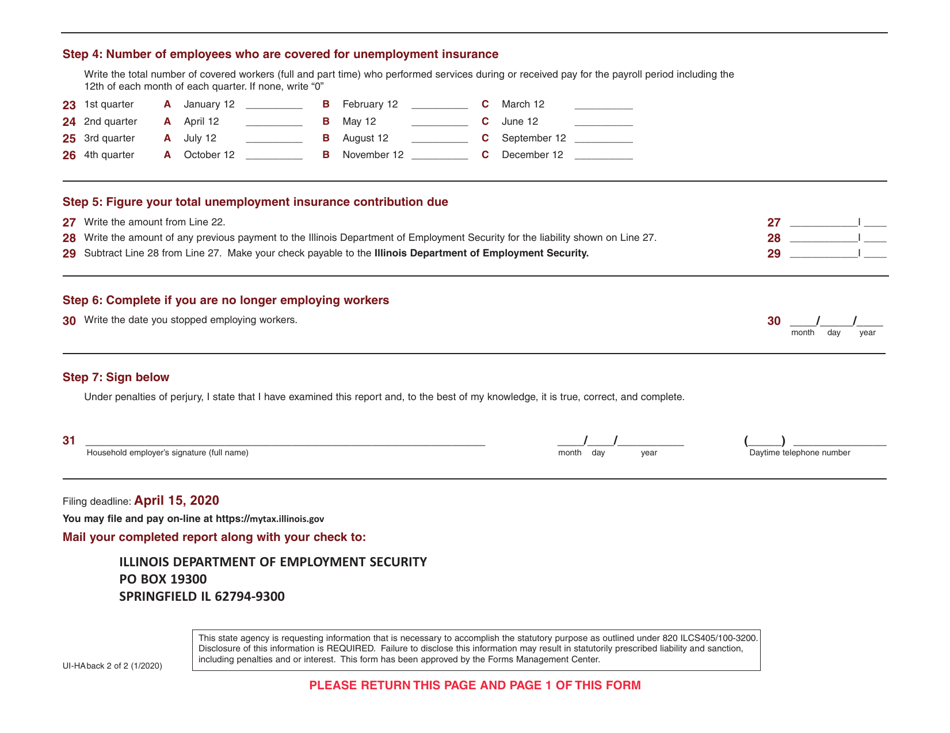

This version of the form is not currently in use and is provided for reference only. Download this version of

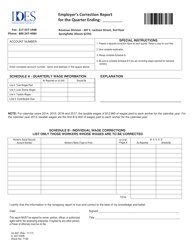

Form UI-HA

for the current year.

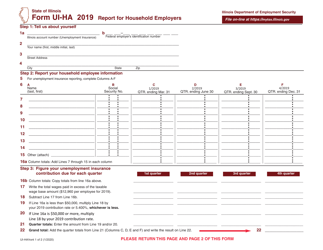

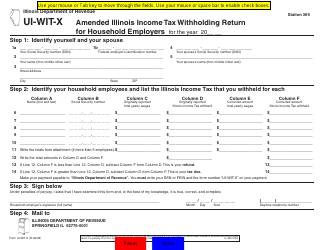

Form UI-HA Report for Household Employers - Illinois

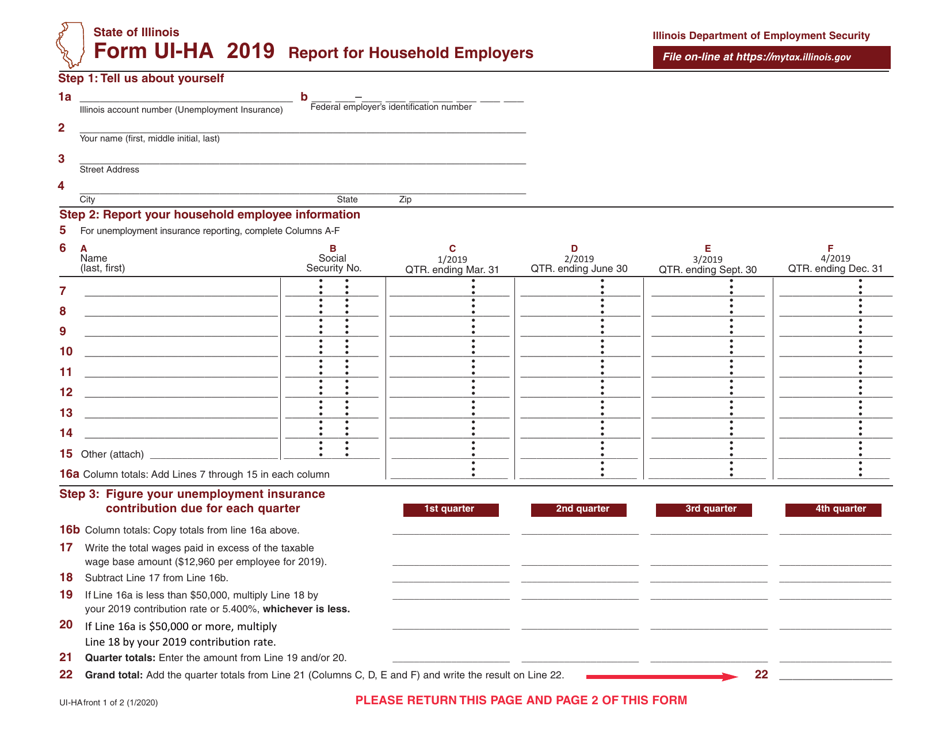

What Is Form UI-HA?

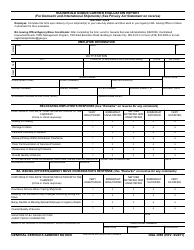

This is a legal form that was released by the Illinois Department of Employment Security - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

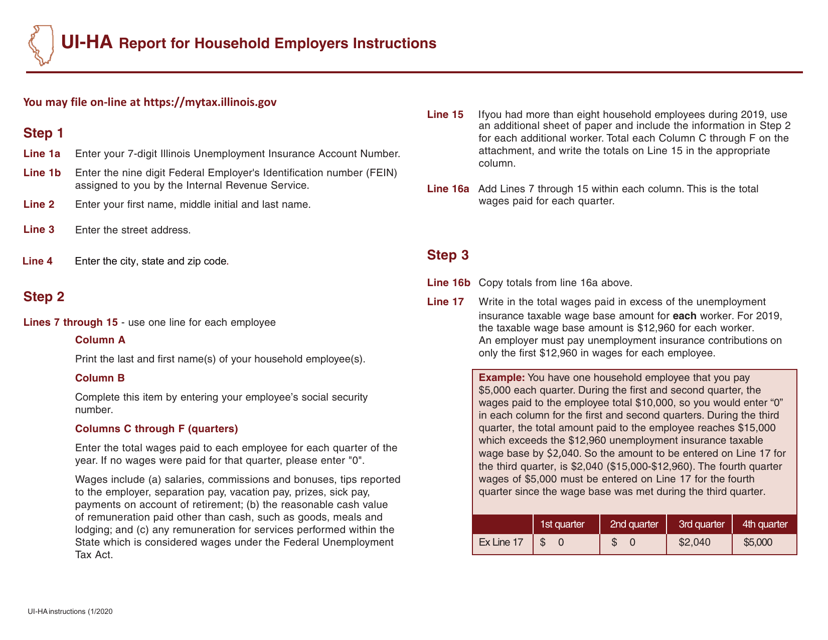

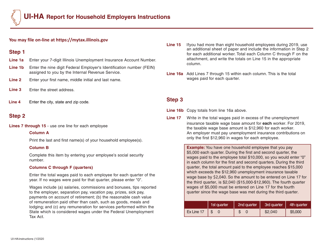

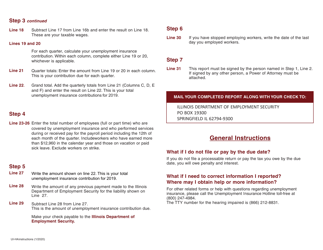

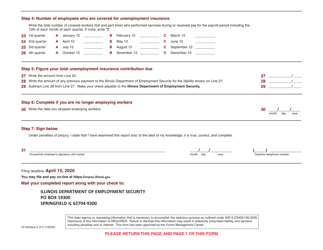

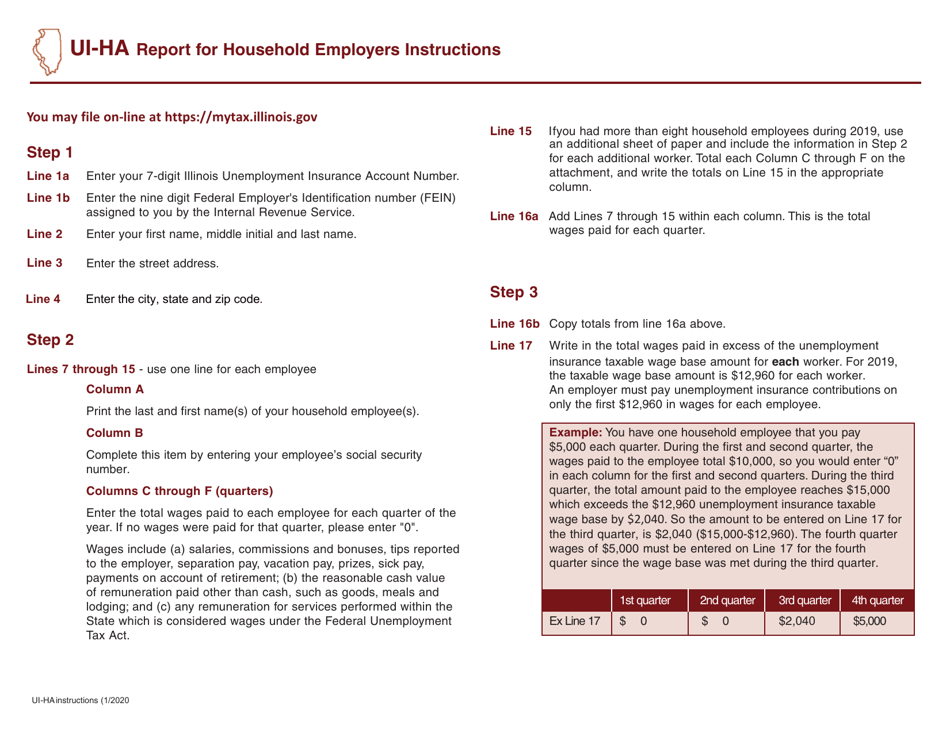

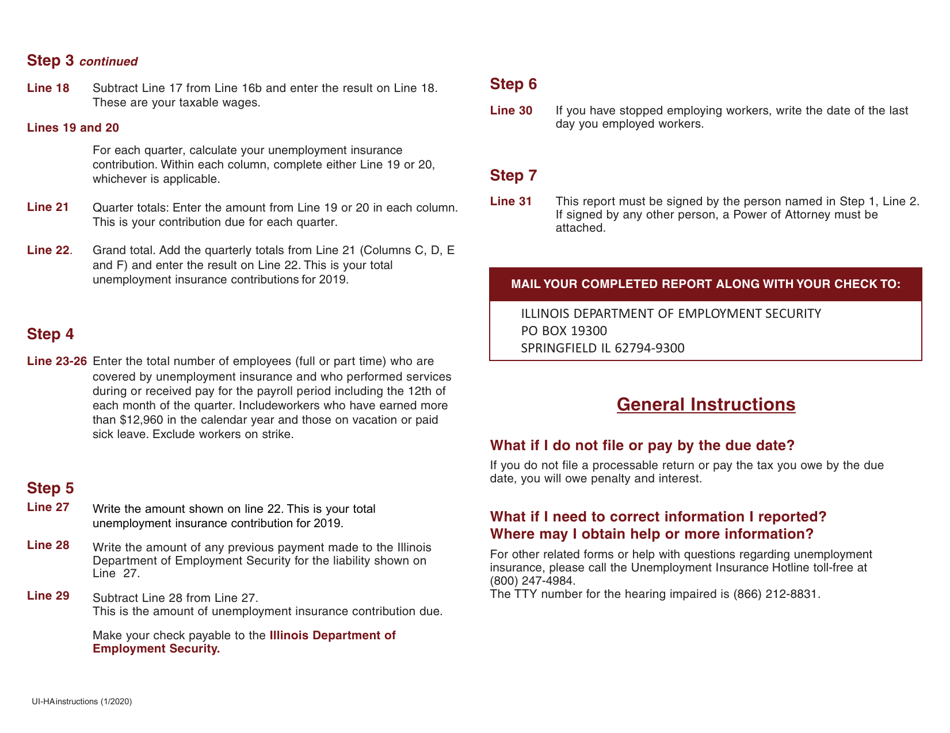

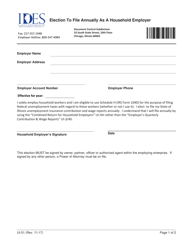

Q: What is a UI-HA Report?

A: The UI-HA Report is a form used by household employers in Illinois to report wages and pay unemployment insurance taxes.

Q: Who needs to file a UI-HA Report?

A: Household employers in Illinois who pay at least $1,000 in gross wages in a calendar quarter must file a UI-HA Report.

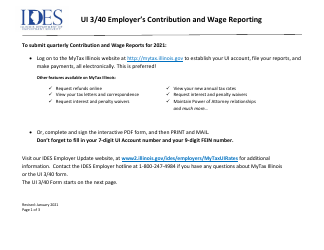

Q: How often do I need to file a UI-HA Report?

A: UI-HA Reports must be filed quarterly, by the last day of the month following the end of the calendar quarter.

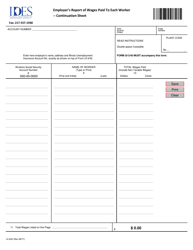

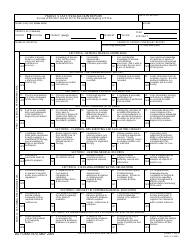

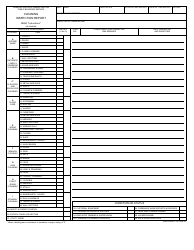

Q: What information is required on the UI-HA Report?

A: The UI-HA Report requires information about the household employer, the employee(s), wages paid, and unemployment insurance taxes owed.

Q: What happens if I don't file a UI-HA Report?

A: Failure to file a UI-HA Report may result in penalties and interest charges.

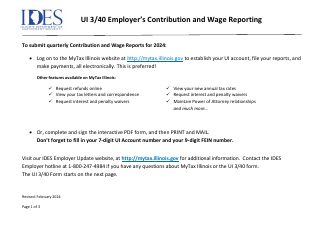

Q: Are there any exemptions from filing the UI-HA Report?

A: Some household employers may be exempt from filing the UI-HA Report, such as those who only employ immediate family members.

Q: What should I do if I have a question or need assistance with the UI-HA Report?

A: If you have any questions or need assistance with the UI-HA Report, you can contact the Illinois Department of Employment Security (IDES) for guidance.

Form Details:

- Released on January 1, 2020;

- The latest edition provided by the Illinois Department of Employment Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UI-HA by clicking the link below or browse more documents and templates provided by the Illinois Department of Employment Security.