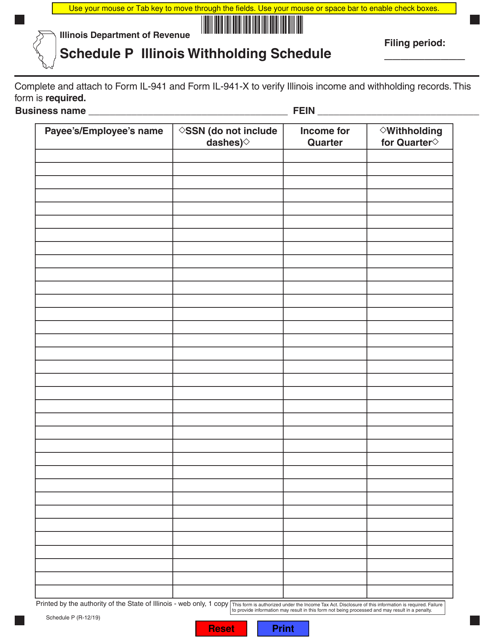

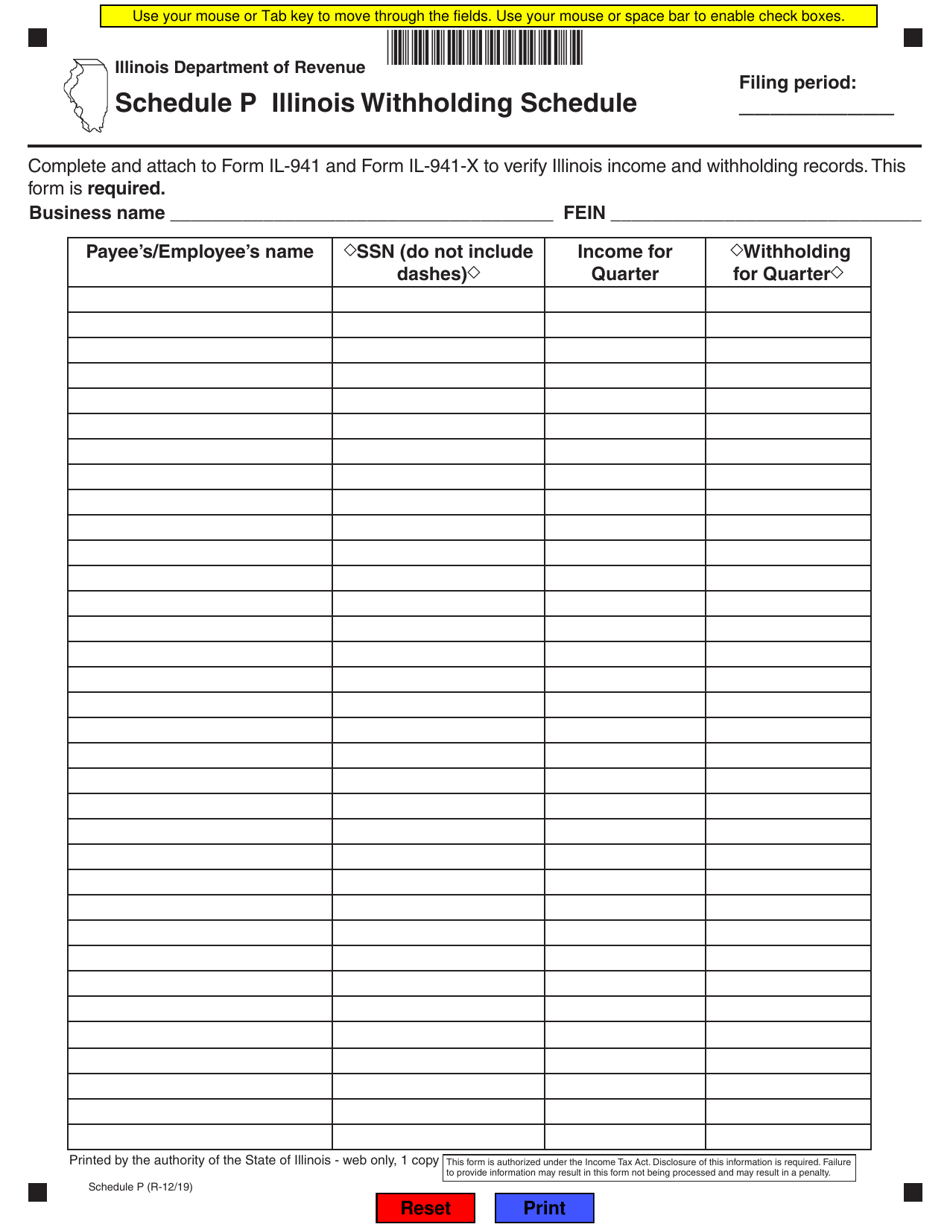

Schedule P Illinois Withholding Schedule - Illinois

What Is Schedule P?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule P?

A: Schedule P is the Illinois Withholding Schedule.

Q: What is the purpose of Schedule P?

A: The purpose of Schedule P is to calculate Illinois state income tax withholding.

Q: Who needs to fill out Schedule P?

A: Employers in Illinois need to fill out Schedule P to report and remit state income tax withholdings.

Q: What information is required on Schedule P?

A: Employers need to provide the total wages paid, state income tax withheld, and other relevant information for each employee.

Q: Are there any deadlines for filing Schedule P?

A: Yes, employers are required to file Schedule P quarterly by the due dates specified by the Illinois Department of Revenue.

Q: Is there a penalty for late filing of Schedule P?

A: Yes, late filing of Schedule P may result in penalties and interest charges.

Q: Can I make corrections to Schedule P?

A: Yes, if you made an error on Schedule P, you can file an amended Schedule P to correct the mistake.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule P by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.