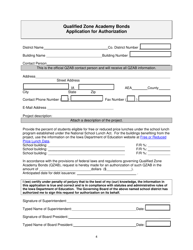

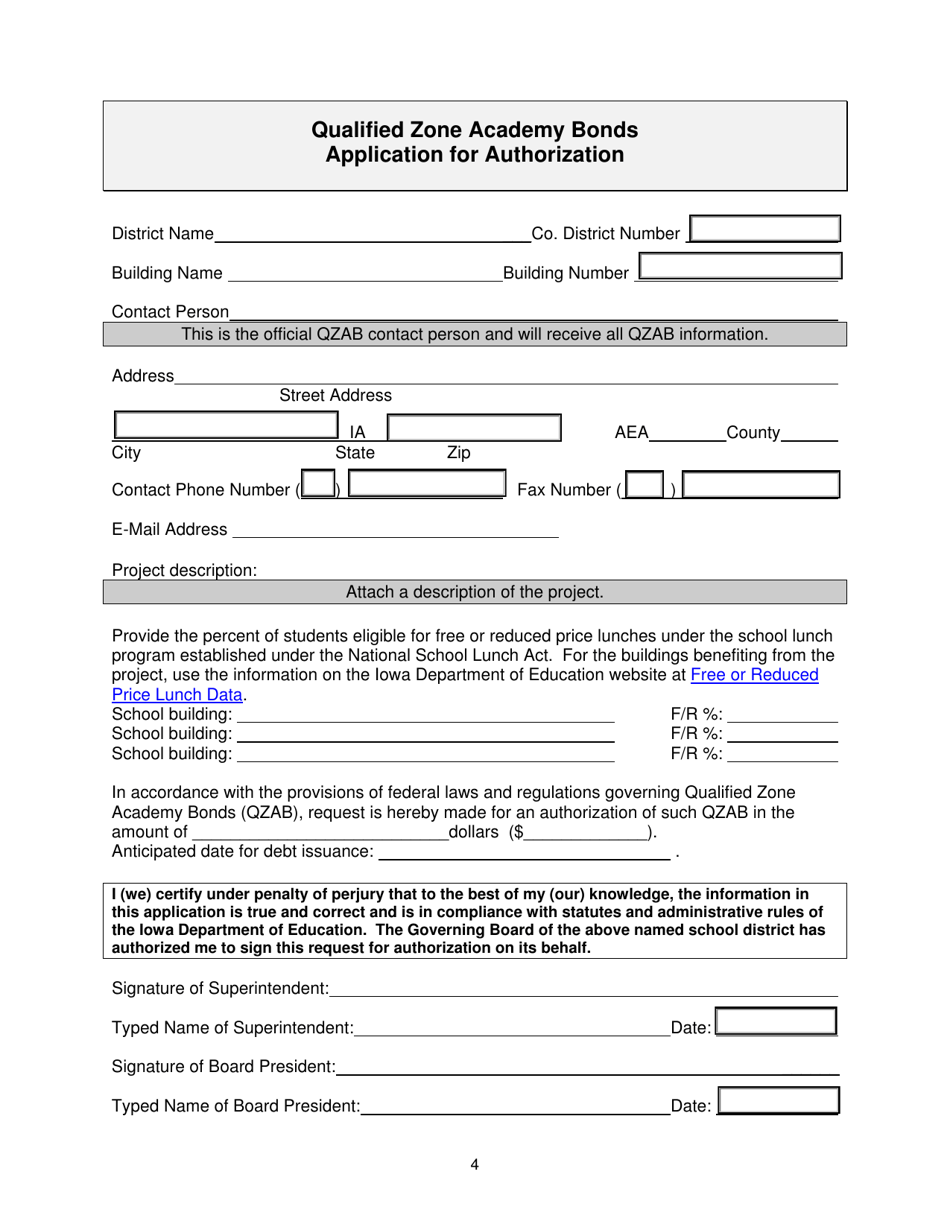

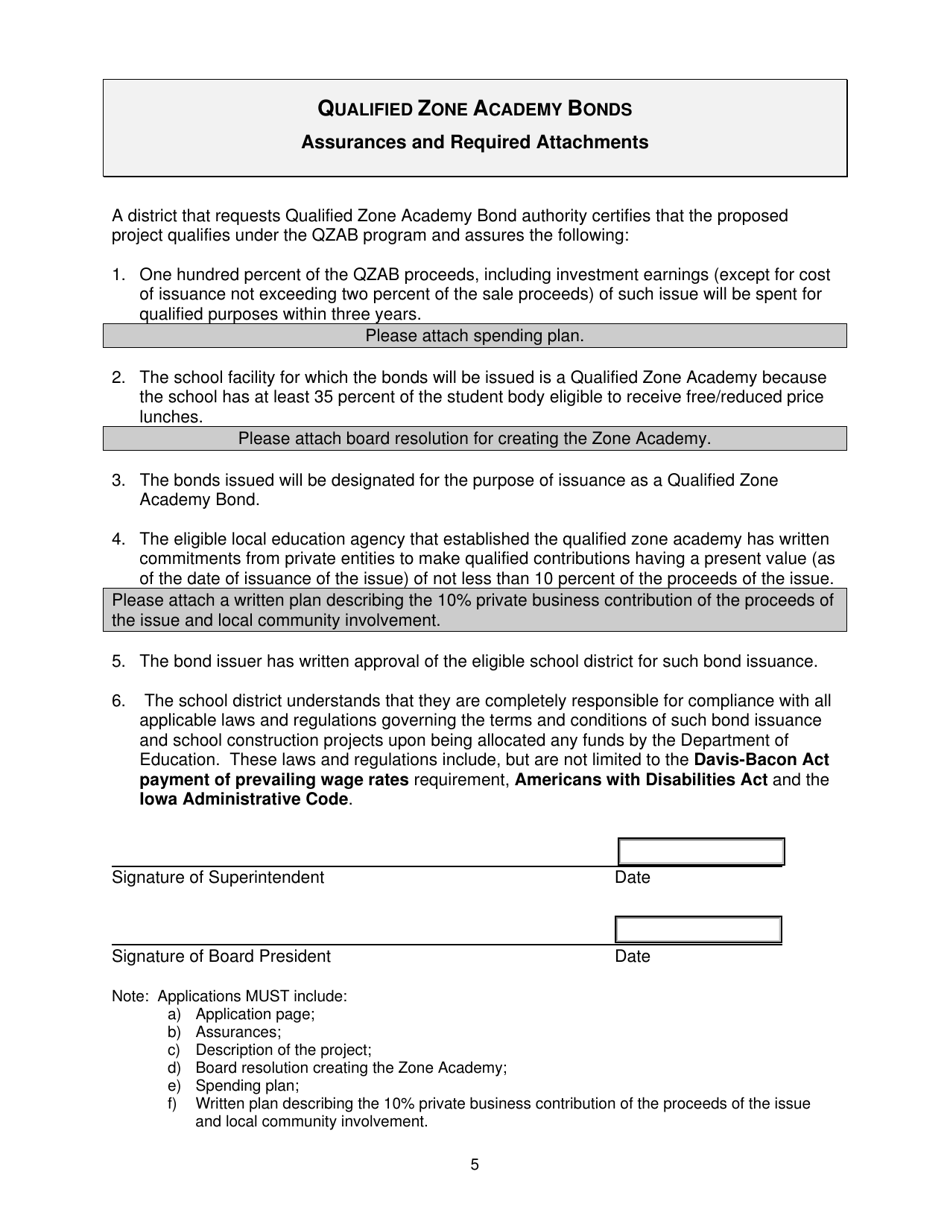

Request for Authorization to Issue Qualified Zone Academy Bonds - Iowa

Request for Authorization to Issue Qualified Zone Academy Bonds is a legal document that was released by the Iowa Department of Education - a government authority operating within Iowa.

FAQ

Q: What is a Qualified Zone Academy Bond?

A: A Qualified Zone Academy Bond (QZAB) is a type of tax-advantaged bond that can be used by qualified schools to finance various educational projects.

Q: How do qualified schools benefit from QZABs?

A: Qualified schools can use the funds raised through QZABs to improve their facilities, purchase equipment, or fund teacher training programs.

Q: Who issues the QZABs?

A: The QZABs are issued by a state or local government on behalf of a qualified school.

Q: Are QZABs subject to federal income tax?

A: No, the interest earned on QZABs is exempt from federal income tax.

Q: How are QZABs different from regular bonds?

A: QZABs have certain restrictions and requirements that must be met in order to qualify for the tax benefits, unlike regular bonds.

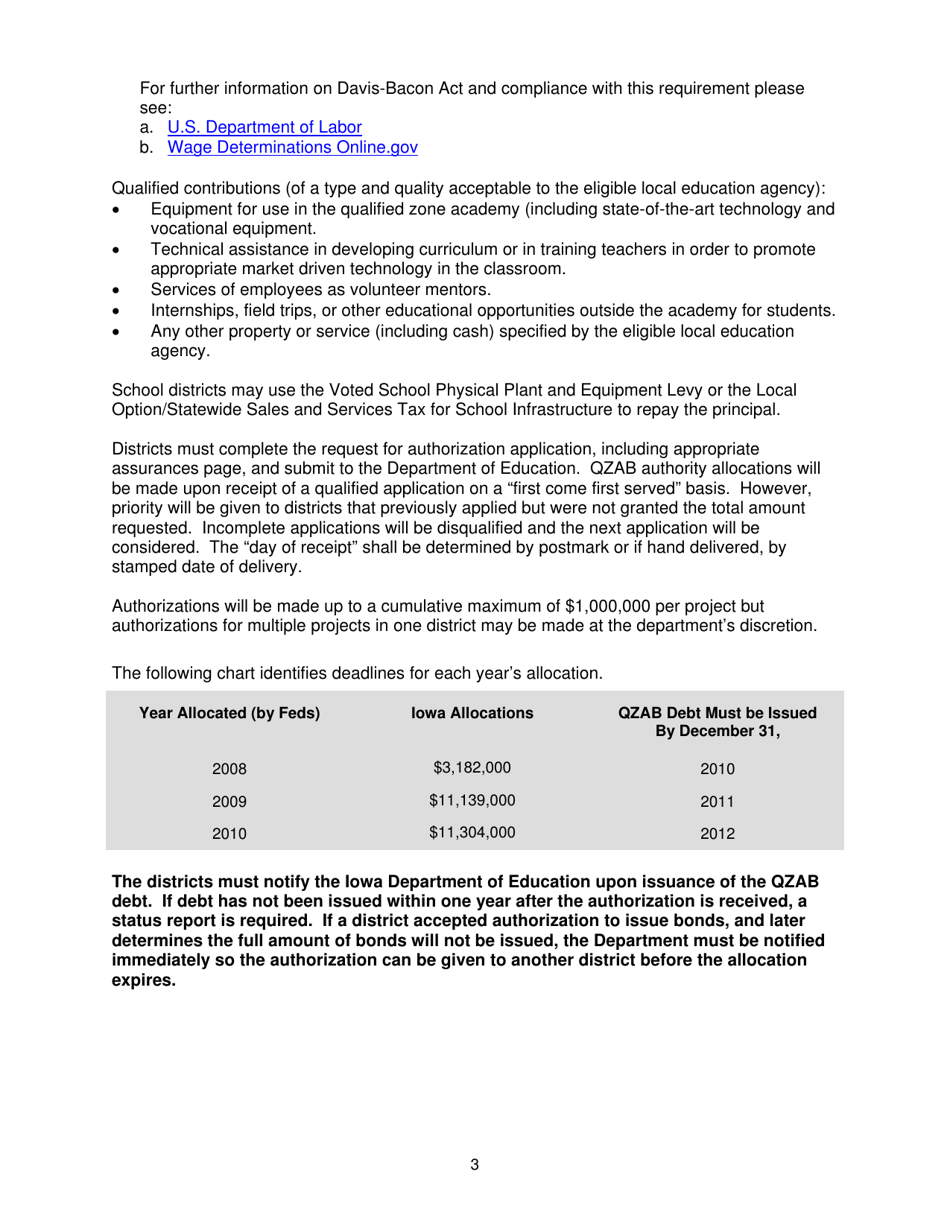

Q: What is the maximum amount of QZABs that can be issued?

A: The maximum amount of QZABs that can be issued is determined based on the number of students in the qualified school.

Q: Who can purchase QZABs?

A: QZABs can be purchased by financial institutions, corporations, or individuals who are looking for a tax-advantaged investment.

Q: What is the purpose of requiring an authorization to issue QZABs?

A: Requiring an authorization ensures that the qualified school has met all the necessary requirements and is eligible to issue QZABs.

Q: Is Iowa participating in the QZAB program?

A: Yes, Iowa is participating in the QZAB program and qualified schools in Iowa can apply for authorization to issue QZABs.

Form Details:

- The latest edition currently provided by the Iowa Department of Education;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Iowa Department of Education.