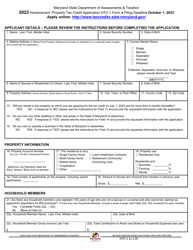

This version of the form is not currently in use and is provided for reference only. Download this version of

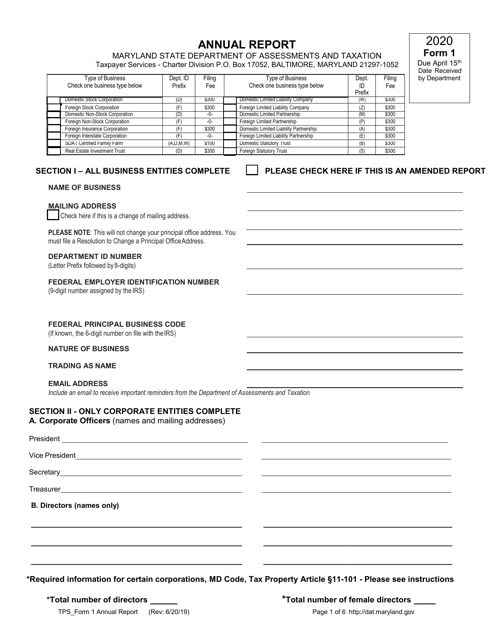

Form 1

for the current year.

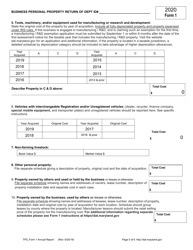

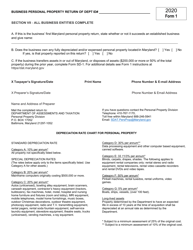

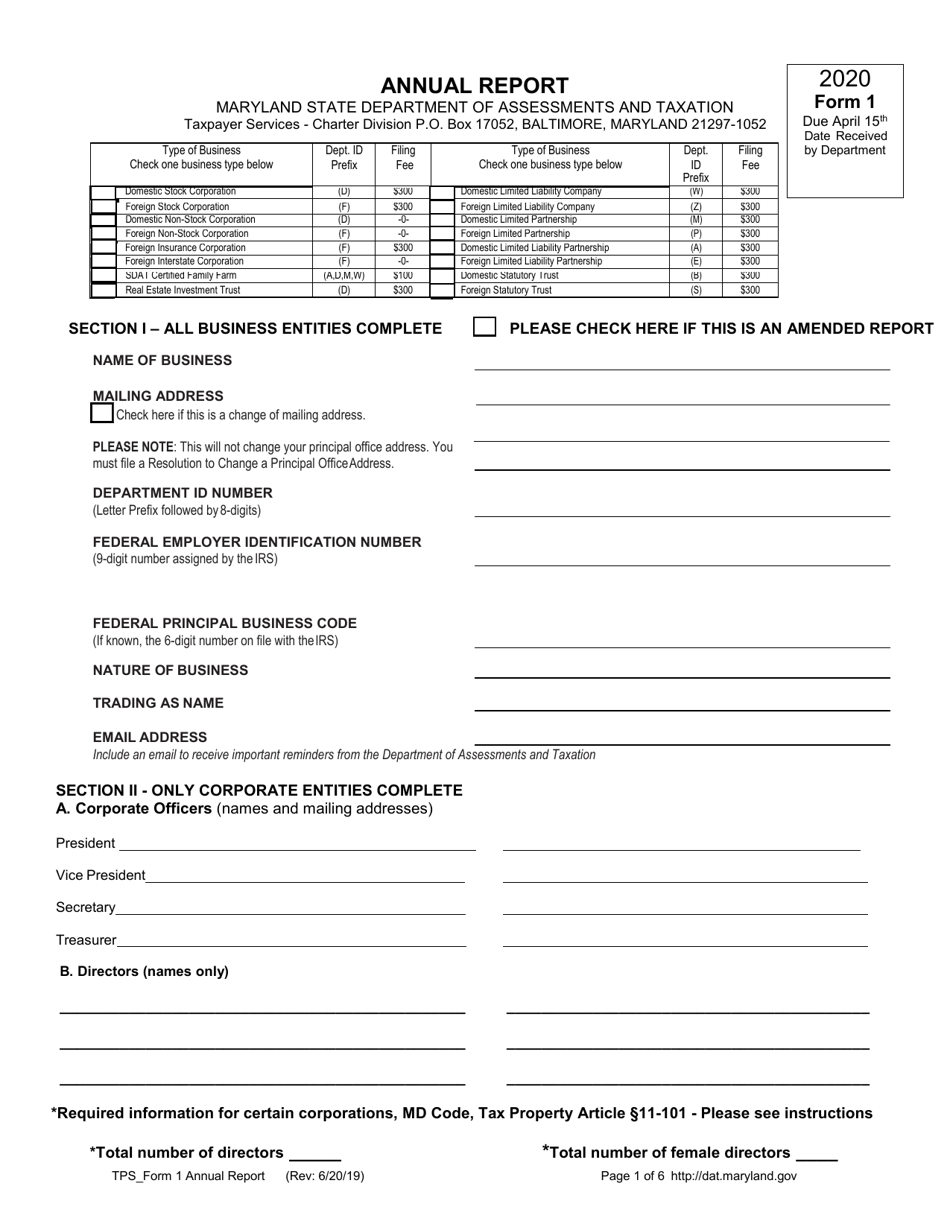

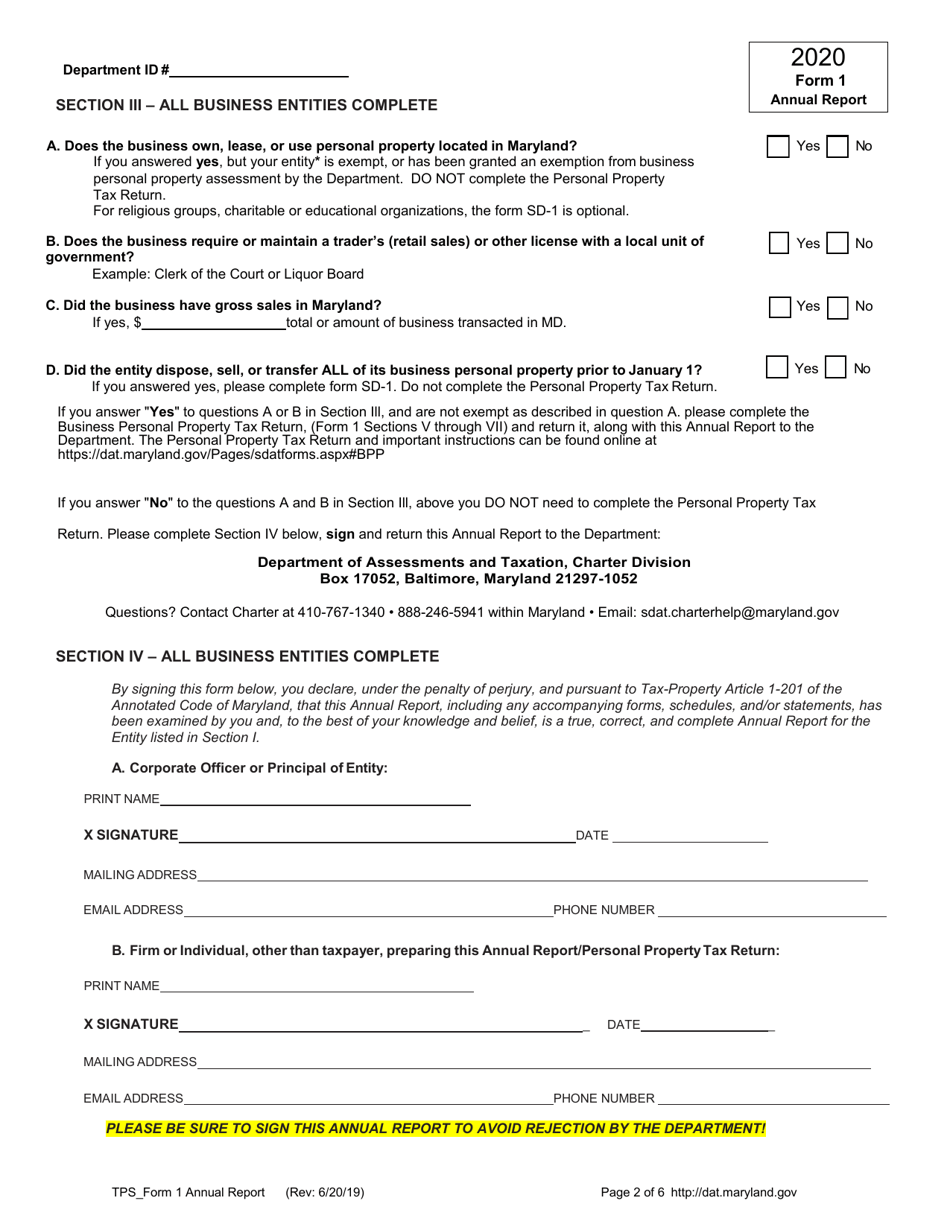

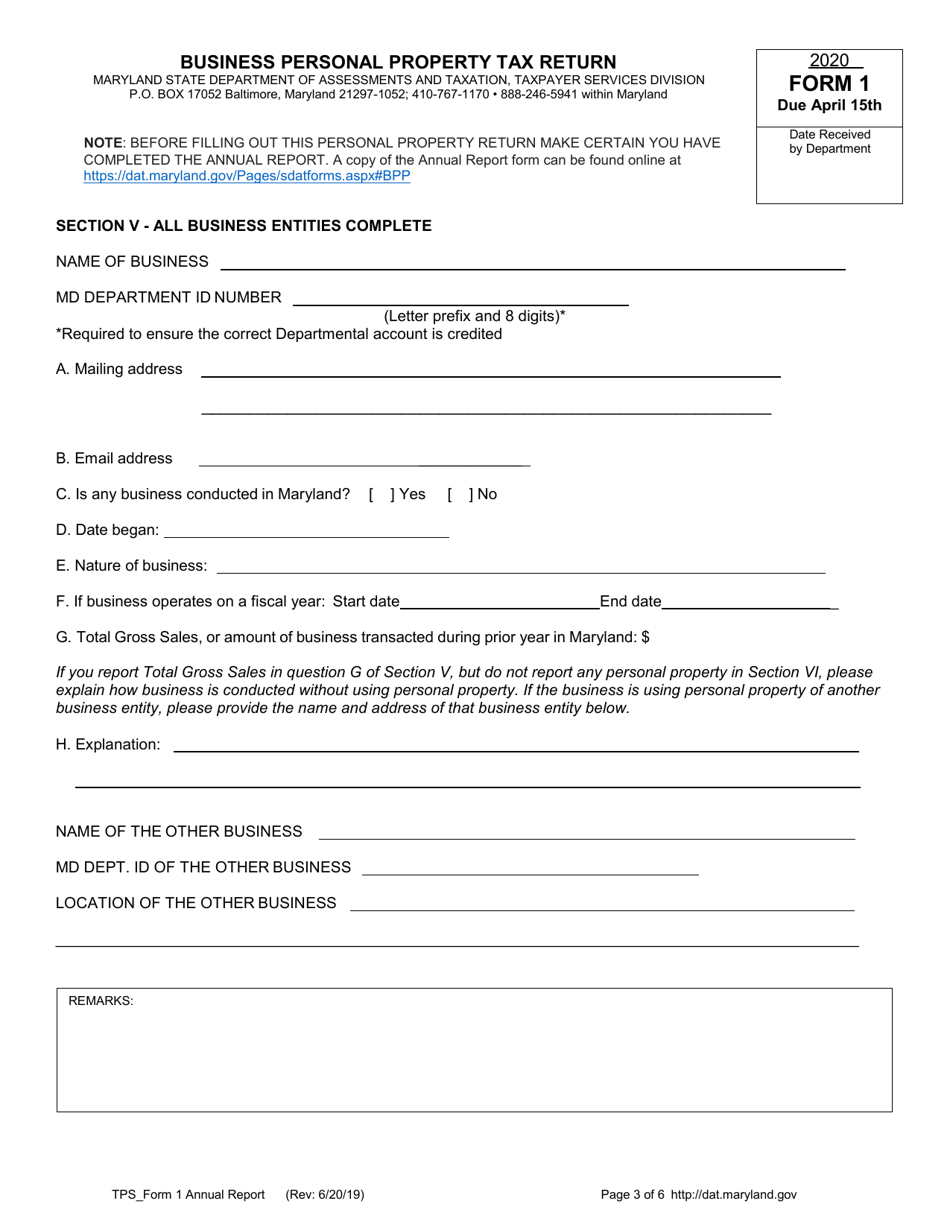

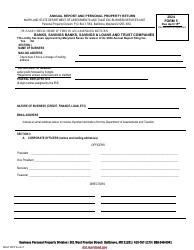

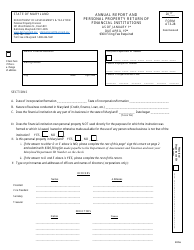

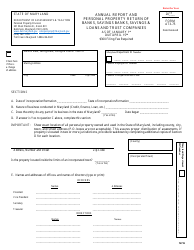

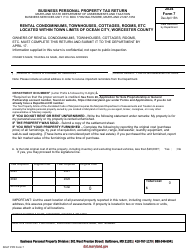

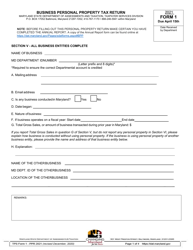

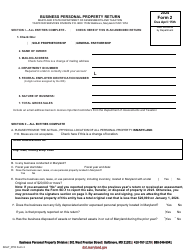

Form 1 Annual Report and Personal Property Tax Return - Maryland

What Is Form 1?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1?

A: Form 1 is the Annual Report and Personal Property Tax Return.

Q: Who needs to file Form 1?

A: All corporations, limited liability companies (LLCs), and limited liability partnerships (LLPs) that are registered to do business in Maryland need to file Form 1.

Q: When is the due date for Form 1?

A: The due date for Form 1 is April 15th of each year.

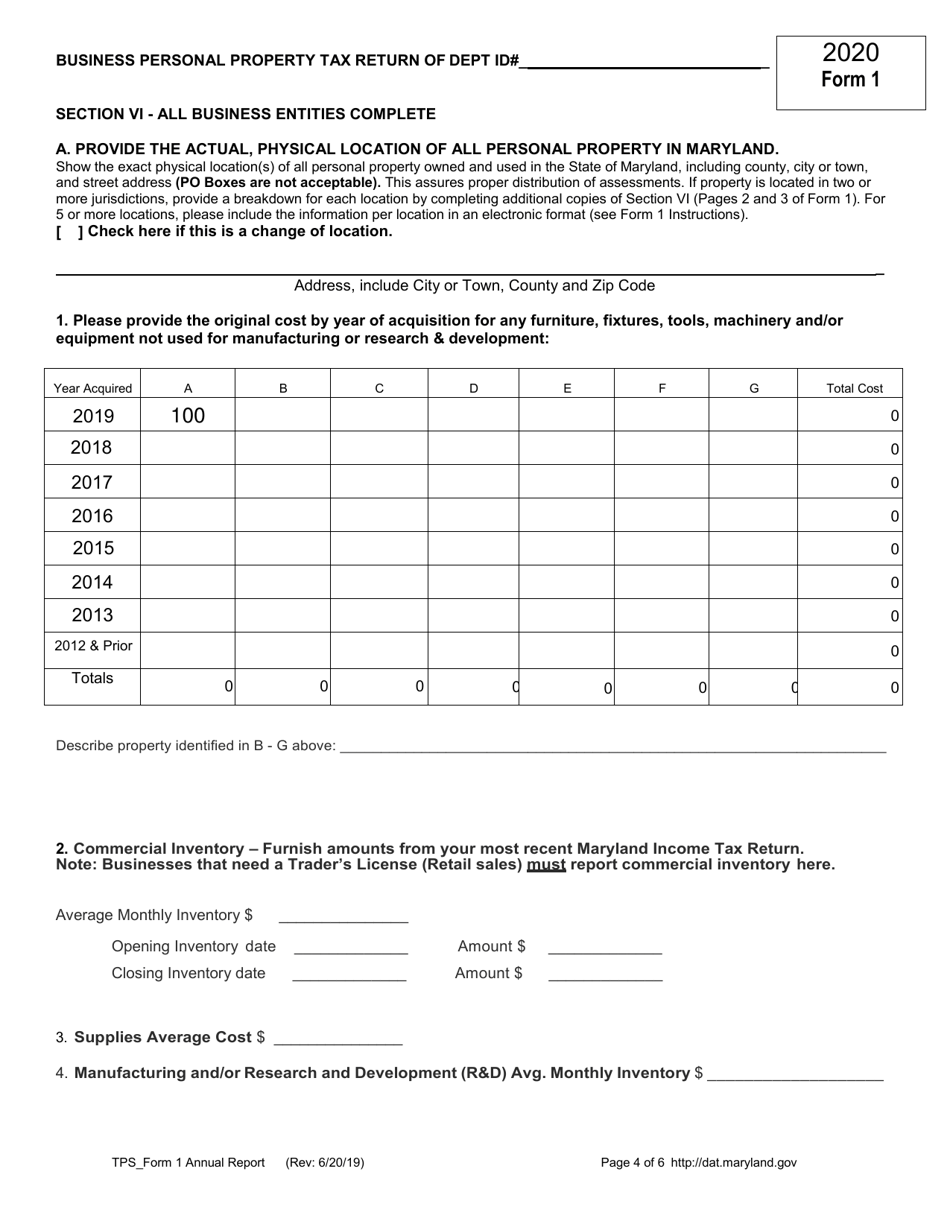

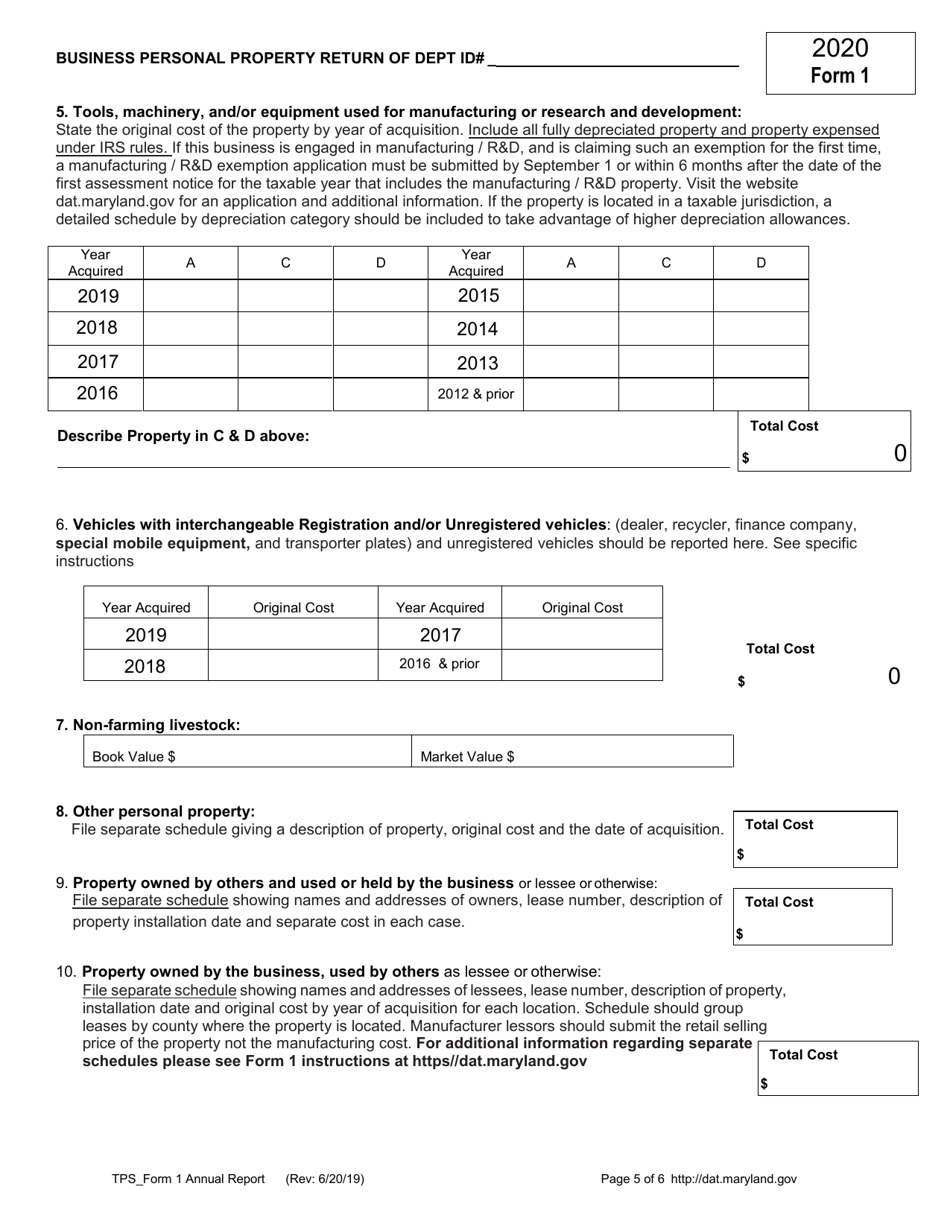

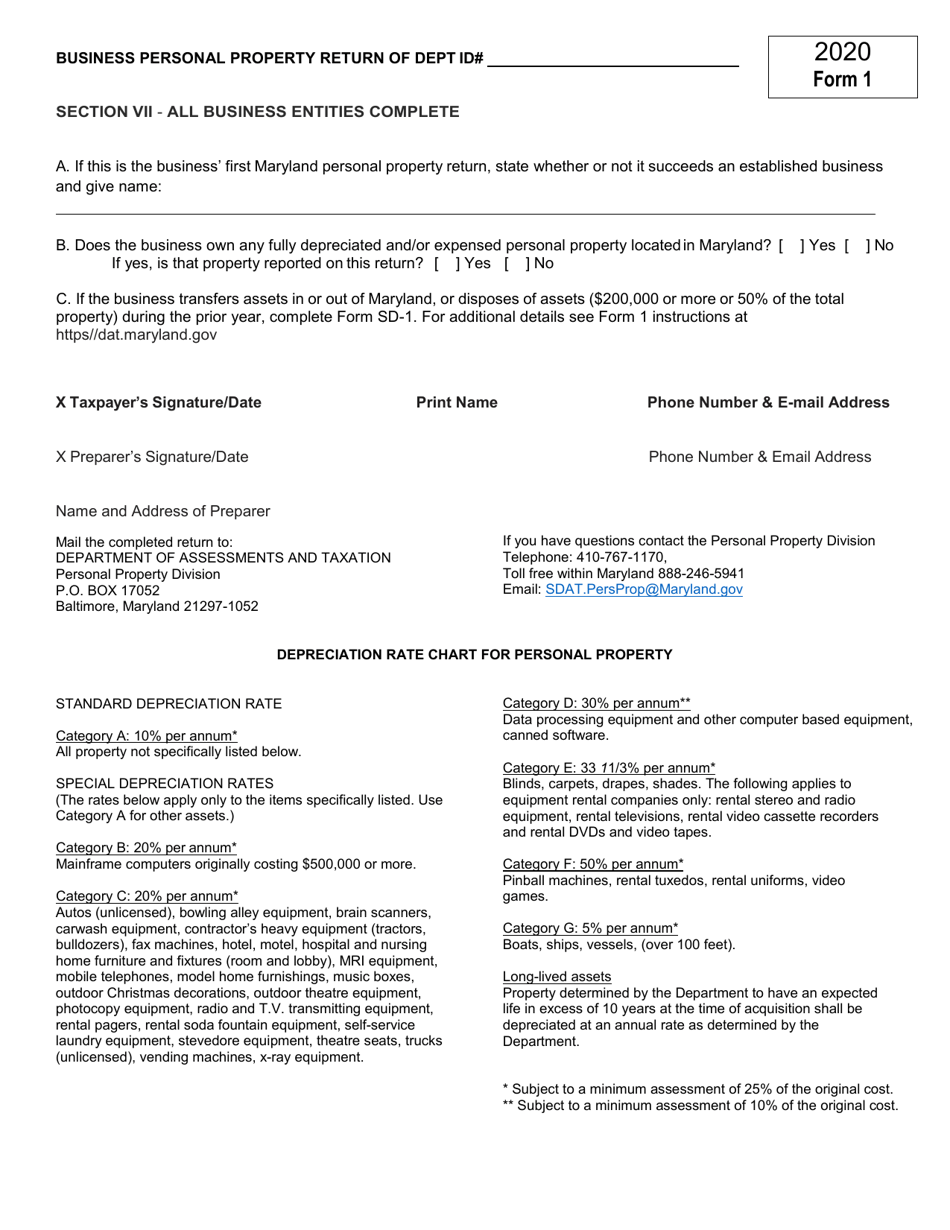

Q: What information is required on Form 1?

A: Form 1 requires information about the business entity's assets, income, and expenses.

Q: Is there a fee for filing Form 1?

A: Yes, there is an annual filing fee associated with Form 1.

Form Details:

- Released on June 20, 2019;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.