This version of the form is not currently in use and is provided for reference only. Download this version of

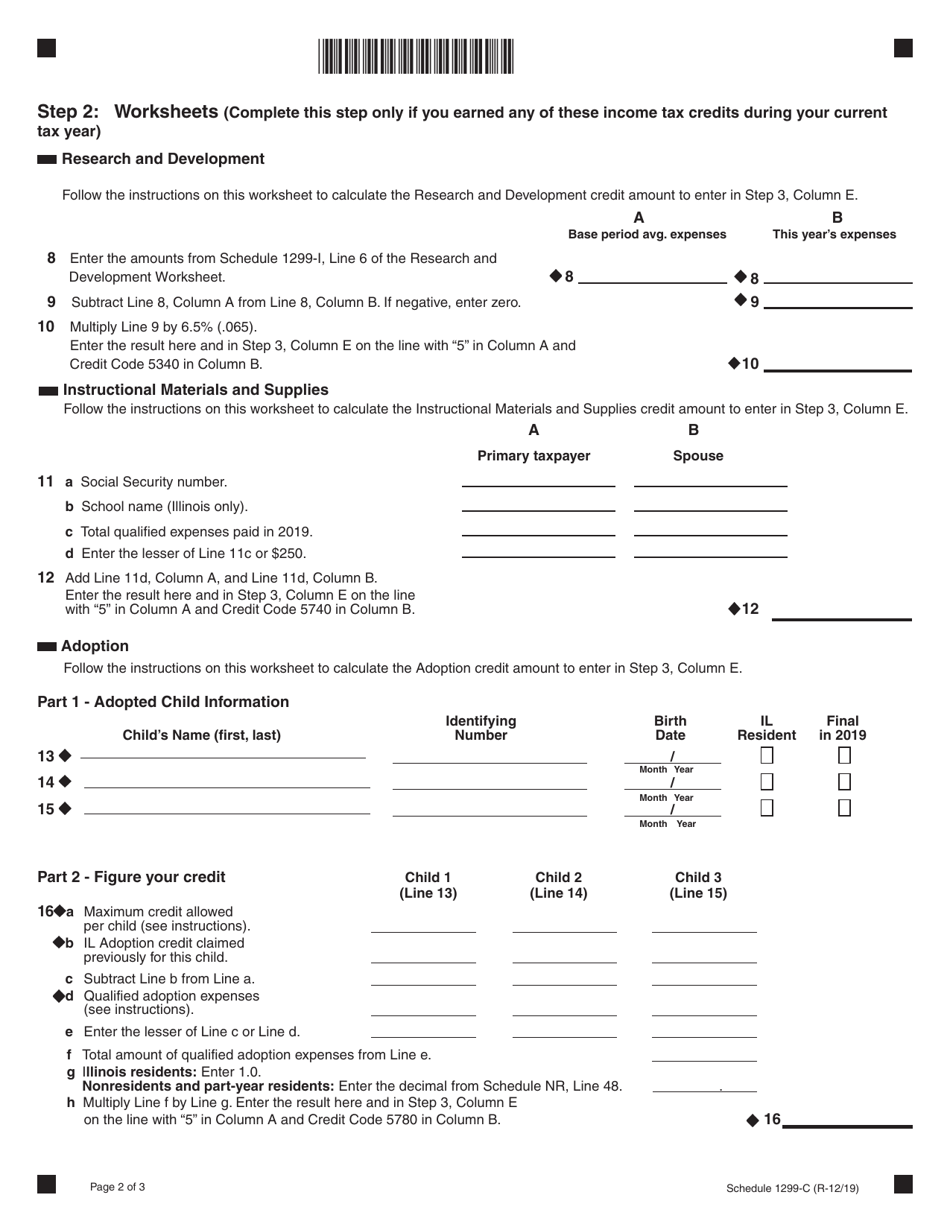

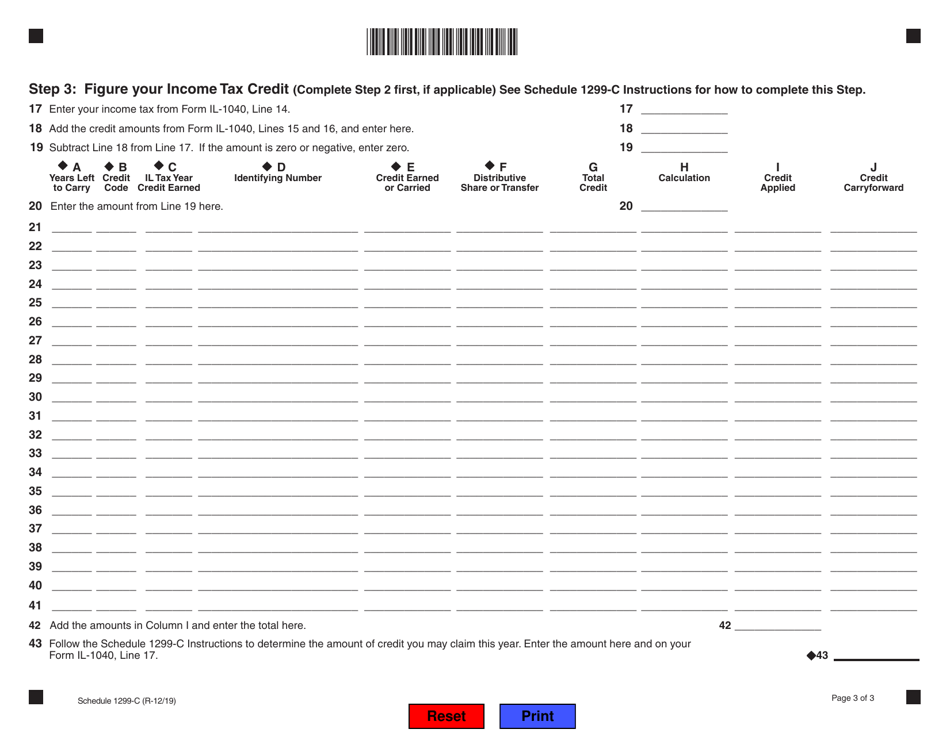

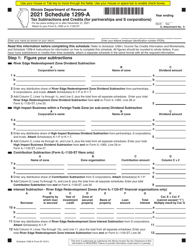

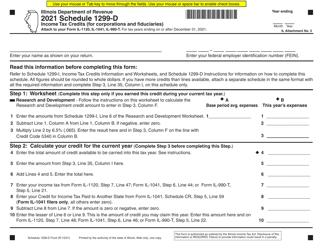

Schedule 1299-C

for the current year.

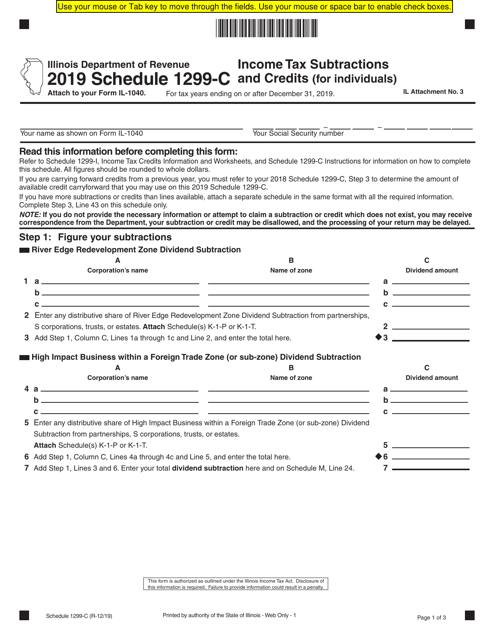

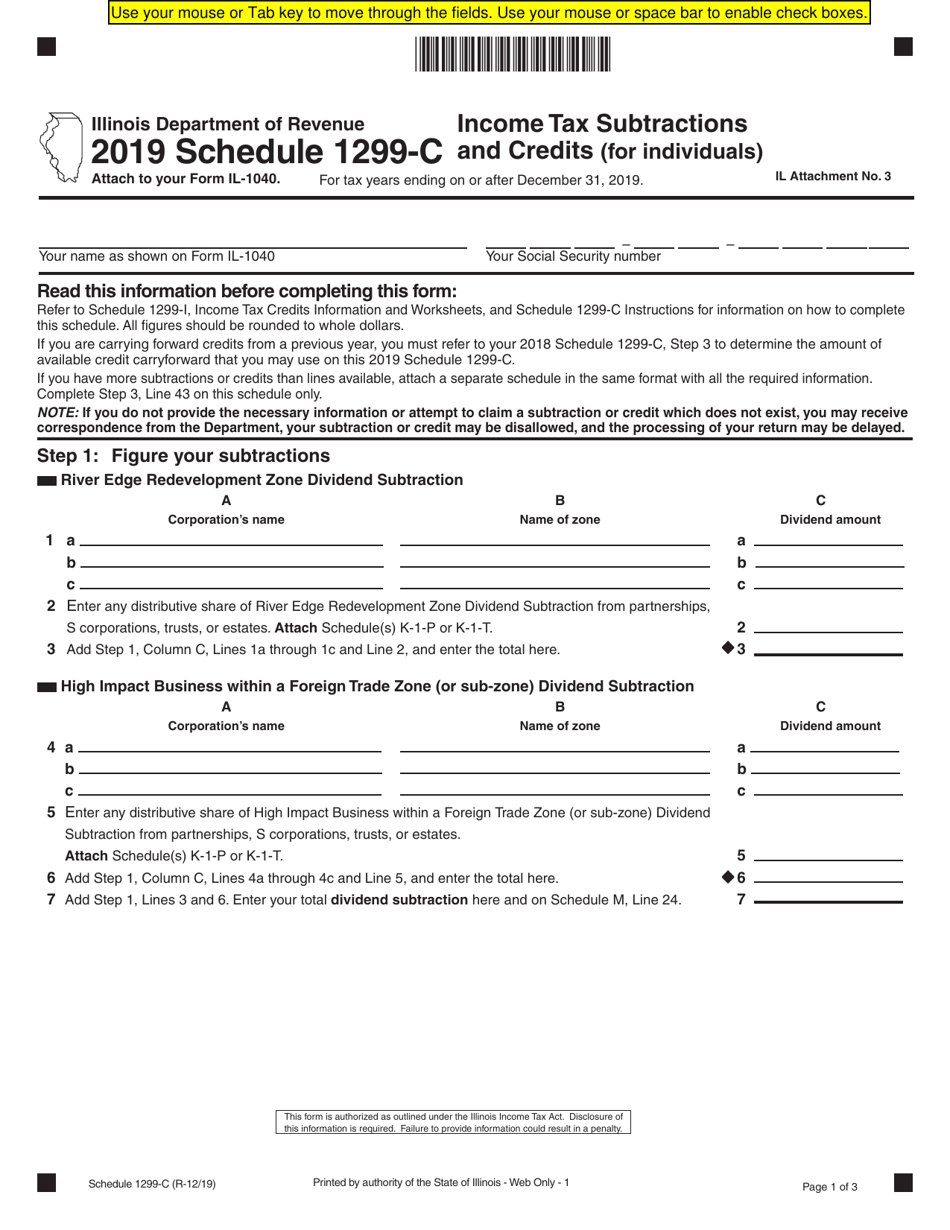

Schedule 1299-C Income Tax Subtractions and Credits (For Individuals) - Illinois

What Is Schedule 1299-C?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 1299-C?

A: Schedule 1299-C is a form used for reporting income tax subtractions and credits for individuals in Illinois.

Q: Who needs to file Schedule 1299-C?

A: Individuals who are residents of Illinois and have eligible income tax subtractions or credits need to file Schedule 1299-C.

Q: What is the purpose of Schedule 1299-C?

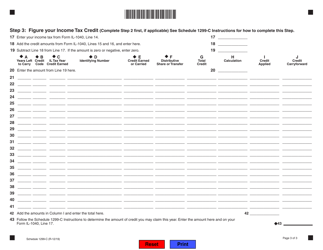

A: The purpose of Schedule 1299-C is to calculate and claim various income tax subtractions and credits that can reduce the amount of tax owed by an individual.

Q: What types of subtractions and credits are reported on Schedule 1299-C?

A: Schedule 1299-C includes subtractions and credits for items such as property tax paid, personal property replacement tax, college savings, and others.

Q: How do I fill out Schedule 1299-C?

A: You need to provide the necessary information and amounts for each applicable subtraction or credit on Schedule 1299-C, following the instructions provided by the Illinois Department of Revenue.

Q: When is the deadline to file Schedule 1299-C?

A: Schedule 1299-C is typically due on the same date as your individual income tax return, which is generally April 15th, unless it falls on a weekend or holiday.

Q: Do I need to attach Schedule 1299-C to my tax return?

A: Yes, you need to attach Schedule 1299-C to your Illinois individual income tax return when filing it.

Q: Can I file Schedule 1299-C electronically?

A: Yes, you can file Schedule 1299-C electronically using the Illinois Department of Revenue's e-file system.

Q: What should I do if I made an error on Schedule 1299-C?

A: If you made an error on Schedule 1299-C after filing, you may need to file an amended return to correct the error. Contact the Illinois Department of Revenue for guidance on how to proceed.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 1299-C by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.