This version of the form is not currently in use and is provided for reference only. Download this version of

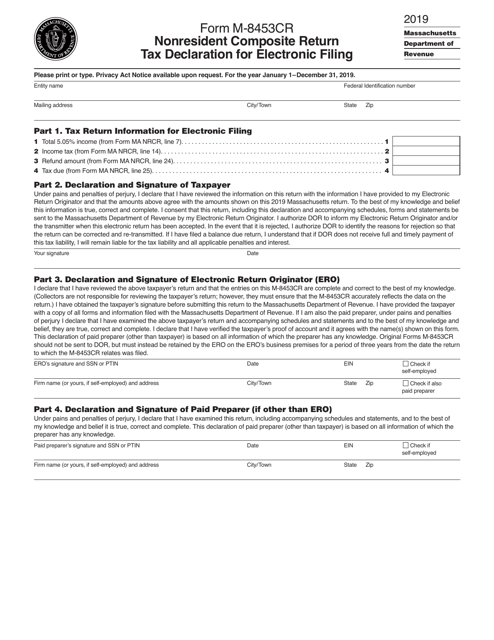

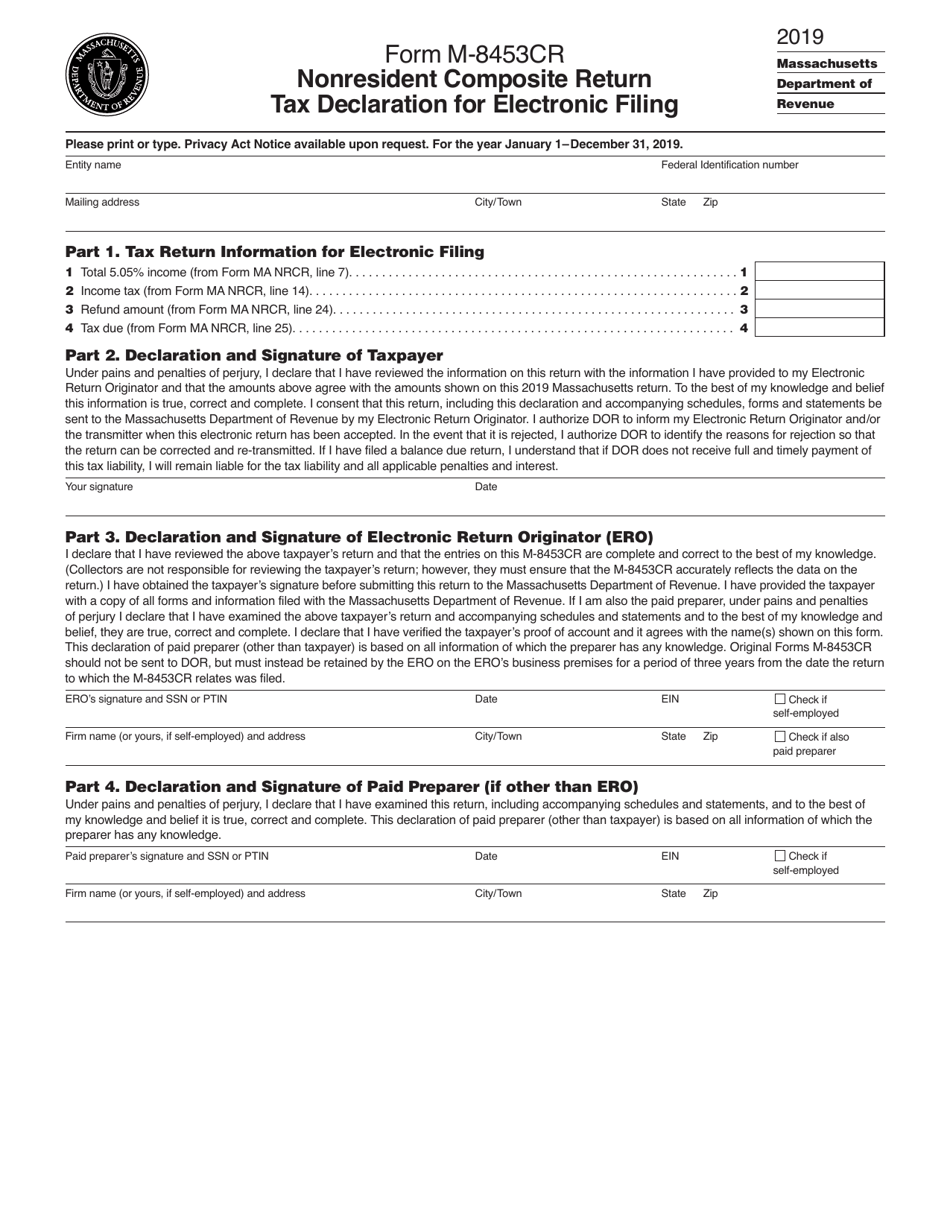

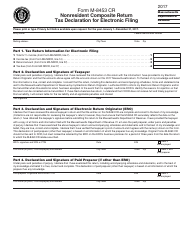

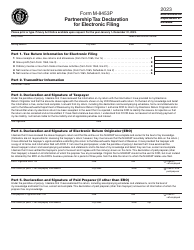

Form M-8453CR

for the current year.

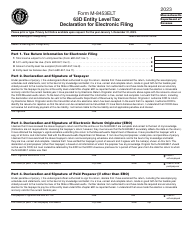

Form M-8453CR Nonresident Composite Return Tax Declaration for Electronic Filing - Massachusetts

What Is Form M-8453CR?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

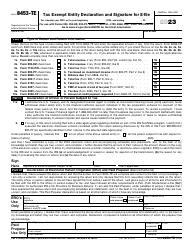

Q: What is Form M-8453CR?

A: Form M-8453CR is a tax declaration form for nonresidents of Massachusetts who are filing a composite return electronically.

Q: Who needs to file Form M-8453CR?

A: Nonresidents of Massachusetts who are filing a composite return electronically need to file Form M-8453CR.

Q: What is a composite return?

A: A composite return is a tax return that is filed on behalf of nonresident individuals who are members of a pass-through entity, such as a partnership or LLC.

Q: What is the purpose of Form M-8453CR?

A: The purpose of Form M-8453CR is to declare that you are authorized to file a composite return on behalf of the nonresident members of a pass-through entity.

Q: Is Form M-8453CR used for federal taxes?

A: No, Form M-8453CR is only used for the state of Massachusetts.

Q: Can Form M-8453CR be filed electronically?

A: Yes, Form M-8453CR can be filed electronically.

Q: Are there any requirements for electronic filing of Form M-8453CR?

A: Yes, you must have an approved software or service provider to file Form M-8453CR electronically.

Q: Is there a deadline for filing Form M-8453CR?

A: Yes, the deadline for filing Form M-8453CR is the same as the deadline for filing the composite return, generally April 15th.

Q: Can I mail Form M-8453CR instead of filing electronically?

A: No, Form M-8453CR is specifically for electronic filing and cannot be mailed.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-8453CR by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.