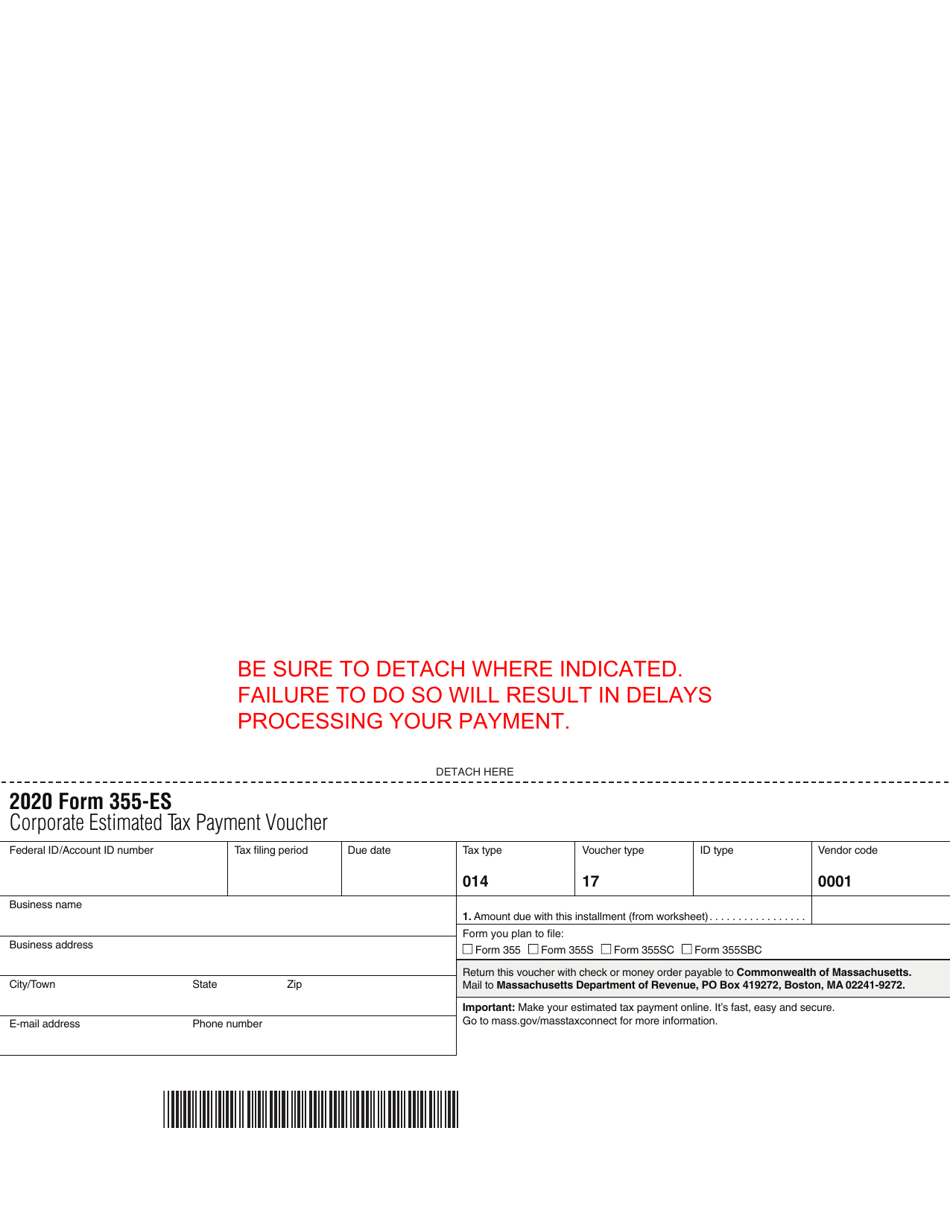

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 355-ES

for the current year.

Form 355-ES Corporate Estimated Tax Payment Voucher - Massachusetts

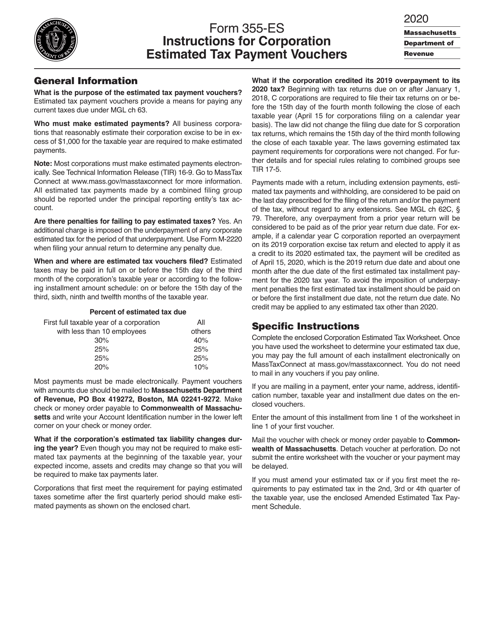

What Is Form 355-ES?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

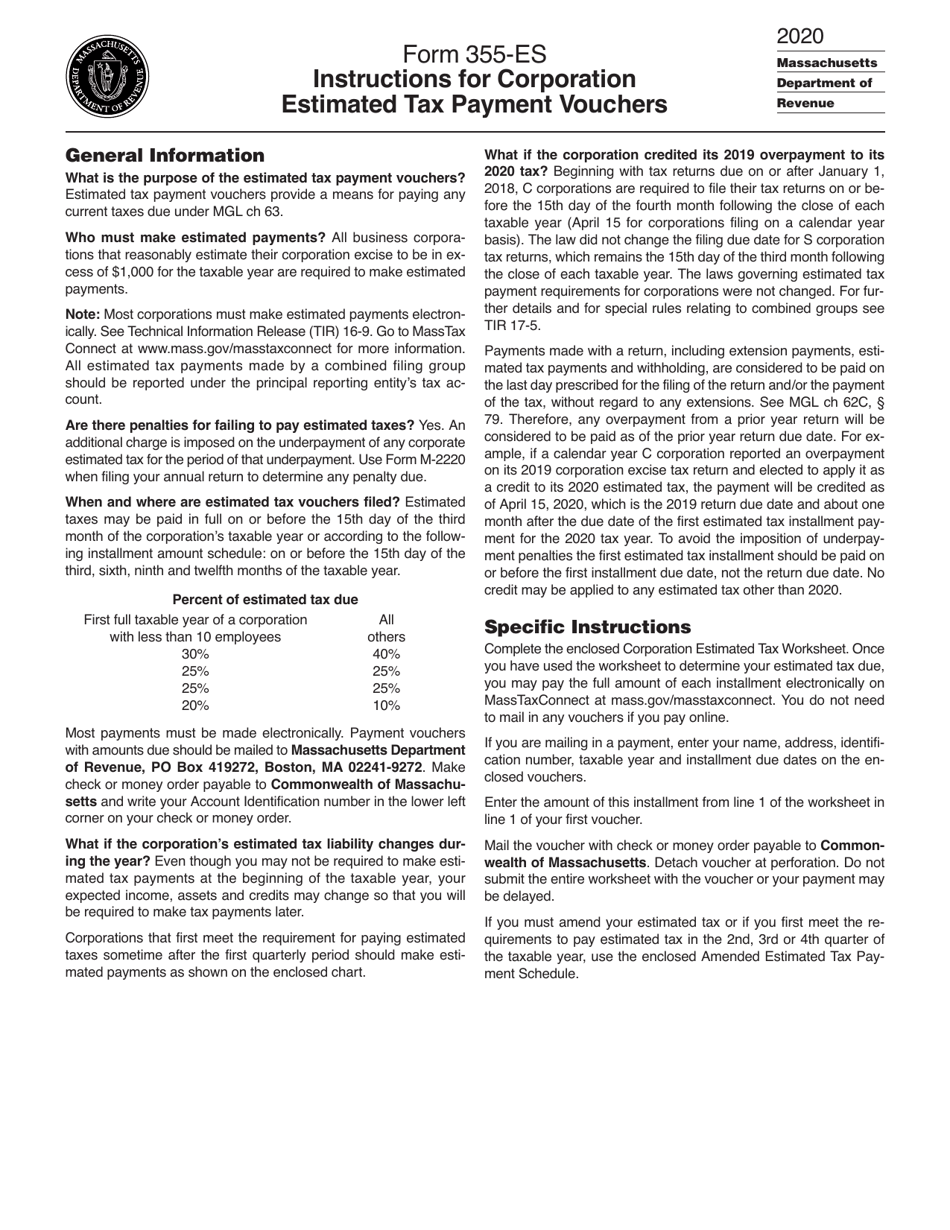

Q: What is Form 355-ES?

A: Form 355-ES is a Corporate Estimated Tax Payment Voucher.

Q: Who needs to use Form 355-ES?

A: Corporations in Massachusetts who need to make estimated tax payments.

Q: What are estimated tax payments?

A: Estimated tax payments are quarterly payments made by businesses to pay their tax liability throughout the year.

Q: Why do corporations need to make estimated tax payments?

A: Corporations are required to make estimated tax payments to avoid penalties for underpaying their taxes.

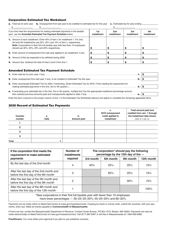

Q: What information is required on Form 355-ES?

A: Form 355-ES requires information about the corporation's taxable income, tax liability, and estimated tax payments.

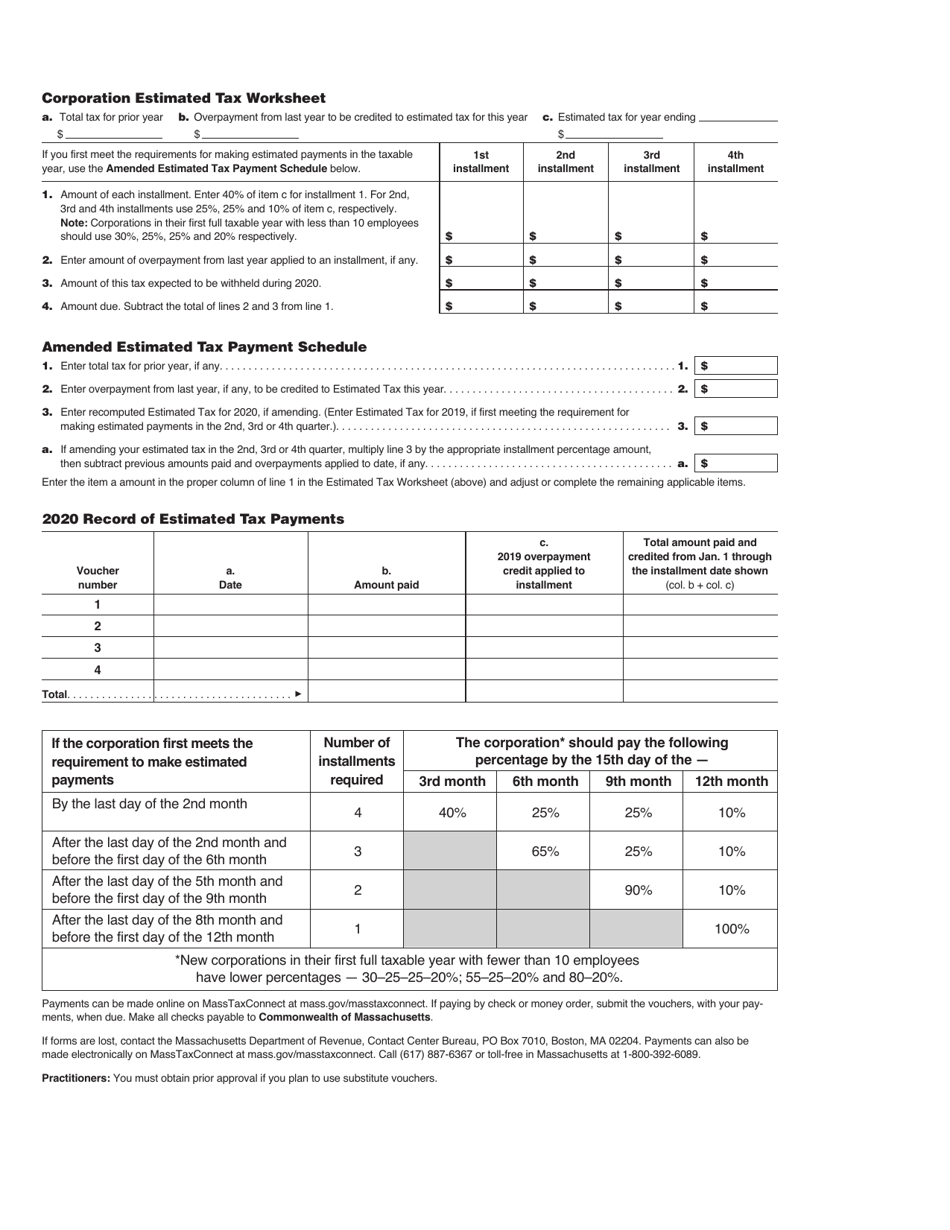

Q: When are estimated tax payments due?

A: Estimated tax payments are due on the 15th day of the 4th, 6th, 9th, and 12th months of the corporation's fiscal year.

Q: What happens if a corporation doesn't make estimated tax payments?

A: If a corporation doesn't make estimated tax payments or underpays its taxes, it may be subject to penalties and interest charges.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 355-ES by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.