This version of the form is not currently in use and is provided for reference only. Download this version of

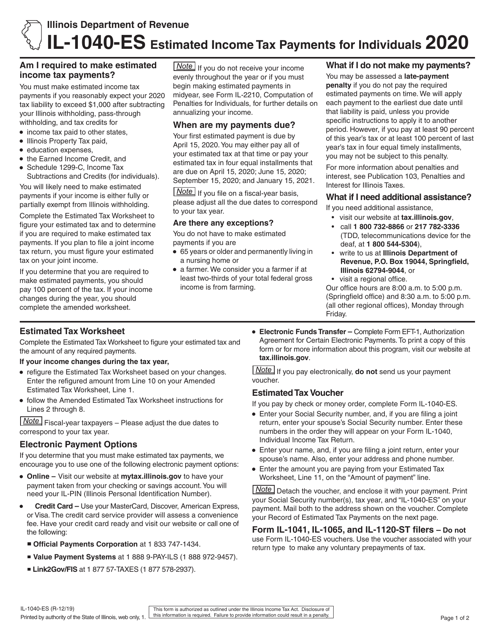

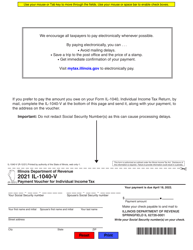

Form IL-1040-ES

for the current year.

Form IL-1040-ES Estimated Income Tax Payments for Individuals - Illinois

What Is Form IL-1040-ES?

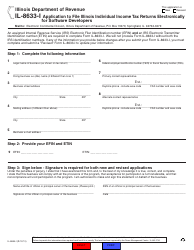

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-1040-ES?

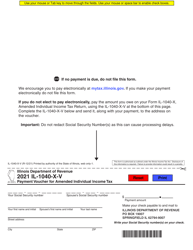

A: Form IL-1040-ES is used to make estimated income tax payments for individuals in Illinois.

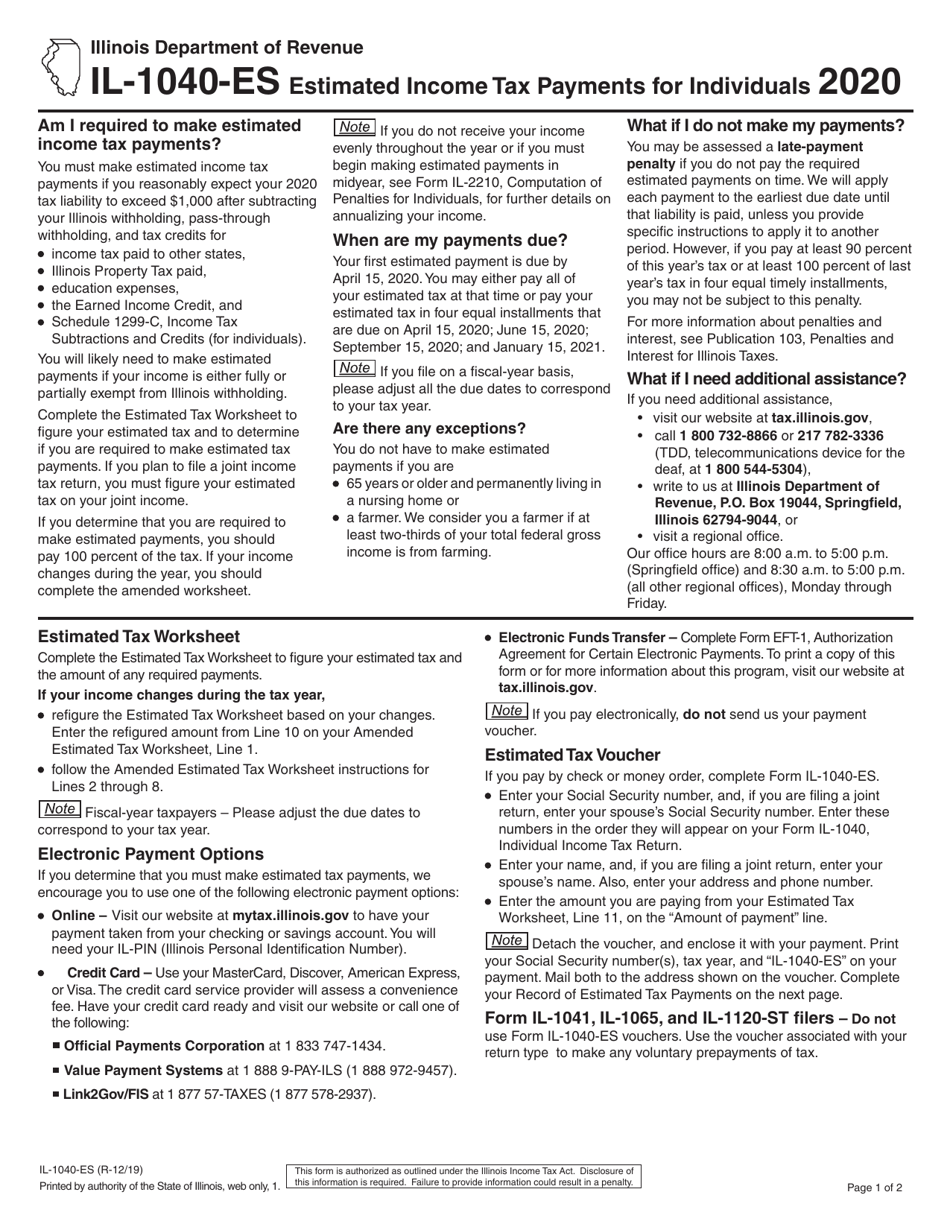

Q: Who needs to use Form IL-1040-ES?

A: Individuals who expect to owe $500 or more in Illinois income tax for the year are required to make estimated tax payments using Form IL-1040-ES.

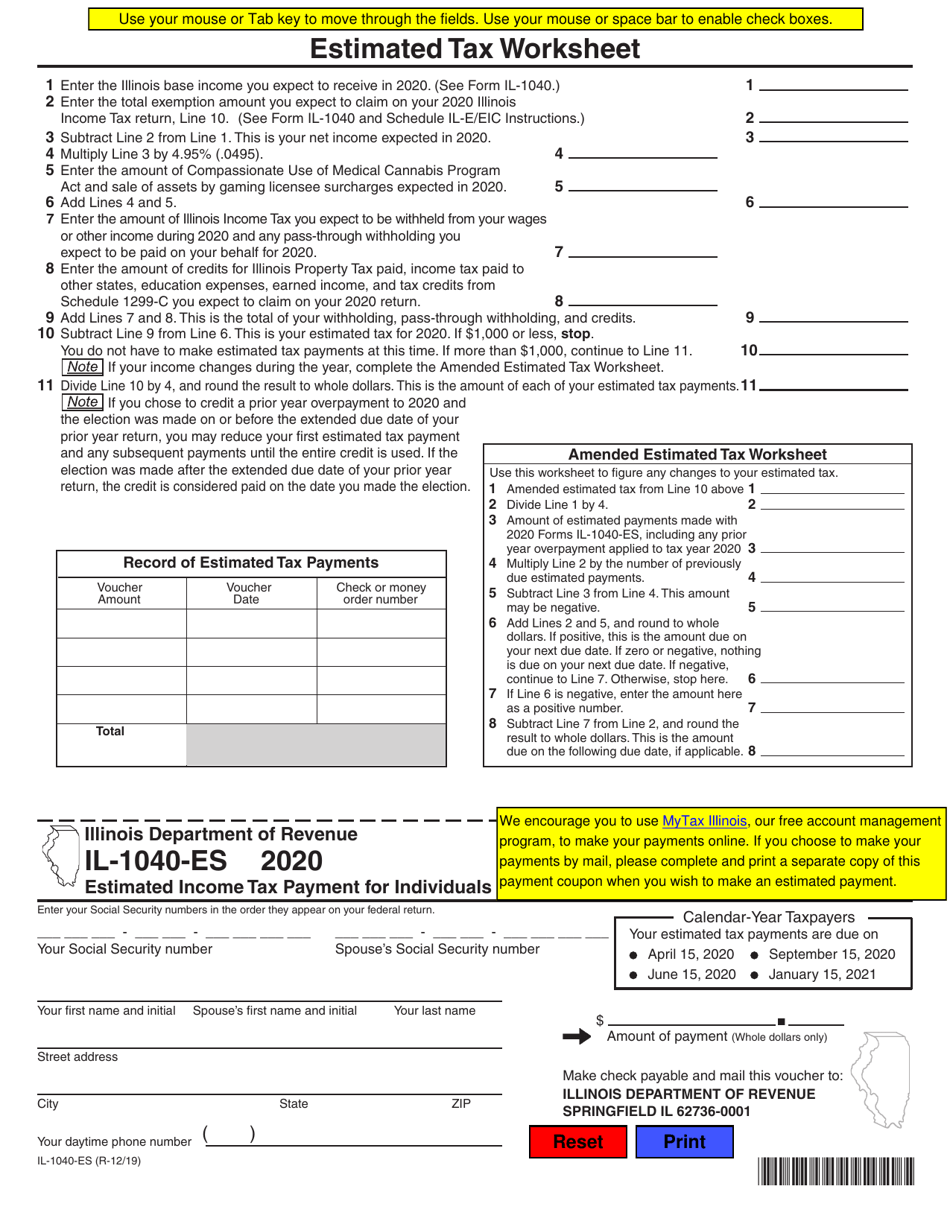

Q: When are the estimated tax payments due?

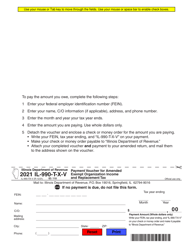

A: The estimated tax payments are due on a quarterly basis - April 15th, June 15th, September 15th, and January 15th of the following year.

Q: Do I need to file Form IL-1040-ES if I receive a refund?

A: No, if you expect to receive a refund or have zero tax liability, you do not need to file Form IL-1040-ES.

Q: What happens if I don't make estimated tax payments?

A: If you do not make estimated tax payments and owe $500 or more in Illinois income tax, you may be subject to penalties and interest.

Q: Can I adjust my estimated tax payments?

A: Yes, if your income or deductions change, you can adjust your estimated tax payments using Form IL-1040-ES by submitting a revised payment voucher.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040-ES by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.