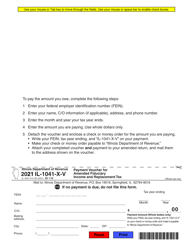

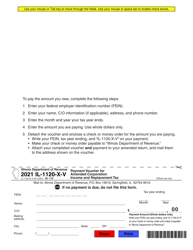

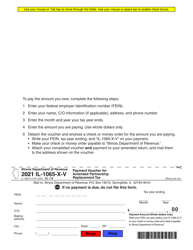

This version of the form is not currently in use and is provided for reference only. Download this version of

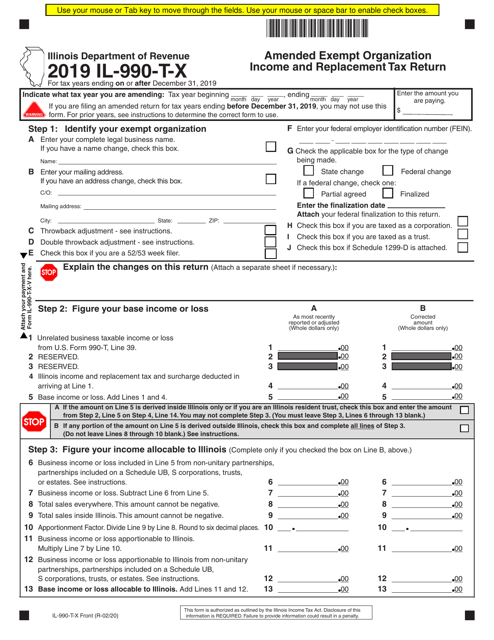

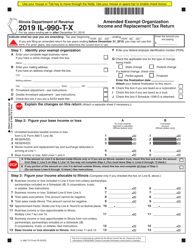

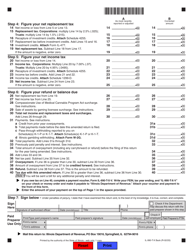

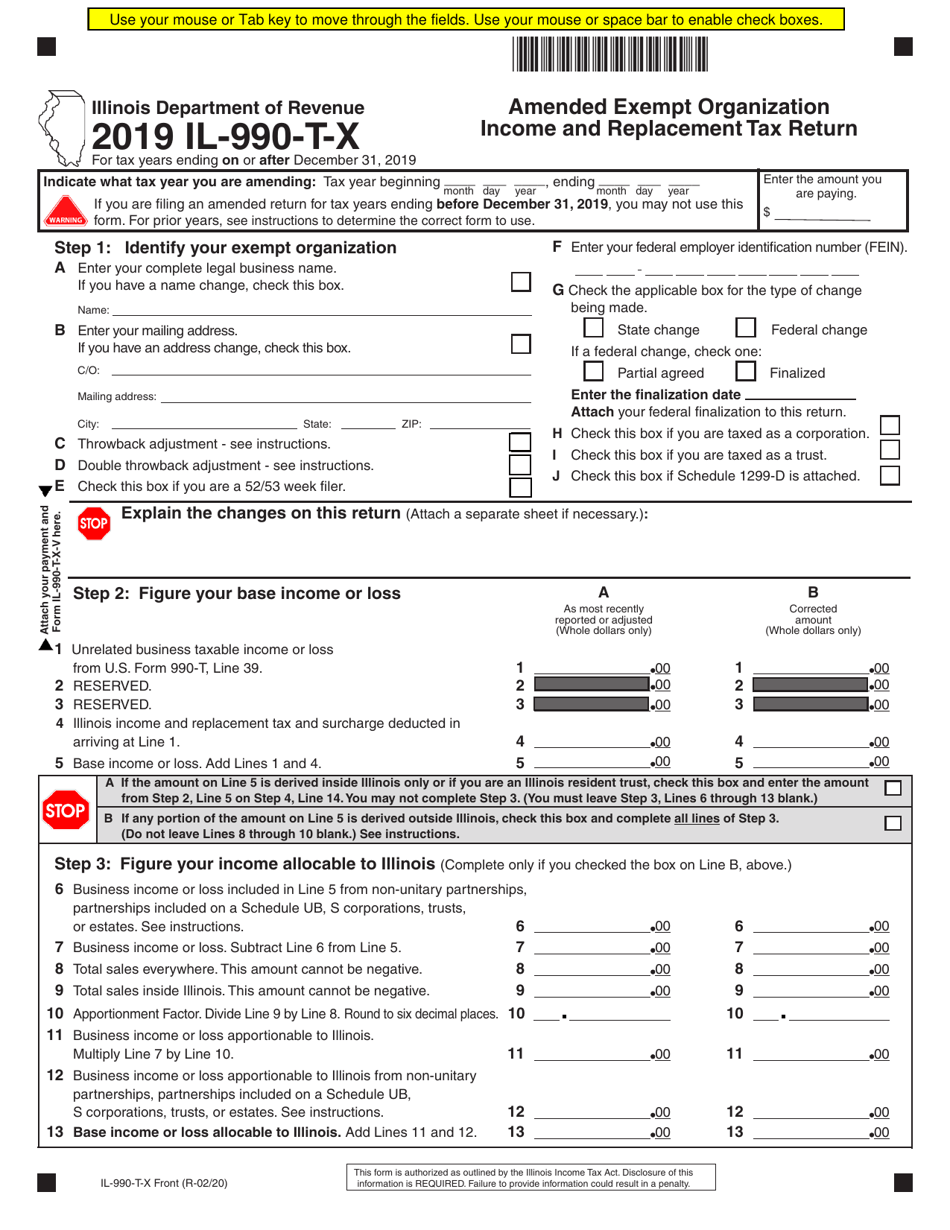

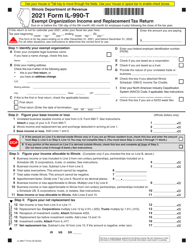

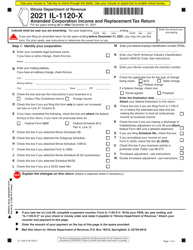

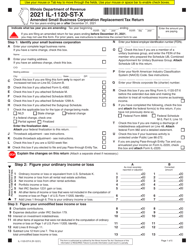

Form IL-990-T-X

for the current year.

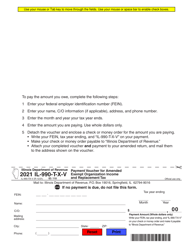

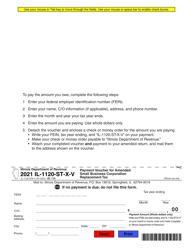

Form IL-990-T-X Amended Exempt Organization Income and Replacement Tax Return - Illinois

What Is Form IL-990-T-X?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-990-T-X?

A: Form IL-990-T-X is the Amended Exempt Organization Income and Replacement Tax Return for organizations in Illinois.

Q: Who needs to file Form IL-990-T-X?

A: Organizations that are exempt from federal income tax and operate in Illinois need to file Form IL-990-T-X if they have income or owe replacement tax.

Q: What is the purpose of Form IL-990-T-X?

A: The purpose of Form IL-990-T-X is to report and amend the income and replacement tax liabilities of exempt organizations in Illinois.

Q: When is Form IL-990-T-X due?

A: Form IL-990-T-X is due on the 15th day of the 5th month following the close of the organization's fiscal year.

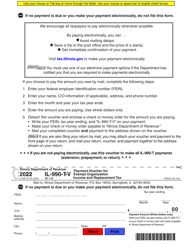

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-990-T-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.