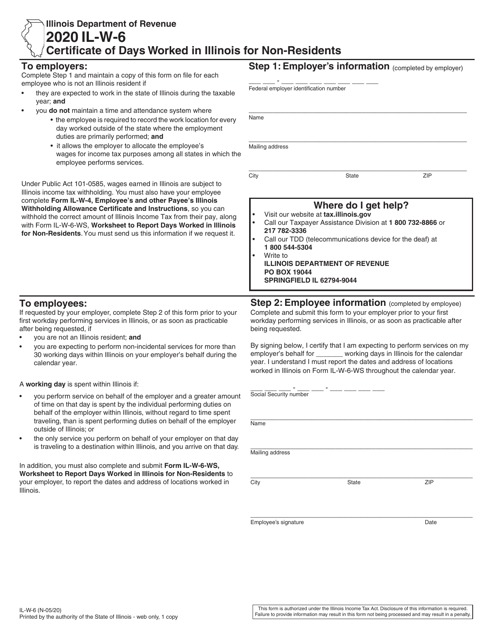

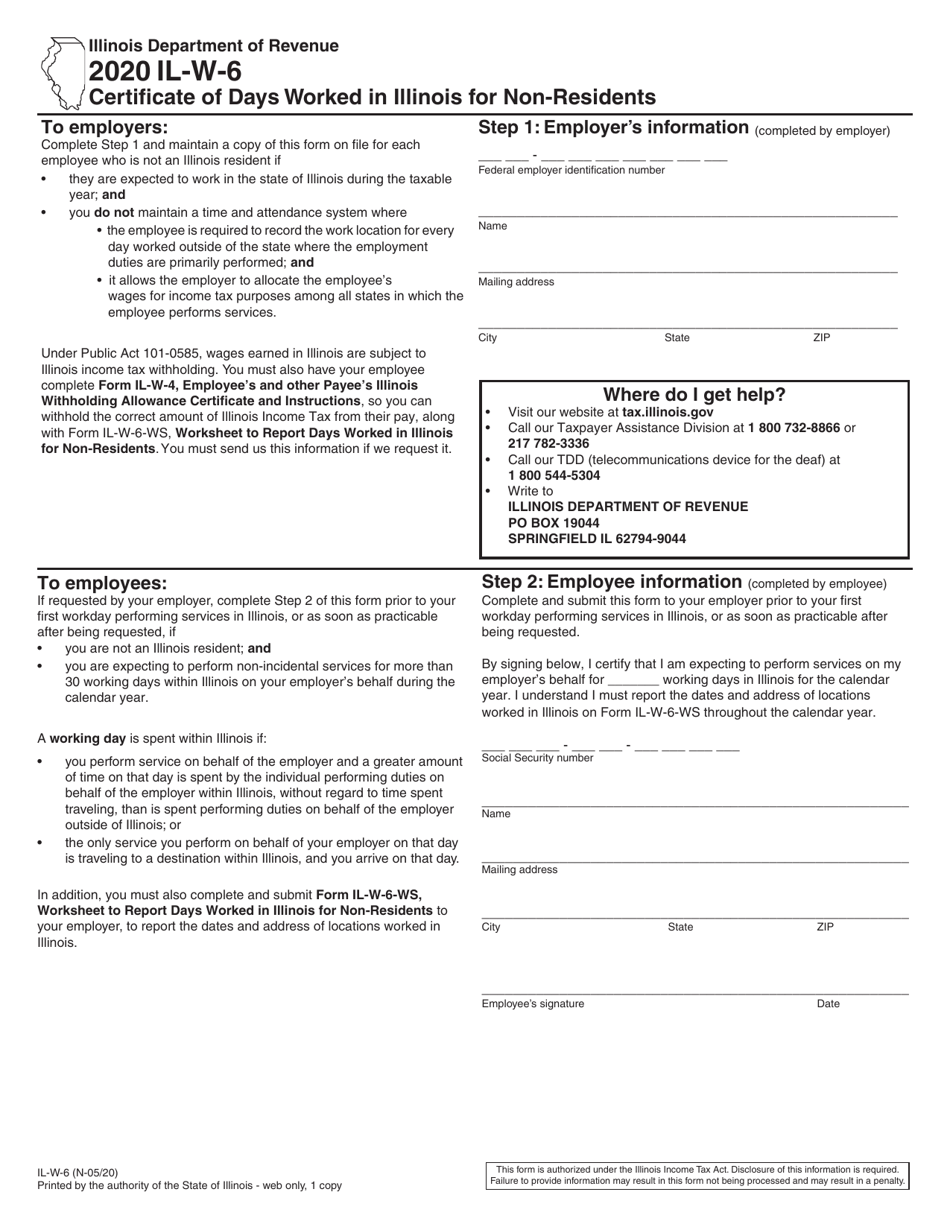

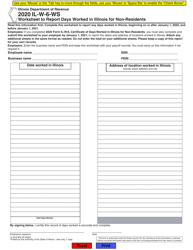

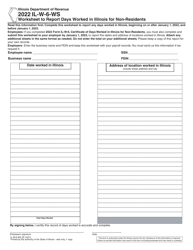

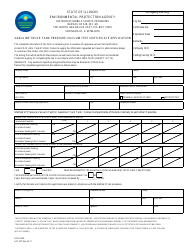

Form IL-W-6 Certificate of Days Worked in Illinois for Non-residents - Illinois

What Is Form IL-W-6?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-W-6?

A: Form IL-W-6 is the Certificate of Days Worked in Illinois for Non-residents.

Q: Who is required to fill out Form IL-W-6?

A: Non-residents who worked in Illinois and earned income during the tax year are required to fill out Form IL-W-6.

Q: When should Form IL-W-6 be filled out?

A: Form IL-W-6 should be filled out at the end of the tax year.

Q: What information is needed to fill out Form IL-W-6?

A: You will need to provide your personal information, details about your days worked in Illinois, and your employer's information.

Q: Is there a deadline for submitting Form IL-W-6?

A: Yes, Form IL-W-6 must be submitted by January 31 of the following year.

Q: What if I am exempt from filing a federal tax return?

A: Even if you are exempt from filing a federal tax return, you must still file Form IL-W-6 if you worked in Illinois and earned income.

Q: What happens if I do not submit Form IL-W-6?

A: Failure to submit Form IL-W-6 may result in penalties and interest.

Q: Can I make changes to Form IL-W-6 after submitting it?

A: Yes, you can make changes to Form IL-W-6 by filing an amended form with the Illinois Department of Revenue.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IL-W-6 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.