This version of the form is not currently in use and is provided for reference only. Download this version of

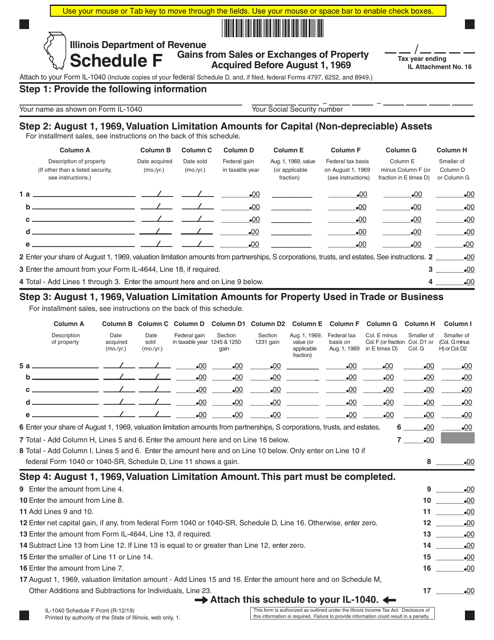

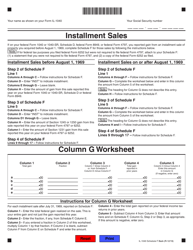

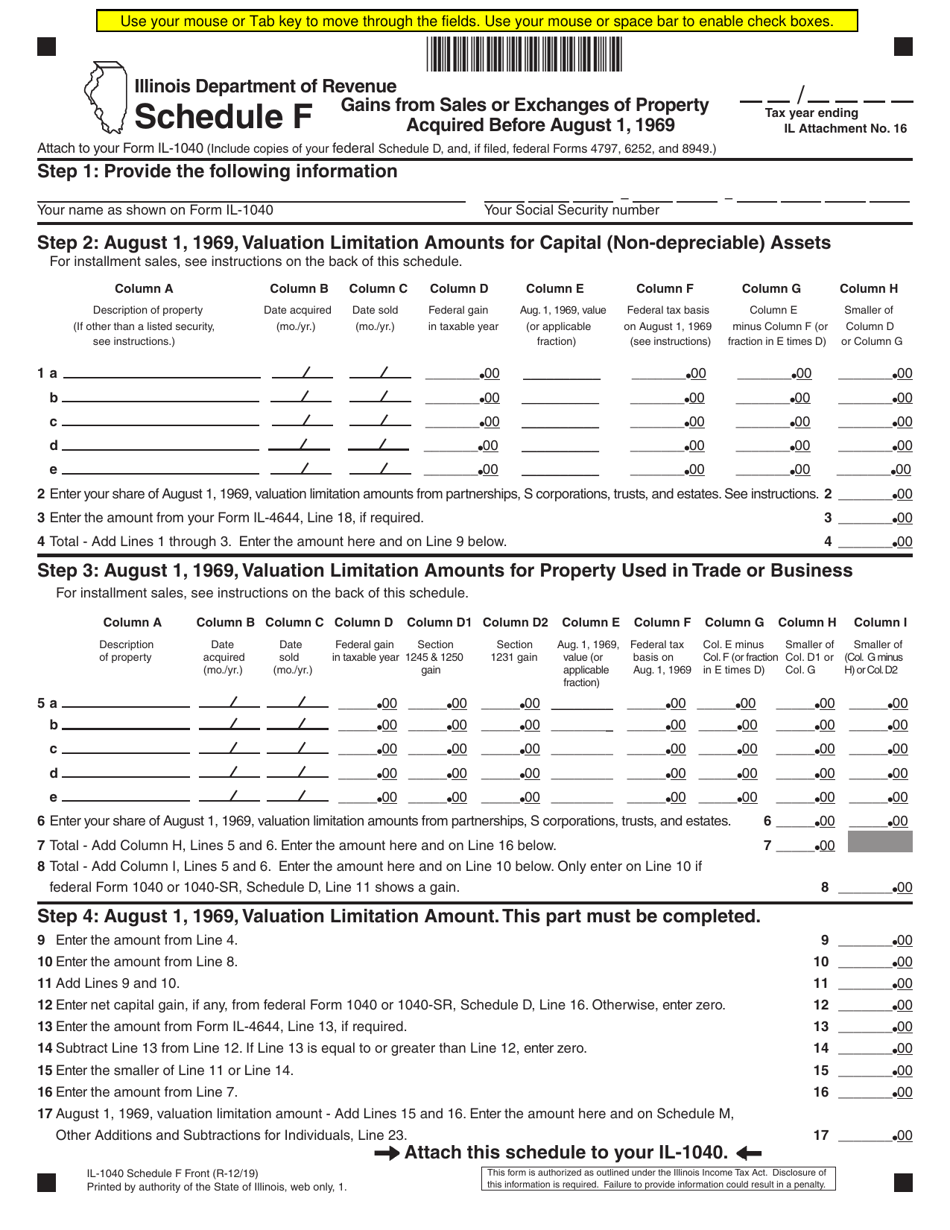

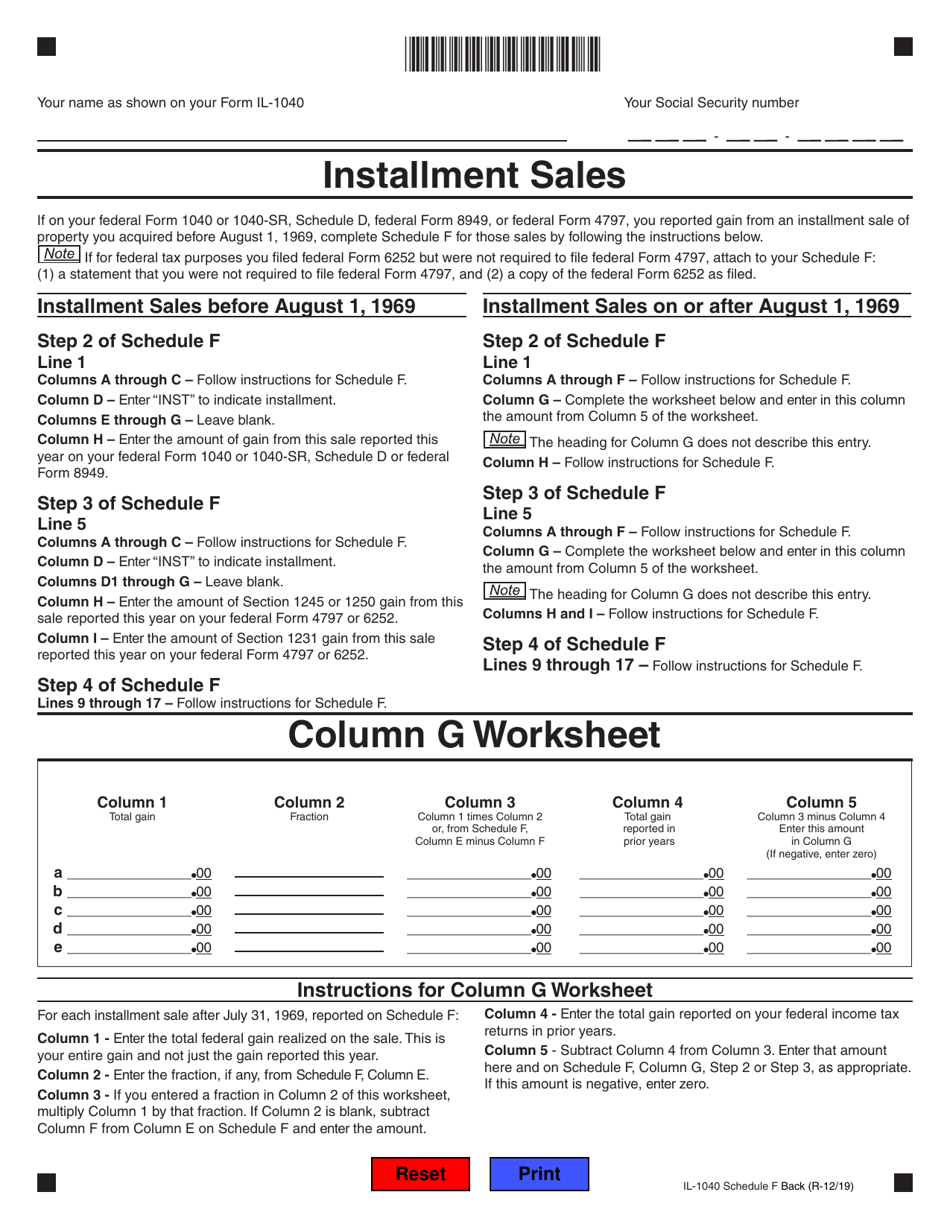

Form IL-1040 Schedule F

for the current year.

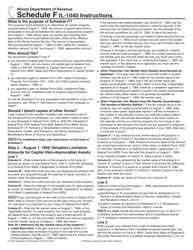

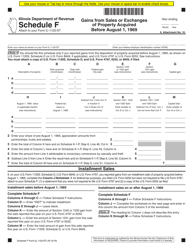

Form IL-1040 Schedule F Gains From Sales or Exchanges of Property Acquired Before August 1, 1969 - Illinois

What Is Form IL-1040 Schedule F?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1040 Schedule F?

A: Form IL-1040 Schedule F is a tax form used in Illinois to report gains from sales or exchanges of property acquired before August 1, 1969.

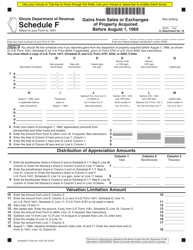

Q: What type of property does Schedule F cover?

A: Schedule F covers property acquired before August 1, 1969.

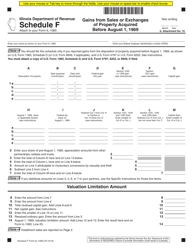

Q: What is the purpose of reporting gains from sales or exchanges of property on Schedule F?

A: The purpose of reporting gains from sales or exchanges of property on Schedule F is to calculate the amount of taxable income and determine the tax liability.

Q: Are there any special rules for property acquired before August 1, 1969?

A: Yes, property acquired before August 1, 1969 is subject to different tax rules and requires the use of Schedule F to calculate gains.

Q: Do I need to file Schedule F if I didn't have any gains from sales or exchanges of property acquired before August 1, 1969?

A: No, if you didn't have any gains from sales or exchanges of property acquired before August 1, 1969, you don't need to file Schedule F.

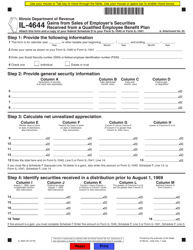

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040 Schedule F by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.