This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

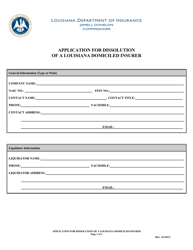

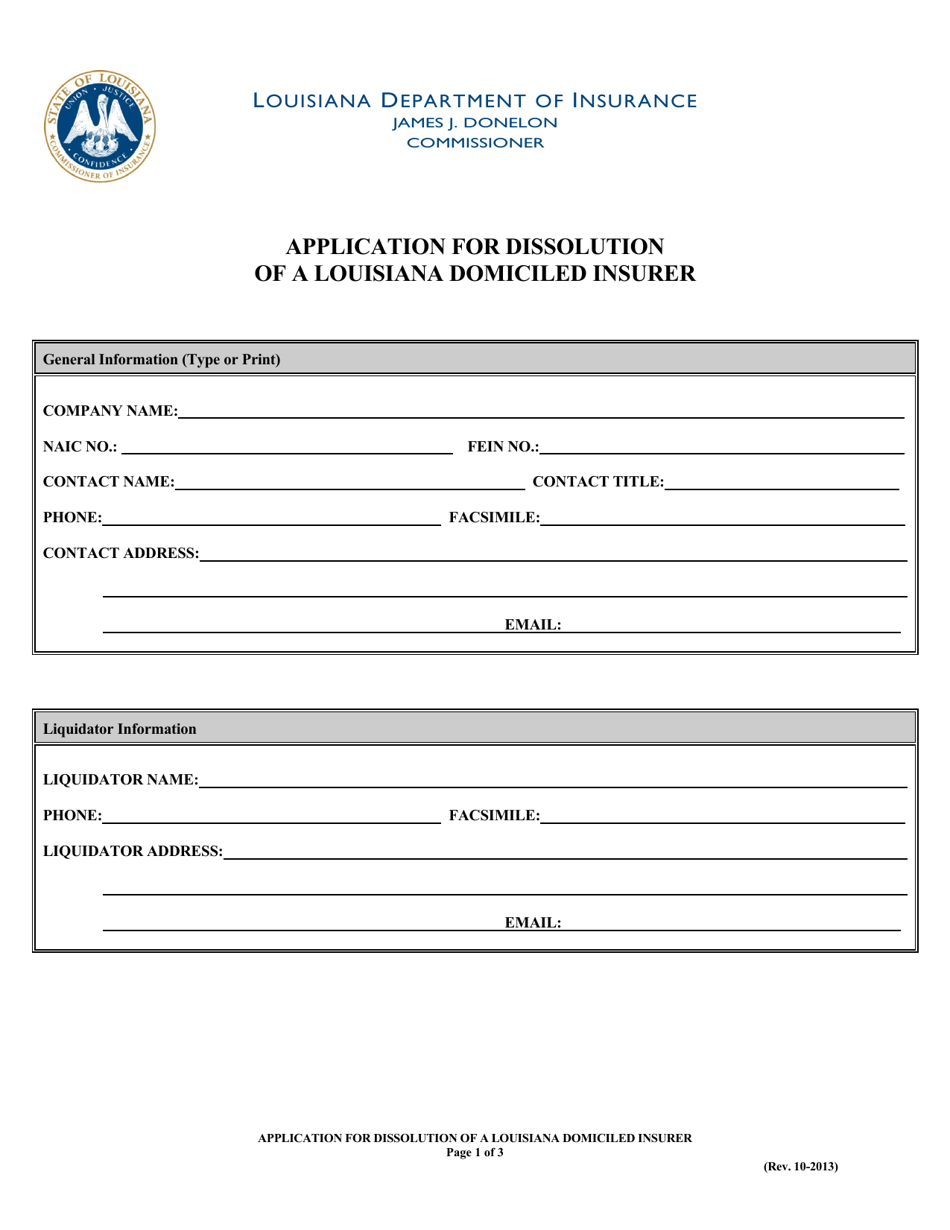

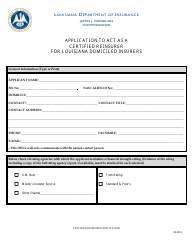

Application for Dissolution of a Louisiana Domiciled Insurer - Louisiana

Application for Dissolution of a Louisiana Domiciled Insurer is a legal document that was released by the Louisiana Department of Insurance - a government authority operating within Louisiana.

FAQ

Q: What is an application for dissolution of a Louisiana domiciled insurer?

A: An application for dissolution of a Louisiana domiciled insurer is a request to terminate the legal existence of an insurance company based in Louisiana.

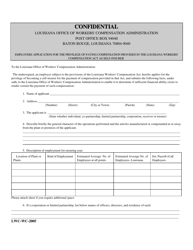

Q: Who can file an application for dissolution?

A: The application for dissolution can be filed by the directors, shareholders, or managers of the Louisiana domiciled insurer.

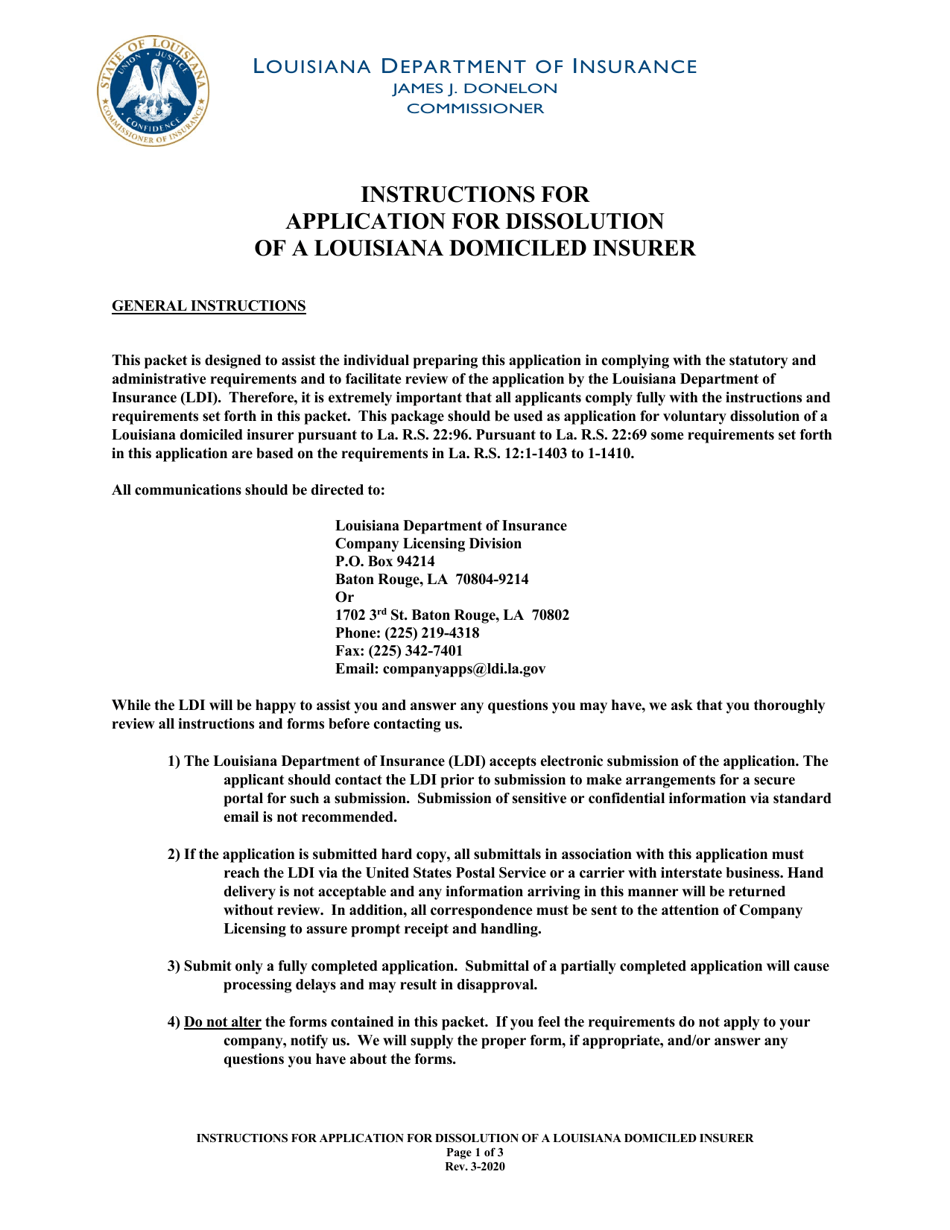

Q: What is the process for filing an application for dissolution?

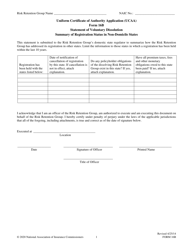

A: The process for filing an application for dissolution involves completing the necessary forms and submitting them to the Louisiana Department of Insurance.

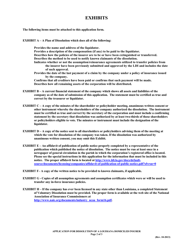

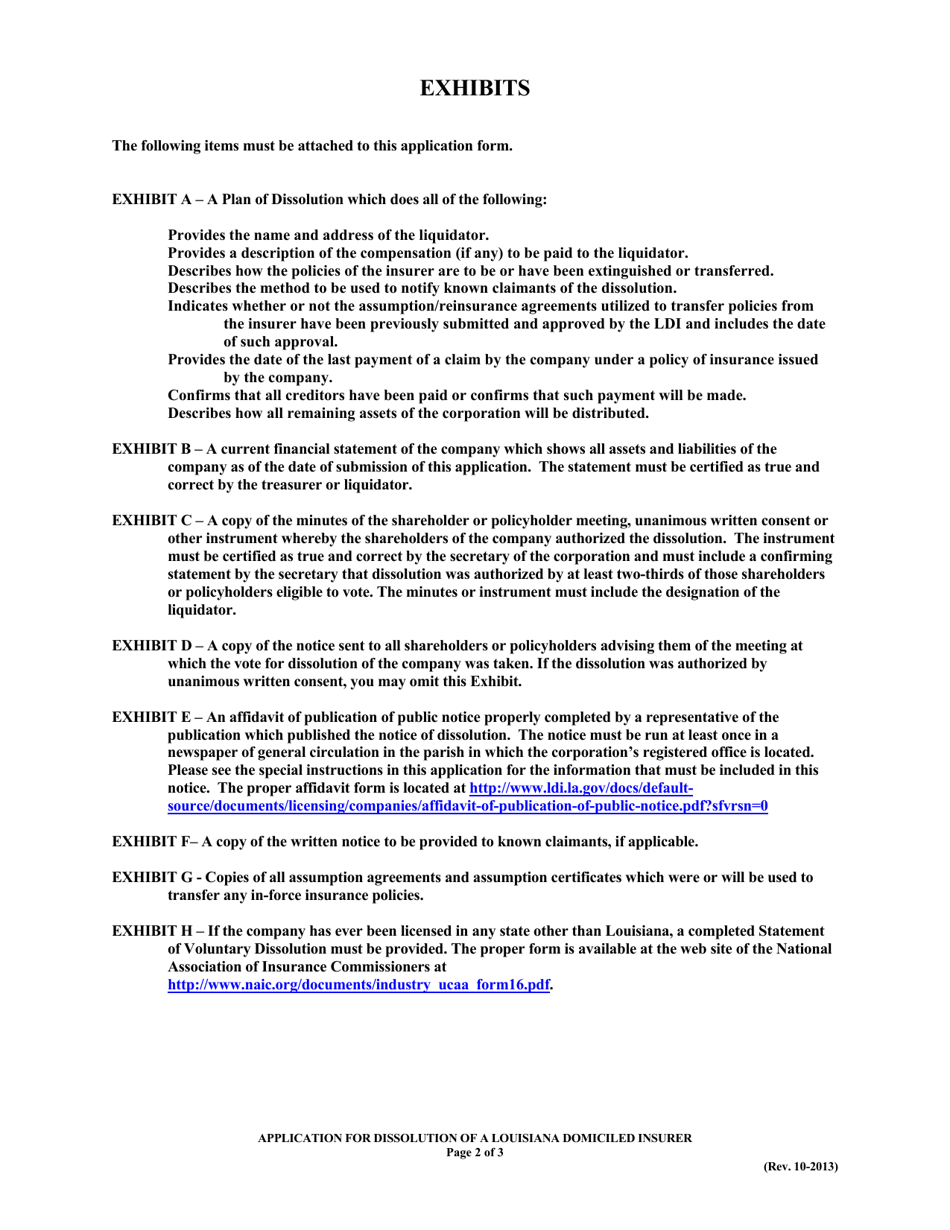

Q: What documents are required to be included with the application for dissolution?

A: The application for dissolution should include an explanation of the reasons for dissolution, a certified copy of the resolution authorizing the dissolution, and financial statements.

Q: Is there a fee for filing an application for dissolution?

A: Yes, there is a fee for filing an application for dissolution. The fee amount may vary and should be verified with the Louisiana Department of Insurance.

Q: What happens after an application for dissolution is filed?

A: After an application for dissolution is filed, it will be reviewed by the Louisiana Department of Insurance. If all requirements are met, the insurer's legal existence may be terminated.

Q: Are there any additional requirements or steps after the application is approved?

A: Yes, there may be additional requirements or steps after the application for dissolution is approved, such as notifying policyholders and creditors, and distributing remaining assets.

Q: Can an application for dissolution be denied?

A: Yes, an application for dissolution can be denied if the Louisiana Department of Insurance determines that the requirements for dissolution have not been met or if there are outstanding issues with the insurer.

Q: What is the effect of dissolution on policyholders?

A: The effect of dissolution on policyholders may vary. Policies may be transferred to another insurer, canceled, or other arrangements may be made. Policyholders should be notified of the dissolution and any applicable changes.

Form Details:

- Released on March 1, 2020;

- The latest edition currently provided by the Louisiana Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Louisiana Department of Insurance.