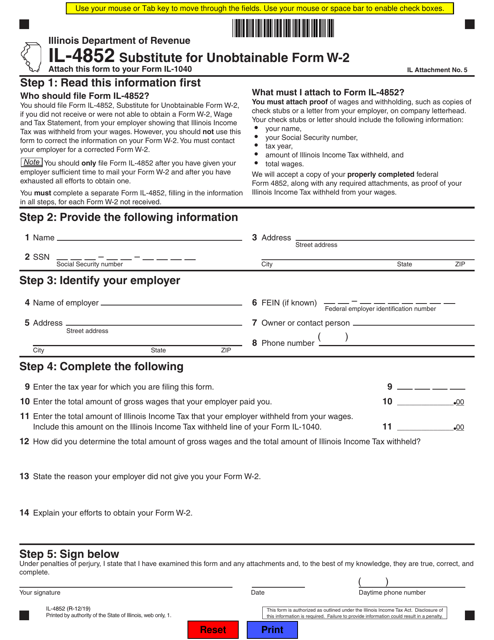

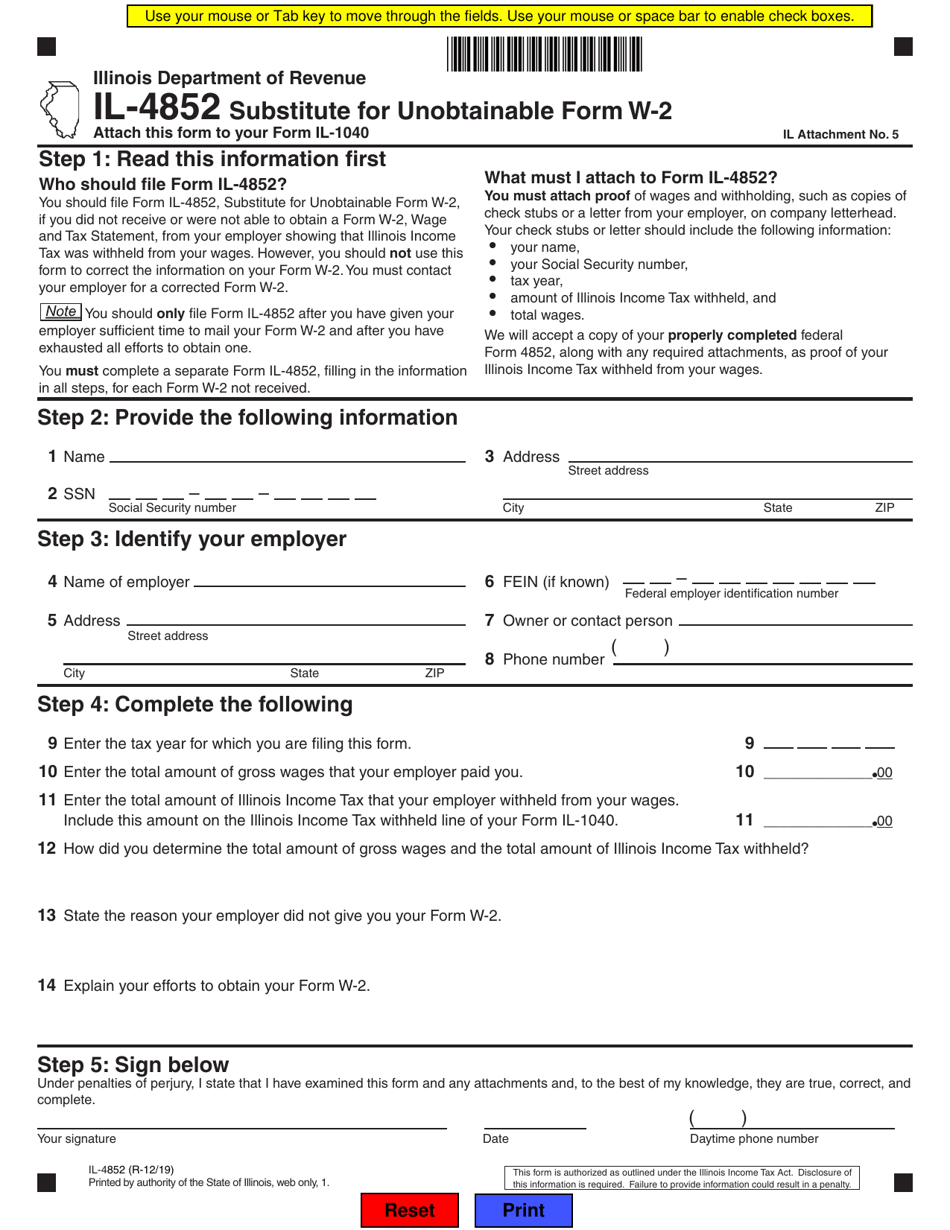

Form IL-4852 Substitute for Unobtainable Form W-2 - Illinois

What Is Form IL-4852?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-4852?

A: Form IL-4852 is a substitute form for the Unobtainable Form W-2 in Illinois.

Q: When should I use Form IL-4852?

A: You should use Form IL-4852 if you are unable to obtain a copy of your Form W-2.

Q: What information do I need to complete Form IL-4852?

A: You will need to provide your personal information, as well as details about your employer.

Q: Can I use Form IL-4852 for federal taxes?

A: No, Form IL-4852 is specific to the state of Illinois and cannot be used for federal taxes.

Q: What should I do if I later receive my Form W-2?

A: If you receive your Form W-2 after filing Form IL-4852, you should file an amended tax return to include the correct information from your Form W-2.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-4852 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.