This version of the form is not currently in use and is provided for reference only. Download this version of

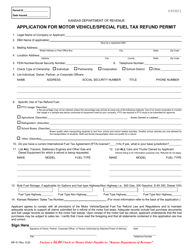

Form ST-21

for the current year.

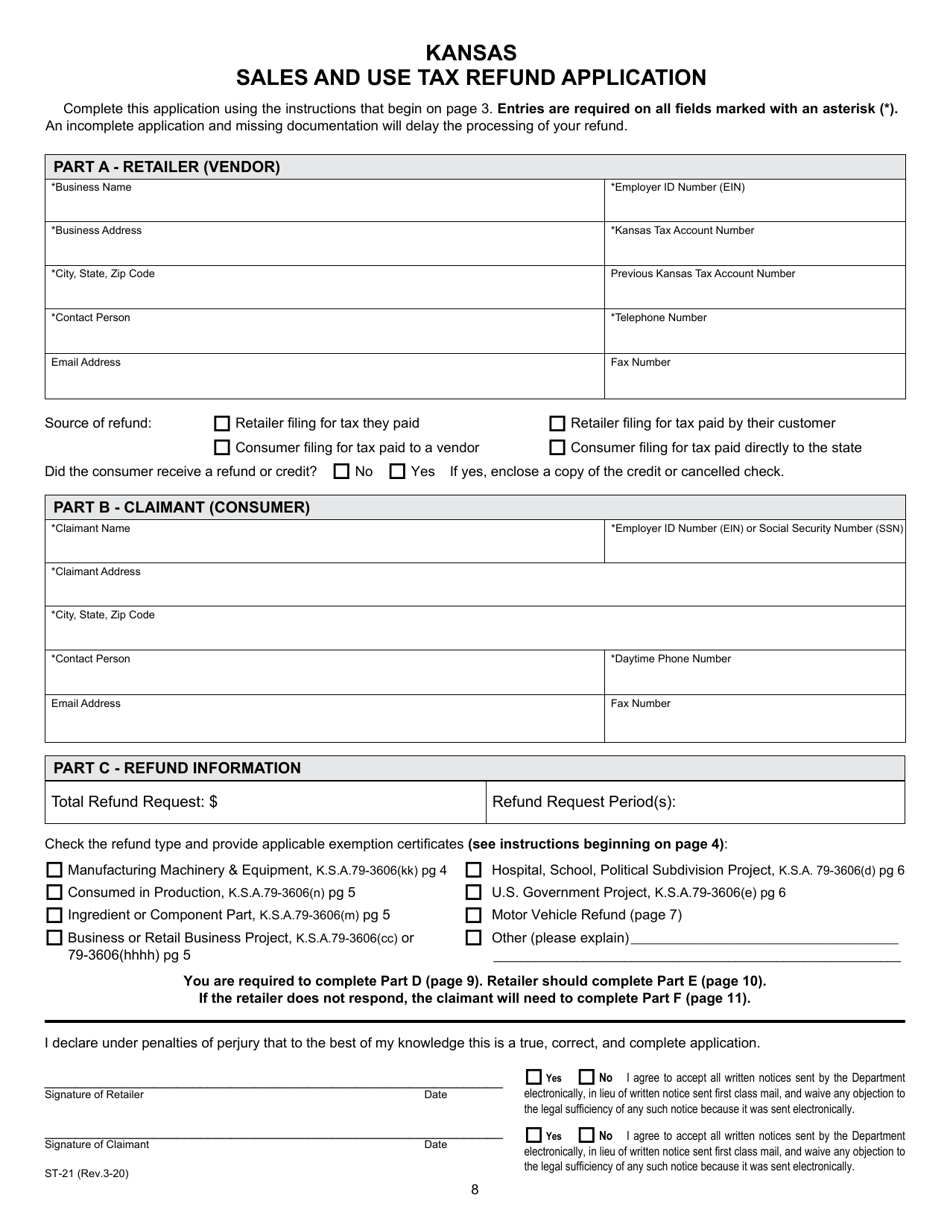

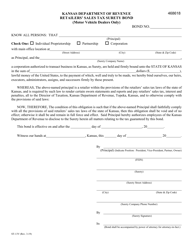

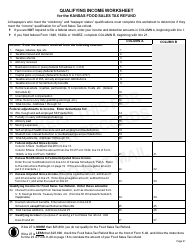

Form ST-21 Kansas Sales and Use Tax Refund Application - Kansas

What Is Form ST-21?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

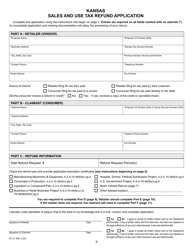

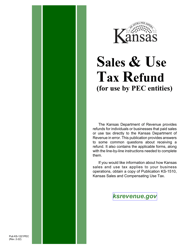

Q: What is Form ST-21?

A: Form ST-21 is the Kansas Sales and Use Tax Refund Application.

Q: What is the purpose of Form ST-21?

A: The purpose of Form ST-21 is to apply for a refund of sales and use tax paid to the state of Kansas.

Q: Who can use Form ST-21?

A: Any individual or business who has paid sales and use tax to the state of Kansas and wants to claim a refund can use Form ST-21.

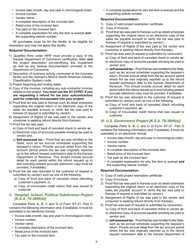

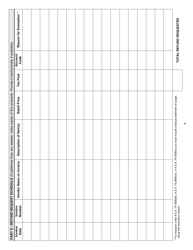

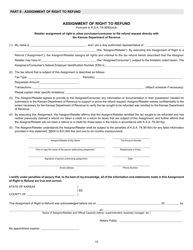

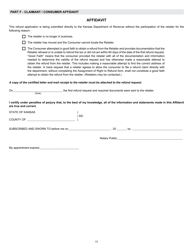

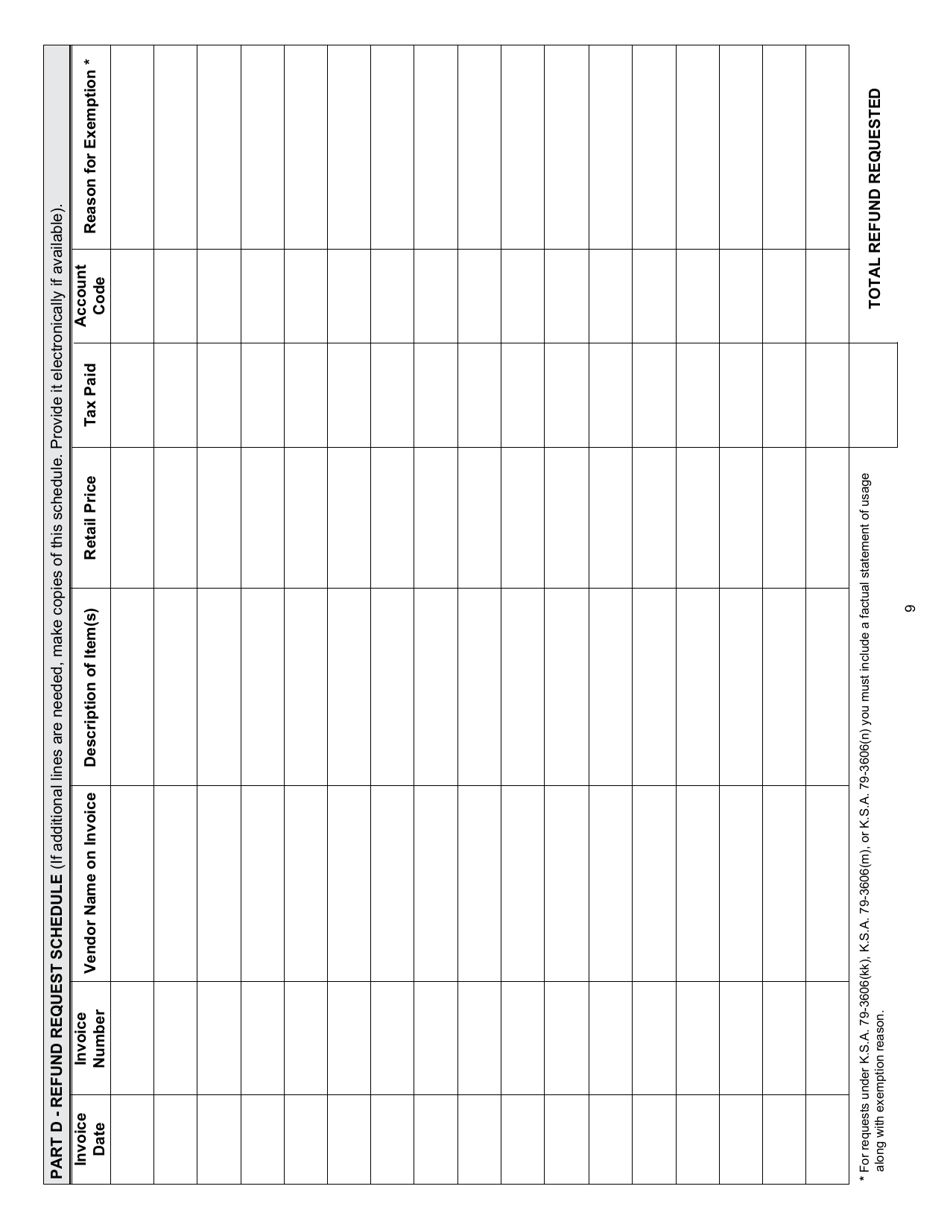

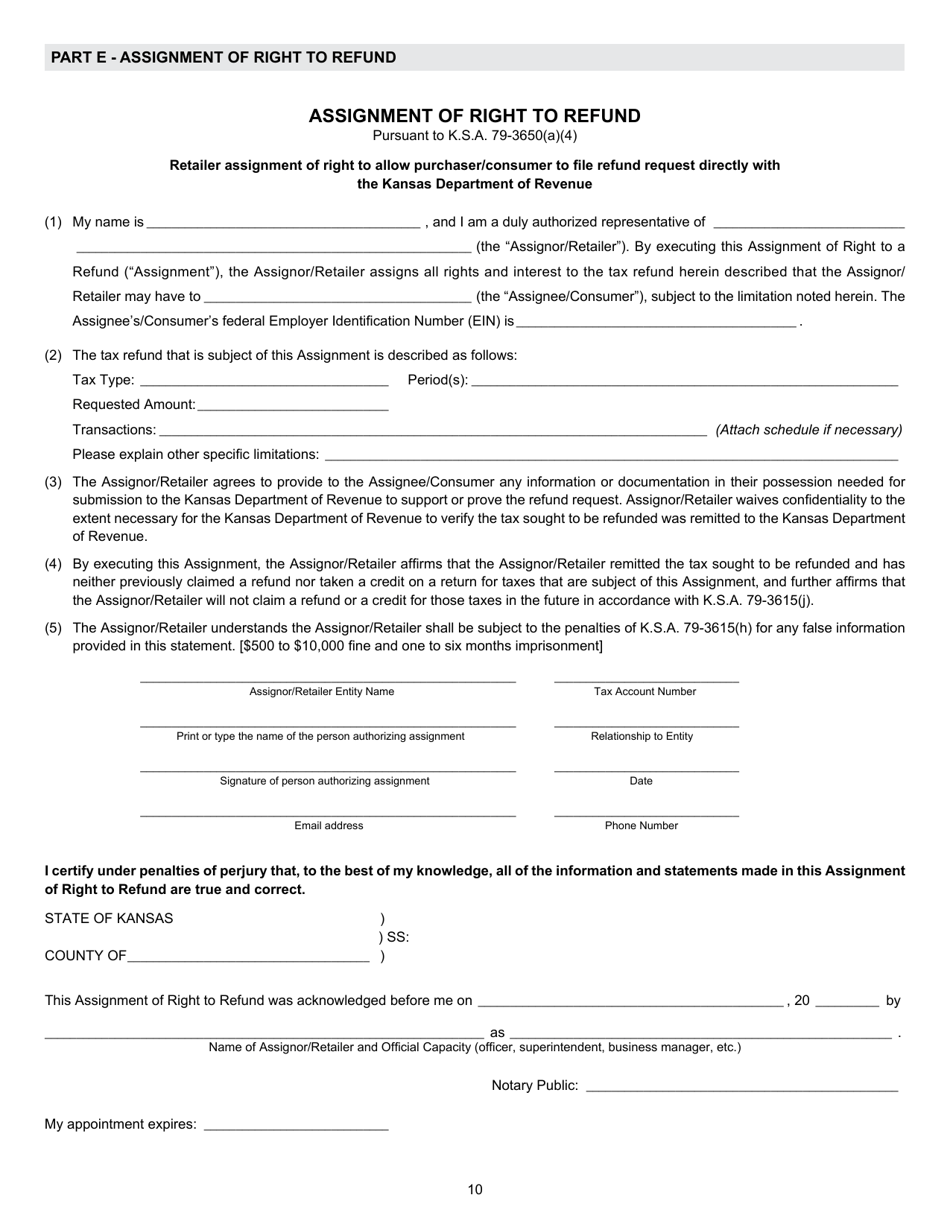

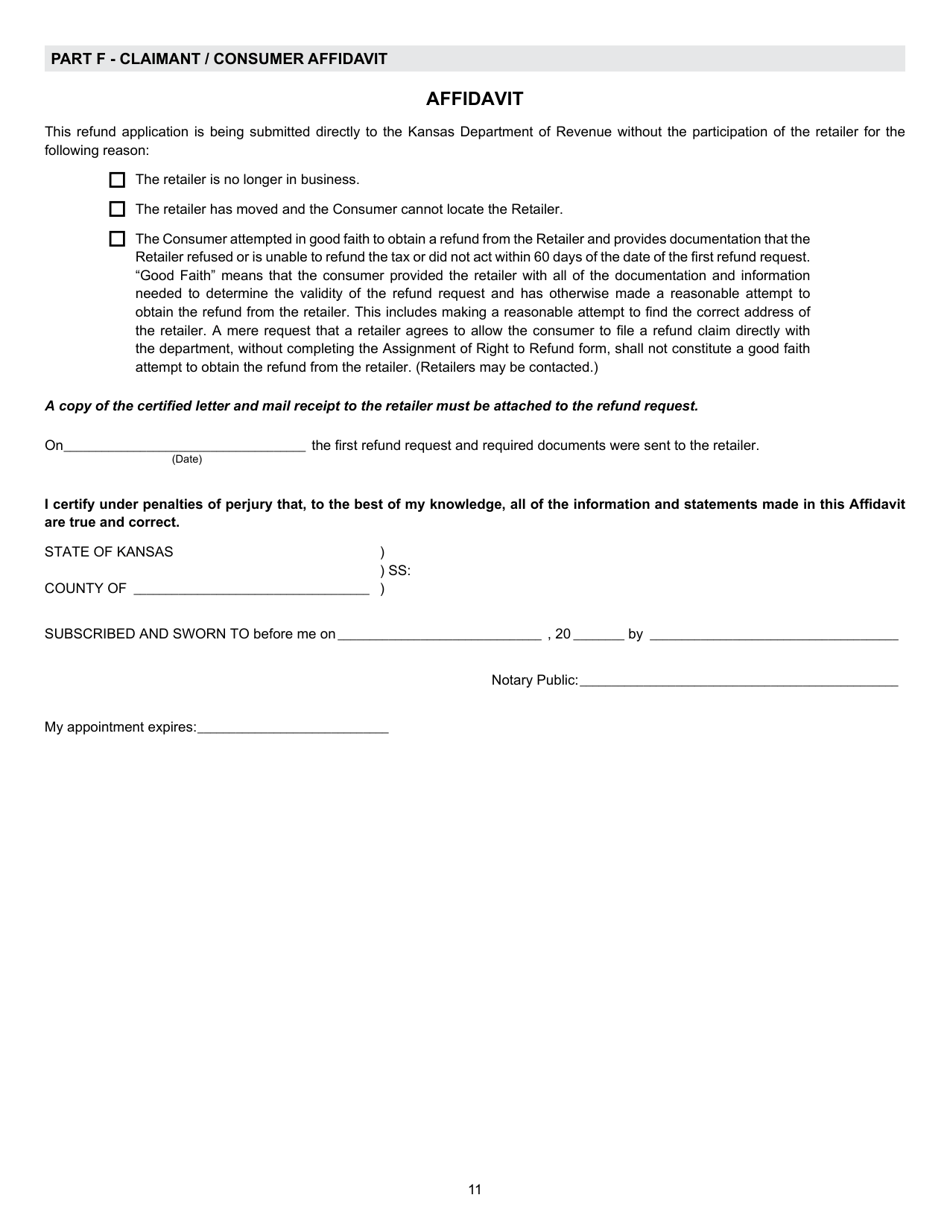

Q: What information do I need to provide on Form ST-21?

A: You need to provide information such as your name, address, tax identification number, the specific tax period you are claiming a refund for, and details about the purchases for which you are seeking a refund.

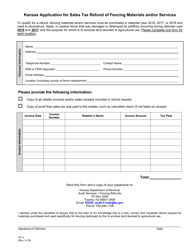

Q: Is there a deadline to file Form ST-21?

A: Yes, Form ST-21 must be filed within three years from the due date of the return or two years from the date the tax was paid, whichever is later.

Q: Are there any supporting documents required with Form ST-21?

A: Yes, you must attach copies of invoices, receipts, and other supporting documentation that proves the amount of tax paid and the validity of your claim.

Q: How long does it take to receive a refund after filing Form ST-21?

A: The processing time for refunds can vary, but typically it takes around 4-6 weeks to receive a refund after filing Form ST-21.

Q: What should I do if I have more questions about Form ST-21?

A: If you have more questions about Form ST-21 or the refund process, you can contact the Kansas Department of Revenue for assistance.

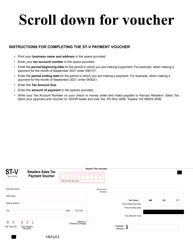

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-21 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.