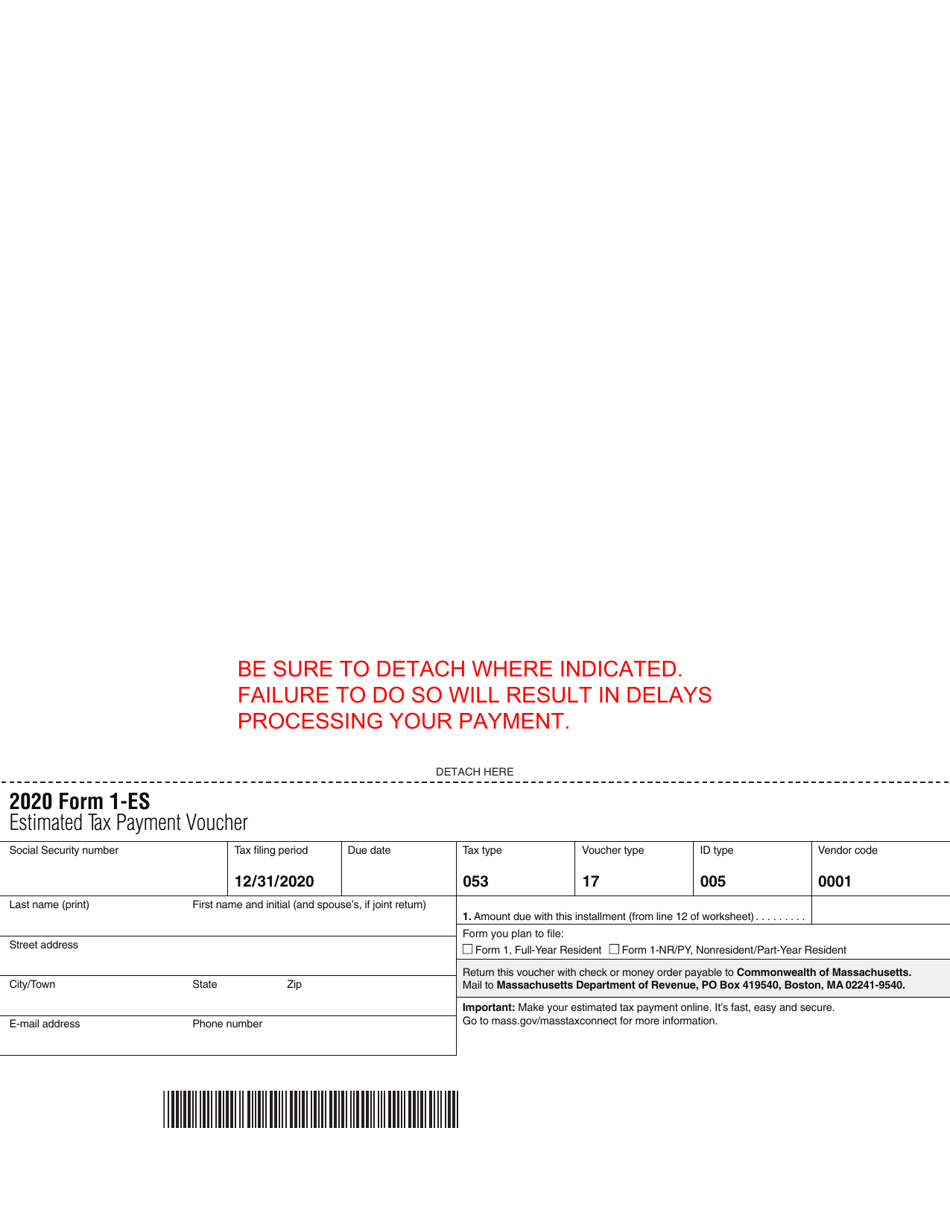

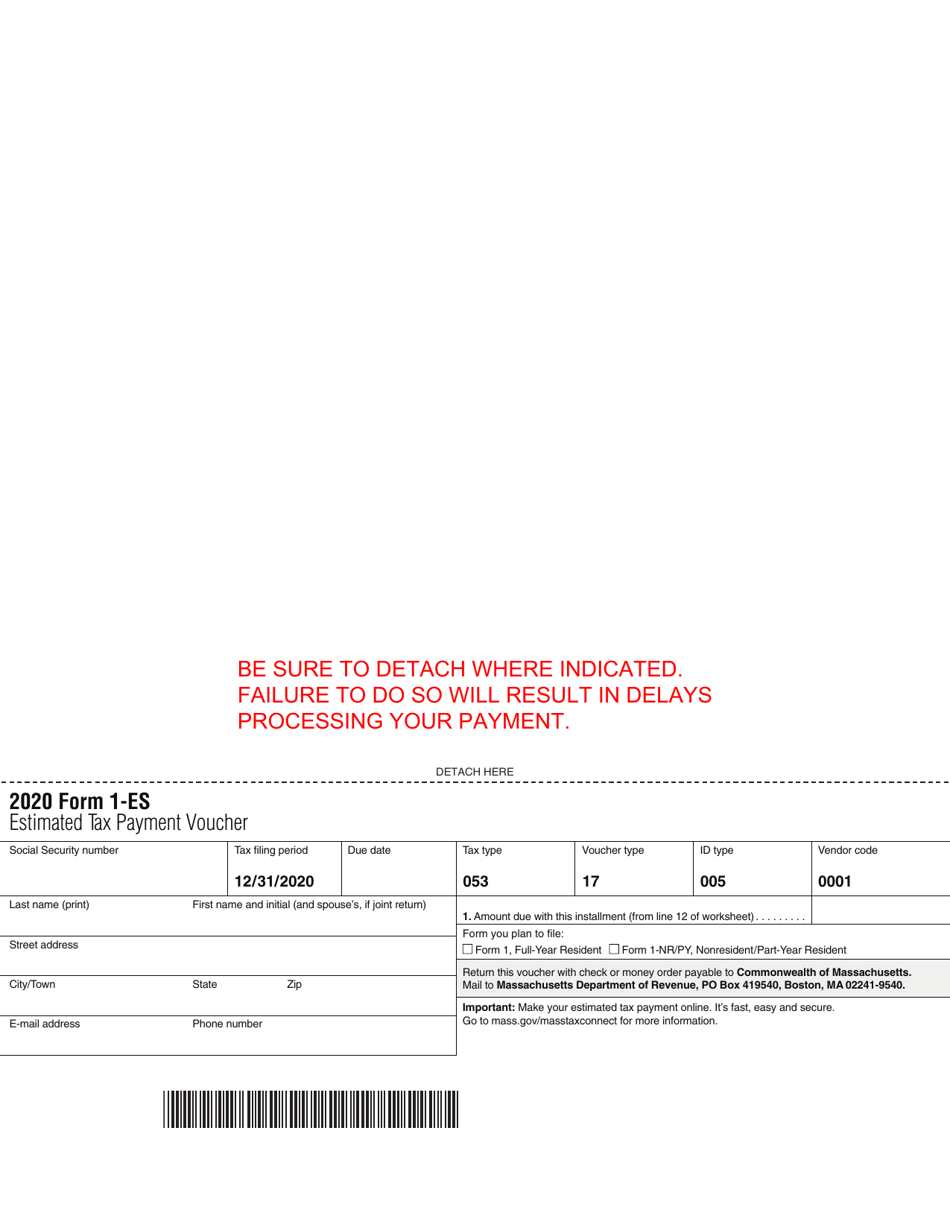

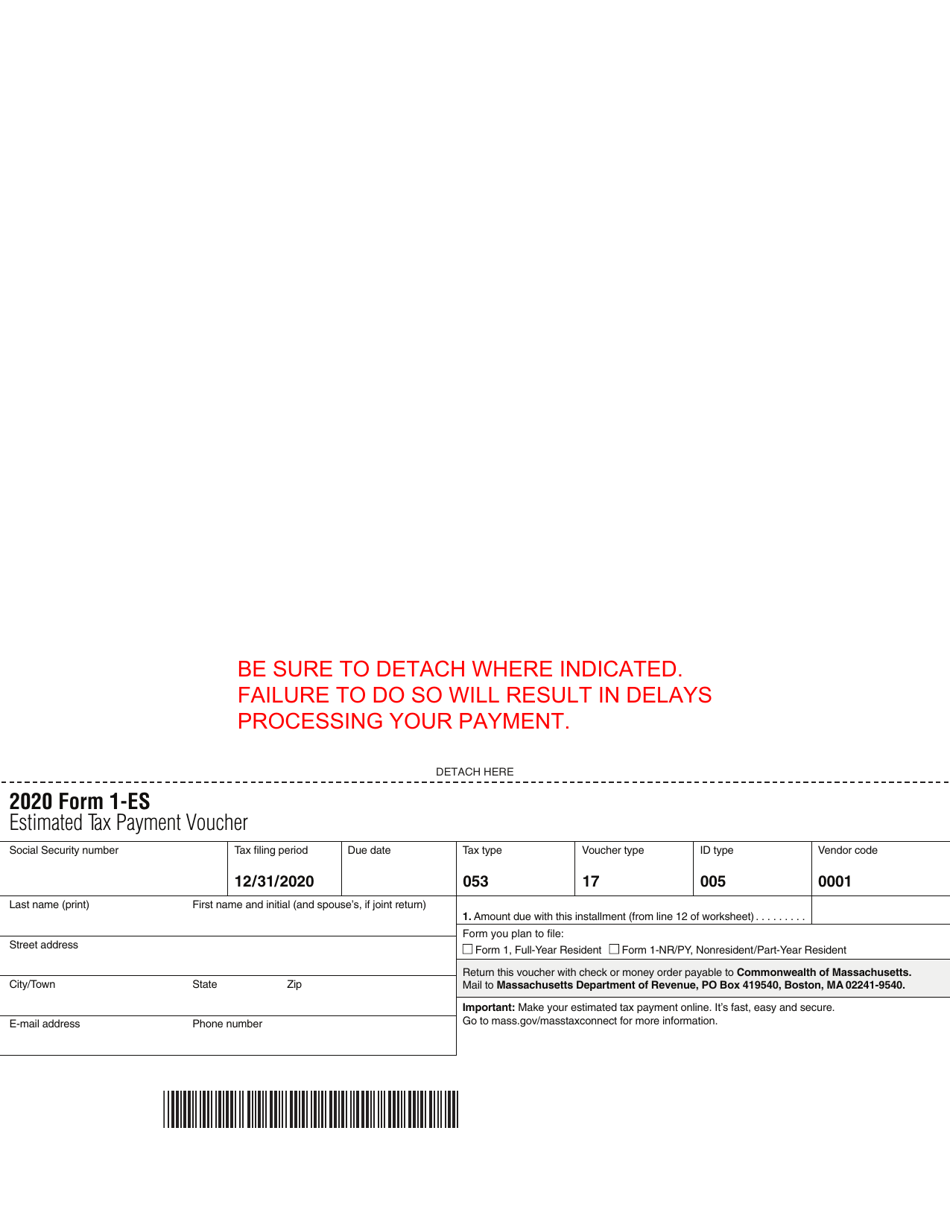

This version of the form is not currently in use and is provided for reference only. Download this version of

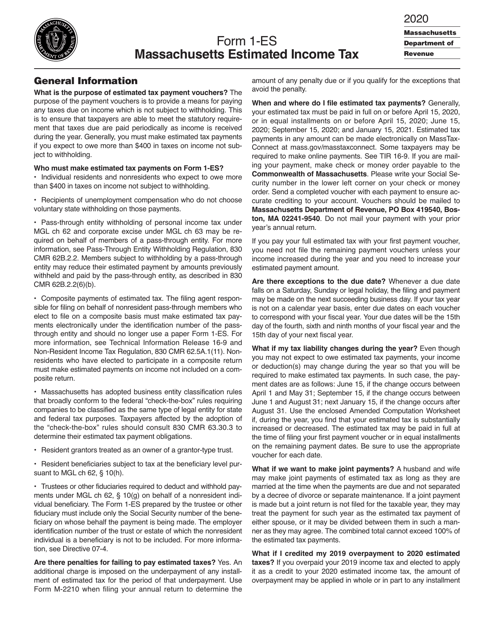

Form 1-ES

for the current year.

Form 1-ES Estimated Income Tax Payment Voucher - Massachusetts

What Is Form 1-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1-ES?

A: Form 1-ES is an Estimated Income Tax Payment Voucher used in Massachusetts.

Q: What is the purpose of Form 1-ES?

A: The purpose of Form 1-ES is to make estimated income tax payments to the state of Massachusetts.

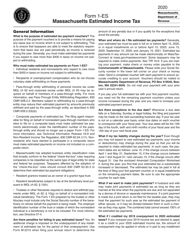

Q: Who needs to file Form 1-ES?

A: Form 1-ES needs to be filed by individuals or businesses who expect to owe income tax to Massachusetts and want to make estimated tax payments.

Q: How often do I need to file Form 1-ES?

A: Form 1-ES needs to be filed quarterly, with payments due in April, June, September, and January of the following year.

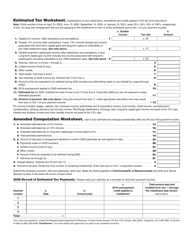

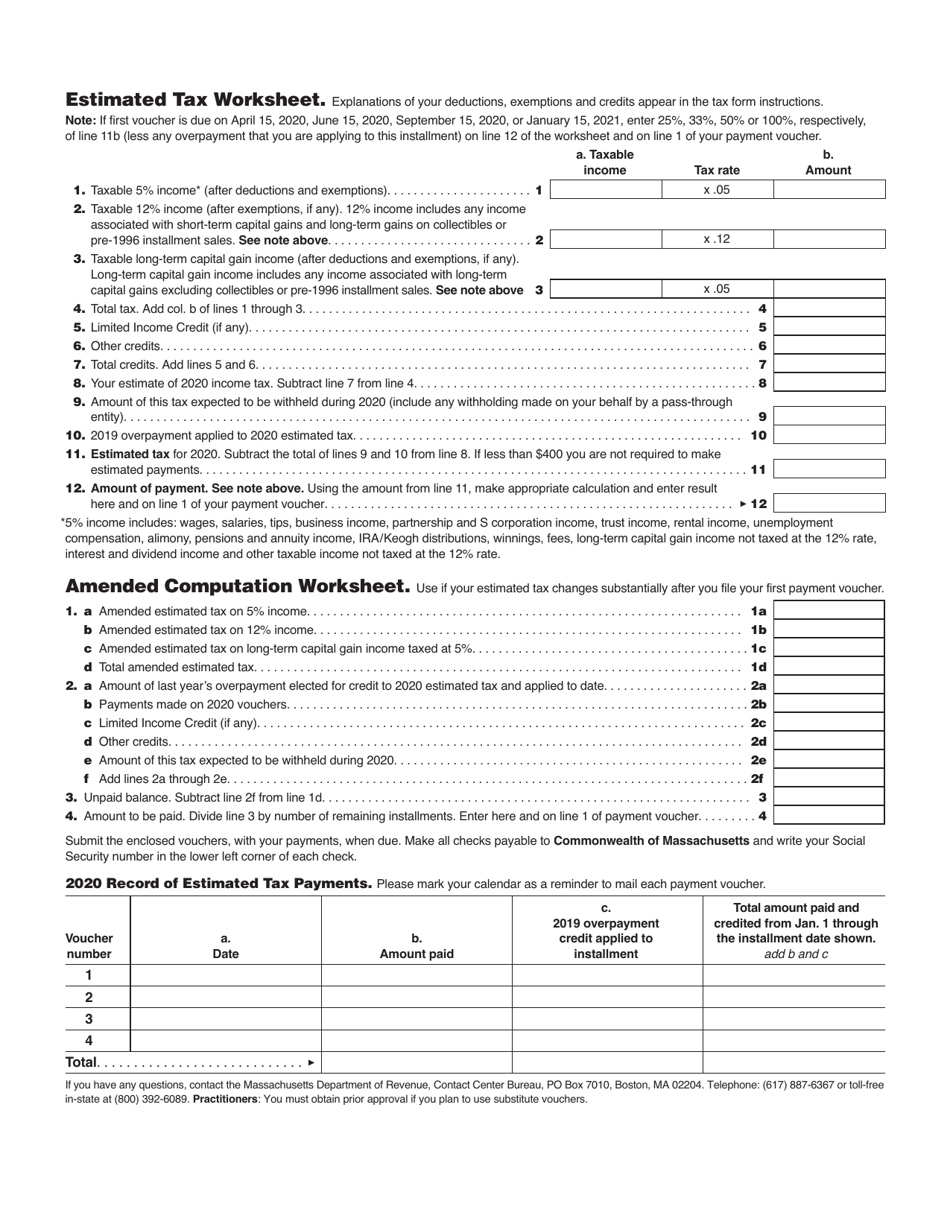

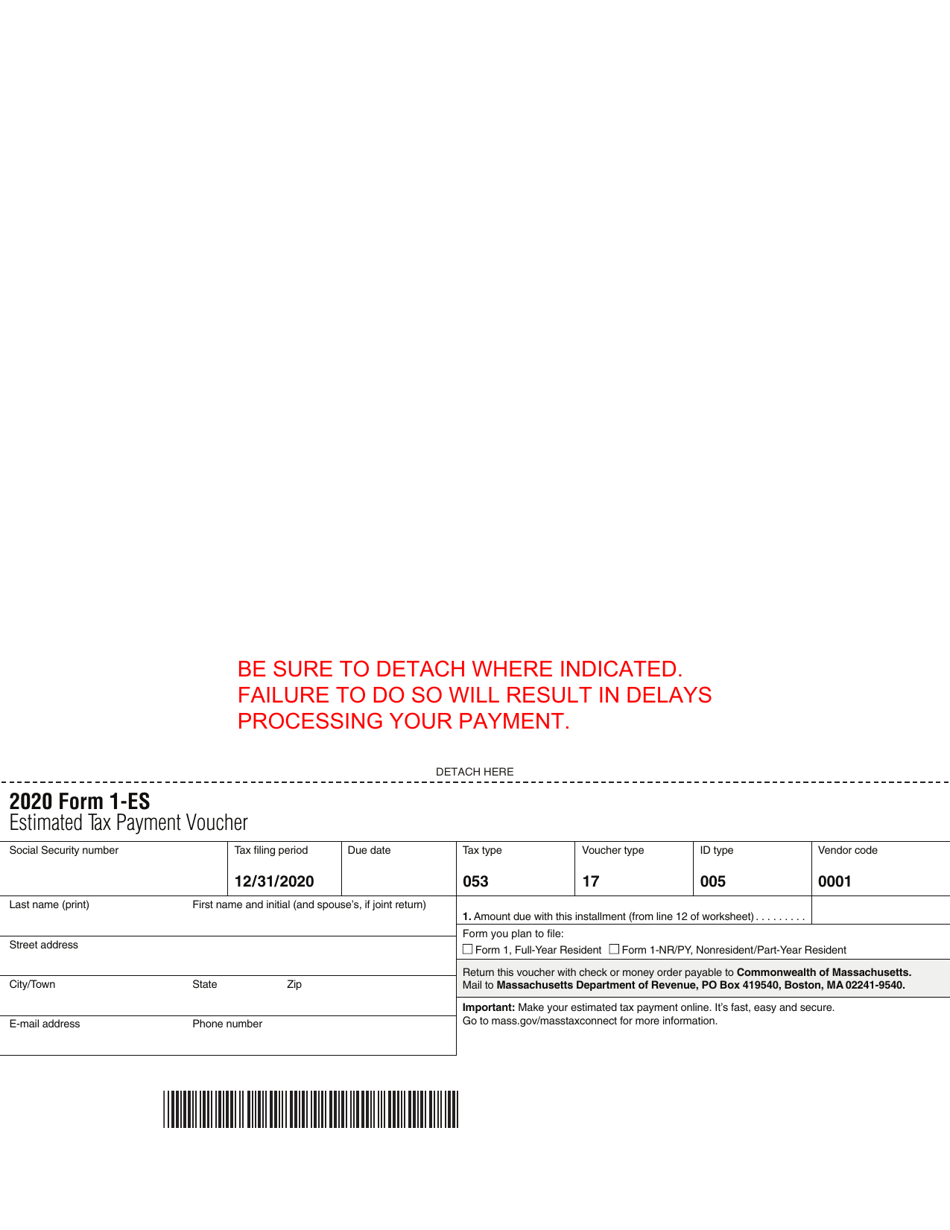

Q: What information do I need to fill out Form 1-ES?

A: You will need to provide your name, address, Social Security number (or tax ID number), and estimate of your taxable income and tax liability for the year.

Q: What happens if I don't file Form 1-ES?

A: If you don't file Form 1-ES and make estimated tax payments when required, you may be subject to penalties and interest on the unpaid tax amount.

Q: Can I still file Form 1-ES if I am due a refund?

A: Yes, even if you expect to receive a refund, you can still file Form 1-ES and make estimated tax payments to avoid any potential penalties.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.