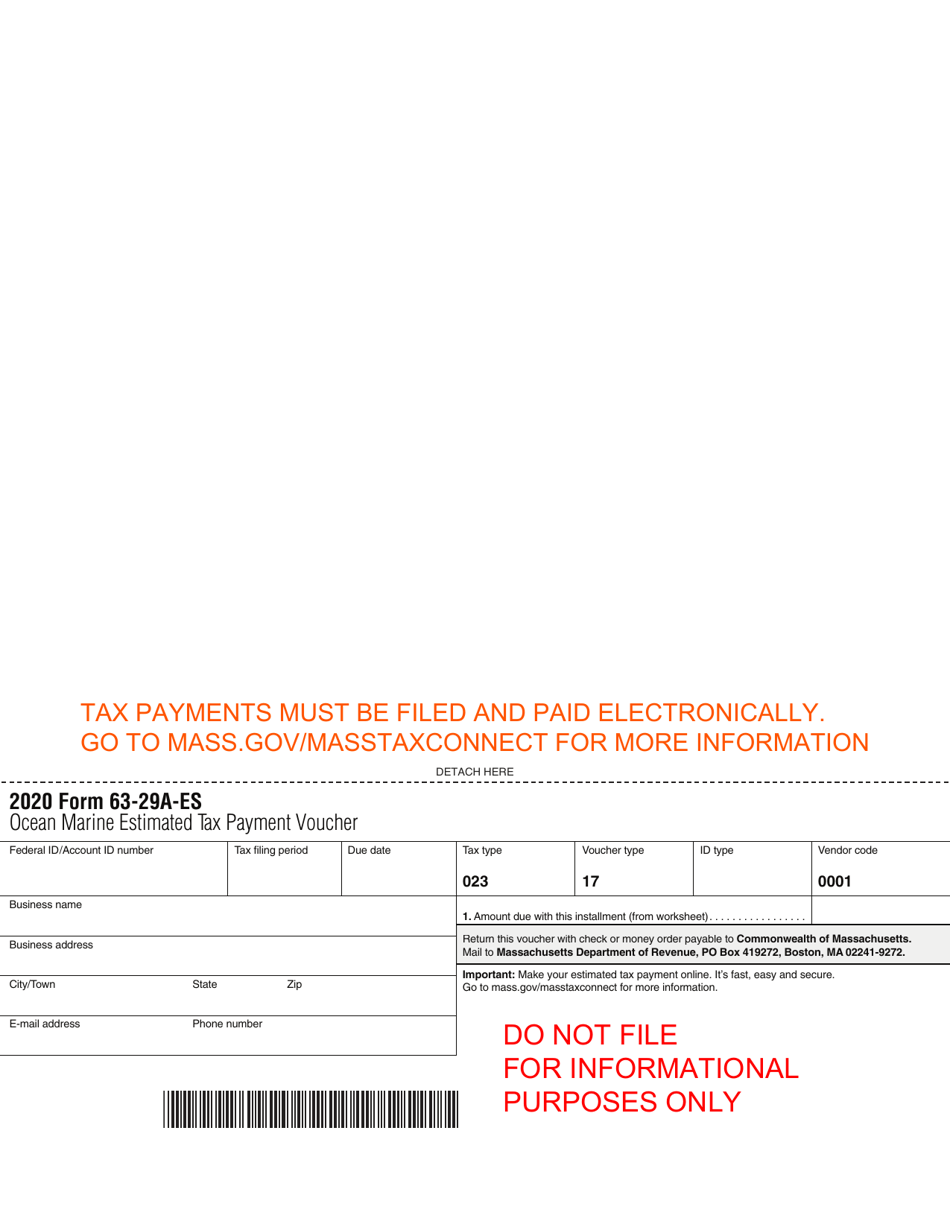

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 63-29A-ES

for the current year.

Form 63-29A-ES Ocean Marine Estimated Tax Payment Voucher - Massachusetts

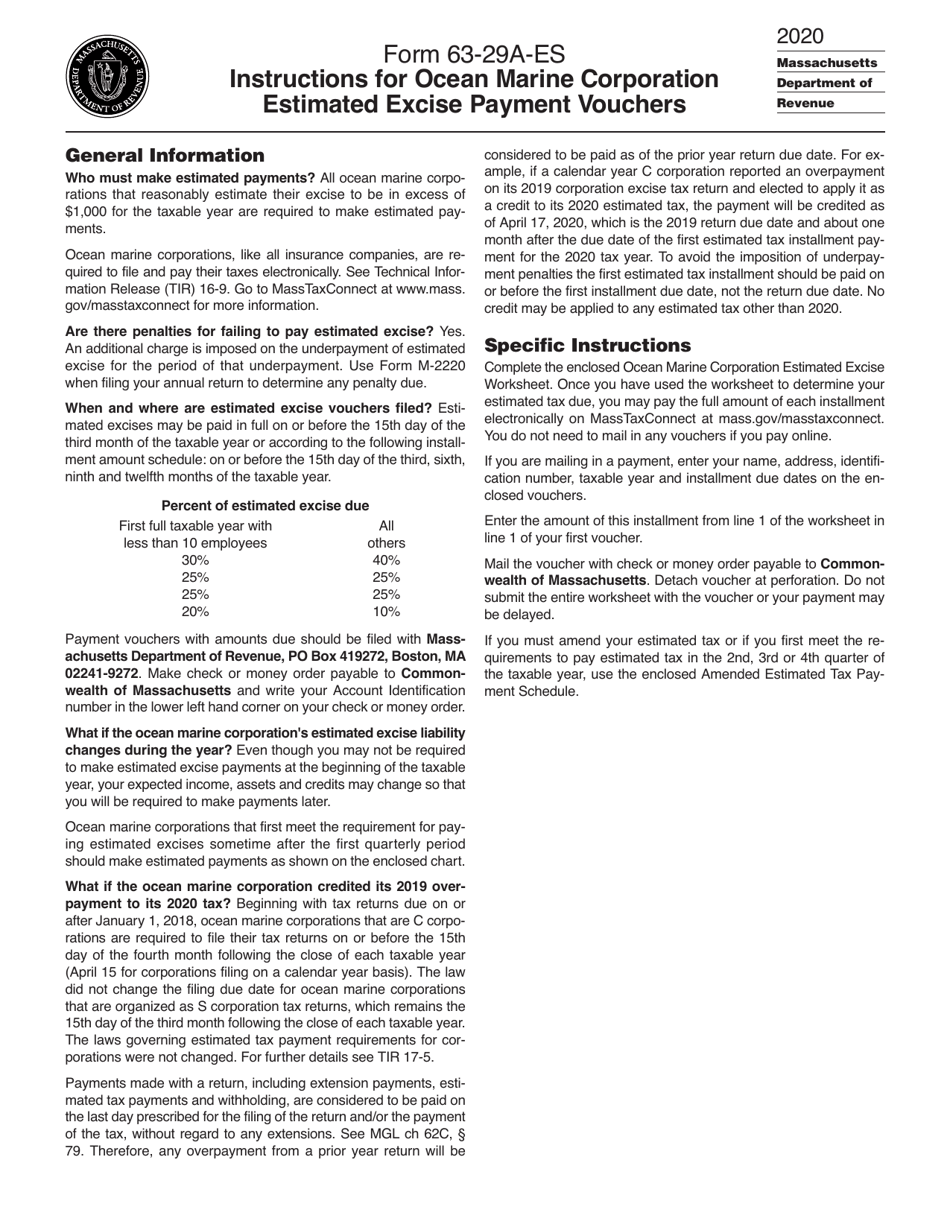

What Is Form 63-29A-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

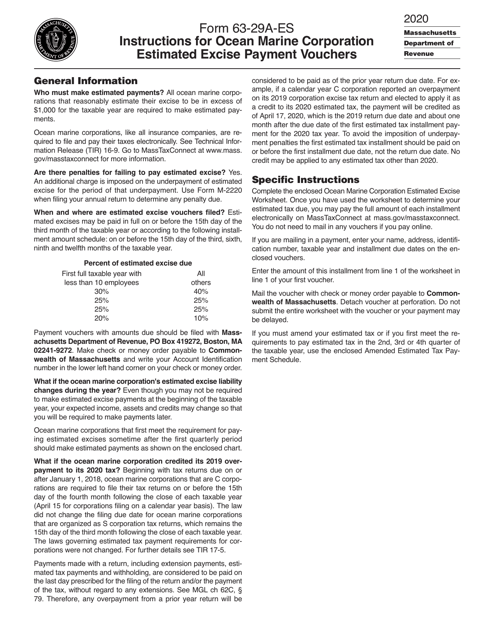

Q: What is Form 63-29A-ES?

A: Form 63-29A-ES is the Ocean Marine Estimated Tax Payment Voucher used in Massachusetts.

Q: What is the purpose of Form 63-29A-ES?

A: The purpose of Form 63-29A-ES is to make estimated tax payments for ocean marine activities in Massachusetts.

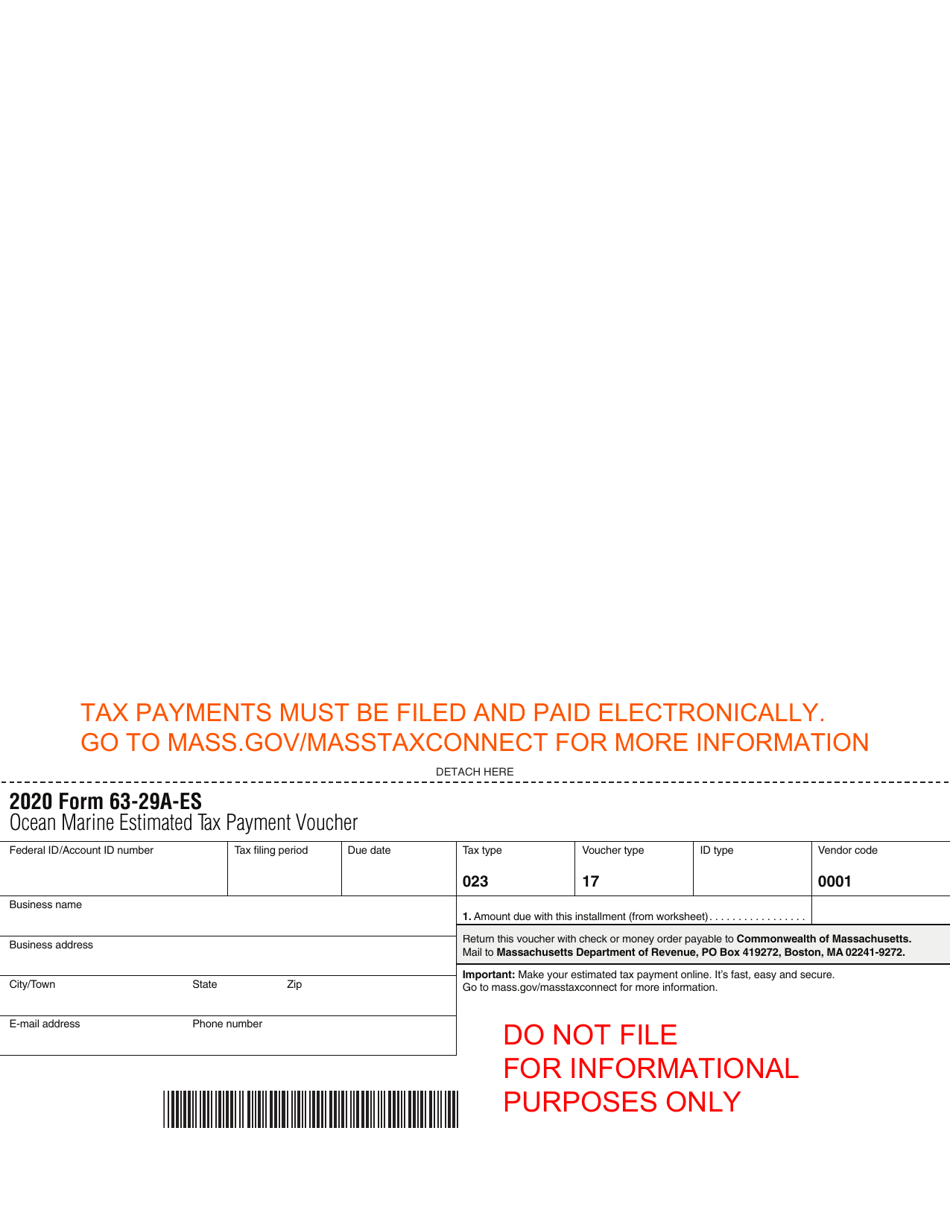

Q: Who needs to use Form 63-29A-ES?

A: Anyone engaged in ocean marine activities in Massachusetts who needs to make estimated tax payments should use Form 63-29A-ES.

Q: When is Form 63-29A-ES used?

A: Form 63-29A-ES is used to make quarterly estimated tax payments for ocean marine activities in Massachusetts.

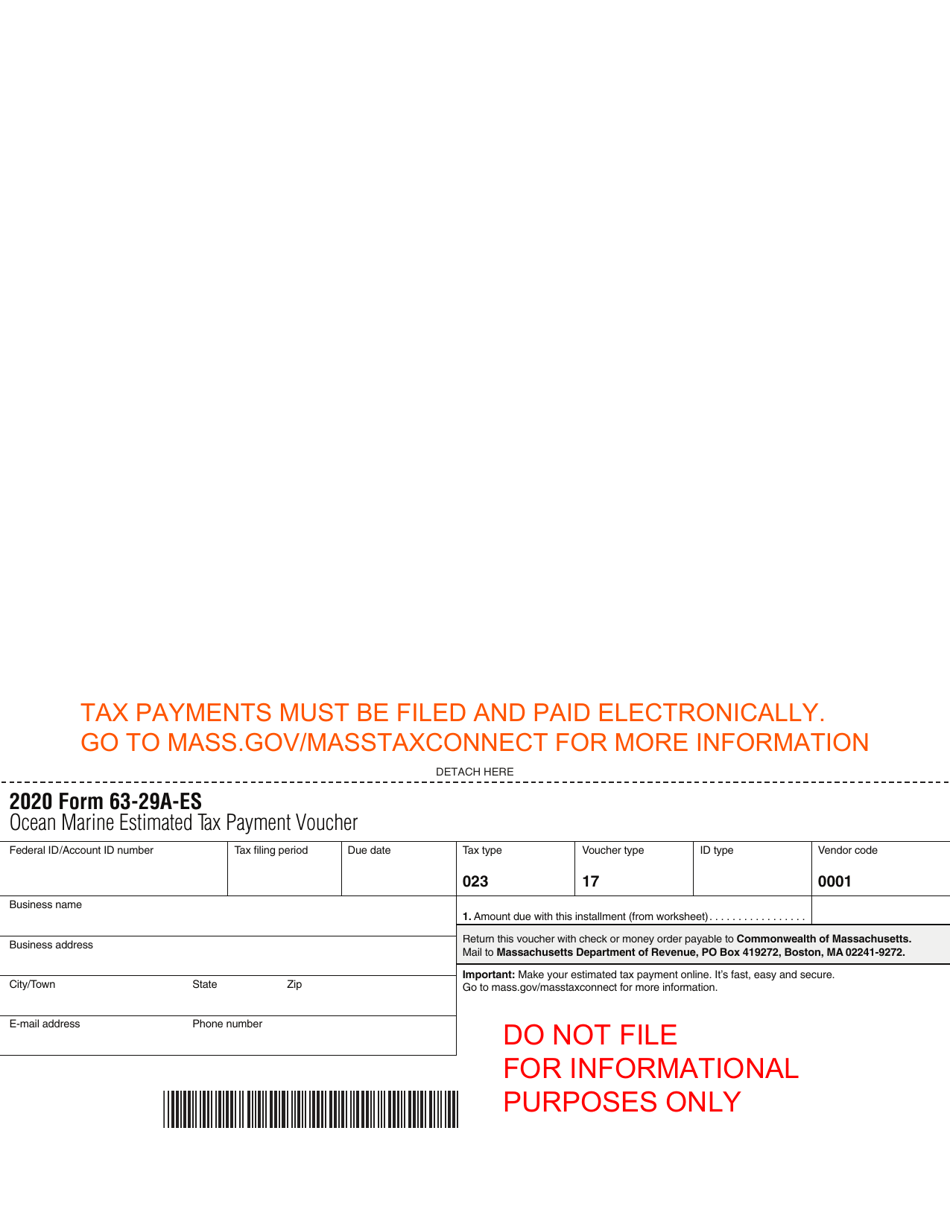

Q: How often do I need to file Form 63-29A-ES?

A: You need to file Form 63-29A-ES quarterly, for each quarter of the tax year.

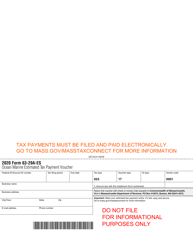

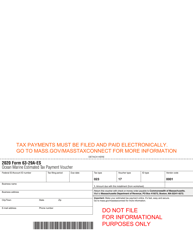

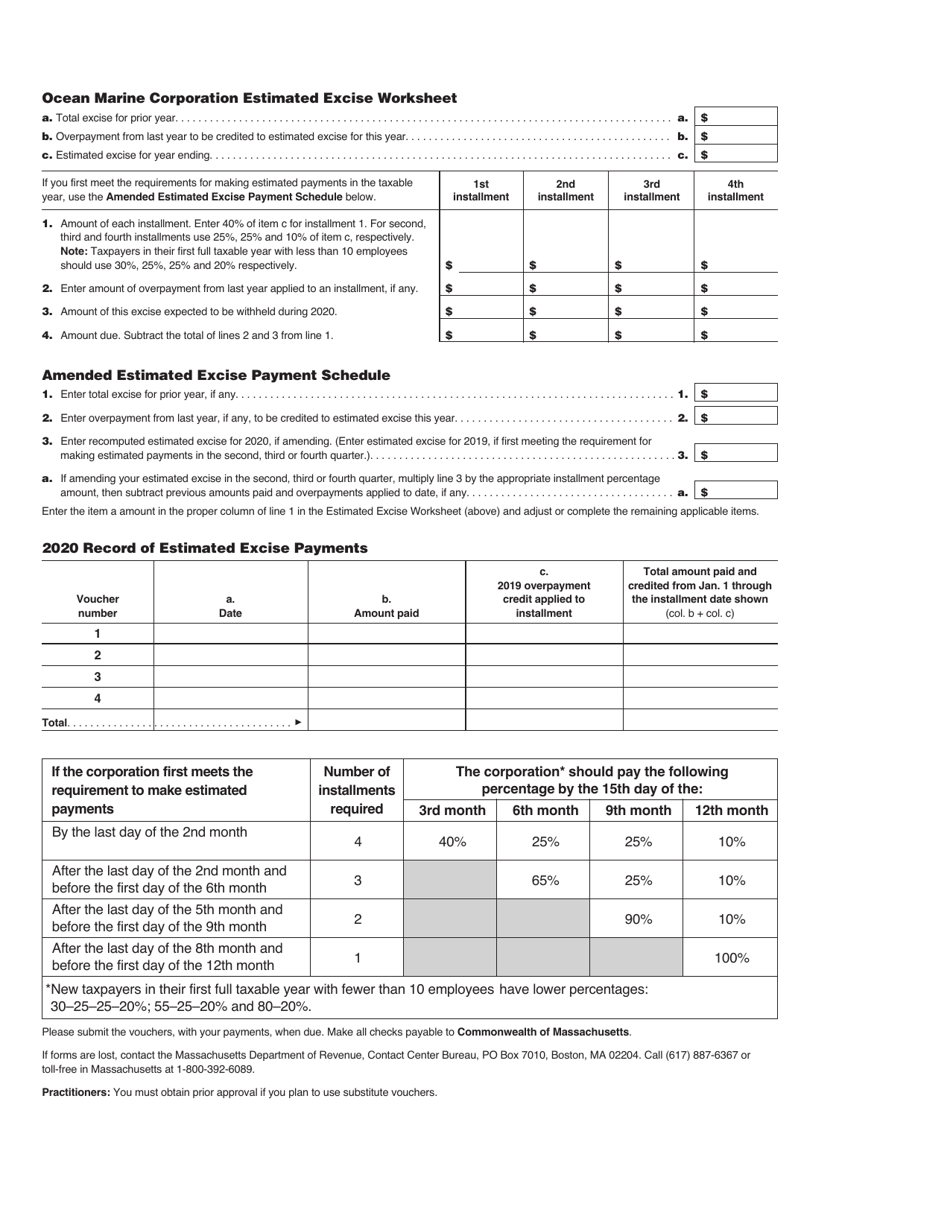

Q: What information is required on Form 63-29A-ES?

A: Form 63-29A-ES requires information such as the taxpayer's name, address, social security number, estimated tax amount, and payment details.

Q: Do I need to attach any other documents with Form 63-29A-ES?

A: No, you don't need to attach any other documents with Form 63-29A-ES.

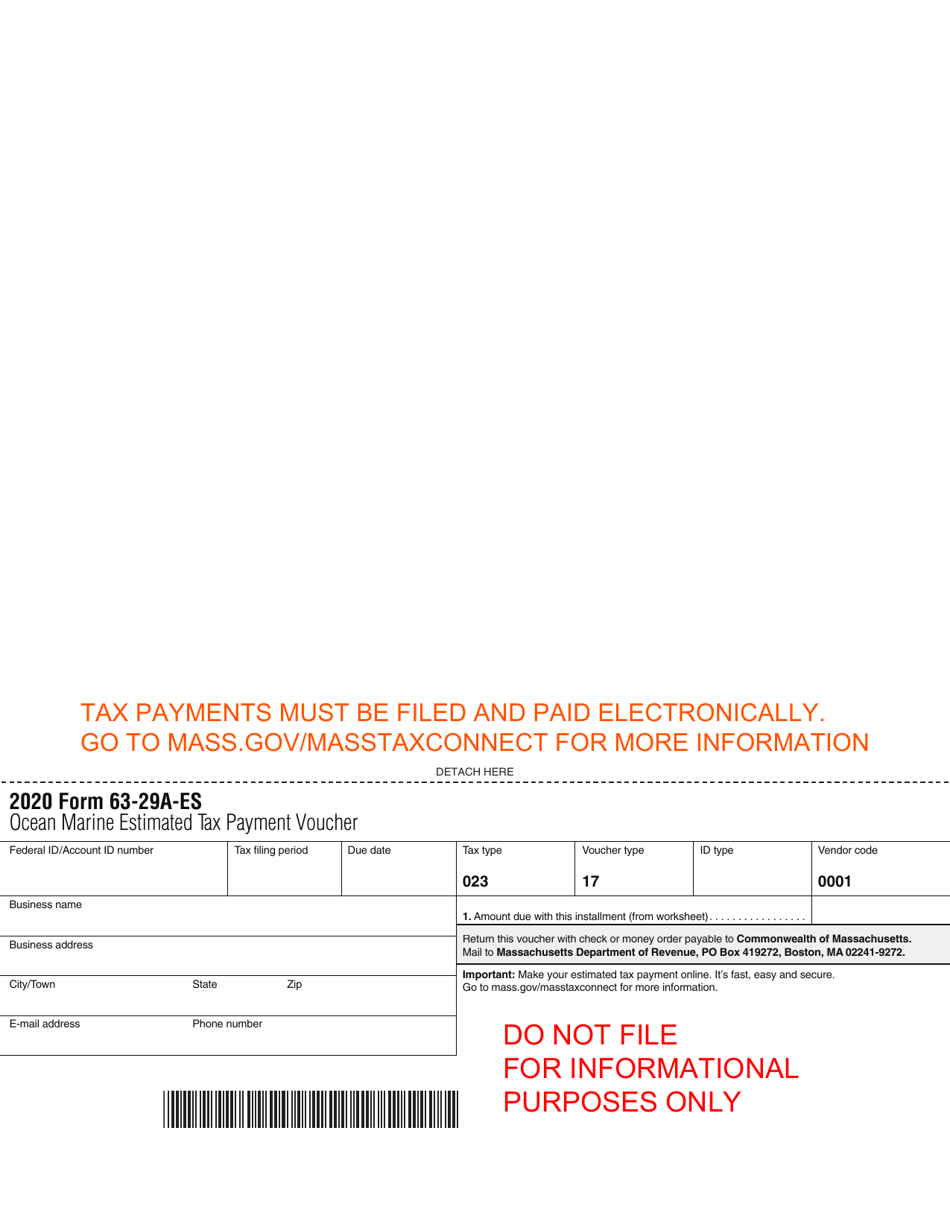

Q: How do I pay the estimated tax amount using Form 63-29A-ES?

A: You can pay the estimated tax amount by check or money order, payable to the Massachusetts Department of Revenue, or electronically.

Q: When is the deadline to file Form 63-29A-ES?

A: The deadline to file Form 63-29A-ES is the 15th day of the fourth, sixth, ninth, and twelfth months of the tax year.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63-29A-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.