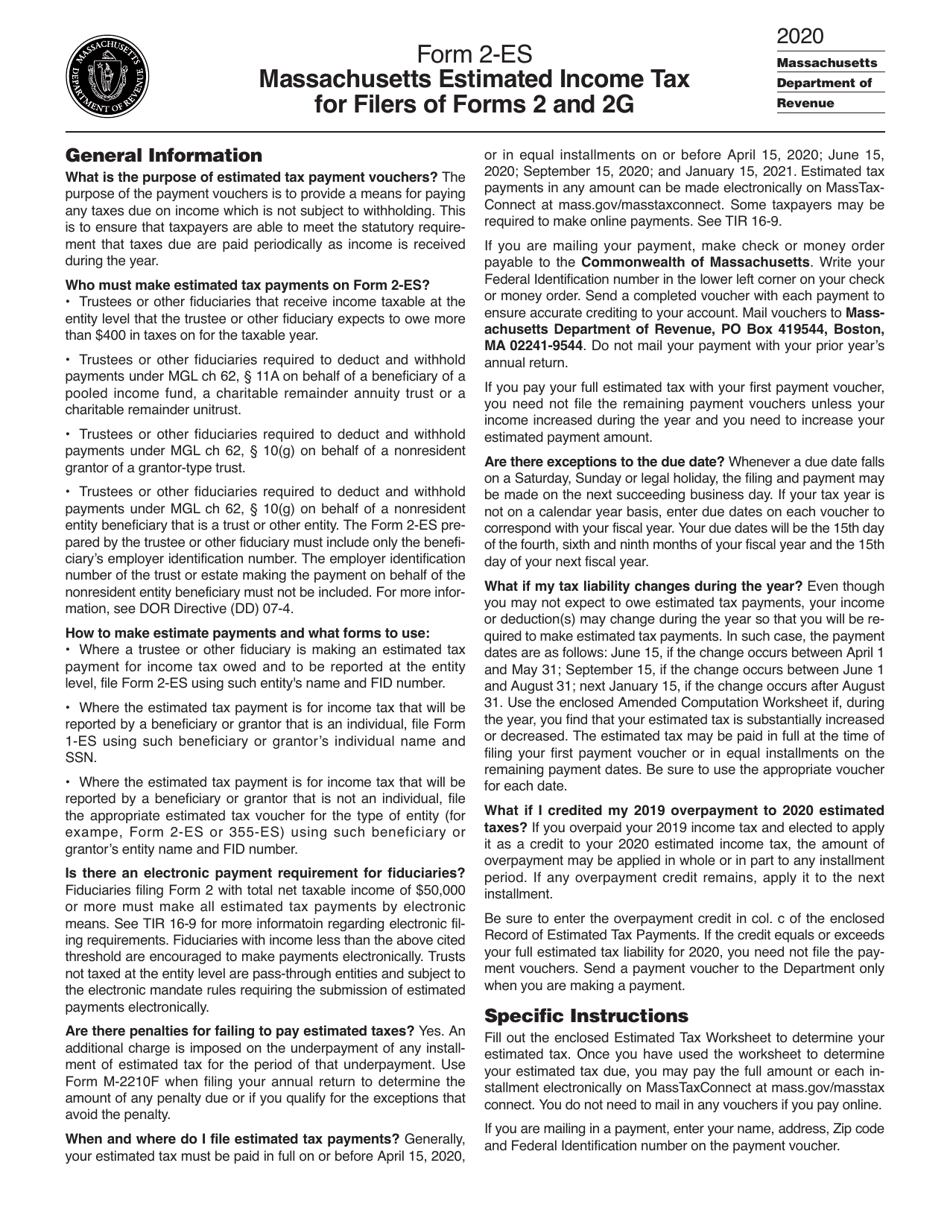

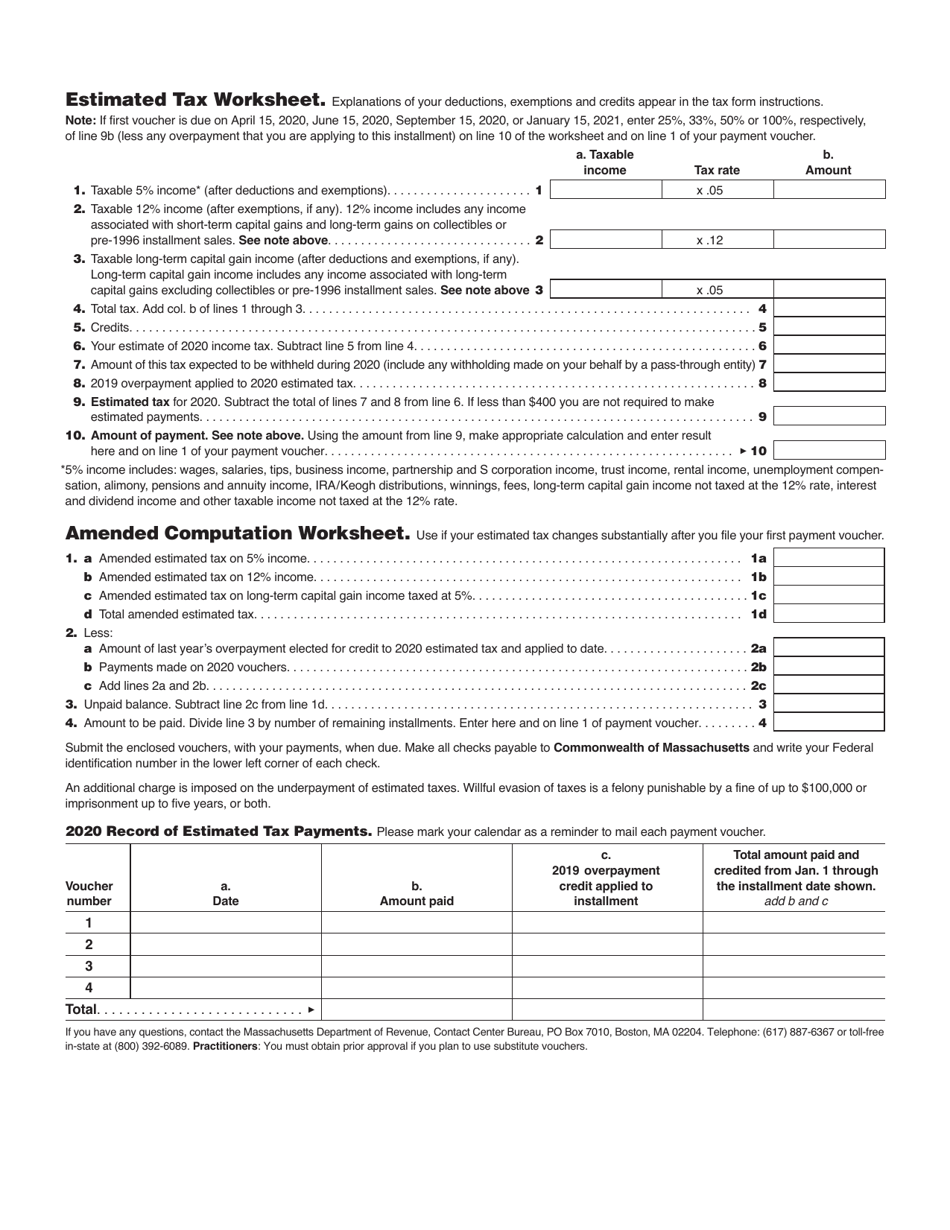

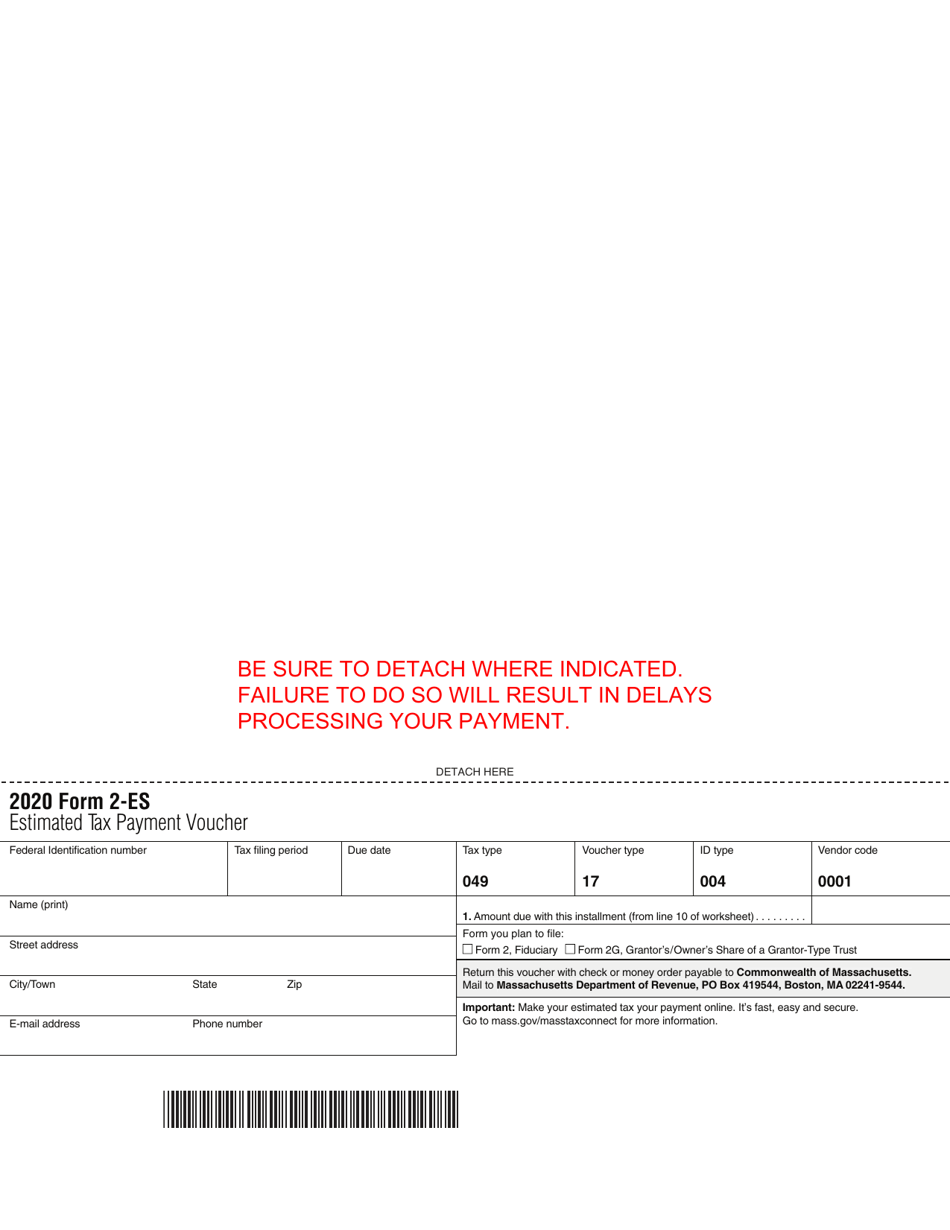

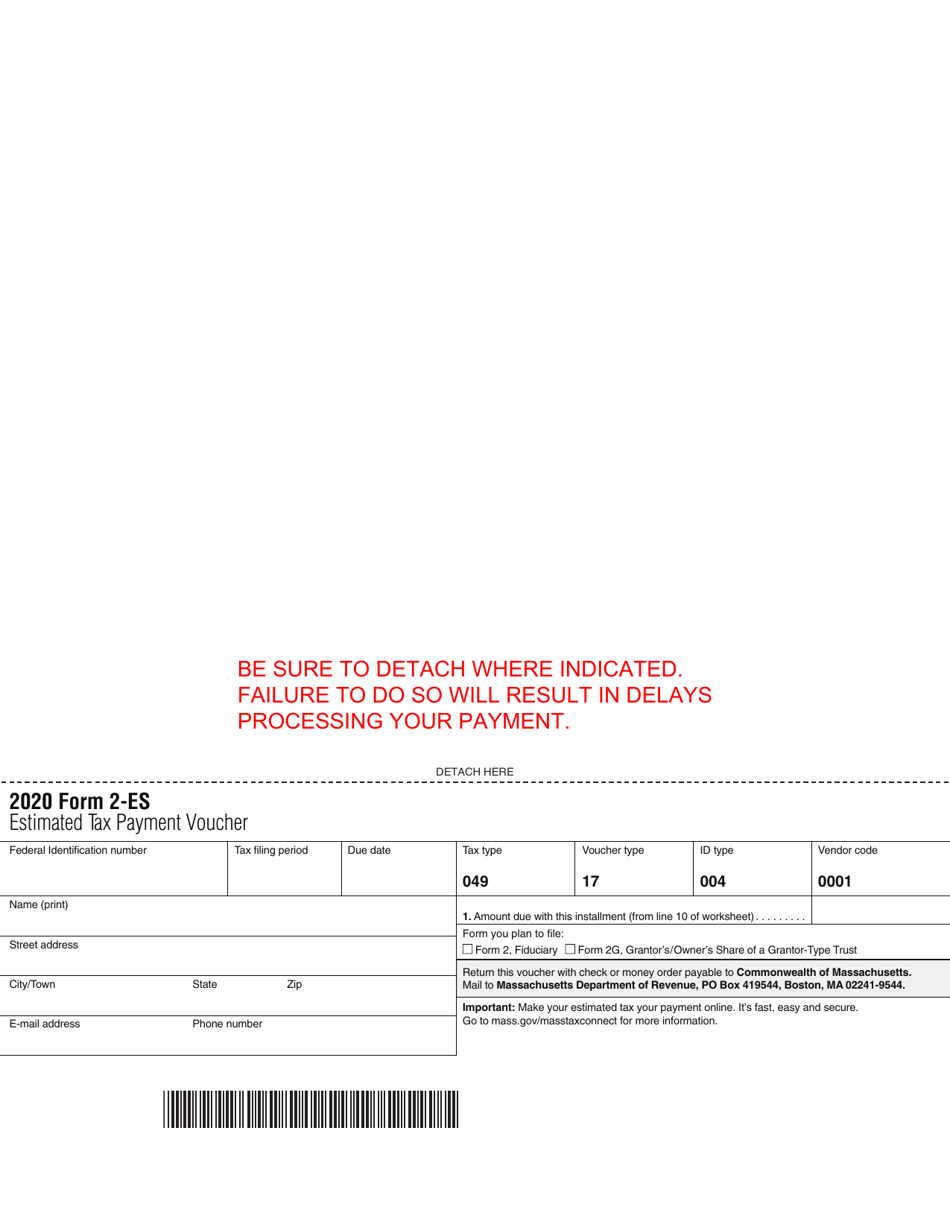

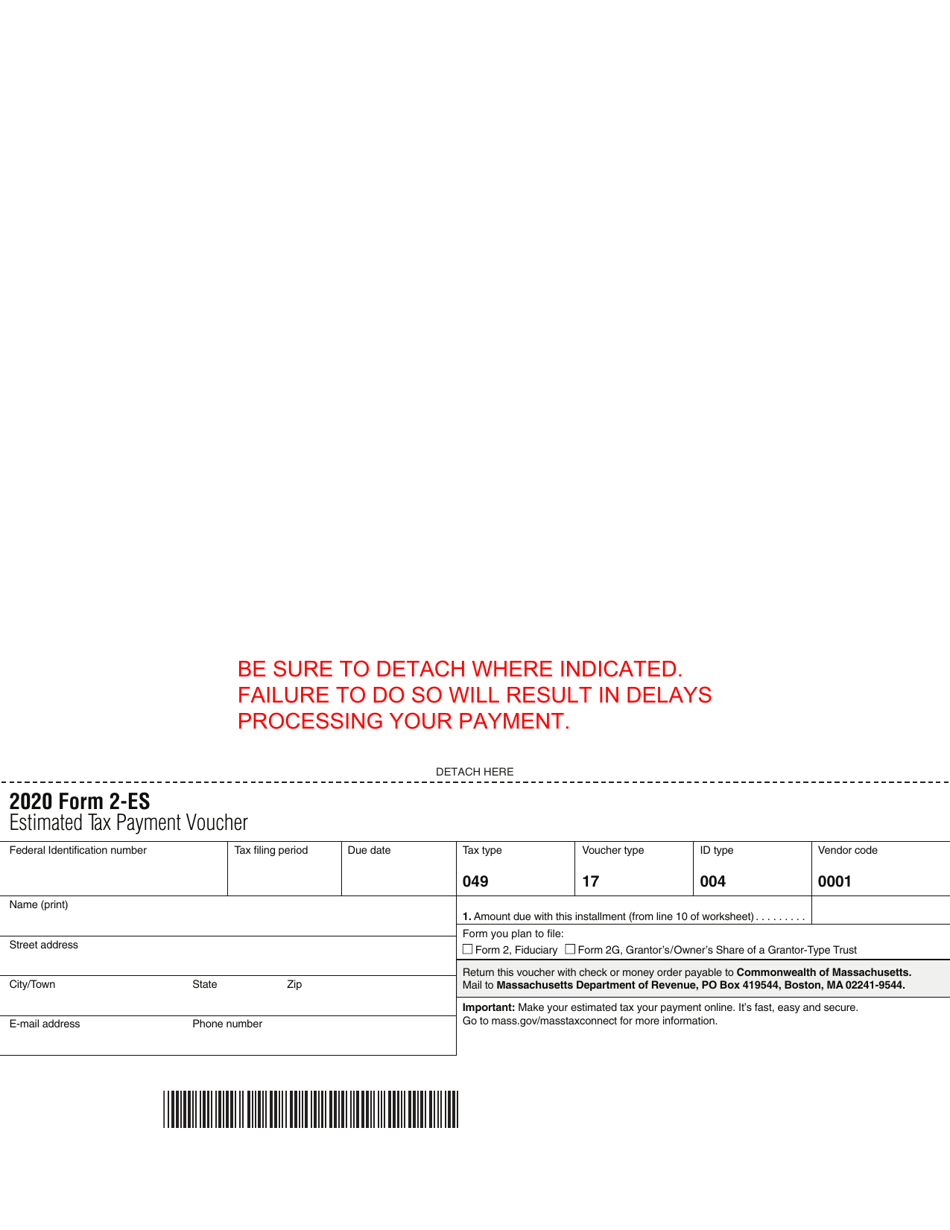

Form 2-ES

for the current year.

Form 2-ES Estimated Tax Payment Voucher - Massachusetts

What Is Form 2-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2-ES?

A: Form 2-ES is the Estimated Tax Payment Voucher for Massachusetts.

Q: What is the purpose of Form 2-ES?

A: Form 2-ES is used to make estimated tax payments to the state of Massachusetts.

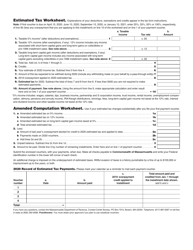

Q: What are estimated tax payments?

A: Estimated tax payments are payments made throughout the year to cover an individual's or business's anticipated tax liability.

Q: Who needs to file Form 2-ES?

A: Individuals and businesses in Massachusetts who expect to owe tax of $400 or more for the tax year are required to make estimated tax payments and file Form 2-ES.

Q: When are estimated tax payments due?

A: Estimated tax payments for Massachusetts are due on April 15th, June 15th, September 15th, and January 15th of the following year.

Q: What happens if I don't file Form 2-ES?

A: If you are required to make estimated tax payments and fail to do so, you may be subject to penalties and interest on the unpaid amount.

Q: Is Form 2-ES the same as Form 2?

A: No, Form 2-ES is specifically for estimated tax payments, while Form 2 is the regular Massachusetts Resident Income Tax Return.

Q: Can I make changes to my estimated tax payments?

A: Yes, if your circumstances change during the year, you can make adjustments to your estimated tax payments by filing a new Form 2-ES.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.