This version of the form is not currently in use and is provided for reference only. Download this version of

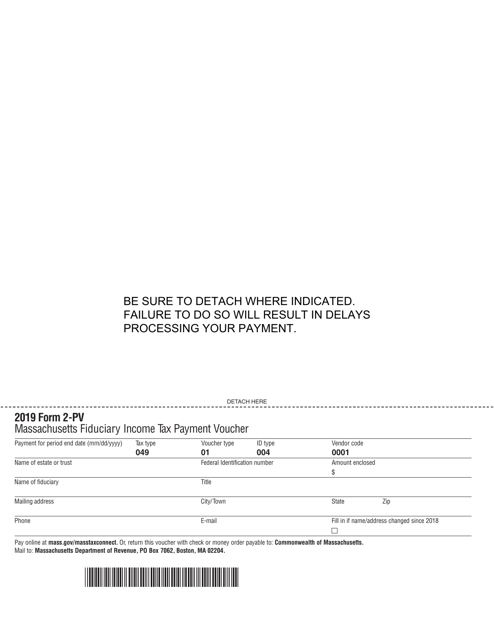

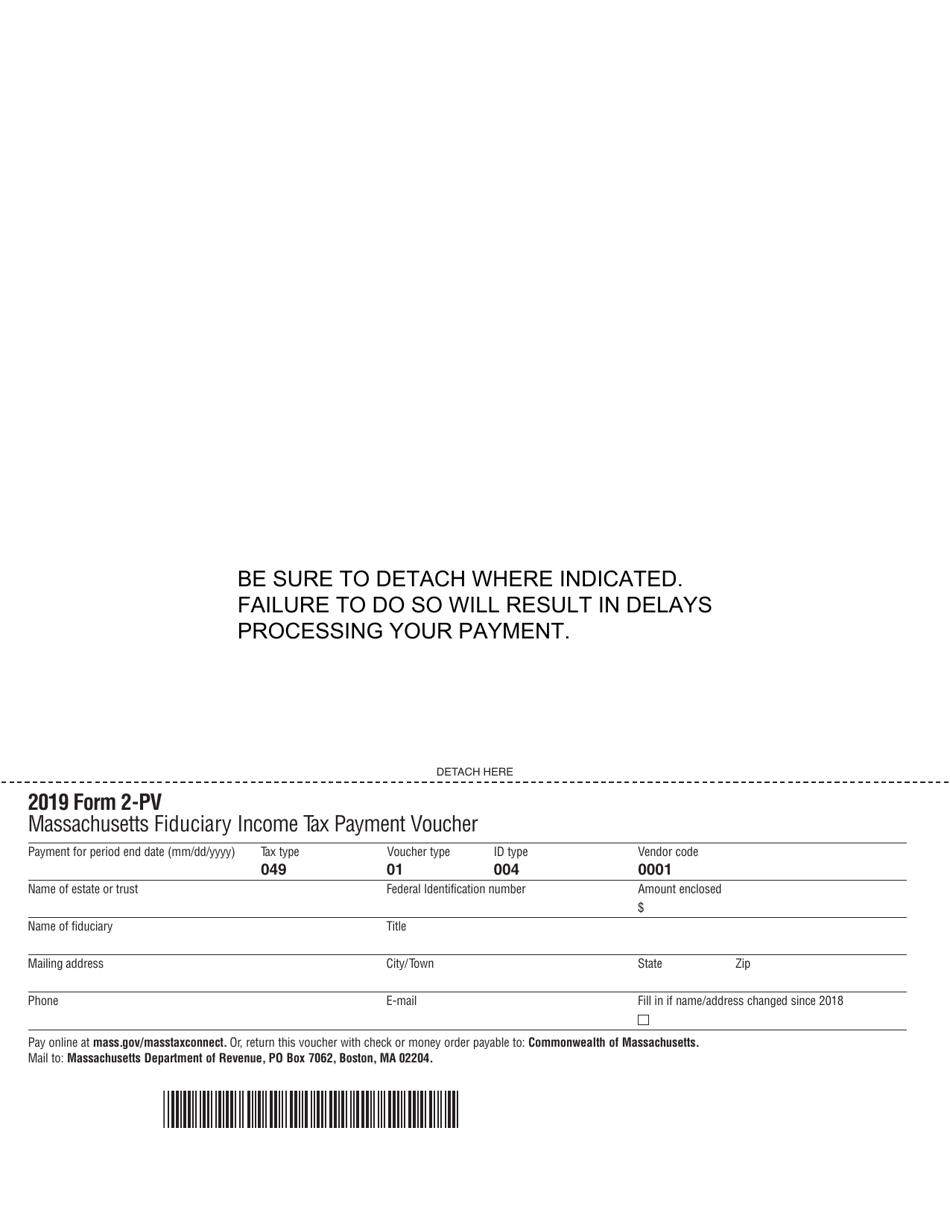

Form 2-PV

for the current year.

Form 2-PV Massachusetts Fiduciary Income Tax Payment Voucher - Massachusetts

What Is Form 2-PV?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2-PV?

A: Form 2-PV is the Massachusetts Fiduciary Income Tax Payment Voucher.

Q: Who should use Form 2-PV?

A: Form 2-PV should be used by fiduciaries (trustees or personal representatives) who are making payments for Massachusetts fiduciary income tax.

Q: What is the purpose of Form 2-PV?

A: The purpose of Form 2-PV is to provide a voucher for fiduciaries to make their Massachusetts fiduciary income tax payments.

Q: When should Form 2-PV be filed?

A: Form 2-PV should be filed when making a payment for Massachusetts fiduciary income tax.

Q: What information is needed to fill out Form 2-PV?

A: You will need to provide your name, address, Social Security number or federal employer identification number, tax year, and the amount of your payment.

Q: Is there a deadline for filing Form 2-PV?

A: Yes, the deadline for filing Form 2-PV is the same as the deadline for filing your Massachusetts fiduciary income tax return, which is typically on or around April 15th.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 2-PV by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.