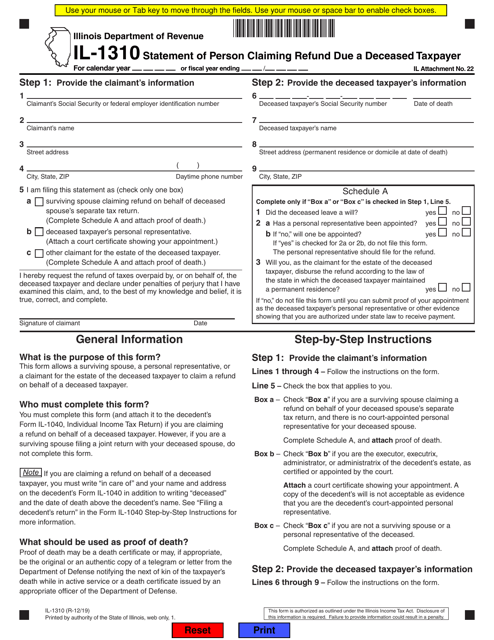

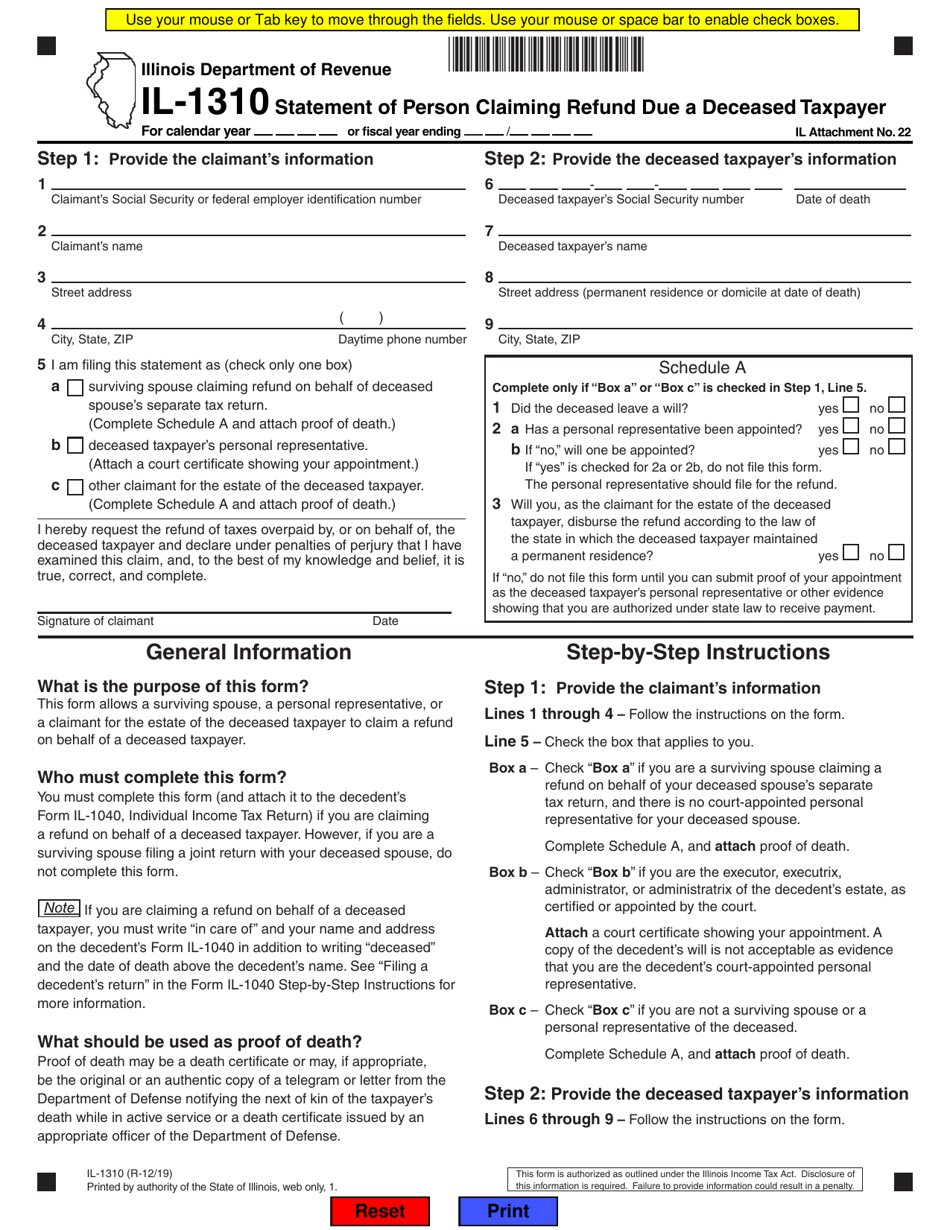

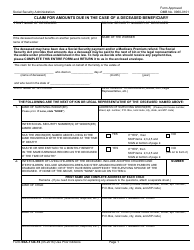

Form IL-1310 Statement of Person Claiming Refund Due a Deceased Taxpayer - Illinois

What Is Form IL-1310?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-1310?

A: Form IL-1310 is the Statement of Person Claiming Refund Due a Deceased Taxpayer in Illinois.

Q: Who can claim a refund using Form IL-1310?

A: A person who has paid taxes on behalf of a deceased taxpayer and is entitled to a refund can use Form IL-1310.

Q: What is the purpose of Form IL-1310?

A: The purpose of Form IL-1310 is to claim a refund on behalf of a deceased taxpayer in Illinois.

Q: When should Form IL-1310 be filed?

A: Form IL-1310 should be filed when a refund is due to a deceased taxpayer.

Q: Do I need to include supporting documentation with Form IL-1310?

A: Yes, you should include any necessary supporting documentation, such as a death certificate and proof of payment, when filing Form IL-1310.

Q: Is there a deadline for filing Form IL-1310?

A: Yes, Form IL-1310 should be filed within 3 years from the due date of the original tax return or within 1 year from the date of payment, whichever is later.

Q: Can I file Form IL-1310 electronically?

A: No, Form IL-1310 cannot be filed electronically. It must be filed by mail or in person.

Q: What should I do if I have questions about Form IL-1310?

A: If you have questions about Form IL-1310, you should contact the Illinois Department of Revenue for assistance.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1310 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.