This version of the form is not currently in use and is provided for reference only. Download this version of

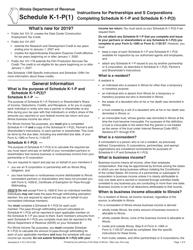

Instructions for Schedule K-1-P(2)

for the current year.

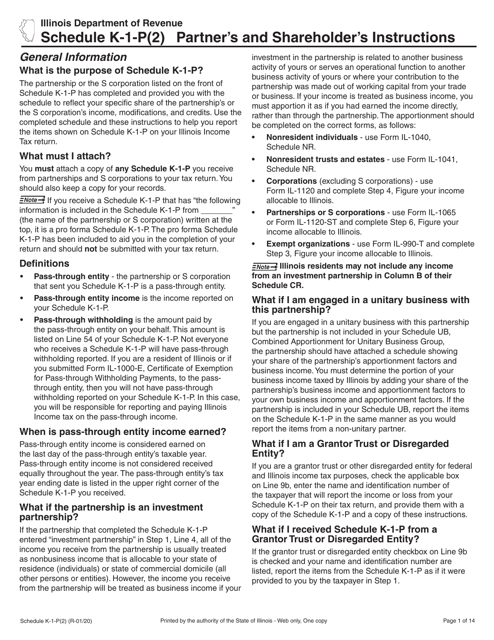

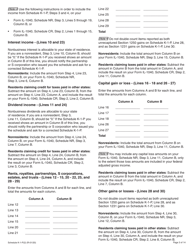

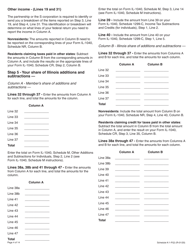

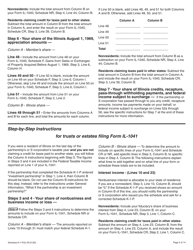

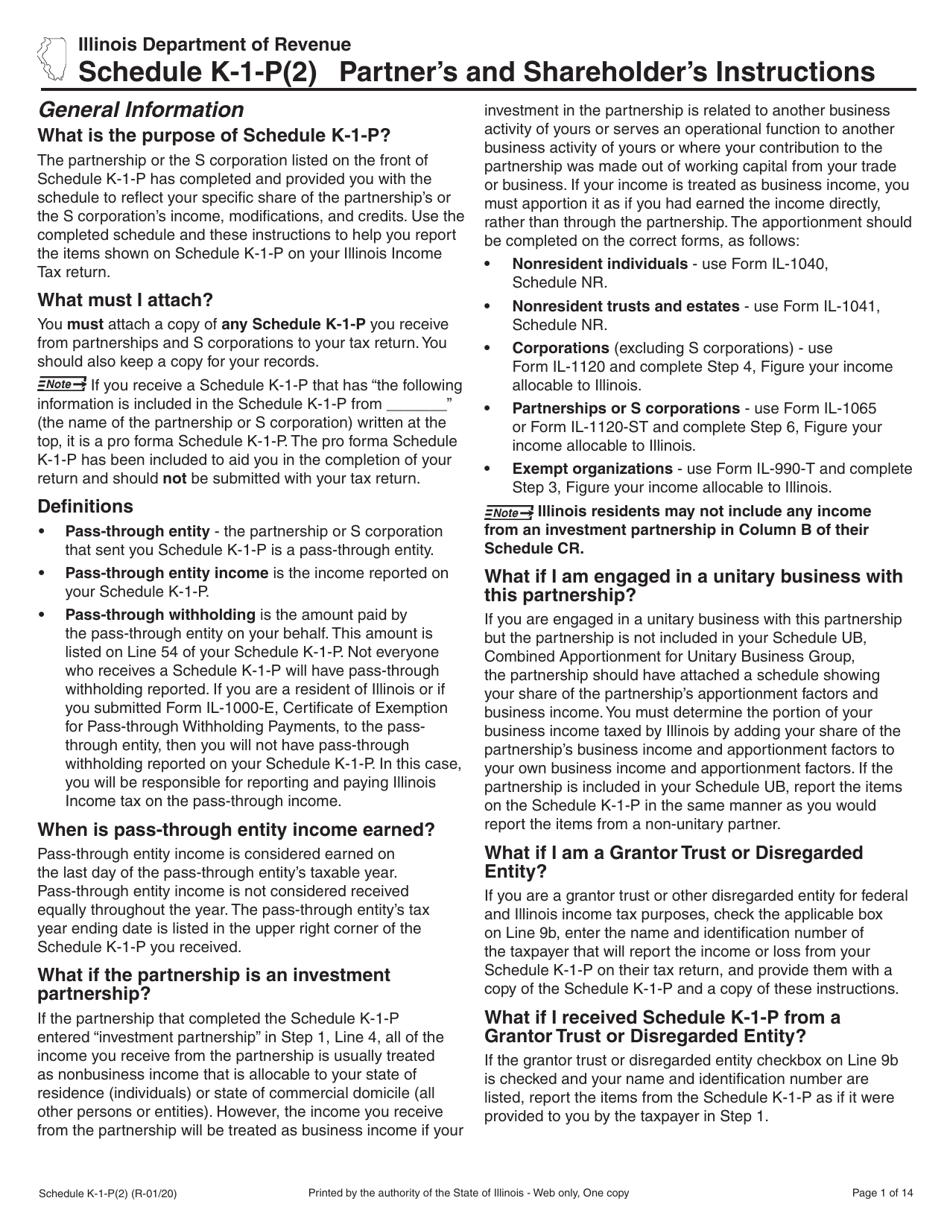

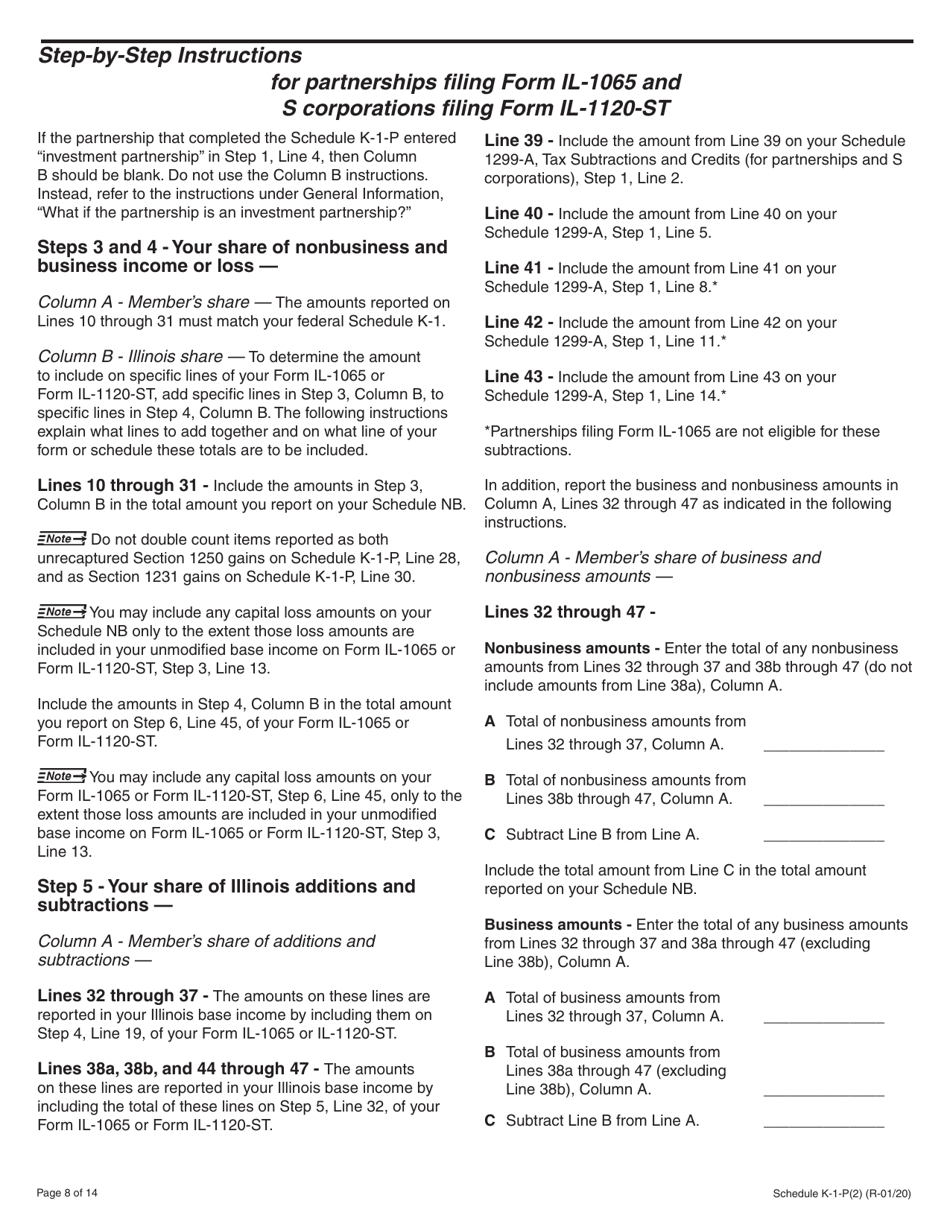

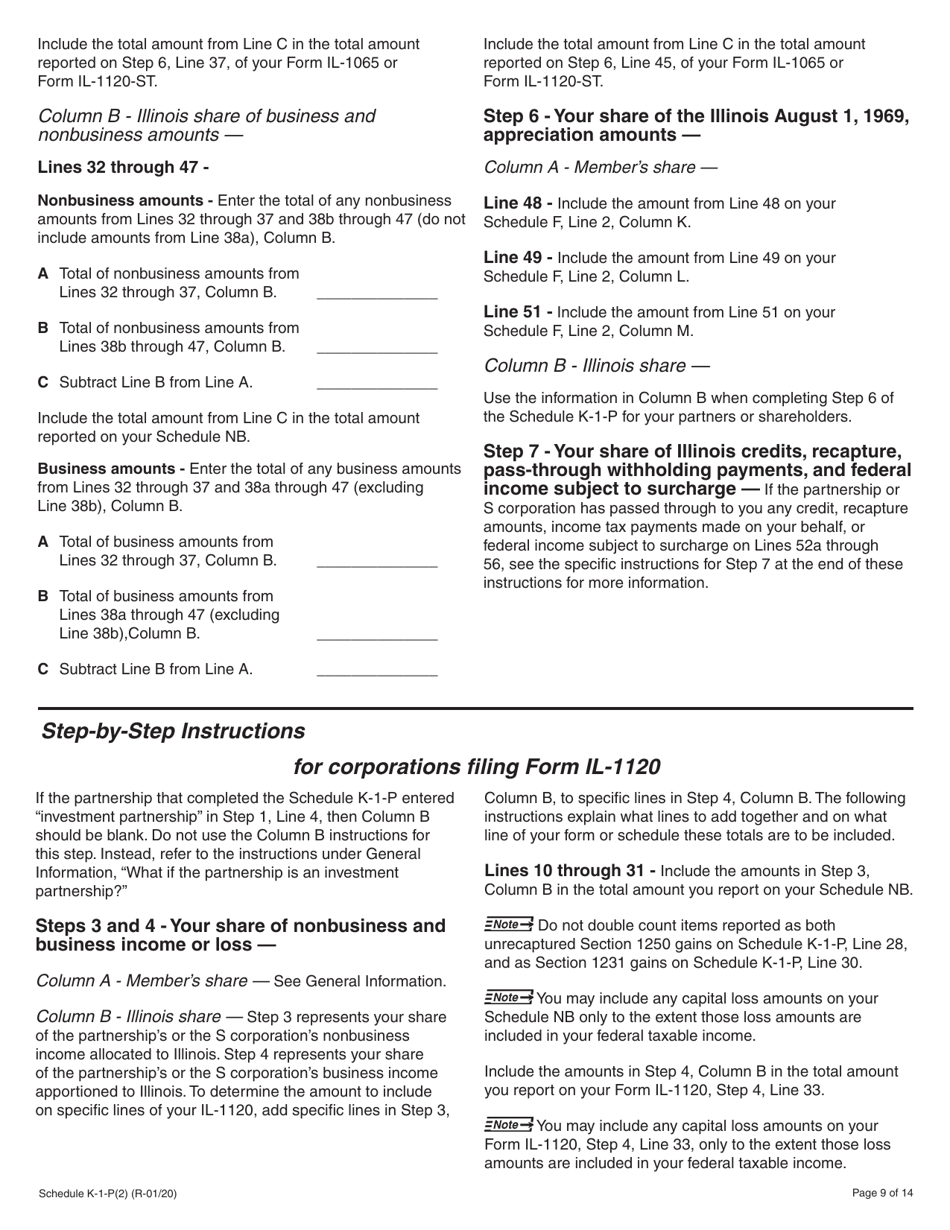

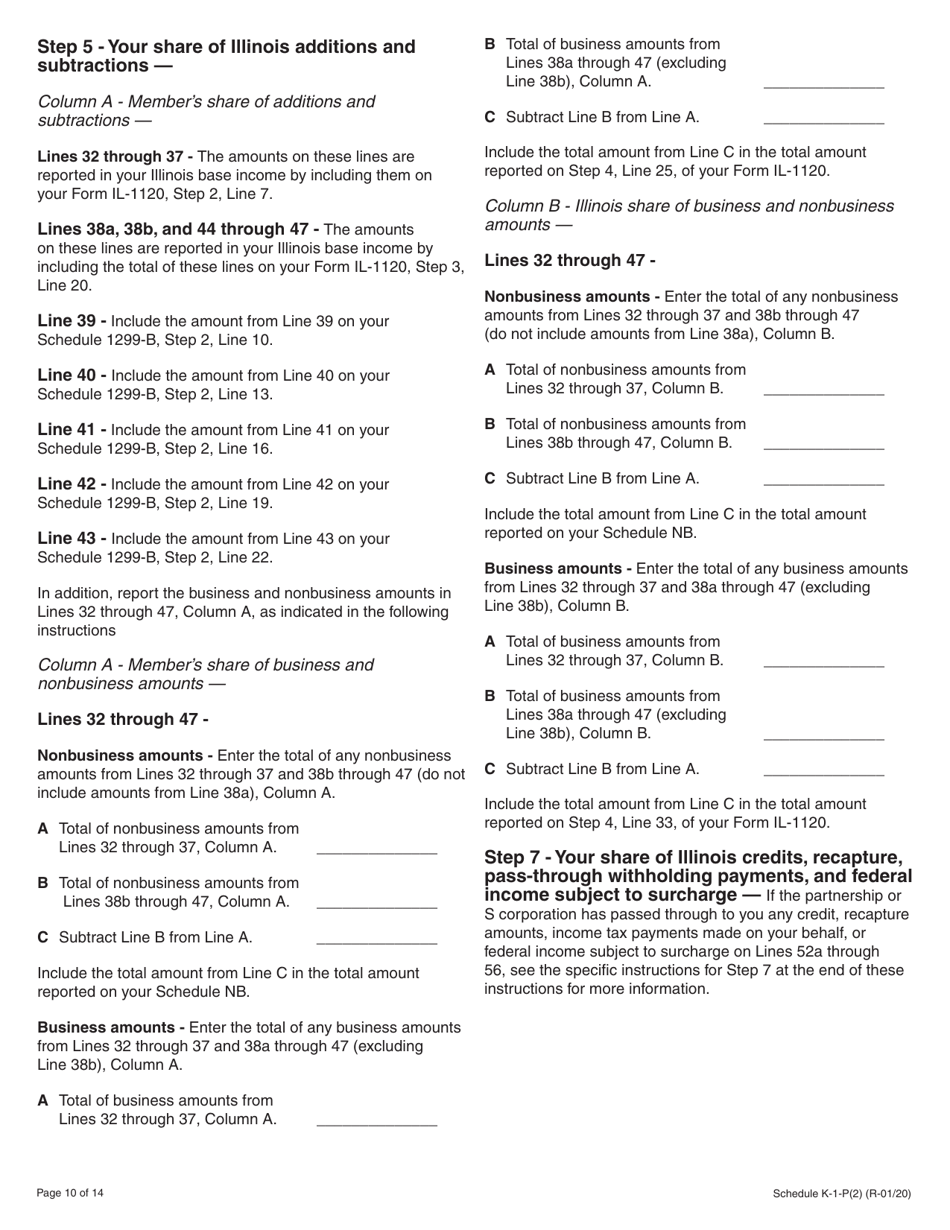

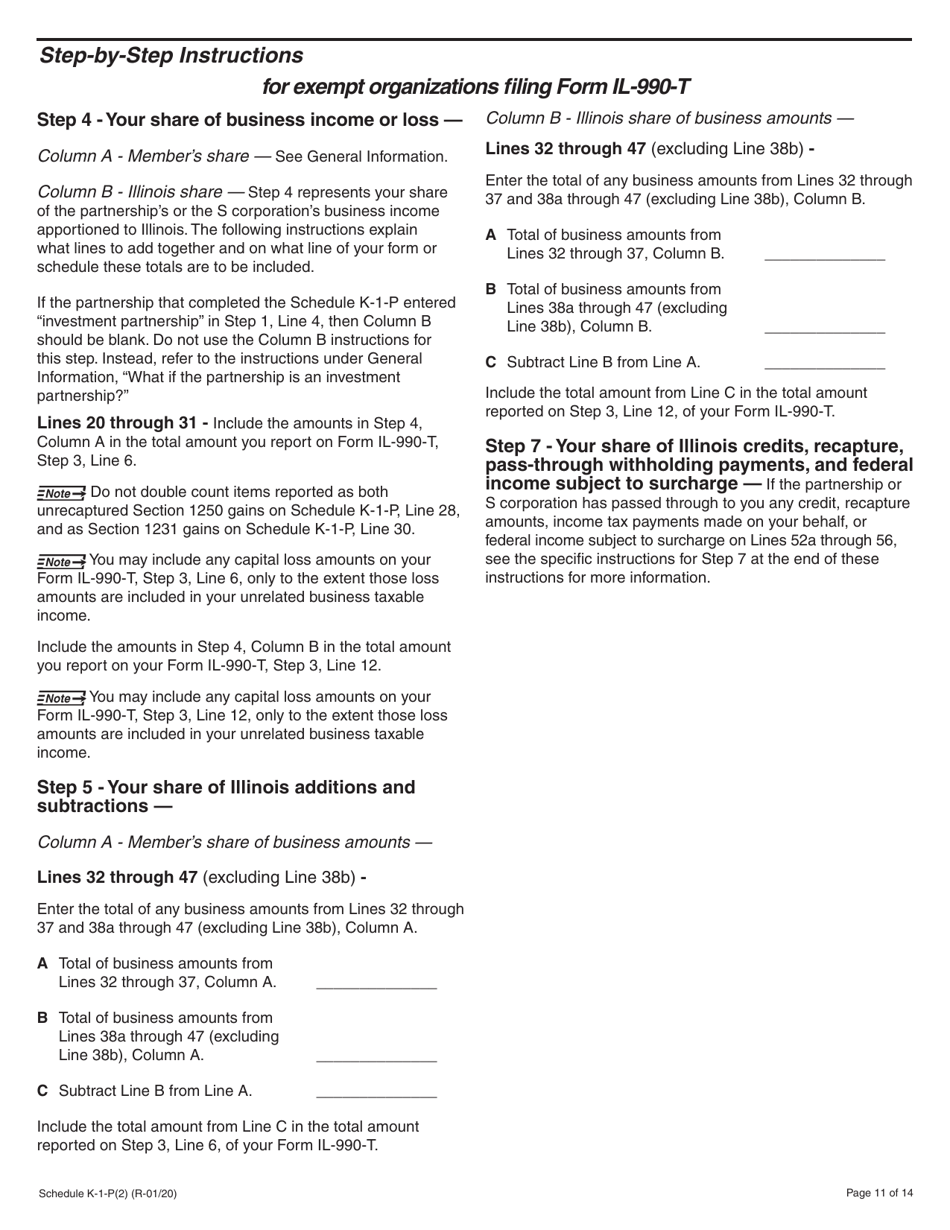

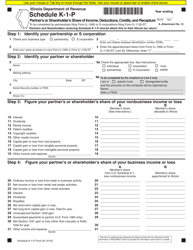

Instructions for Schedule K-1-P(2) Partner's or Shareholder's Share of Income, Deductions, Credits, and Recapture - Illinois

This document contains official instructions for Schedule K-1-P(2) , Partner's or Shareholder's Share of Income, Deductions, Credits, and Recapture - a form released and collected by the Illinois Department of Revenue.

FAQ

Q: What is Schedule K-1-P(2)?

A: Schedule K-1-P(2) is a tax form used to report a partner's or shareholder's share of income, deductions, credits, and recapture for Illinois state taxes.

Q: Who needs to file Schedule K-1-P(2)?

A: Partners or shareholders in Illinois partnerships, limited liability companies (LLCs), and S corporations need to file Schedule K-1-P(2).

Q: What information is reported on Schedule K-1-P(2)?

A: Schedule K-1-P(2) reports the partner's or shareholder's share of income, deductions, credits, and recapture for Illinois state taxes.

Q: When is the deadline to file Schedule K-1-P(2)?

A: The deadline to file Schedule K-1-P(2) is the same as the deadline for your Illinois state tax return, which is typically April 15th.

Q: What happens if I don't file Schedule K-1-P(2)?

A: If you are required to file Schedule K-1-P(2) and fail to do so, you may be subject to penalties and interest on any unpaid taxes owed.

Q: Can I e-file Schedule K-1-P(2)?

A: Yes, you can e-file Schedule K-1-P(2) along with your Illinois state tax return.

Q: Do I need to include a copy of Schedule K-1-P(2) with my federal tax return?

A: No, Schedule K-1-P(2) is specific to Illinois state taxes and does not need to be included with your federal tax return.

Q: Can I request an extension to file Schedule K-1-P(2)?

A: Yes, you can request an extension to file Schedule K-1-P(2) by filing Form IL-505-I, Automatic Extension Payment for Individuals.

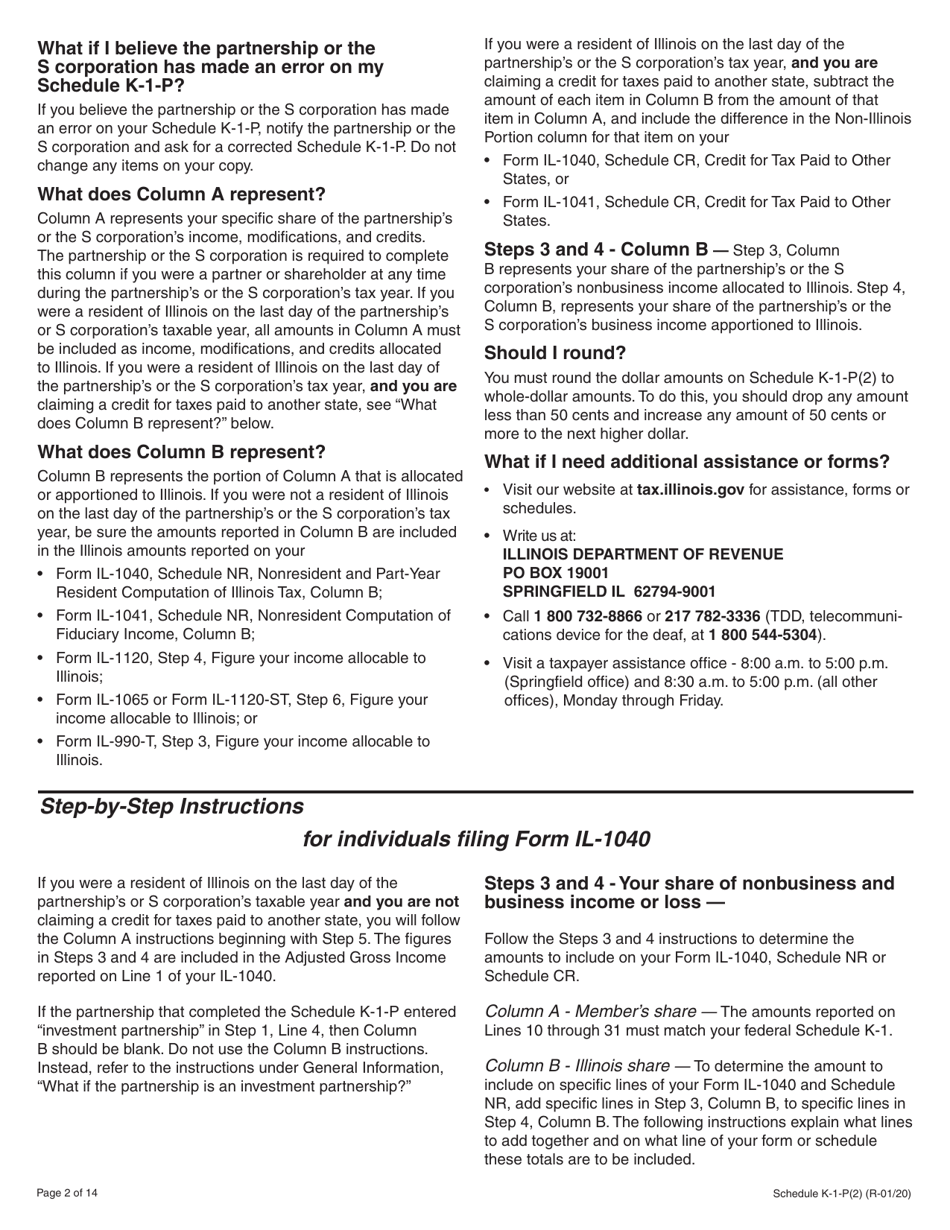

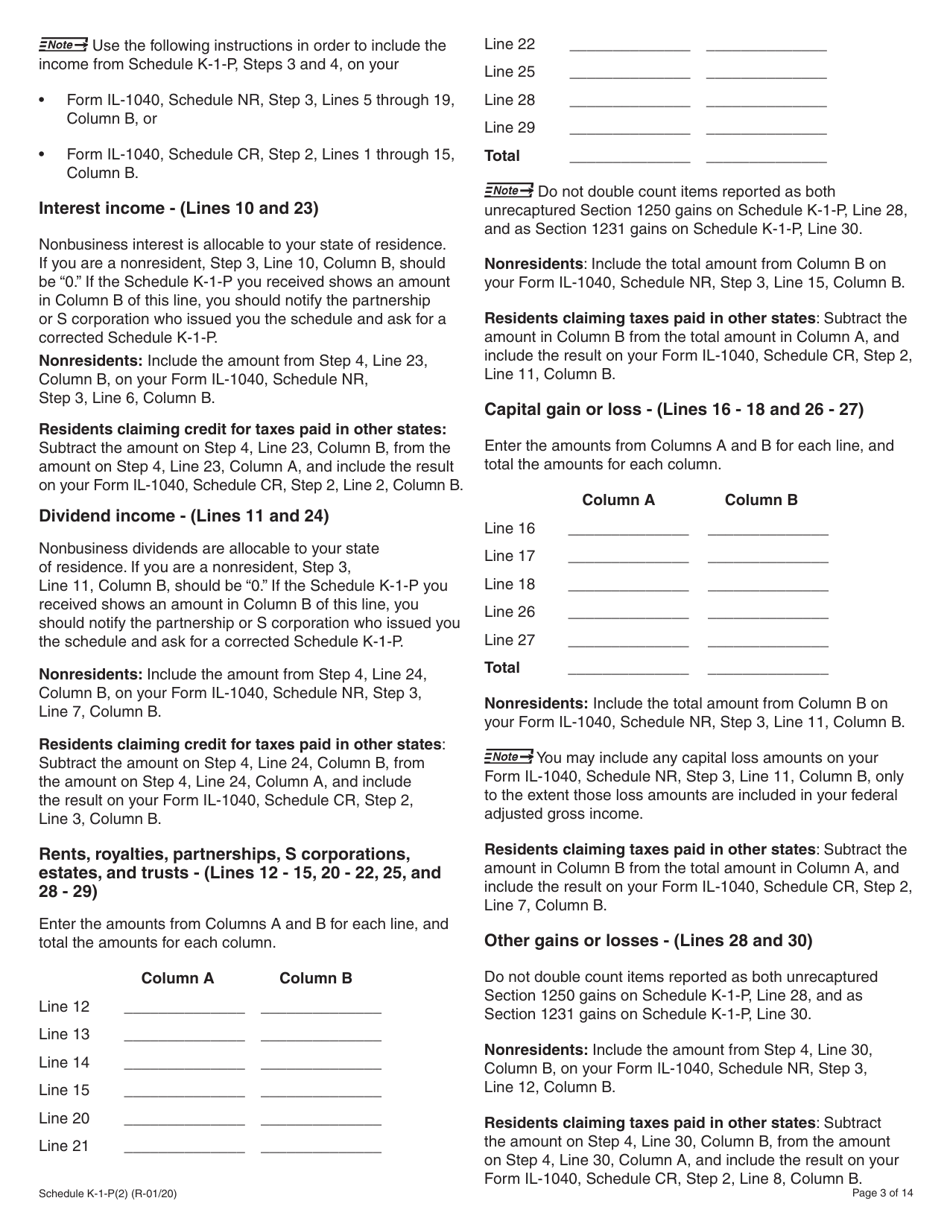

Q: How do I report the information from Schedule K-1-P(2) on my Illinois state tax return?

A: You will report the information from Schedule K-1-P(2) on the appropriate lines of your Illinois state tax return, following the instructions provided by the Illinois Department of Revenue.

Instruction Details:

- This 14-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.