This version of the form is not currently in use and is provided for reference only. Download this version of

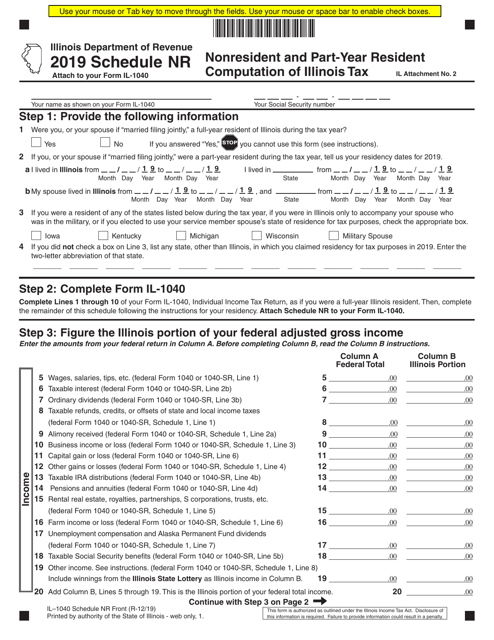

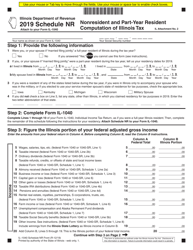

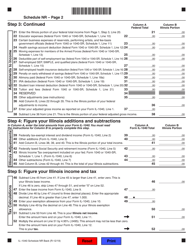

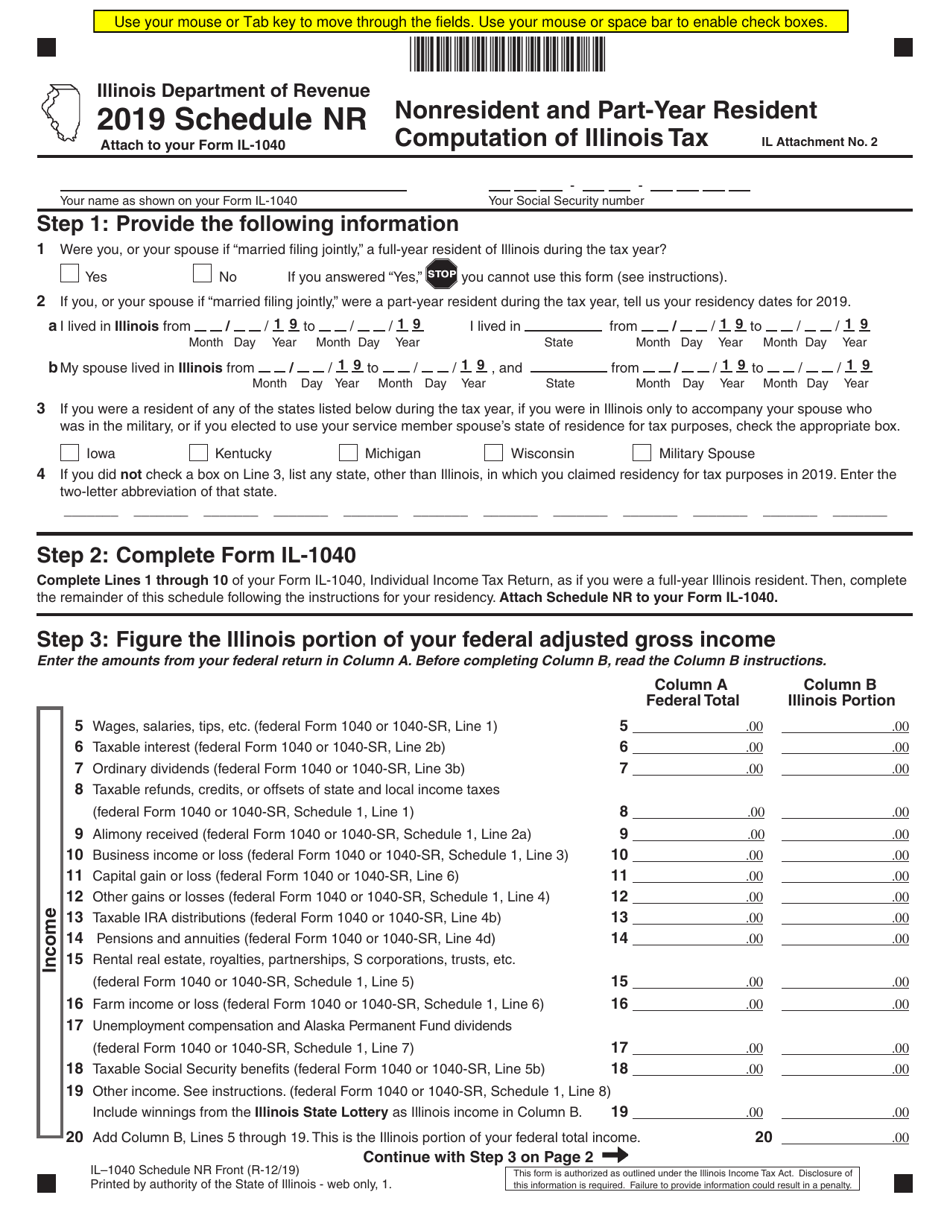

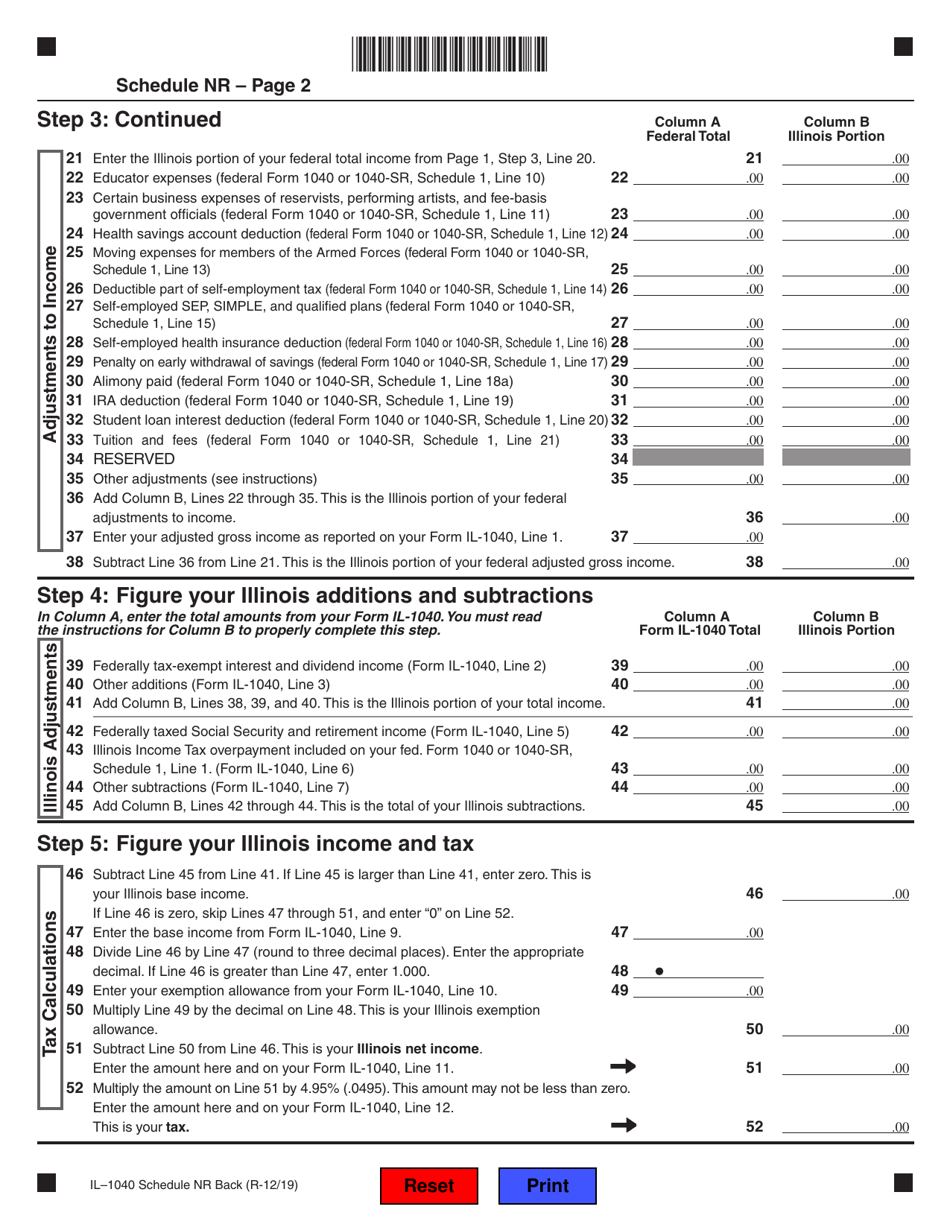

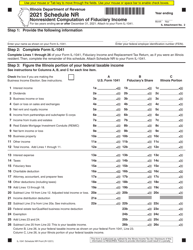

Form IL-1040 Schedule NR

for the current year.

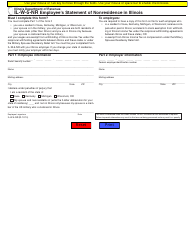

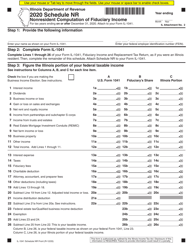

Form IL-1040 Schedule NR Nonresident and Part-Year Resident Computation of Illinois Tax - Illinois

What Is Form IL-1040 Schedule NR?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

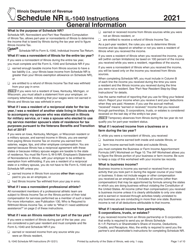

Q: What is Form IL-1040 Schedule NR?

A: Form IL-1040 Schedule NR is a tax form used to calculate the Illinois tax liability for nonresidents and part-year residents.

Q: Who needs to fill out Form IL-1040 Schedule NR?

A: Nonresidents and part-year residents of Illinois need to fill out Form IL-1040 Schedule NR if they have income from Illinois sources.

Q: What is the purpose of Form IL-1040 Schedule NR?

A: The purpose of Form IL-1040 Schedule NR is to determine the amount of Illinois tax owed by nonresidents and part-year residents based on their income from Illinois sources.

Q: What information is required to fill out Form IL-1040 Schedule NR?

A: To fill out Form IL-1040 Schedule NR, you will need information such as your income from Illinois sources, deductions, and credits.

Q: When is the deadline to file Form IL-1040 Schedule NR?

A: The deadline to file Form IL-1040 Schedule NR is the same as the deadline for filing your Illinois income tax return, which is usually April 15th.

Q: What happens if I don't file Form IL-1040 Schedule NR?

A: If you are required to file Form IL-1040 Schedule NR and fail to do so, you may be subject to penalties and interest on any unpaid tax liability.

Q: Can I e-file Form IL-1040 Schedule NR?

A: Yes, you can e-file Form IL-1040 Schedule NR using an electronic filing service or software approved by the Illinois Department of Revenue.

Q: Do I need to file Form IL-1040 Schedule NR if I have no income from Illinois sources?

A: No, if you have no income from Illinois sources, you do not need to file Form IL-1040 Schedule NR.

Q: Can I file Form IL-1040 Schedule NR if I am a full-time resident of Illinois?

A: No, Form IL-1040 Schedule NR is only for nonresidents and part-year residents of Illinois. If you are a full-time resident, you should file Form IL-1040 instead.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040 Schedule NR by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.