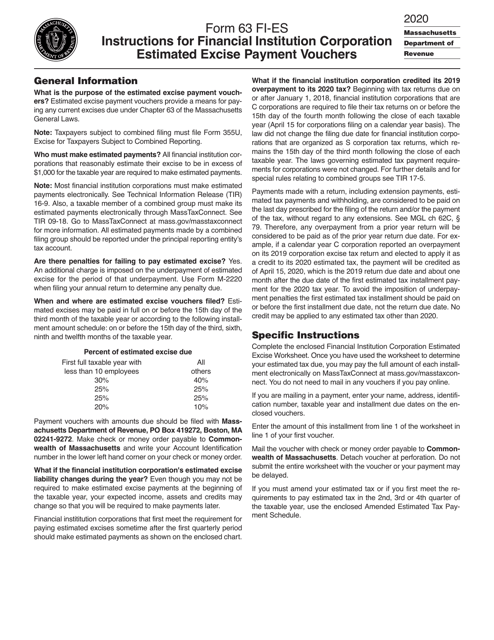

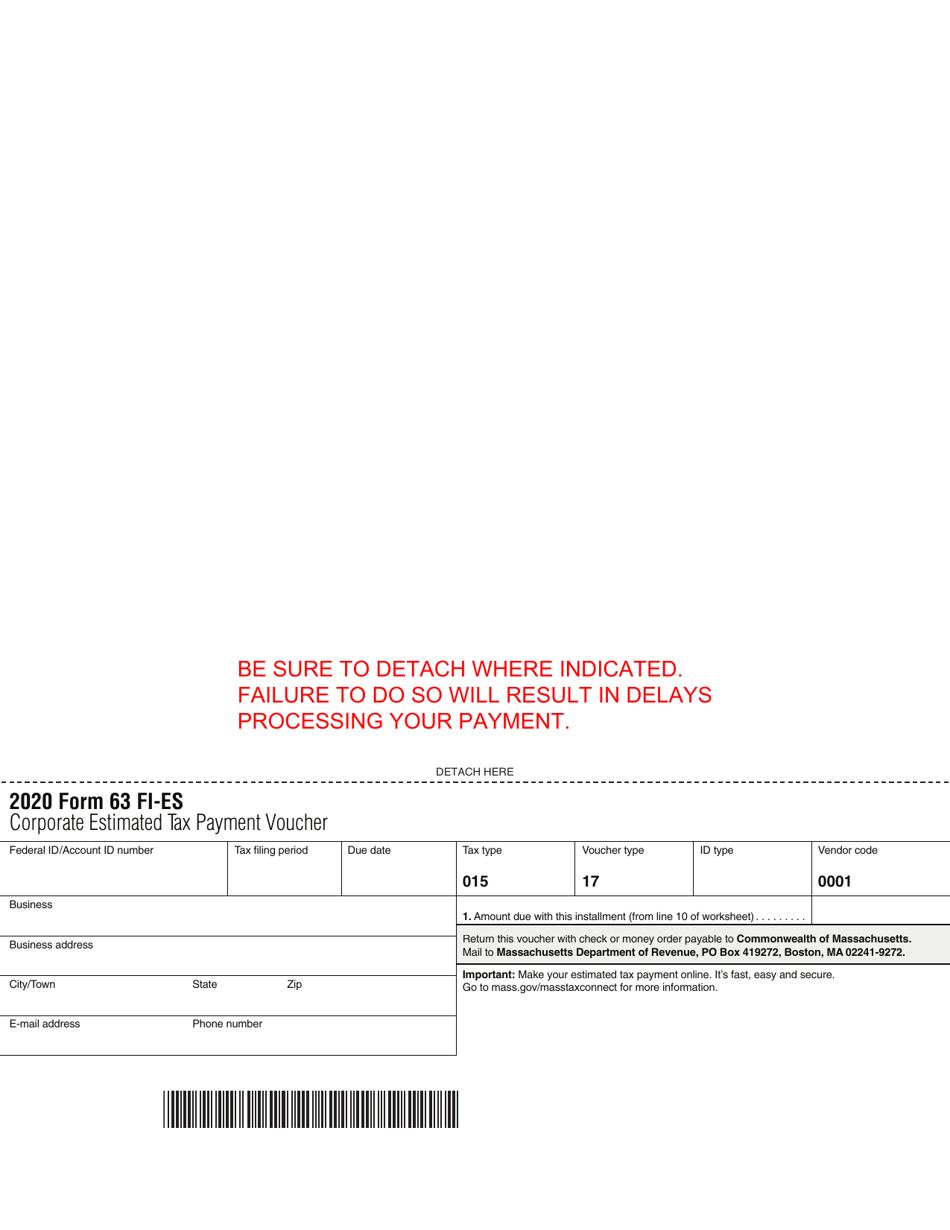

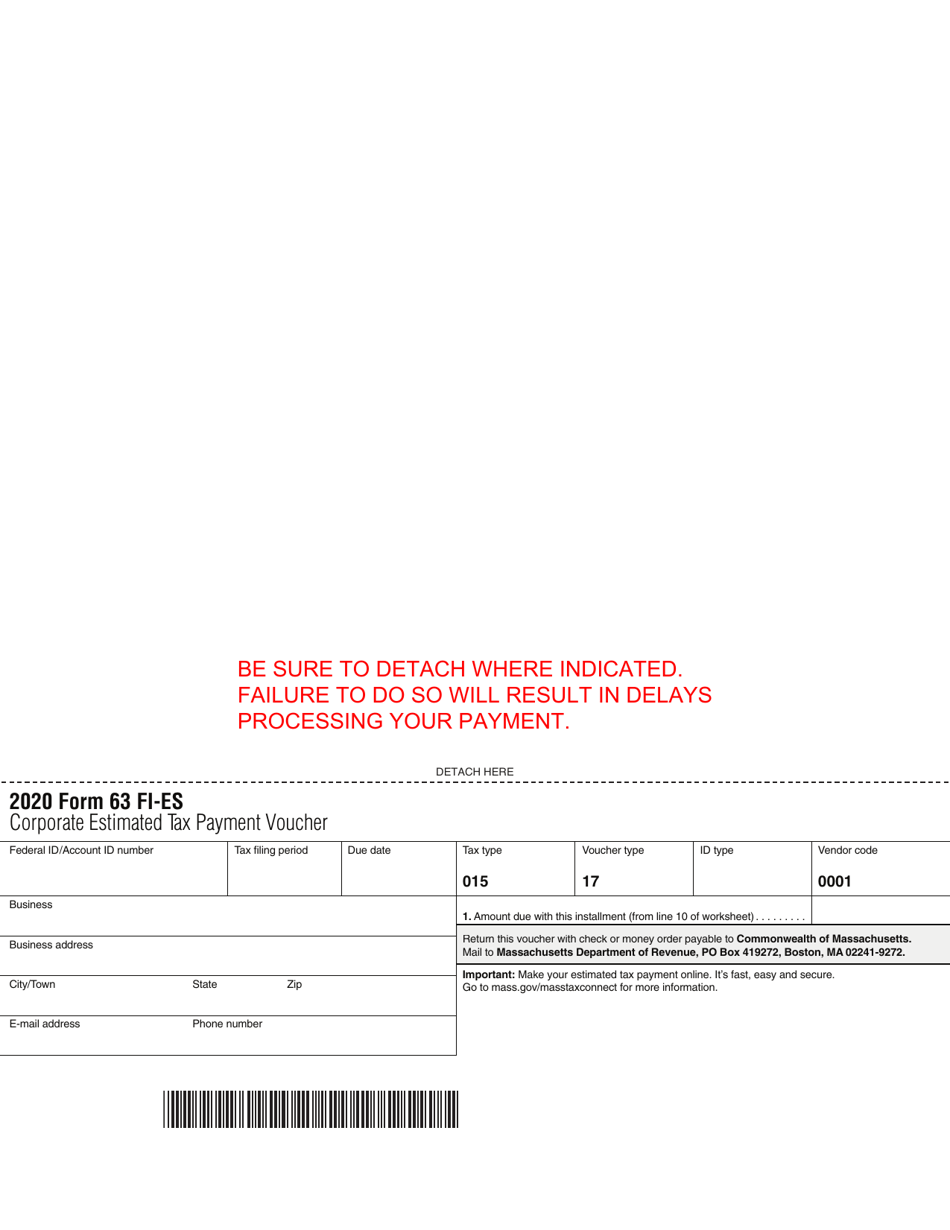

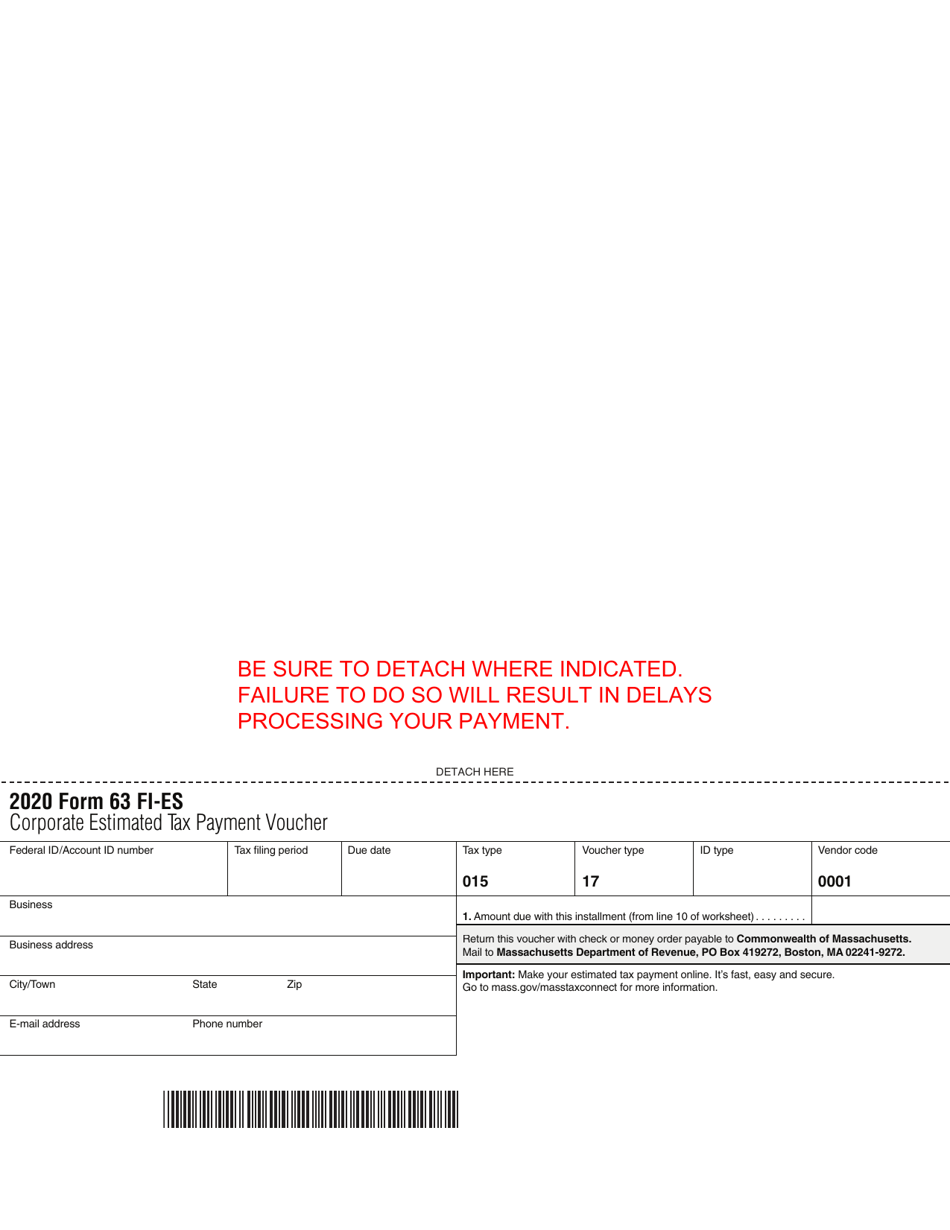

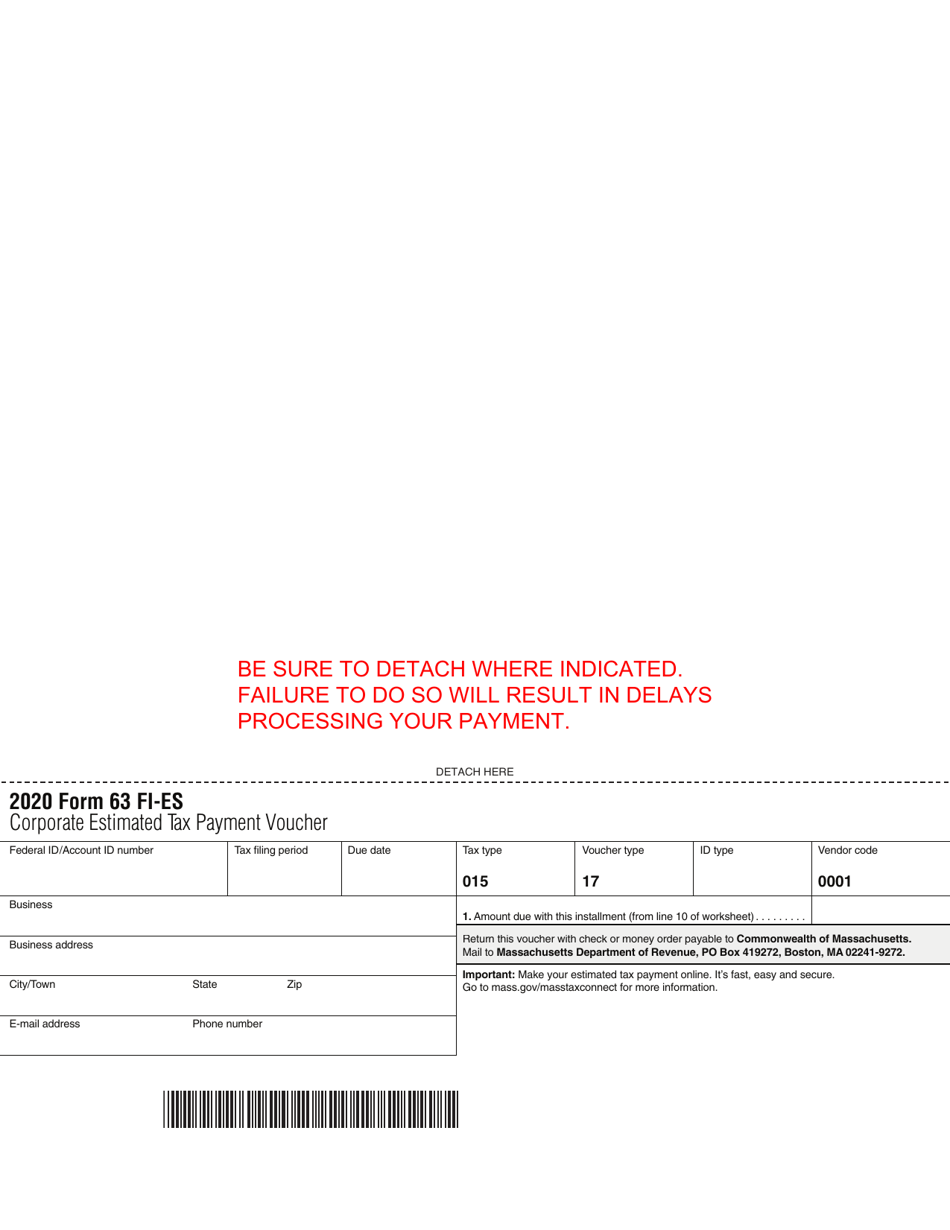

Form 63 FI-ES Corporate Estimated Tax Payment Voucher - Massachusetts

What Is Form 63 FI-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

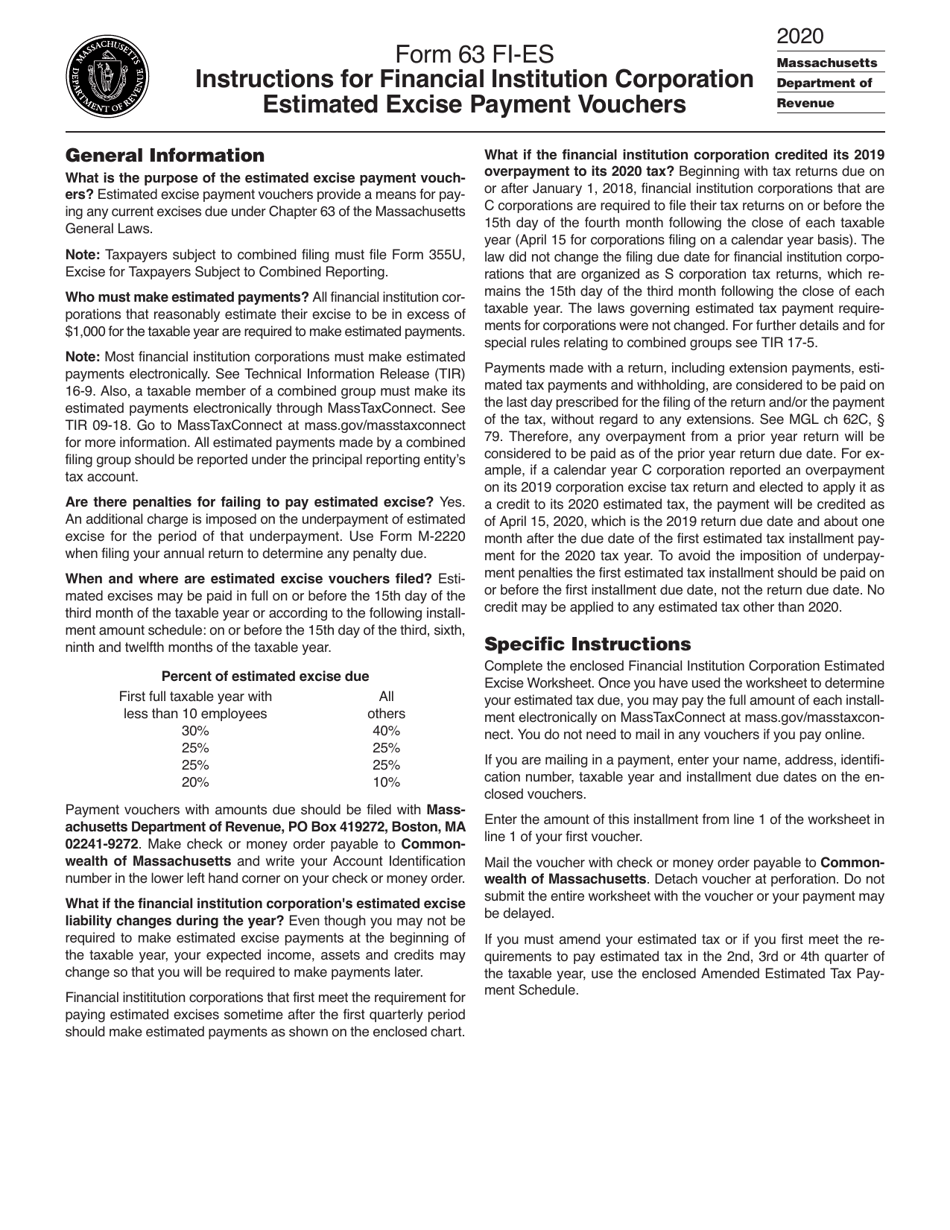

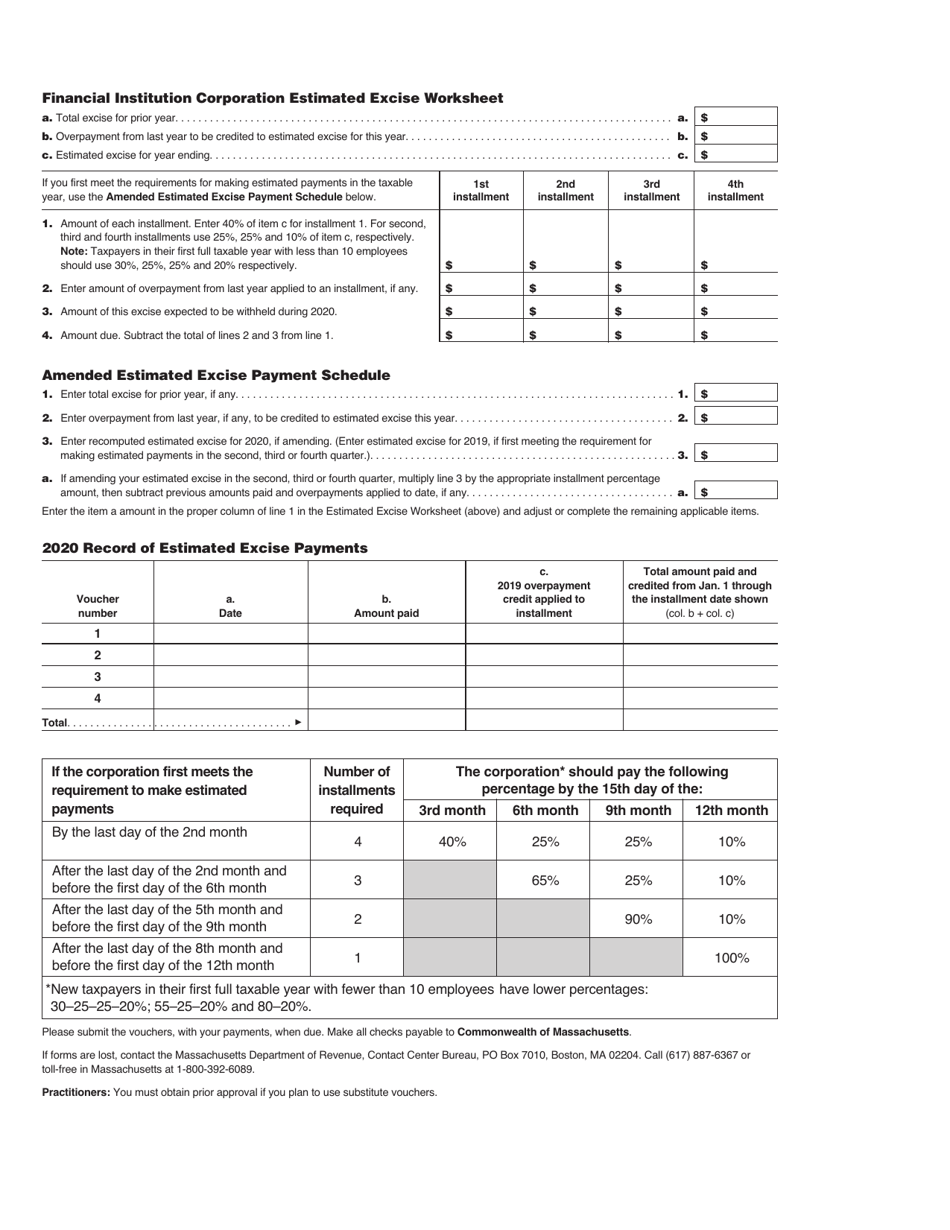

Q: What is Form 63 FI-ES?

A: Form 63 FI-ES is a corporate estimated tax payment voucher for the state of Massachusetts.

Q: Who needs to use Form 63 FI-ES?

A: Corporations making estimated tax payments in Massachusetts need to use Form 63 FI-ES.

Q: What is the purpose of Form 63 FI-ES?

A: Form 63 FI-ES is used to make estimated tax payments for corporate income tax in Massachusetts.

Q: Do I need to file Form 63 FI-ES even if I am not making estimated tax payments?

A: No, you do not need to file Form 63 FI-ES if you are not making estimated tax payments.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63 FI-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.