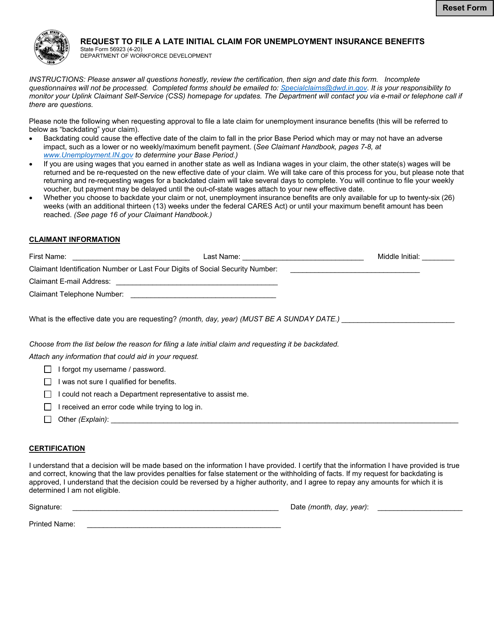

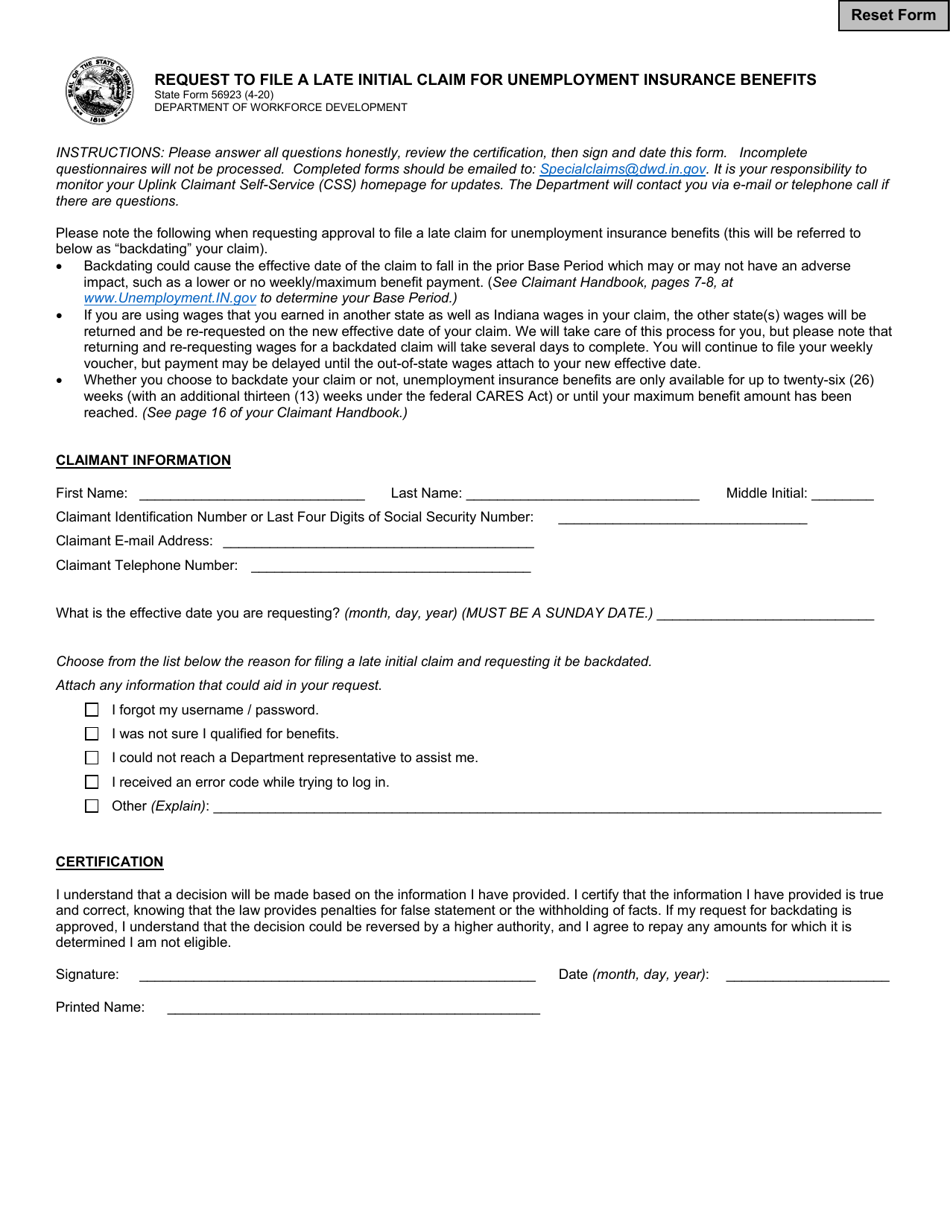

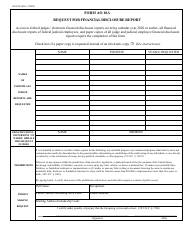

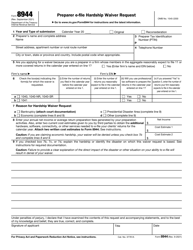

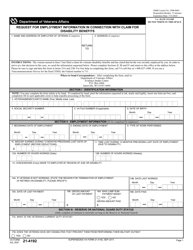

State Form 56923 Request to File a Late Initial Claim for Unemployment Insurance Benefits - Indiana

What Is State Form 56923?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

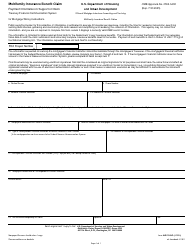

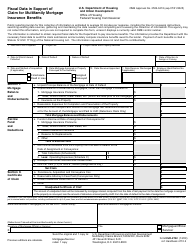

Q: What is Form 56923?

A: Form 56923 is the request form to file a late initial claim for unemployment insurance benefits in Indiana.

Q: How do I use Form 56923?

A: You should use Form 56923 if you missed the deadline to file your initial claim for unemployment insurance benefits in Indiana.

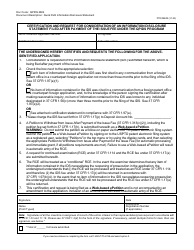

Q: Can I file a late initial claim for unemployment insurance benefits in Indiana?

A: Yes, you can file a late initial claim by submitting Form 56923 and explaining the reasons for filing late.

Q: What should I include with Form 56923?

A: Along with Form 56923, you should include any supporting documents or evidence that explain why you are filing your initial claim late.

Q: What happens after I submit Form 56923?

A: After you submit Form 56923, the Indiana Department of Workforce Development will review your request and determine if you are eligible to file a late initial claim for unemployment insurance benefits.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 56923 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.