This version of the form is not currently in use and is provided for reference only. Download this version of

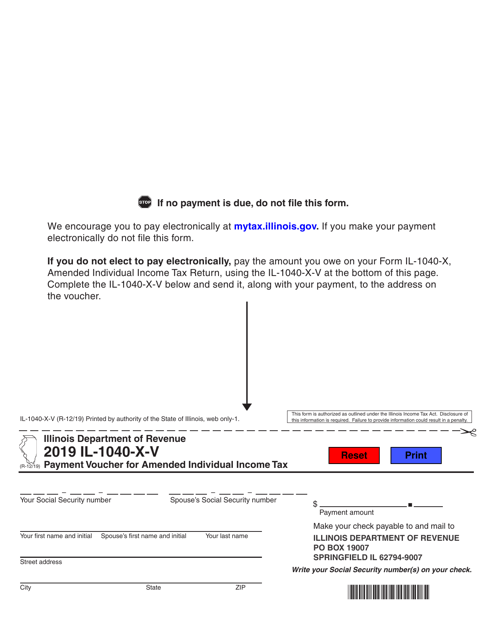

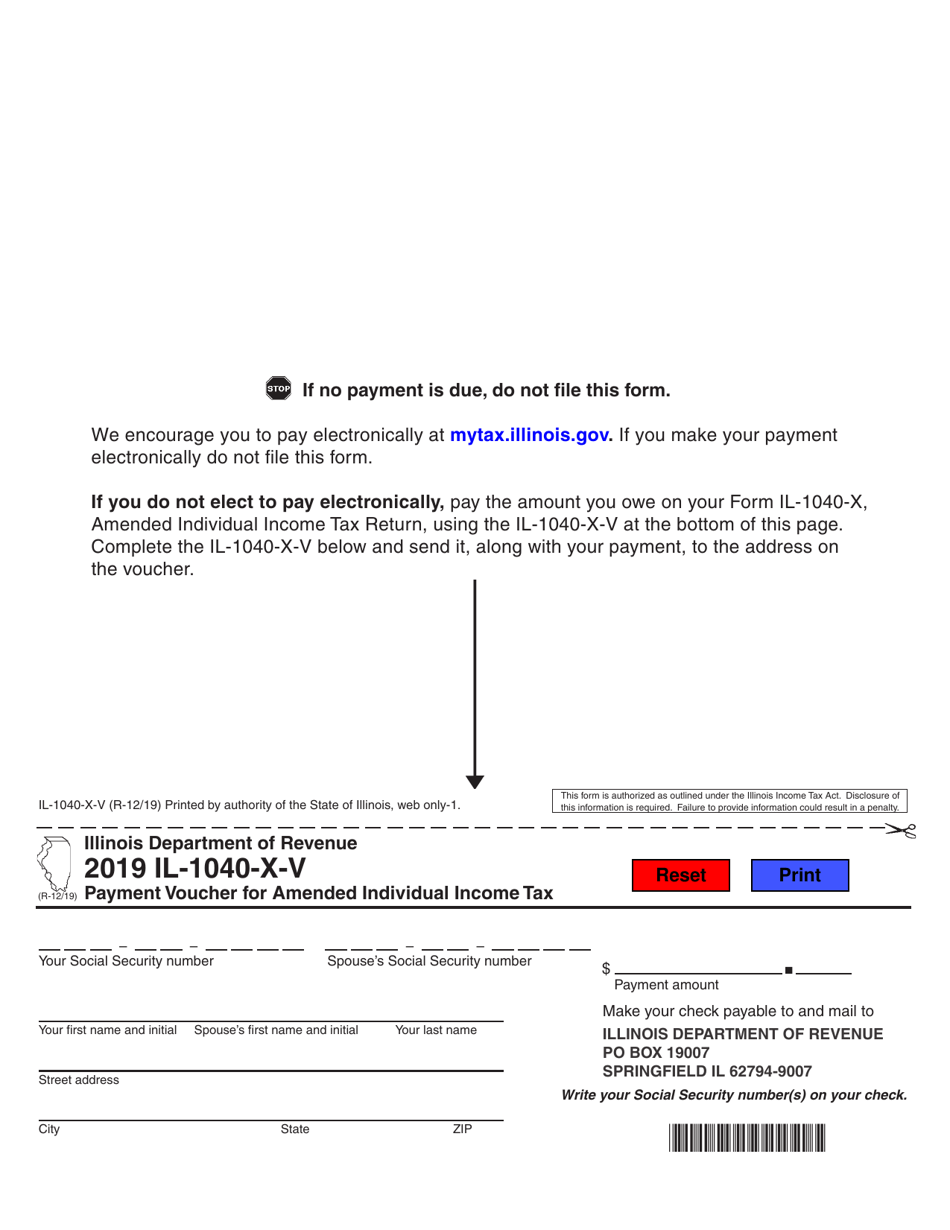

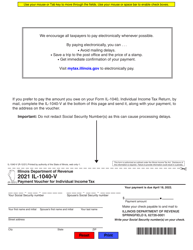

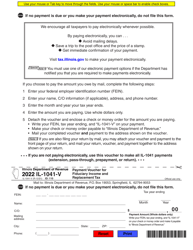

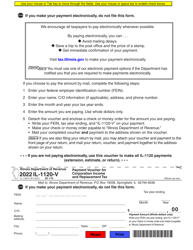

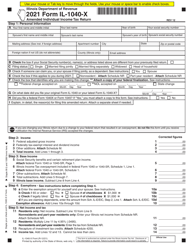

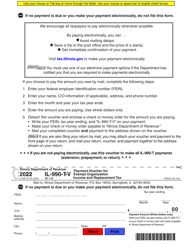

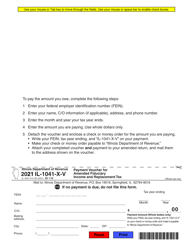

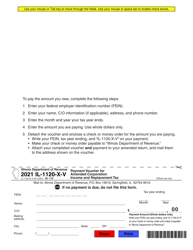

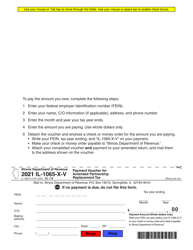

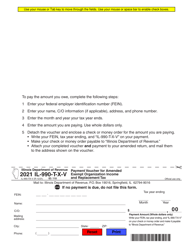

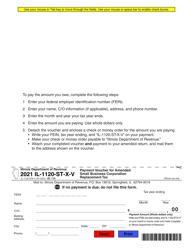

Form IL-1040-X-V

for the current year.

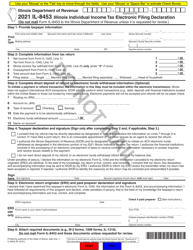

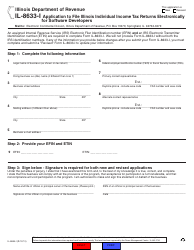

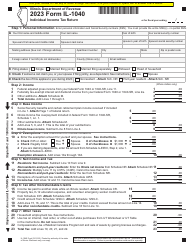

Form IL-1040-X-V Payment Voucher for Amended Individual Income Tax - Illinois

What Is Form IL-1040-X-V?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-1040-X-V?

A: Form IL-1040-X-V is a payment voucher for amended individual income tax in Illinois.

Q: Who needs to use Form IL-1040-X-V?

A: Anyone who is submitting an amended individual income tax return in Illinois and needs to make a payment.

Q: What is the purpose of Form IL-1040-X-V?

A: The purpose of Form IL-1040-X-V is to provide a voucher for individuals to make payments towards their amended income tax return.

Q: How do I fill out Form IL-1040-X-V?

A: Fill out the taxpayer information, the amount you are paying, and include the amended return form and payment voucher together when submitting.

Q: When should I file Form IL-1040-X-V?

A: Form IL-1040-X-V should be filed along with your amended individual income tax return and payment before the filing deadline.

Q: What if I cannot pay the full amount owed?

A: If you cannot pay the full amount owed, it is still important to file Form IL-1040-X-V and make a partial payment. You can then work out a payment plan with the Illinois Department of Revenue.

Q: What if I have questions about Form IL-1040-X-V?

A: If you have questions or need assistance regarding Form IL-1040-X-V, you can contact the Illinois Department of Revenue for guidance.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040-X-V by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.