This version of the form is not currently in use and is provided for reference only. Download this version of

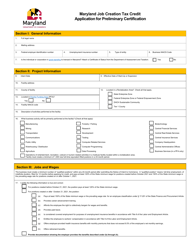

Form RTC-1

for the current year.

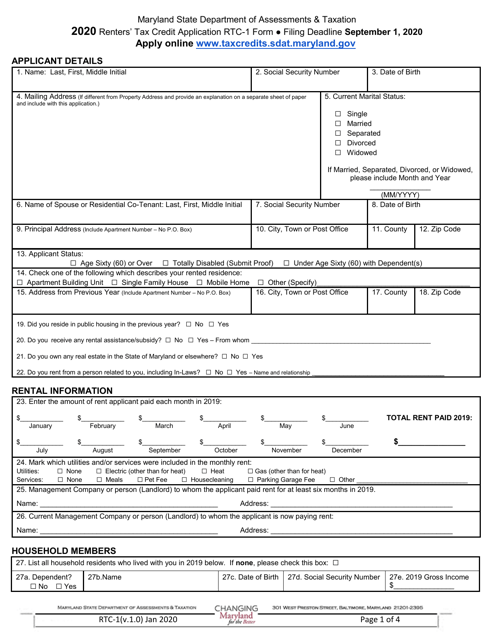

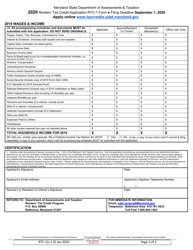

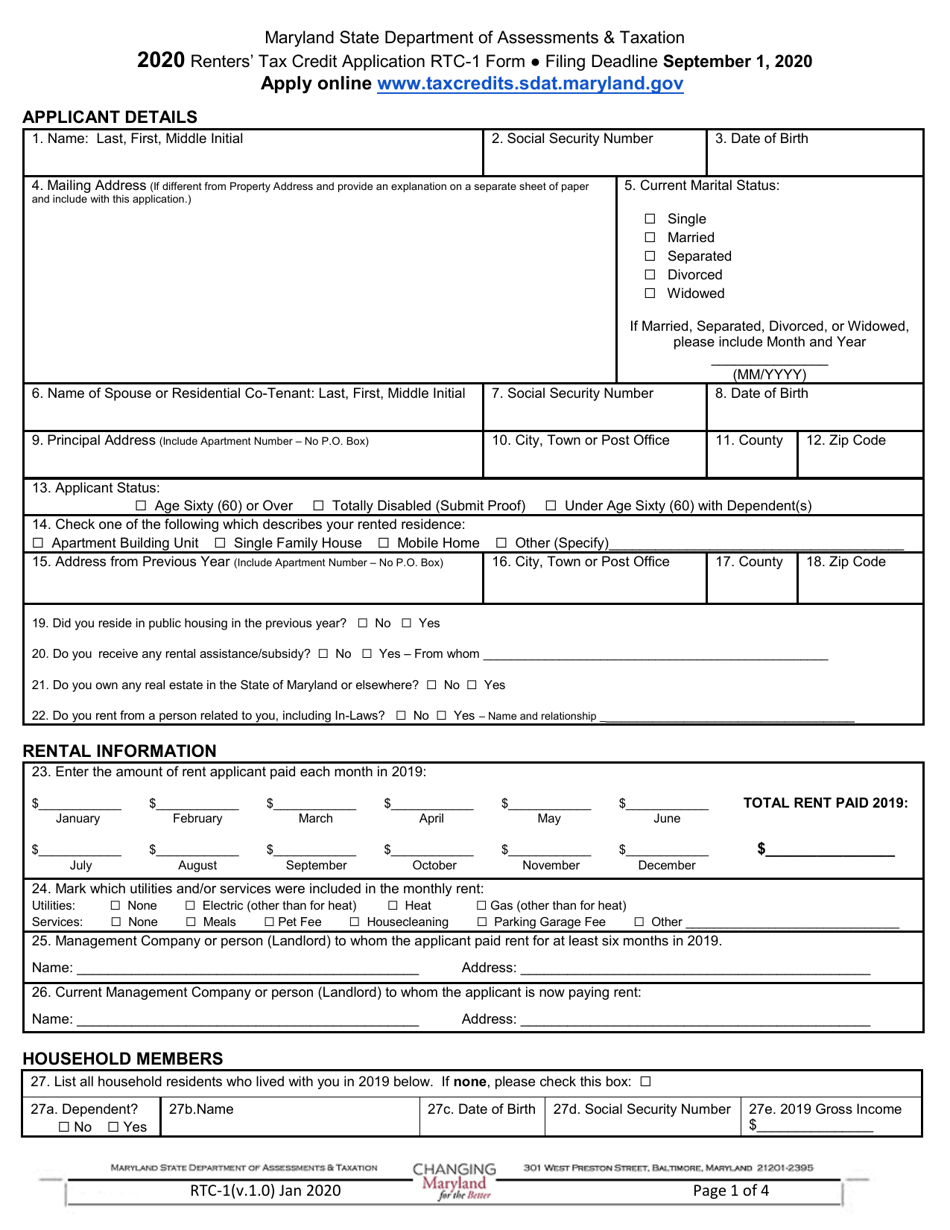

Form RTC-1 Renters' Tax Credit Application - Maryland

What Is Form RTC-1?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

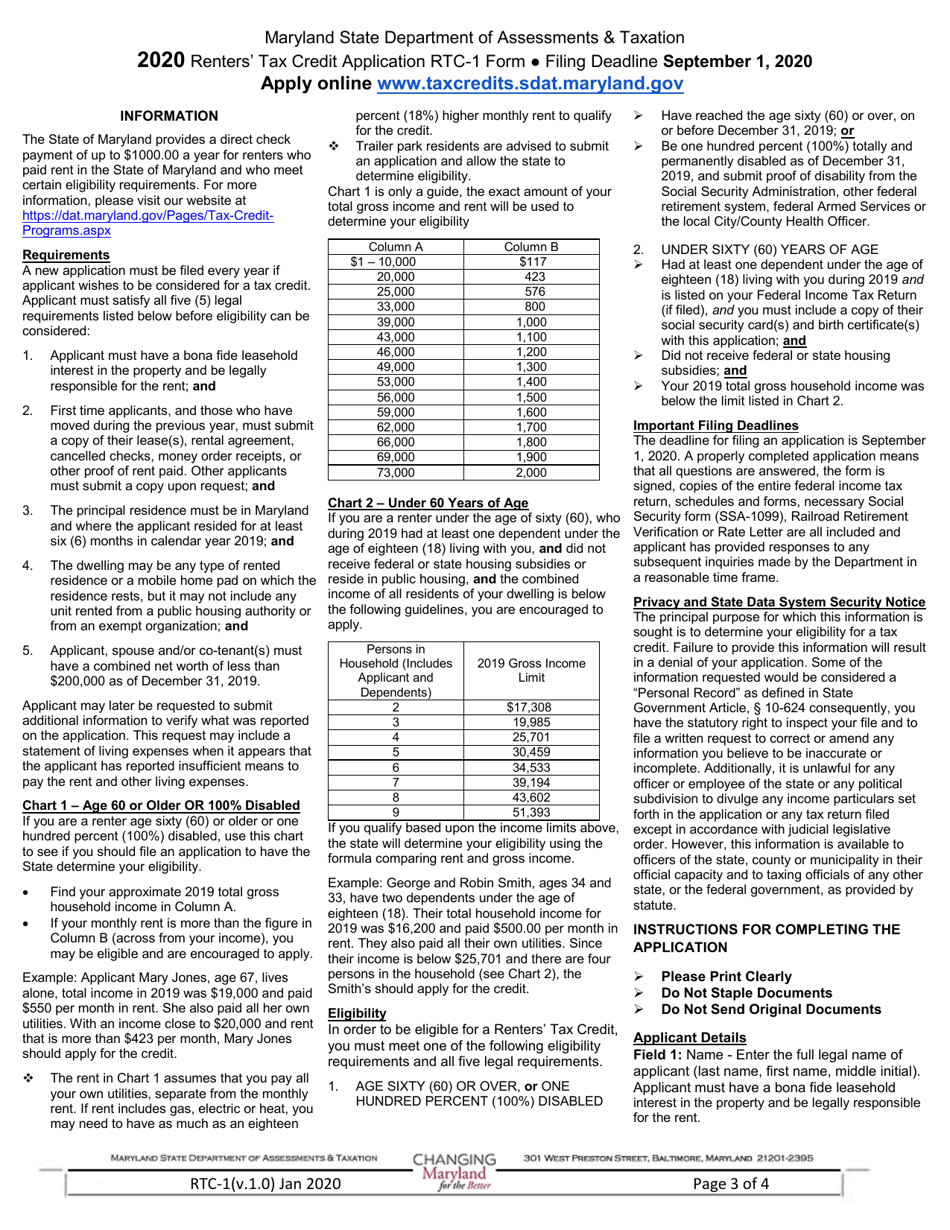

Q: What is the RTC-1 Renters' Tax Credit Application?

A: The RTC-1 Renters' Tax Credit Application is a form used in Maryland to apply for a tax credit for renters.

Q: Who can apply for the RTC-1 Renters' Tax Credit?

A: Maryland residents who rent their primary residence and meet certain income requirements can apply for the RTC-1 Renters' Tax Credit.

Q: What is the purpose of the RTC-1 Renters' Tax Credit?

A: The purpose of the RTC-1 Renters' Tax Credit is to provide financial assistance to eligible low-income renters and help reduce the burden of rent.

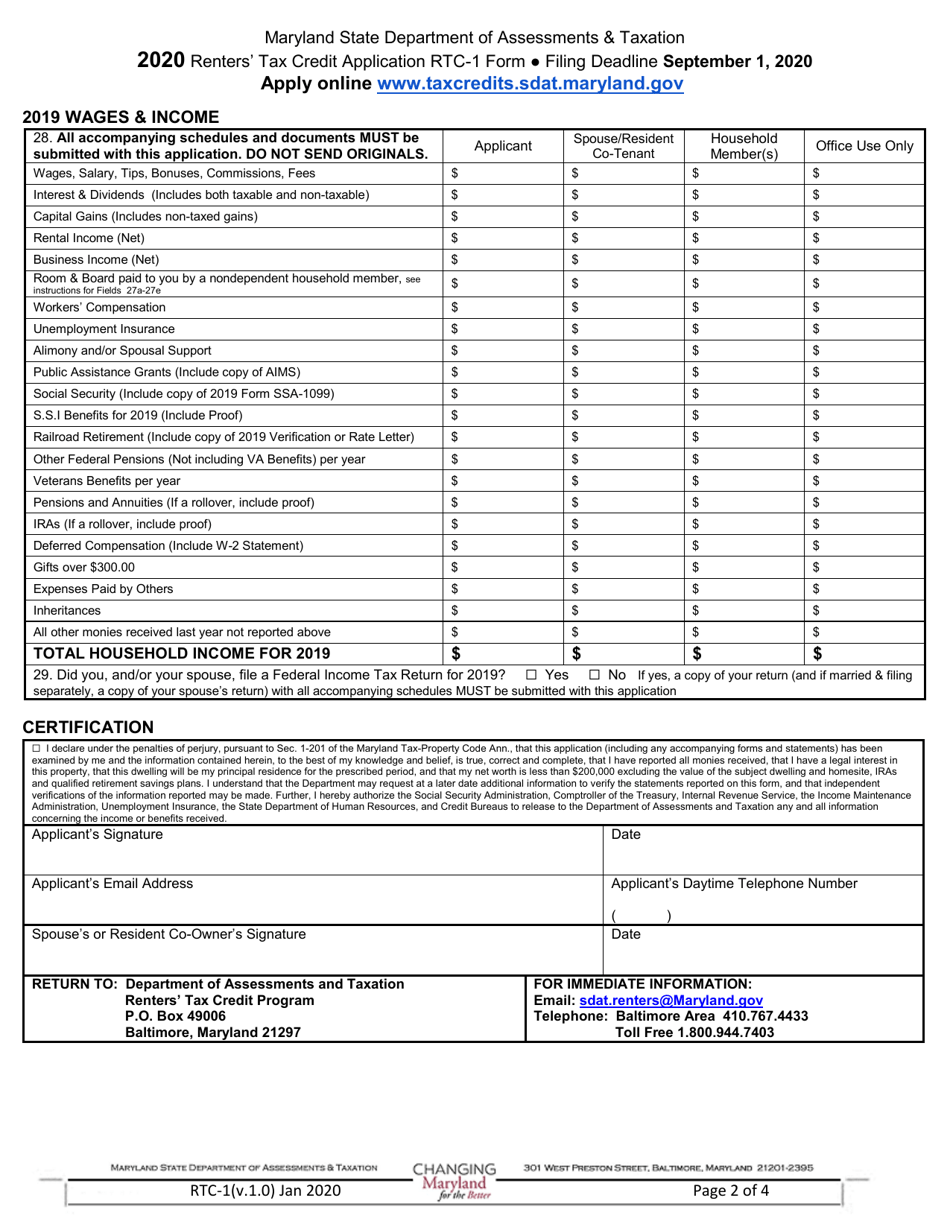

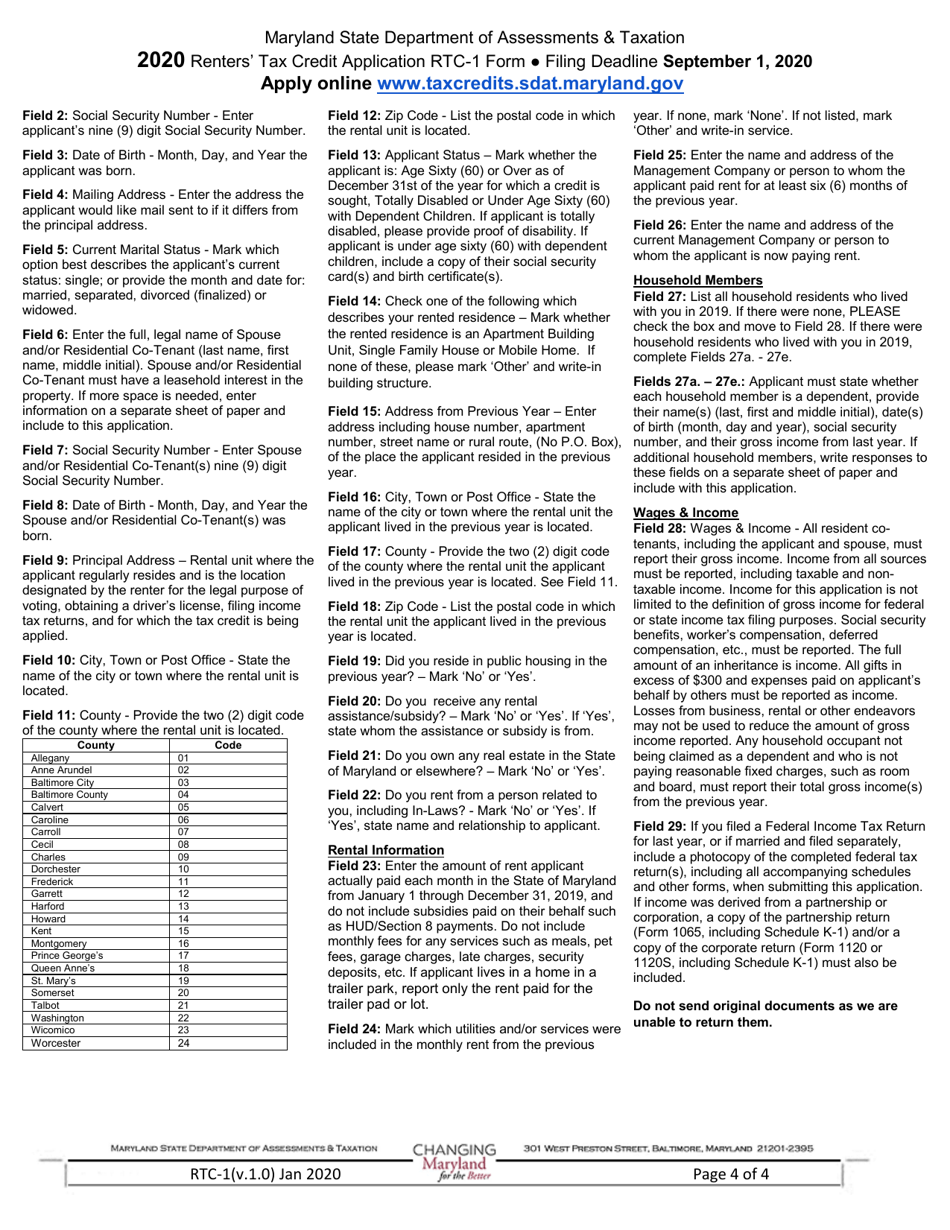

Q: What documents do I need to include with the RTC-1 Renters' Tax Credit Application?

A: You will need to include proof of income, such as pay stubs or tax returns, as well as documentation of your rental expenses.

Q: When should I submit the RTC-1 Renters' Tax Credit Application?

A: The RTC-1 Renters' Tax Credit Application should be submitted on or before September 1st of each year.

Q: What is the deadline for the RTC-1 Renters' Tax Credit Application?

A: The deadline for submitting the RTC-1 Renters' Tax Credit Application is September 1st of each year.

Q: How long does it take to process the RTC-1 Renters' Tax Credit Application?

A: Processing times may vary, but it generally takes several weeks to process the RTC-1 Renters' Tax Credit Application.

Q: What happens after my RTC-1 Renters' Tax Credit Application is approved?

A: If your RTC-1 Renters' Tax Credit Application is approved, you will receive a tax credit that can help reduce your rent.

Q: Is there a fee to submit the RTC-1 Renters' Tax Credit Application?

A: No, there is no fee to submit the RTC-1 Renters' Tax Credit Application.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RTC-1 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.