This version of the form is not currently in use and is provided for reference only. Download this version of

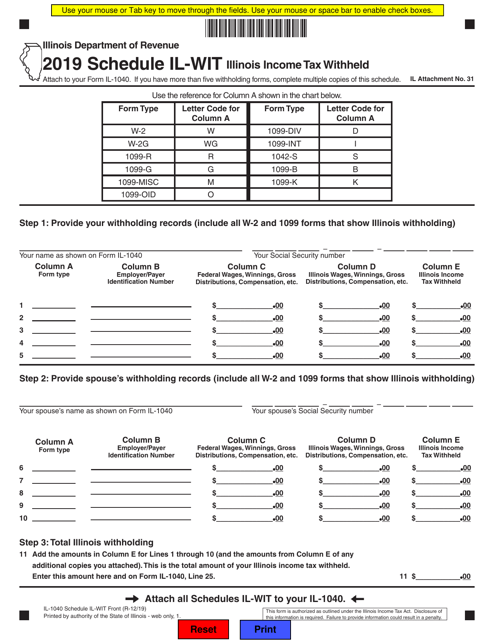

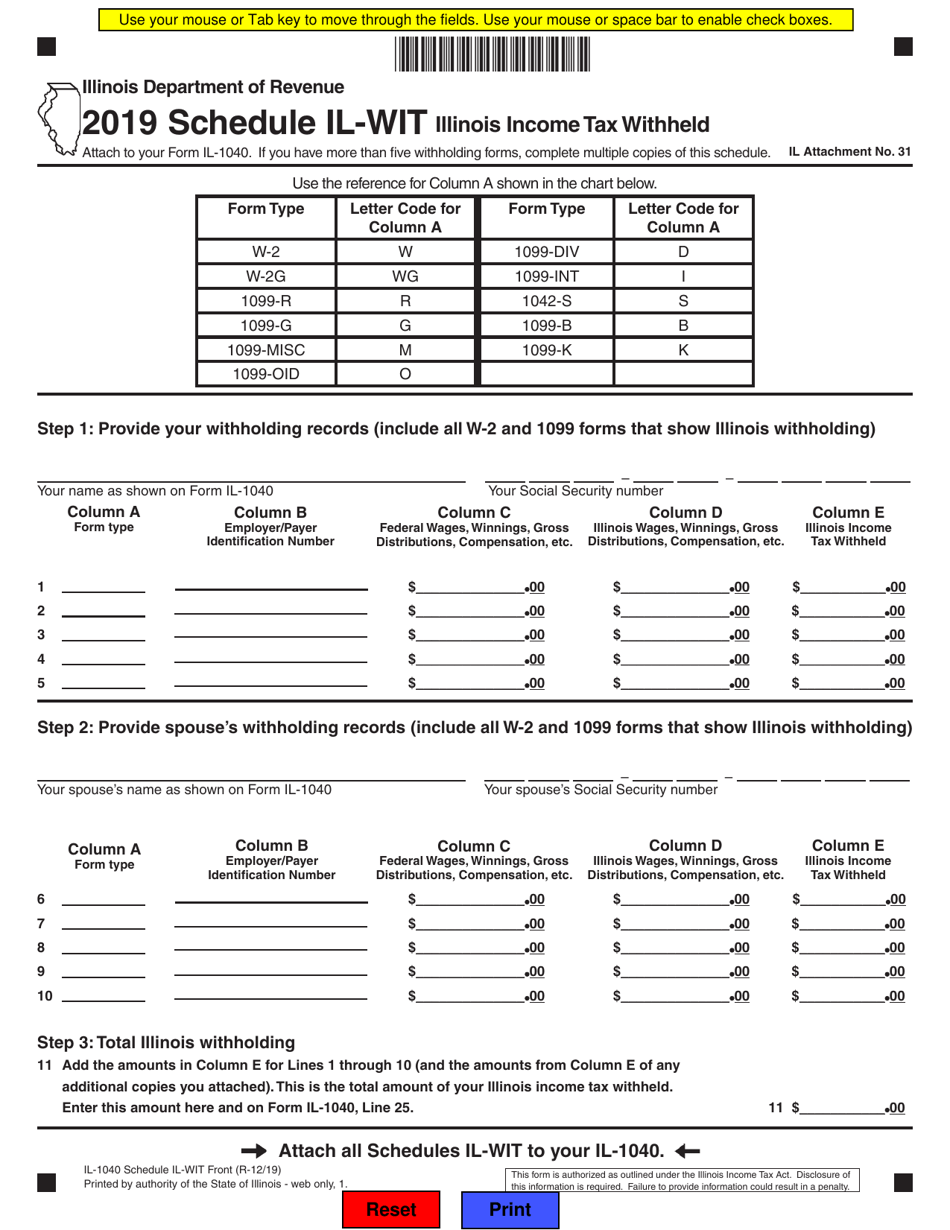

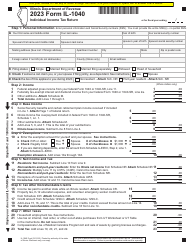

Form IL-1040 Schedule IL-WIT

for the current year.

Form IL-1040 Schedule IL-WIT Illinois Income Tax Withheld - Illinois

What Is Form IL-1040 Schedule IL-WIT?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois.The document is a supplement to Form IL-1040, Individual Income Tax Return. Check the official instructions before completing and submitting the form.

FAQ

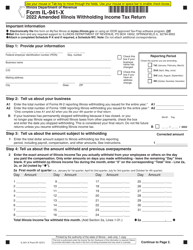

Q: What is Form IL-1040 Schedule IL-WIT?

A: Form IL-1040 Schedule IL-WIT is a form used to report Illinois income tax withheld.

Q: Who should use Form IL-1040 Schedule IL-WIT?

A: Anyone who had Illinois income tax withheld during the tax year should use Form IL-1040 Schedule IL-WIT.

Q: How do I complete Form IL-1040 Schedule IL-WIT?

A: You will need to gather your withholding statements, calculate the total amount of Illinois income tax withheld, and enter the information on the form.

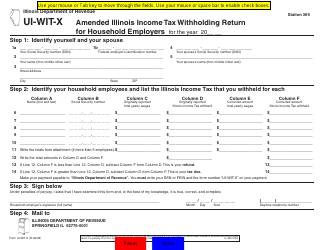

Q: When is the deadline to file Form IL-1040 Schedule IL-WIT?

A: Form IL-1040 Schedule IL-WIT must be filed by the same deadline as your Illinois income tax return, typically April 15th.

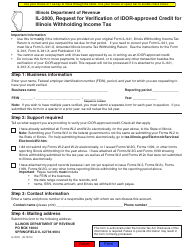

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040 Schedule IL-WIT by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.