This version of the form is not currently in use and is provided for reference only. Download this version of

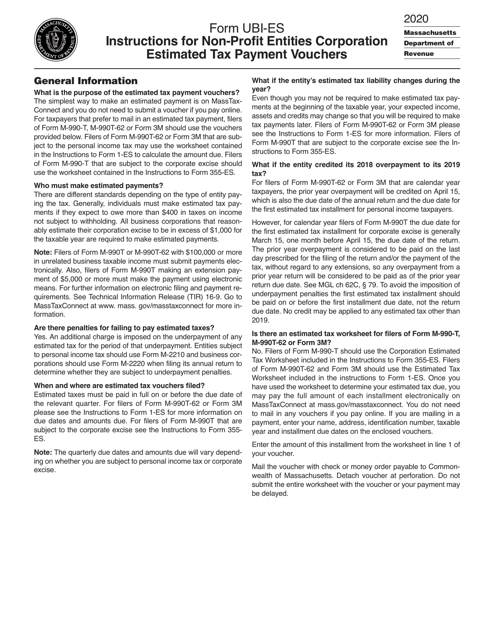

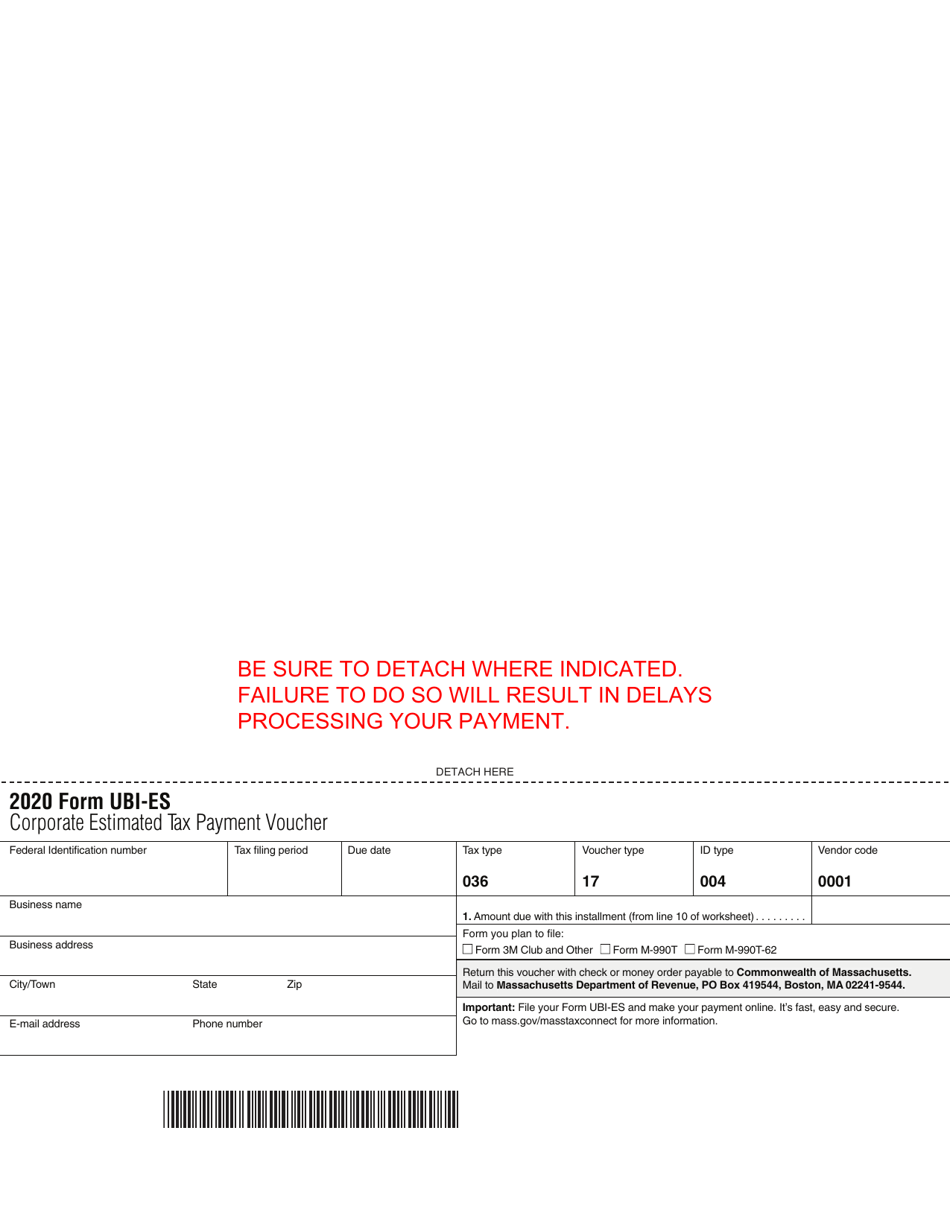

Form UBI-ES

for the current year.

Form UBI-ES Corporate Estimated Tax Payment Voucher - Massachusetts

What Is Form UBI-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

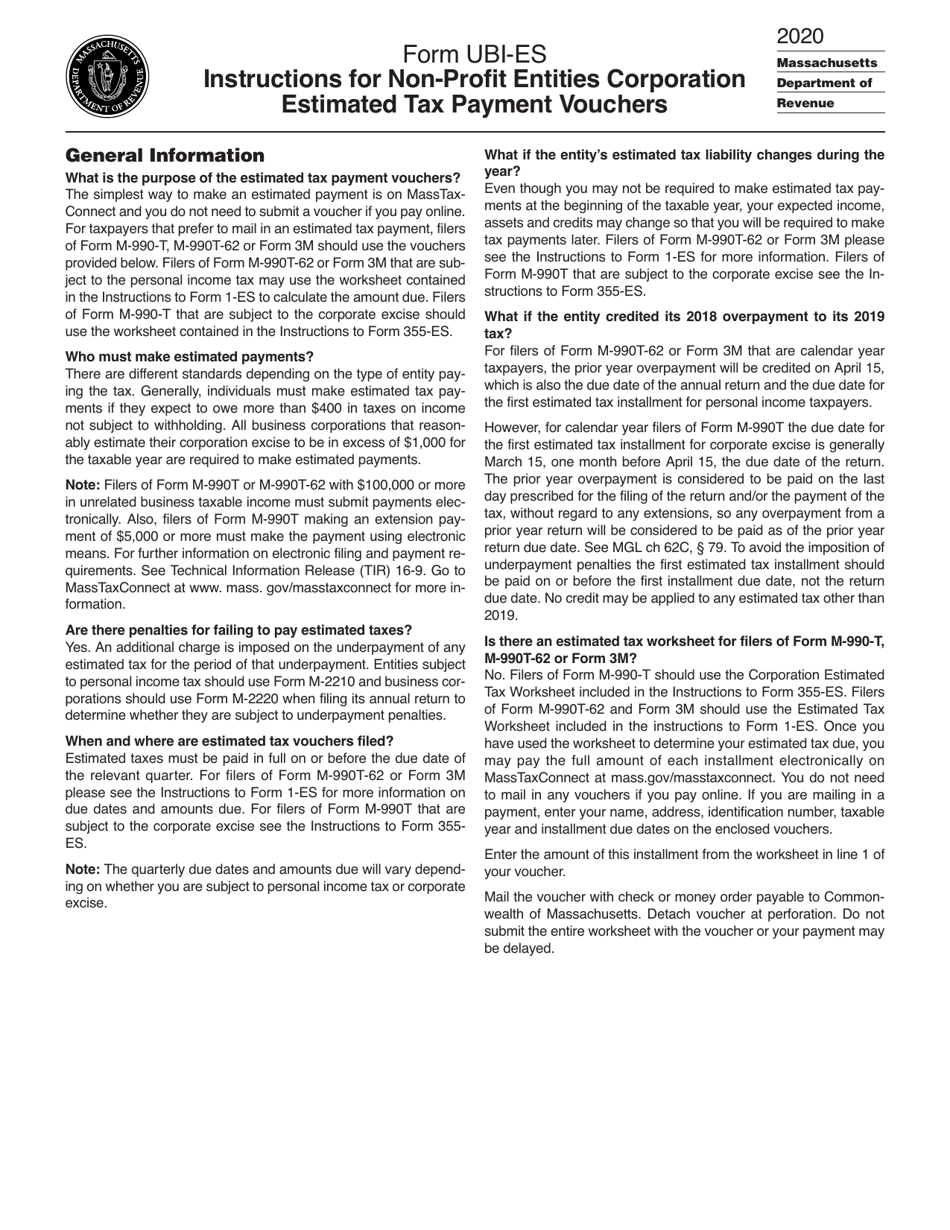

Q: What is a UBI-ES Corporate Estimated Tax Payment Voucher?

A: UBI-ES stands for Unemployment Insurance-Excess Surcharge. It is a tax payment voucher for Massachusetts corporations to make estimated tax payments for their unemployment insurance.

Q: Who needs to file a UBI-ES Corporate Estimated Tax Payment Voucher?

A: Massachusetts corporations that are required to make estimated tax payments for their unemployment insurance need to file this voucher.

Q: How often do I need to file a UBI-ES Corporate Estimated Tax Payment Voucher?

A: The UBI-ES Corporate Estimated Tax Payment Voucher needs to be filed on a quarterly basis.

Q: What information is required to complete the UBI-ES Corporate Estimated Tax Payment Voucher?

A: You will need to provide your corporation's name, federal employer identification number (FEIN), mailing address, contact information, and the estimated tax amount.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UBI-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.