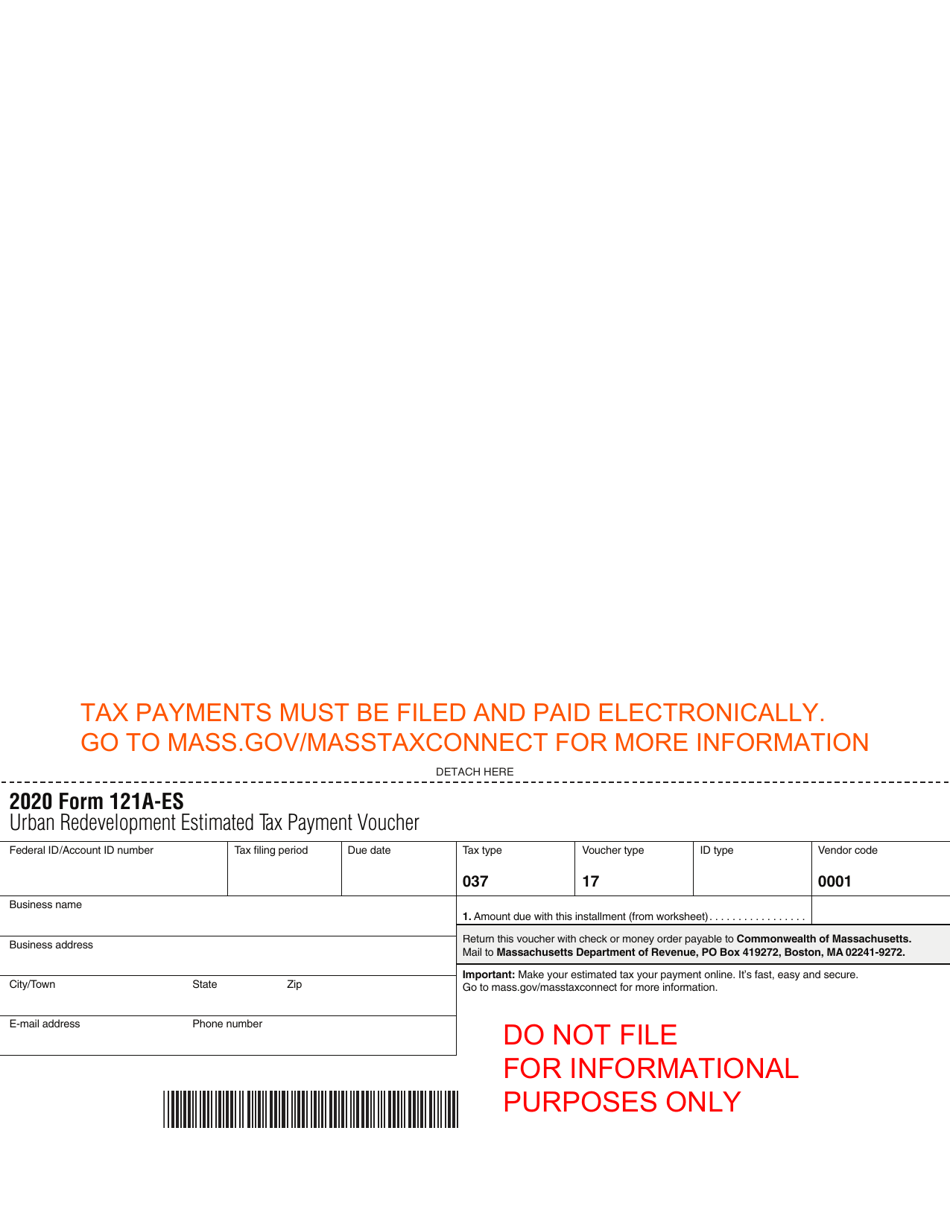

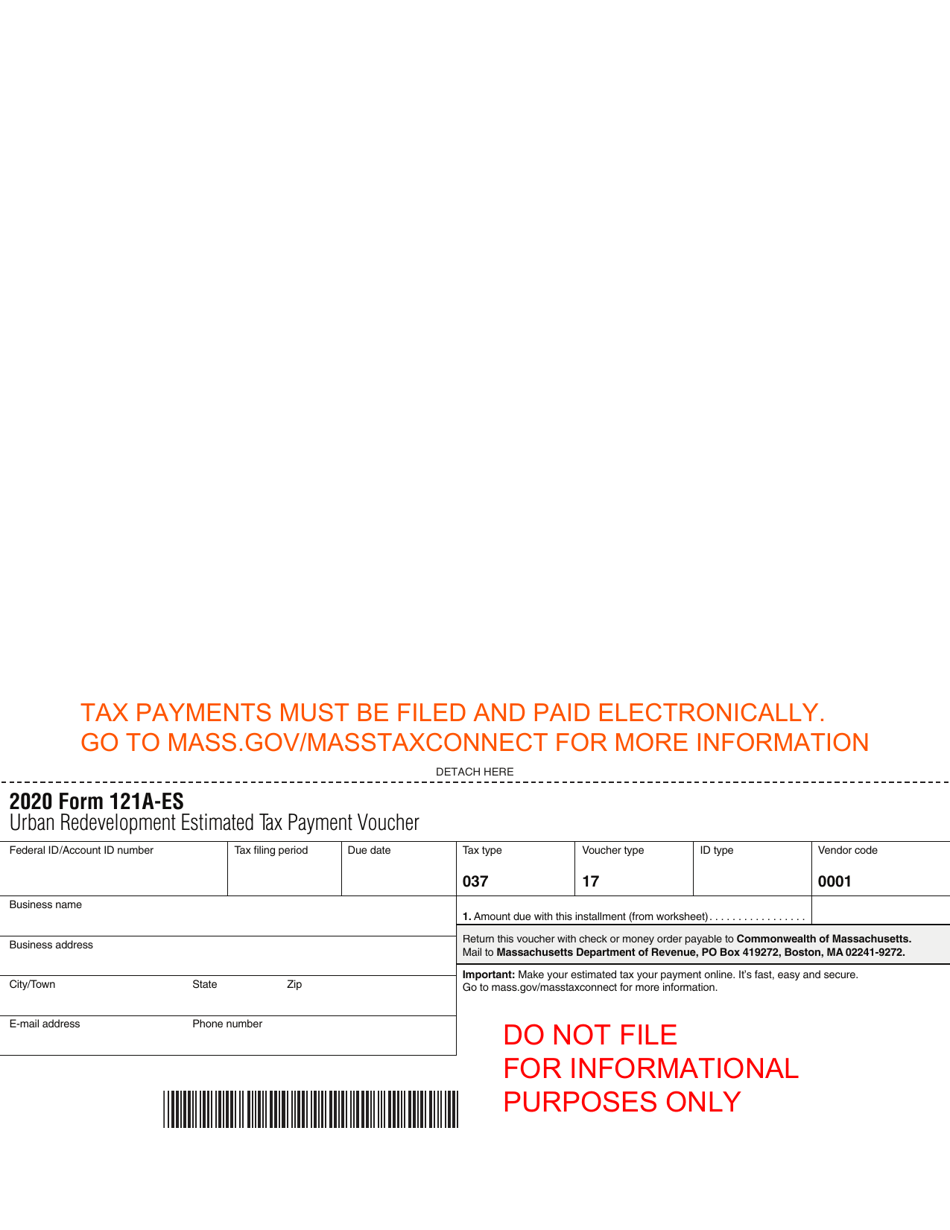

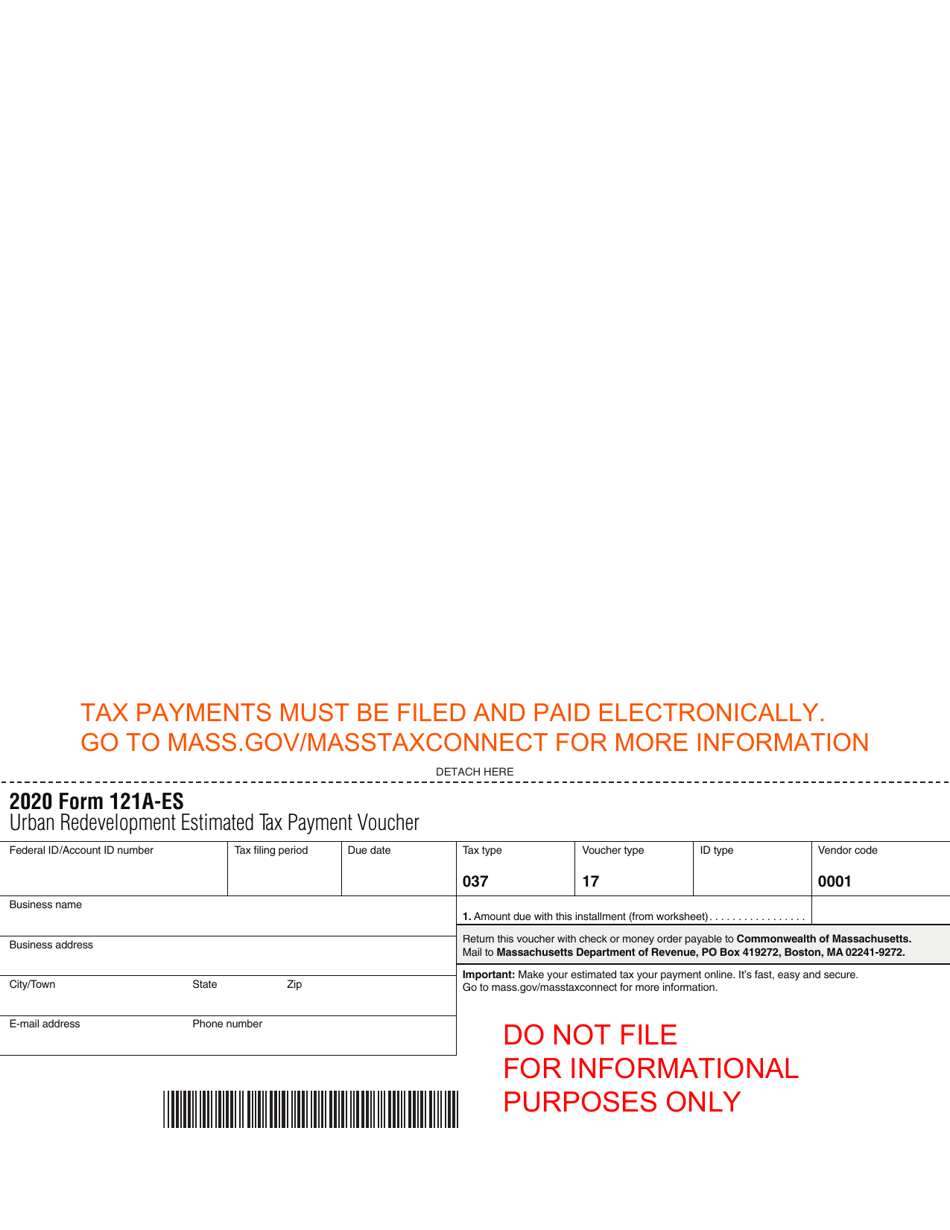

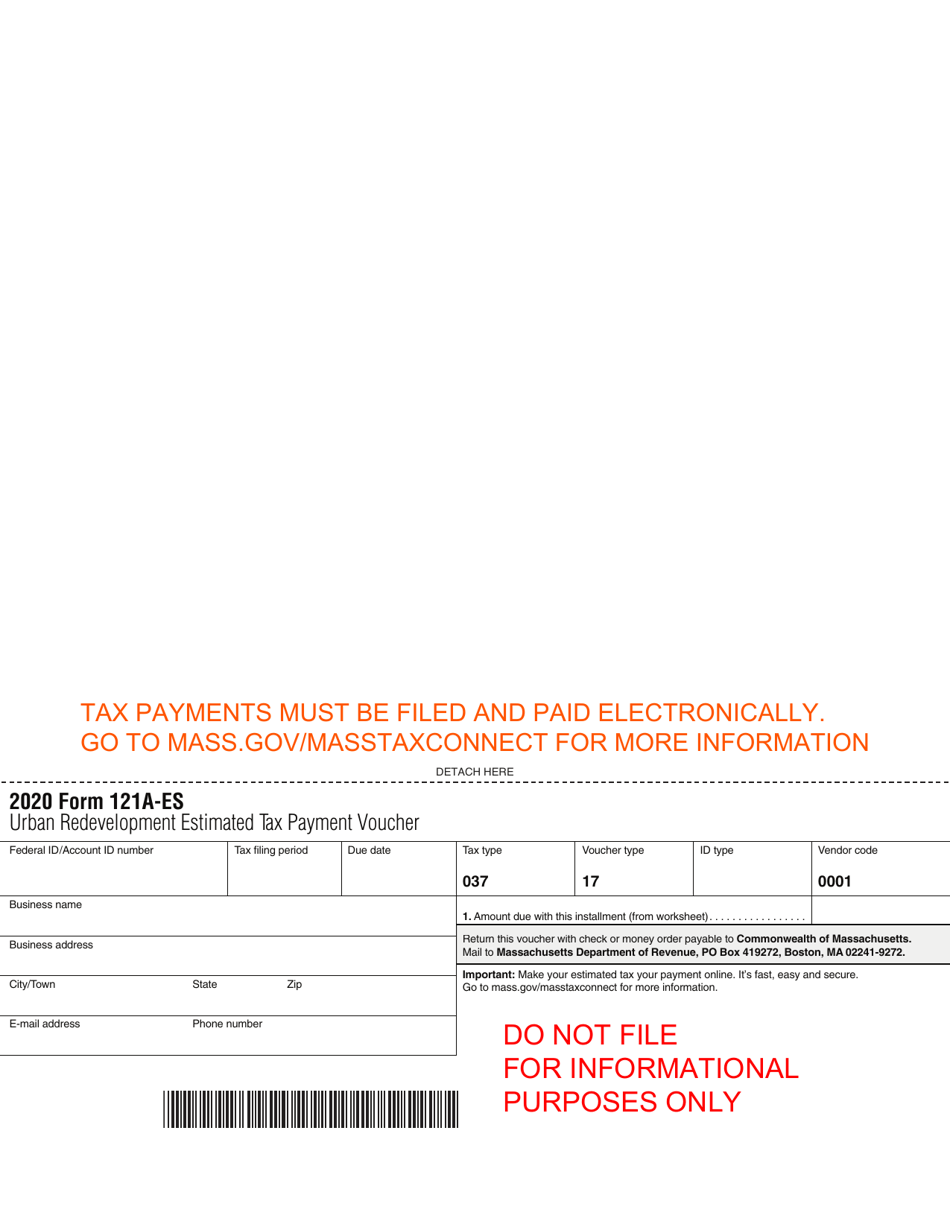

This version of the form is not currently in use and is provided for reference only. Download this version of

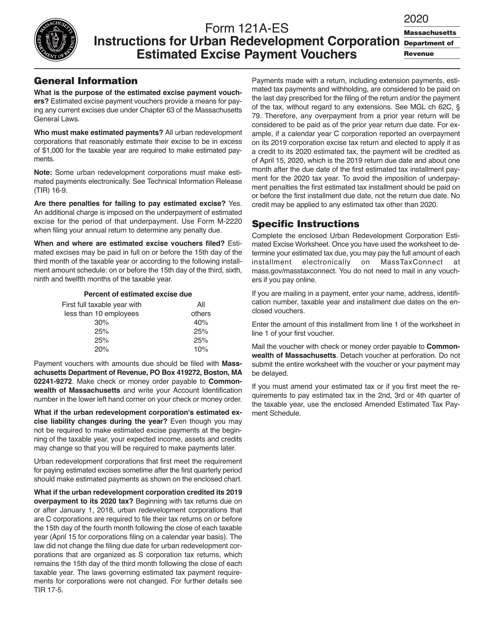

Form 121A-ES

for the current year.

Form 121A-ES Urban Redevelopment Estimated Tax Payment Voucher - Massachusetts

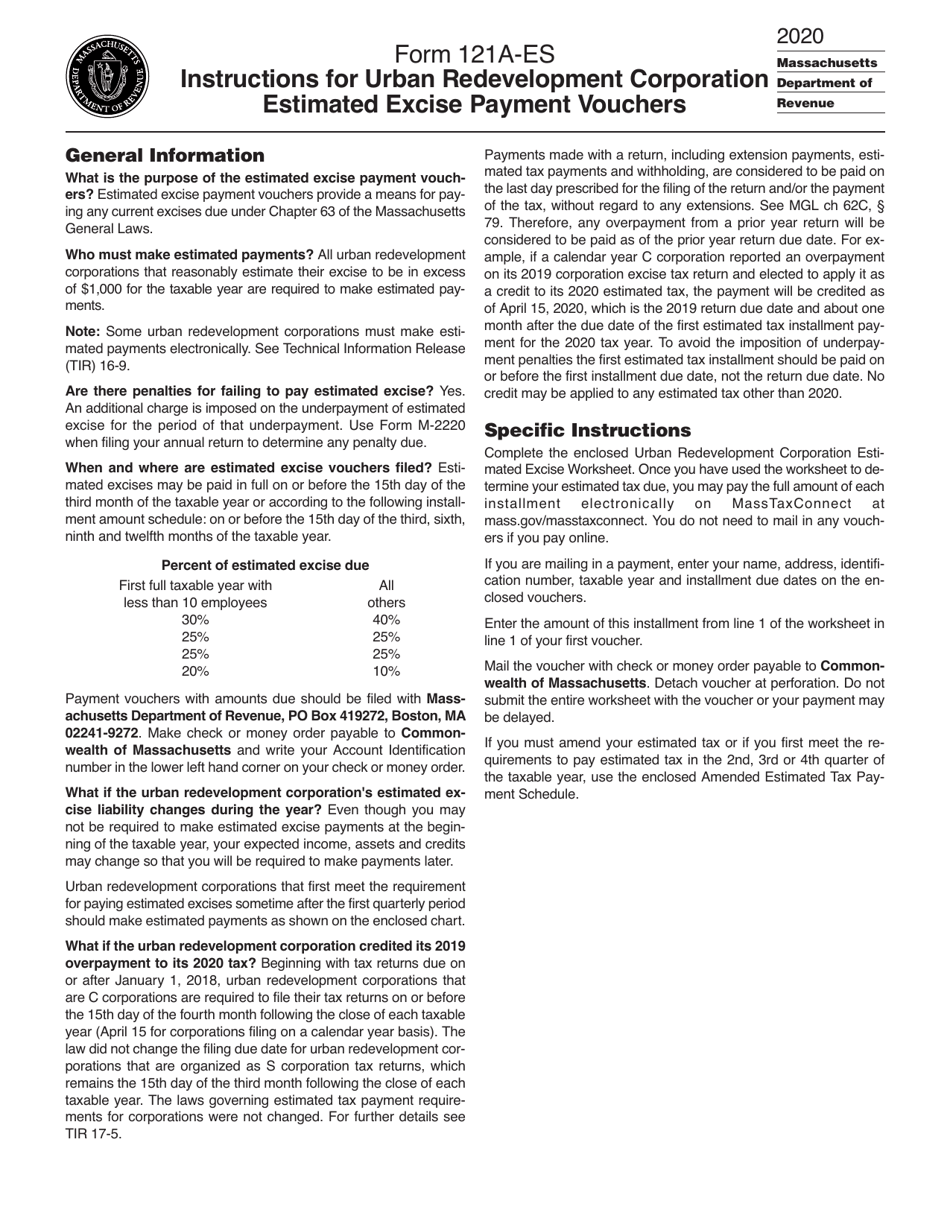

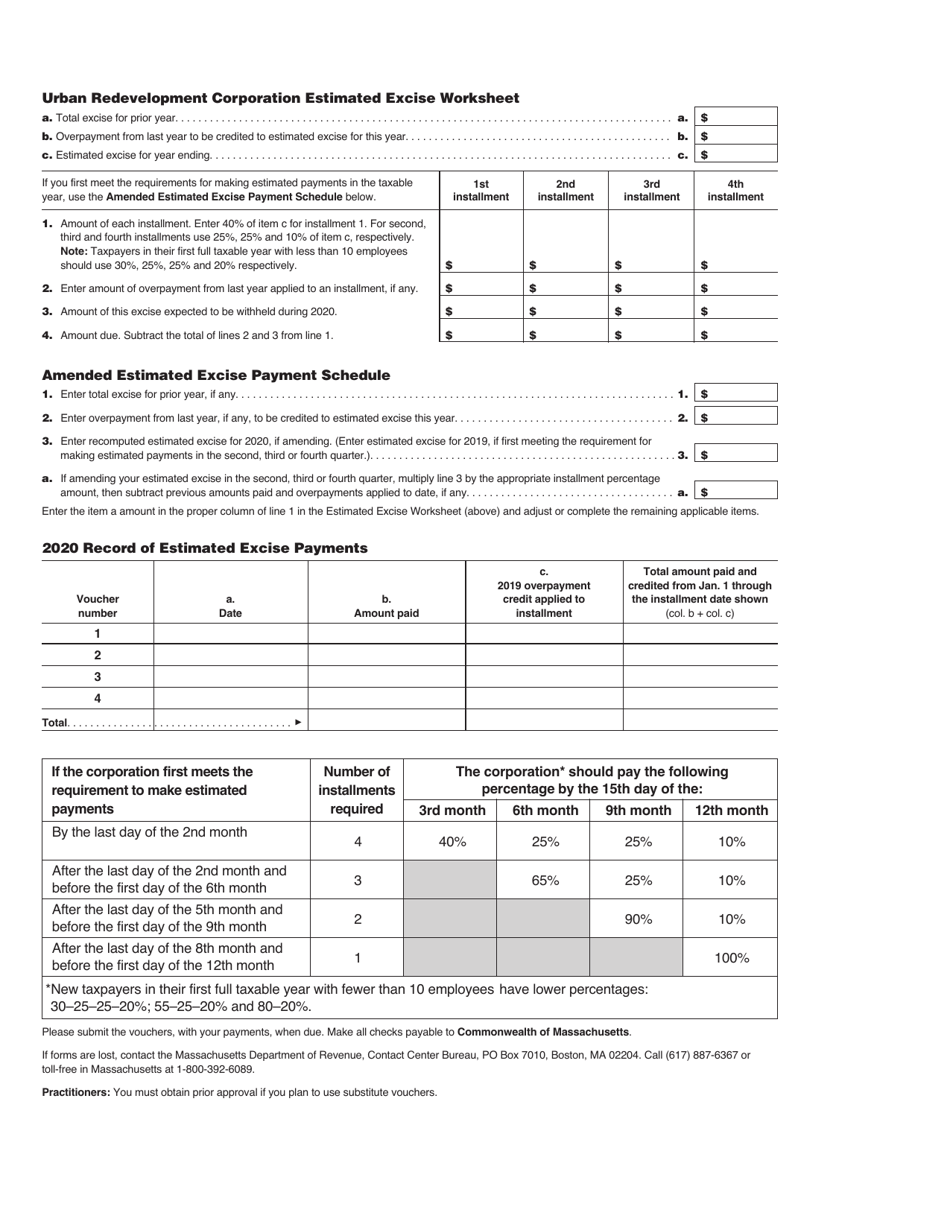

What Is Form 121A-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 121A-ES?

A: Form 121A-ES is an estimated tax payment voucher specifically for Urban Redevelopment projects in Massachusetts.

Q: Who needs to use Form 121A-ES?

A: Urban Redevelopment project owners in Massachusetts need to use Form 121A-ES to make estimated tax payments.

Q: What are estimated tax payments?

A: Estimated tax payments are periodic payments made throughout the year to prepay taxes on income that is not subject to withholding.

Q: Why are estimated tax payments required for Urban Redevelopment projects?

A: Estimated tax payments for Urban Redevelopment projects in Massachusetts help fund and support redevelopment efforts.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 121A-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.