This version of the form is not currently in use and is provided for reference only. Download this version of

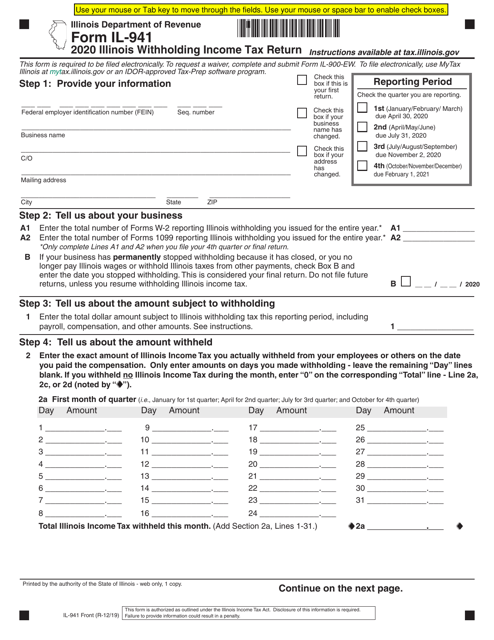

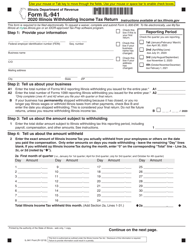

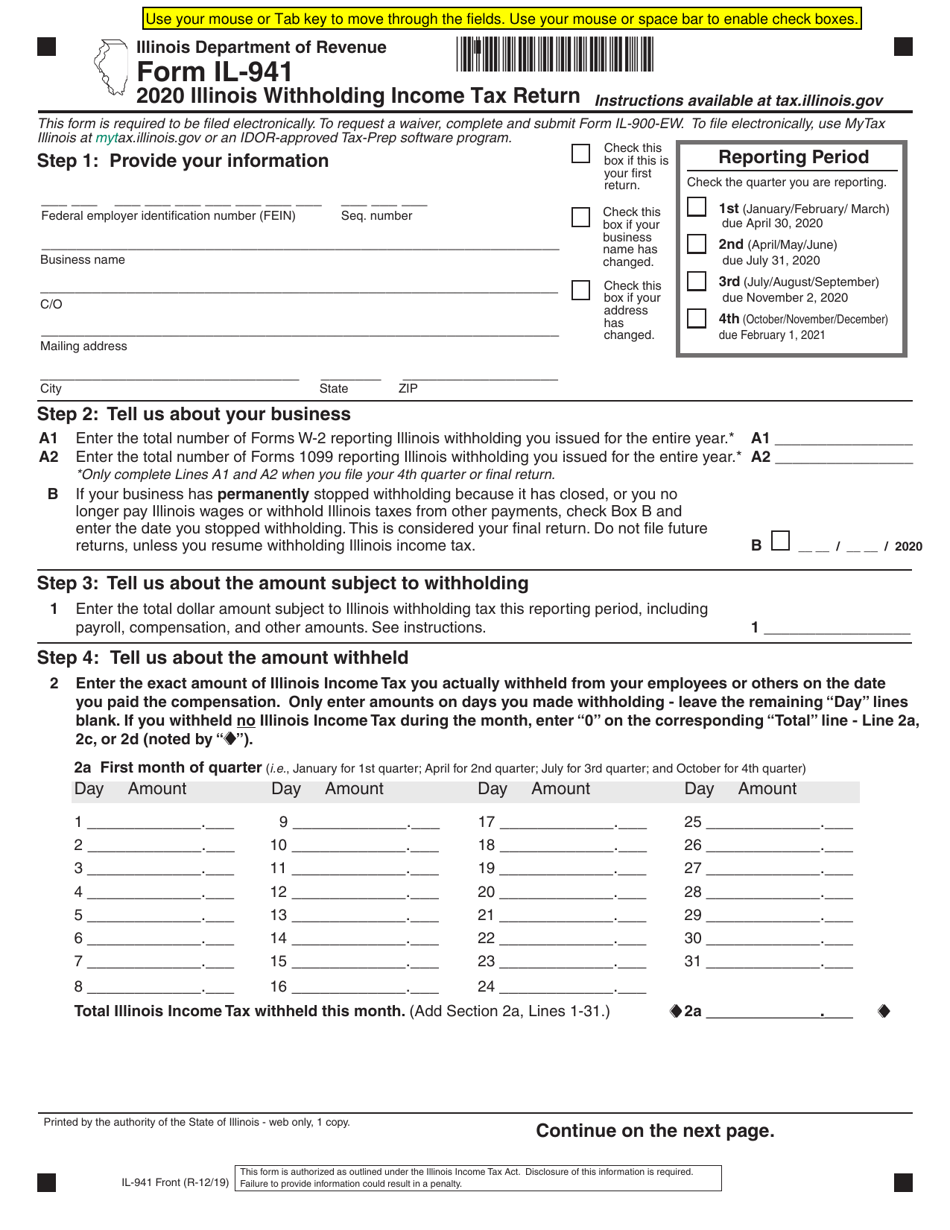

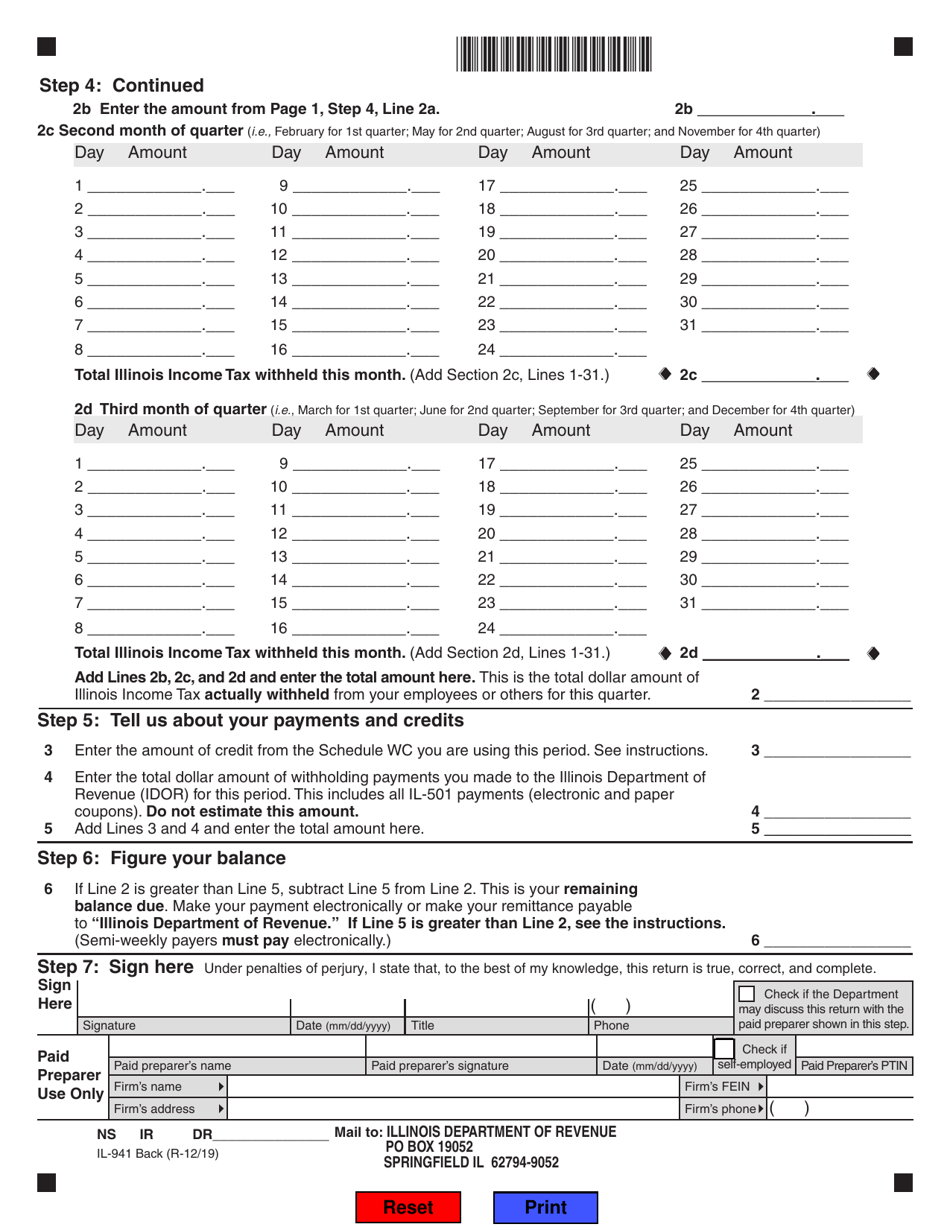

Form IL-941

for the current year.

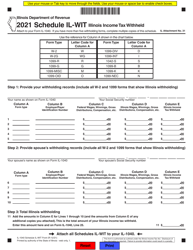

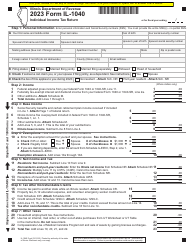

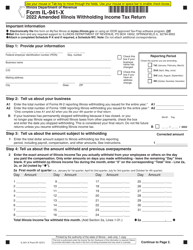

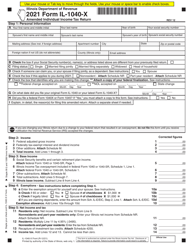

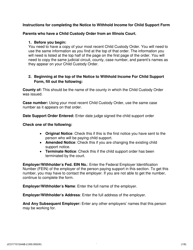

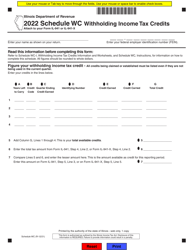

Form IL-941 Illinois Withholding Income Tax Return - Illinois

What Is Form IL-941?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-941?

A: Form IL-941 is the Illinois Withholding Income Tax Return.

Q: Who needs to file Form IL-941?

A: Employers in Illinois who have employees subject to withholding of Illinois income tax must file Form IL-941.

Q: What is the purpose of Form IL-941?

A: Form IL-941 is used to report and pay withholding taxes on wages paid to employees in Illinois.

Q: When is Form IL-941 due?

A: Form IL-941 is due on a quarterly basis. The due dates are April 30, July 31, October 31, and January 31.

Q: Are there any penalties for late filing of Form IL-941?

A: Yes, penalties may apply for late or incomplete filing of Form IL-941. It is important to file the form on time to avoid penalties.

Q: Can Form IL-941 be filed electronically?

A: Yes, Form IL-941 can be filed electronically using the Illinois Department of Revenue's MyTax Illinois system.

Q: What information is required on Form IL-941?

A: Form IL-941 requires information such as employer identification number, total wages paid, total withheld, and total number of employees.

Q: Are there any exceptions to filing Form IL-941?

A: There are some exceptions for small employers who meet certain criteria. They may be eligible to file a simplified version of the form called Form IL-941-X.

Q: Can I make payments electronically for Form IL-941?

A: Yes, payments can be made electronically using the Illinois Department of Revenue's MyTax Illinois system.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-941 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.