This version of the form is not currently in use and is provided for reference only. Download this version of

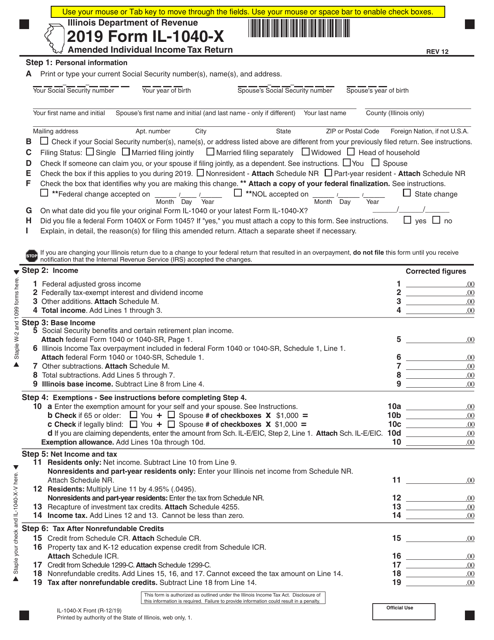

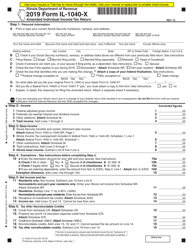

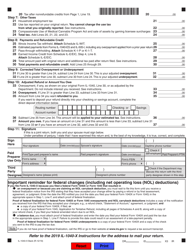

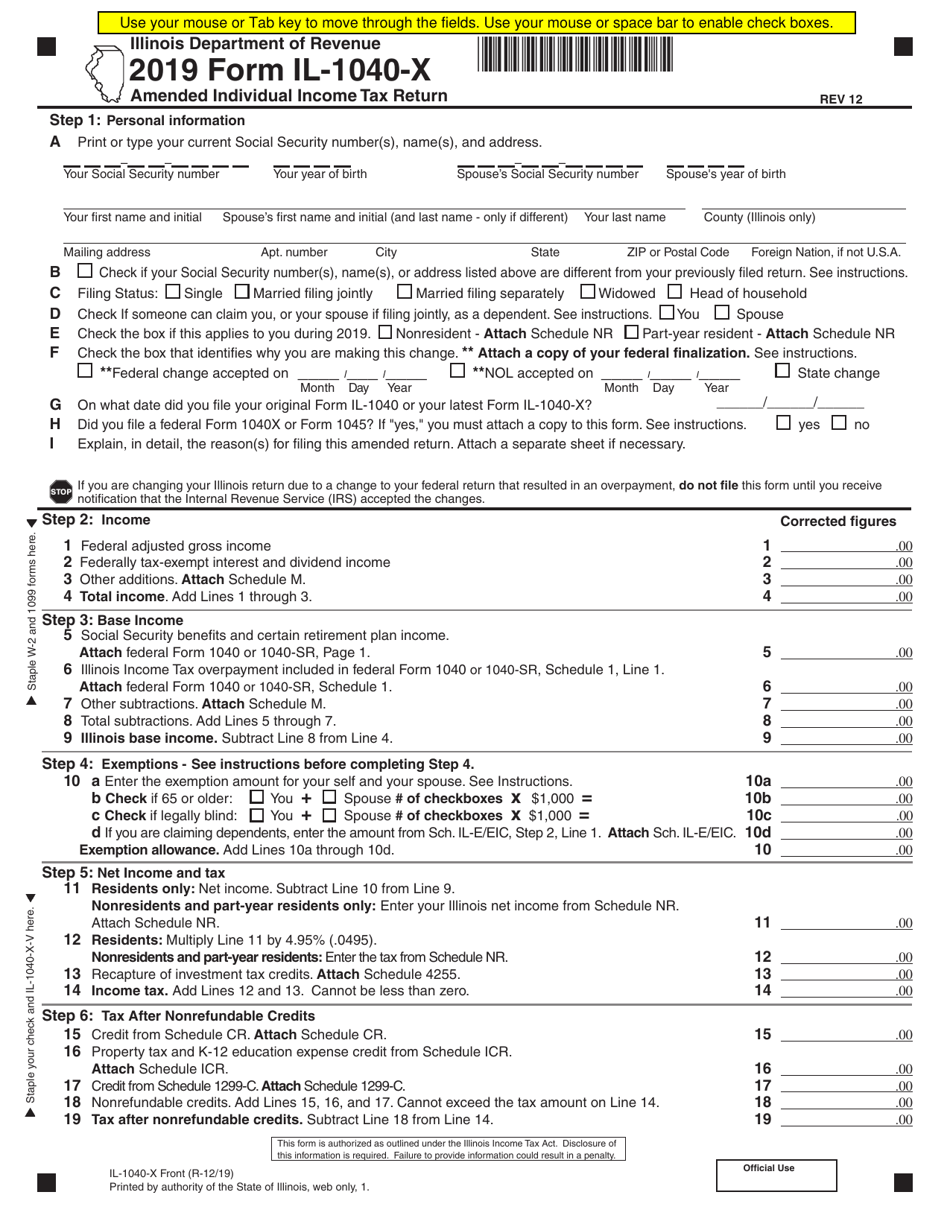

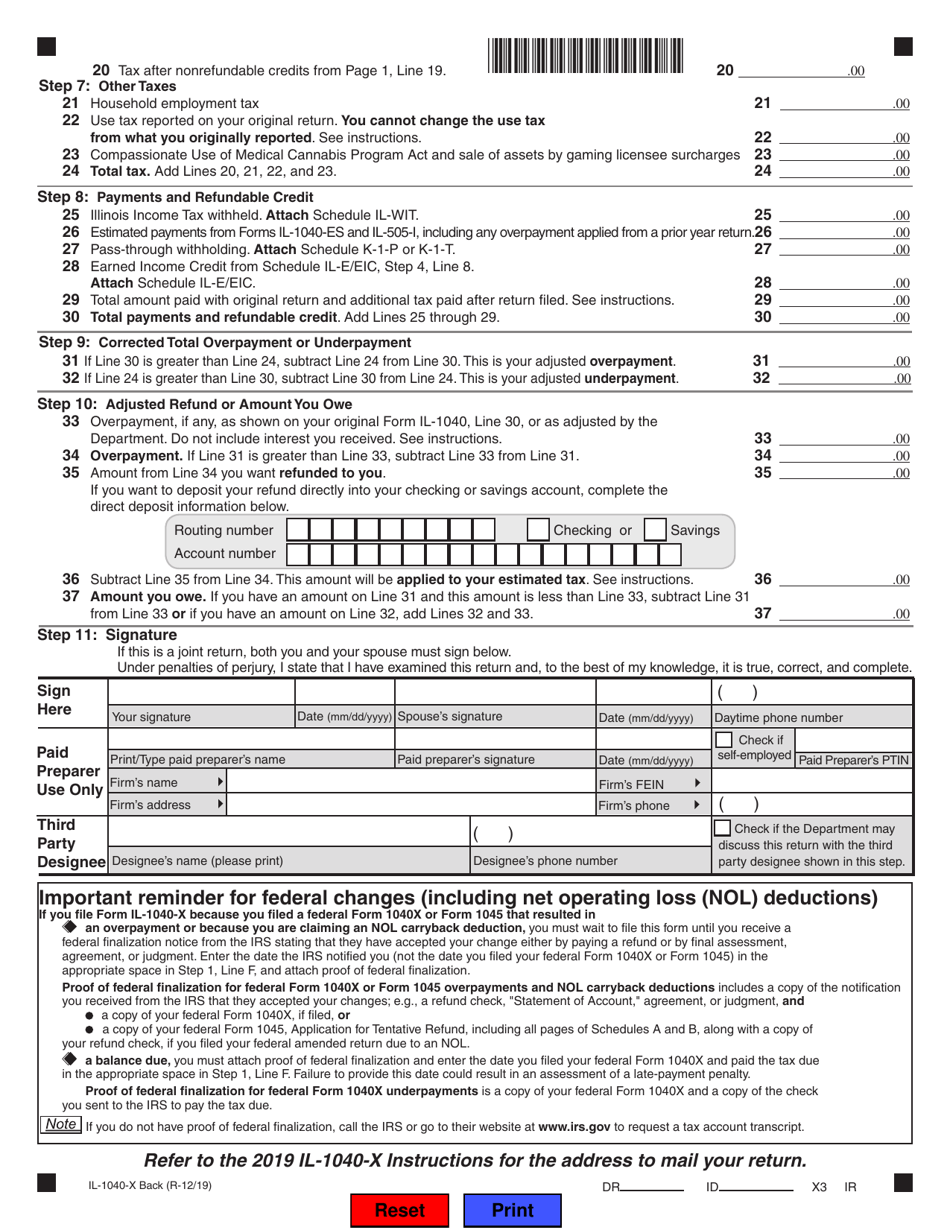

Form IL-1040-X

for the current year.

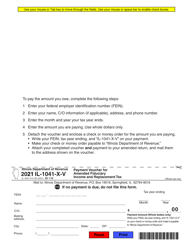

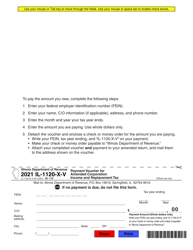

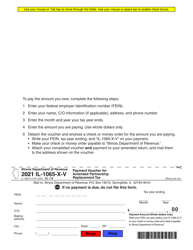

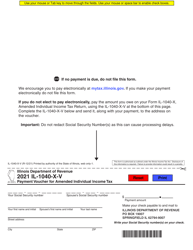

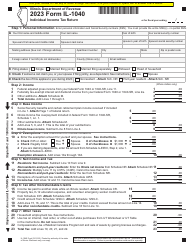

Form IL-1040-X Amended Individual Income Tax Return - Illinois

What Is Form IL-1040-X?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1040-X?

A: Form IL-1040-X is the Amended Individual Income Tax Return for residents of Illinois.

Q: Who needs to file Form IL-1040-X?

A: Residents of Illinois who need to correct or amend their previously filed Illinois Individual Income Tax Return.

Q: When should I file Form IL-1040-X?

A: File Form IL-1040-X as soon as you discover an error or omission on your previously filed Illinois Individual Income Tax Return.

Q: What information do I need to complete Form IL-1040-X?

A: You will need information from your original Illinois Individual Income Tax Return, as well as any additional documentation to support the amendments you are making.

Q: Can I e-file Form IL-1040-X?

A: No, Form IL-1040-X cannot be e-filed. It must be filed by mail.

Q: Is there a deadline for filing Form IL-1040-X?

A: Yes, Form IL-1040-X must be filed within 3 years from the original due date of the return or within 2 years from the date the tax was paid, whichever is later.

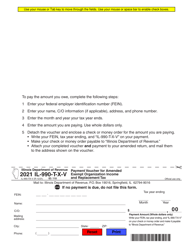

Q: Do I need to include payment with Form IL-1040-X?

A: If you owe additional tax as a result of amending your return, you must include payment with Form IL-1040-X.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.