This version of the form is not currently in use and is provided for reference only. Download this version of

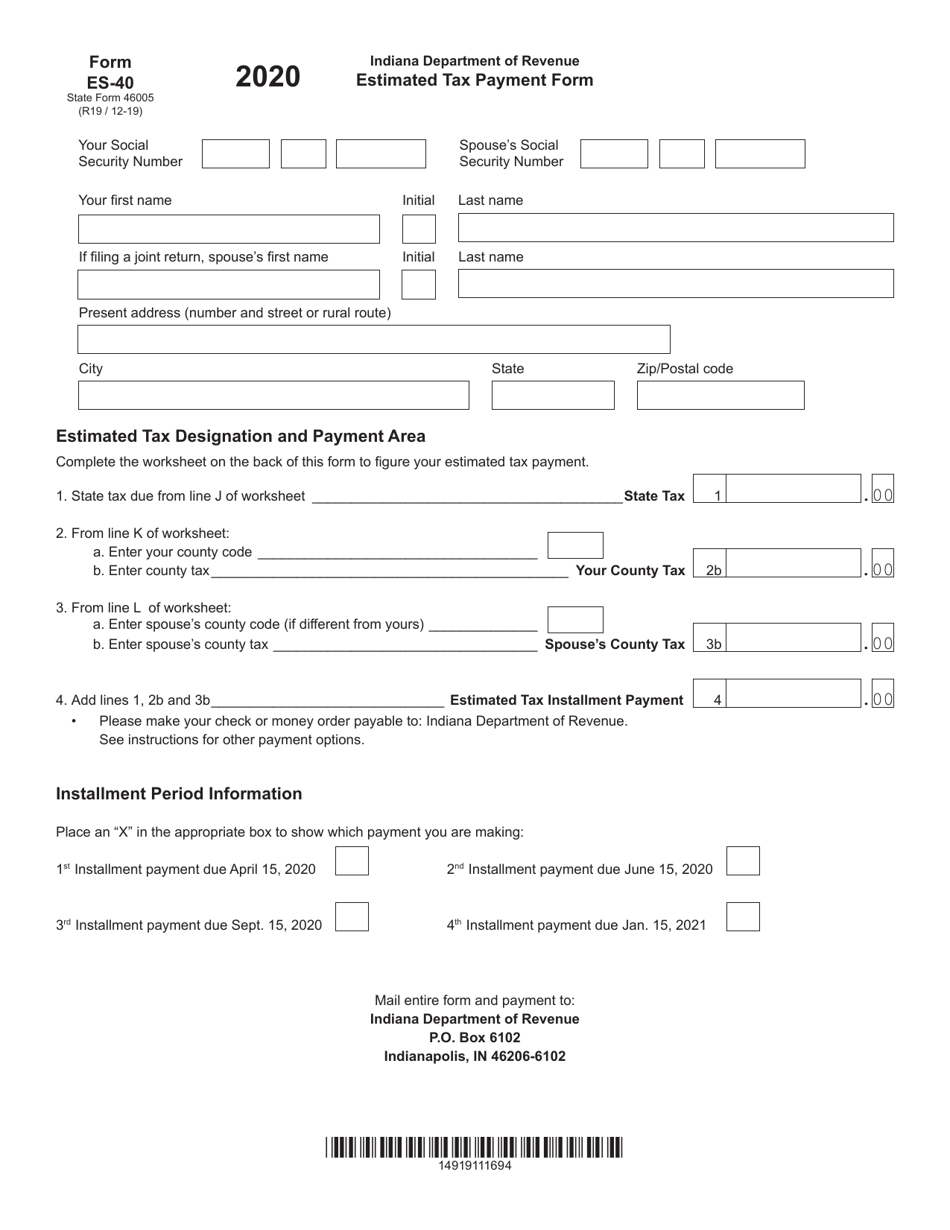

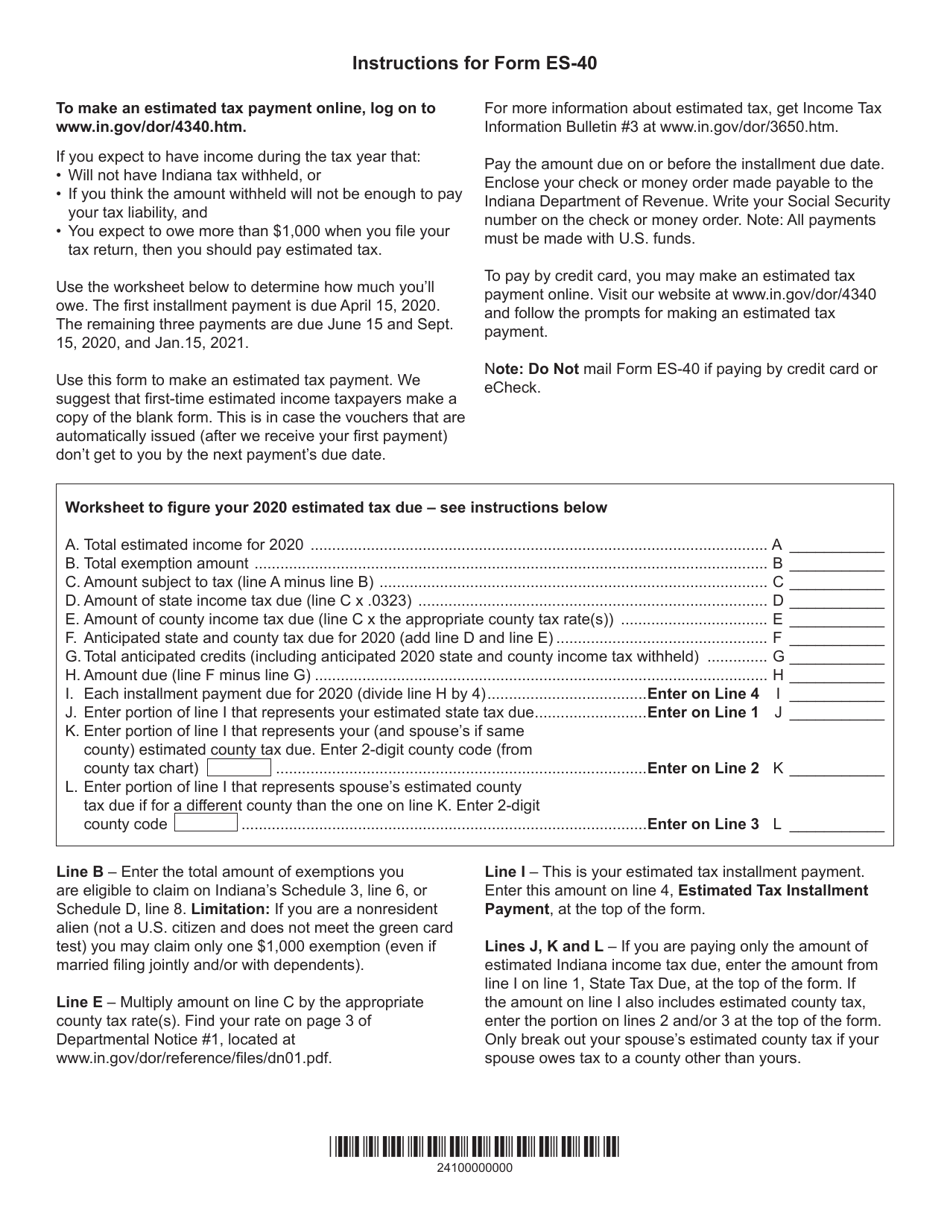

Form ES-40 (State Form 46005)

for the current year.

Form ES-40 (State Form 46005) Estimated Tax Payment Form - Indiana

What Is Form ES-40 (State Form 46005)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ES-40?

A: Form ES-40 is the Estimated Tax Payment Form for Indiana.

Q: What is the purpose of Form ES-40?

A: The purpose of Form ES-40 is to make estimated tax payments to the state of Indiana.

Q: Who needs to use Form ES-40?

A: Individuals or businesses who expect to owe at least $1,000 in tax for the current year must use Form ES-40.

Q: How often do I need to file Form ES-40?

A: Form ES-40 must be filed quarterly, on April 15, June 15, September 15, and January 15 of the following year.

Q: How do I file Form ES-40?

A: Form ES-40 can be filed electronically or by mail. The instructions on the form provide details on how to file.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ES-40 (State Form 46005) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.