This version of the form is not currently in use and is provided for reference only. Download this version of

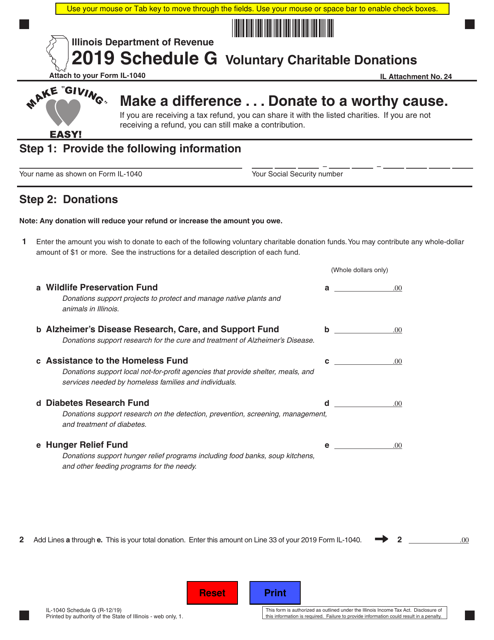

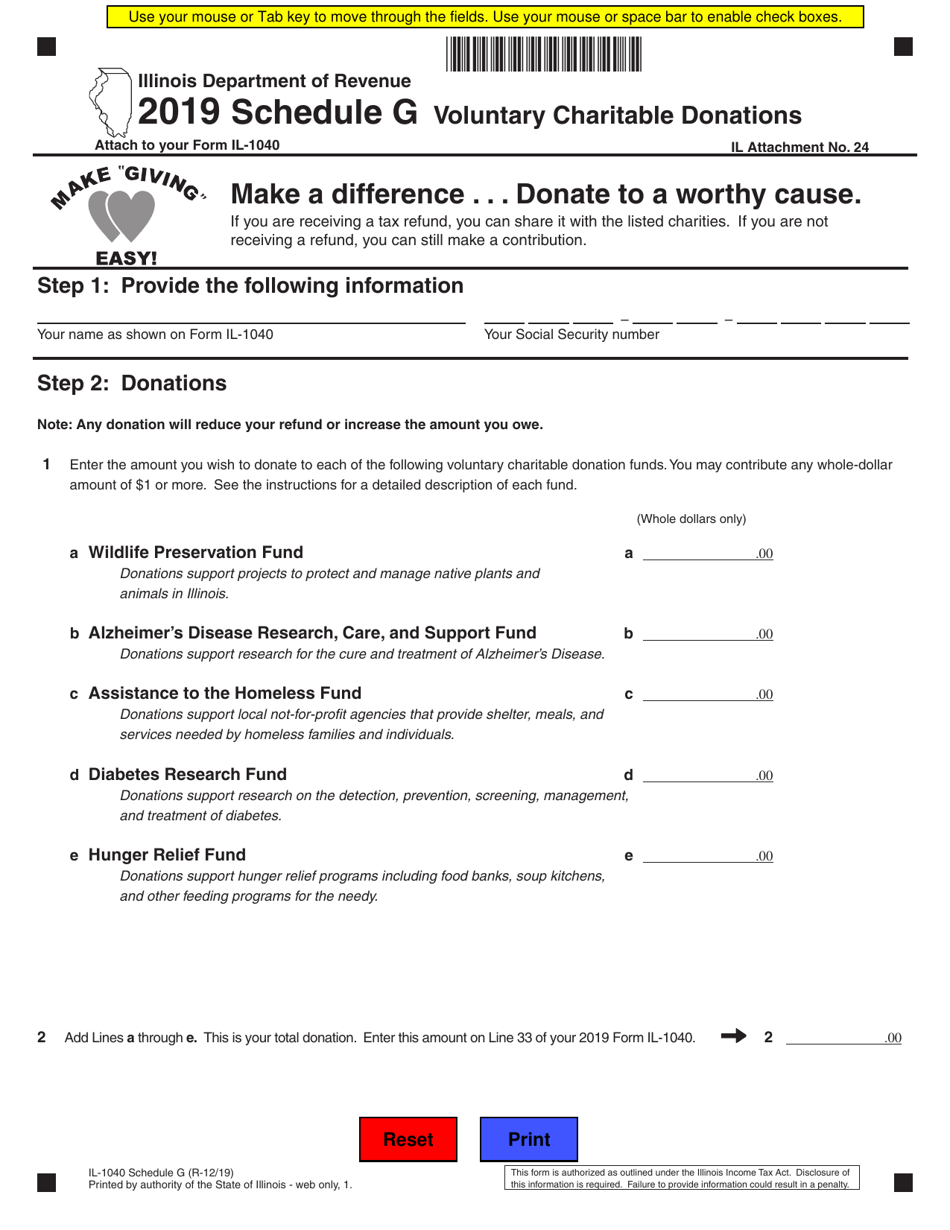

Form IL-1040 Schedule G

for the current year.

Form IL-1040 Schedule G Voluntary Charitable Donations - Illinois

What Is Form IL-1040 Schedule G?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois.The document is a supplement to Form IL-1040, Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-1040 Schedule G?

A: Form IL-1040 Schedule G is a schedule that allows taxpayers in Illinois to report voluntary charitable donations they have made.

Q: What are voluntary charitable donations?

A: Voluntary charitable donations are donations made by taxpayers to qualified charitable organizations that are not mandatory.

Q: Who needs to file Form IL-1040 Schedule G?

A: Taxpayers in Illinois who have made voluntary charitable donations can file Form IL-1040 Schedule G.

Q: What is the purpose of filing Form IL-1040 Schedule G?

A: The purpose of filing Form IL-1040 Schedule G is to report and claim deductions for the voluntary charitable donations made.

Q: How do I fill out Form IL-1040 Schedule G?

A: You need to provide details of the charitable organizations you donated to and the amount of each donation on Form IL-1040 Schedule G.

Q: Are there any restrictions on the organizations for which I can claim deductions?

A: Yes, the organizations must be qualified charitable organizations as recognized by the IRS.

Q: When should I file Form IL-1040 Schedule G?

A: Form IL-1040 Schedule G should be filed along with the taxpayer's Illinois income tax return.

Q: Can I claim deductions for charitable donations on my federal tax return as well?

A: Yes, you can claim deductions for charitable donations on both your federal and state tax returns.

Q: Do I need to attach any supporting documents with Form IL-1040 Schedule G?

A: No, you do not need to attach any supporting documents with Form IL-1040 Schedule G, but you should keep them for your records in case of an audit.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040 Schedule G by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.