This version of the form is not currently in use and is provided for reference only. Download this version of

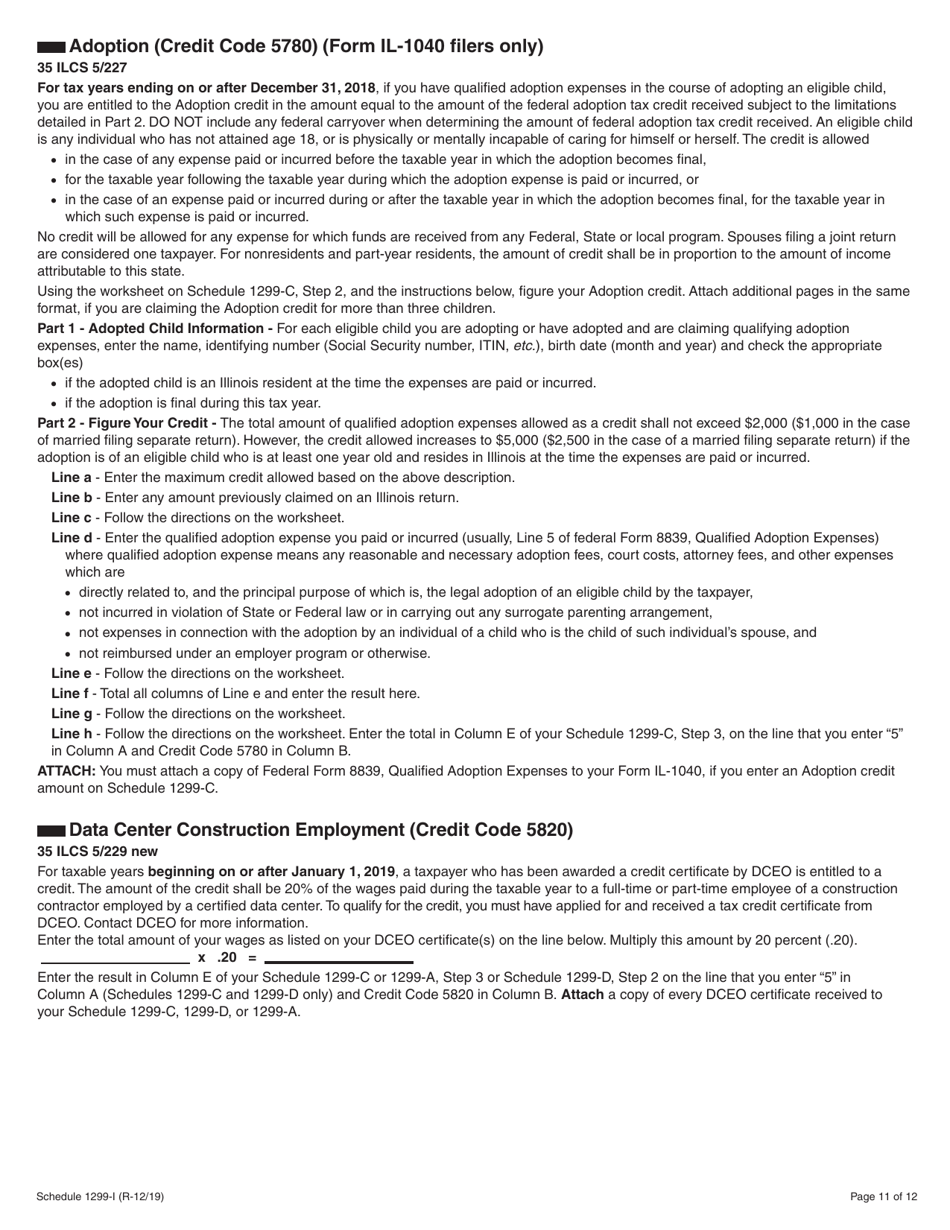

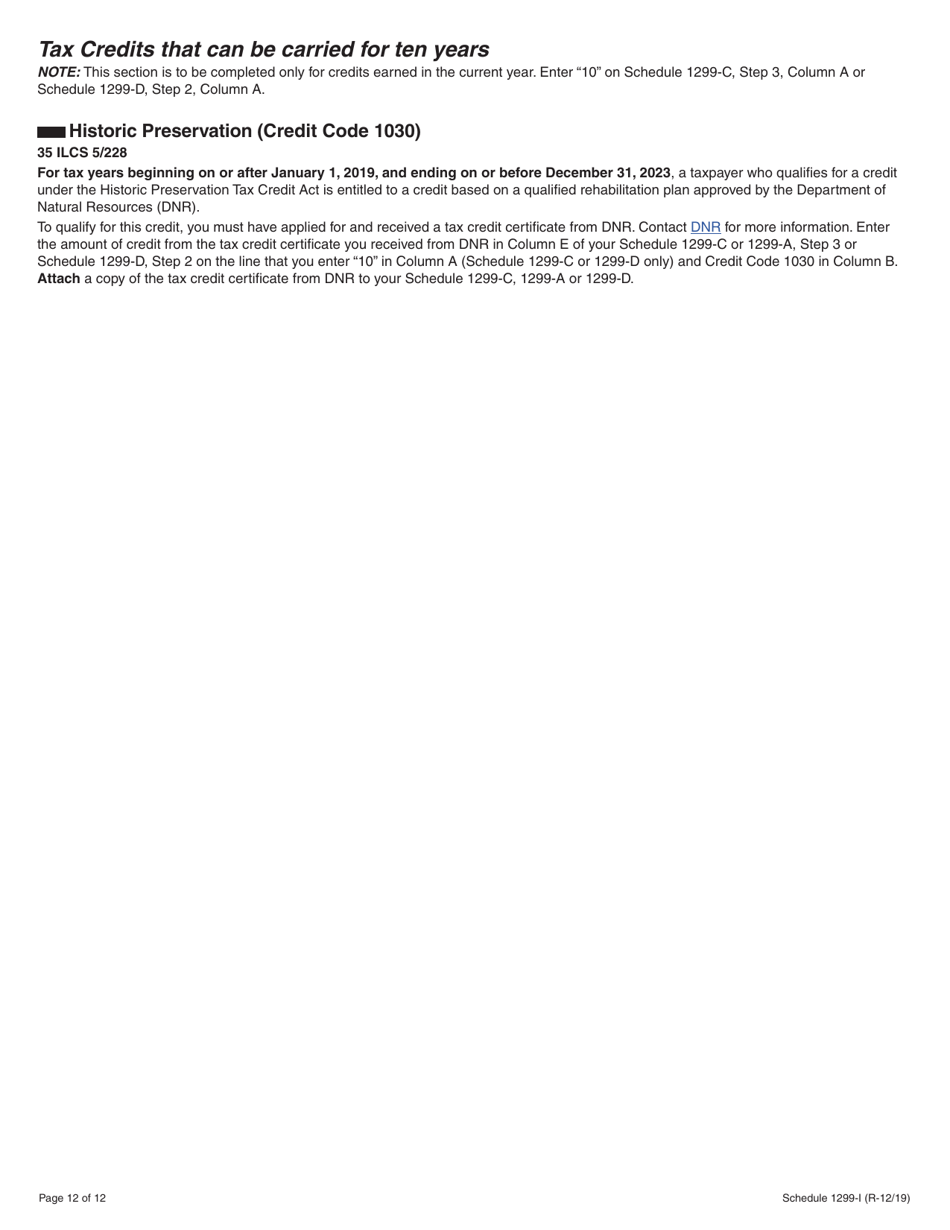

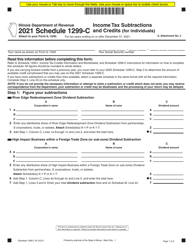

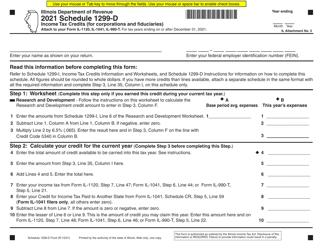

Schedule 1299-I

for the current year.

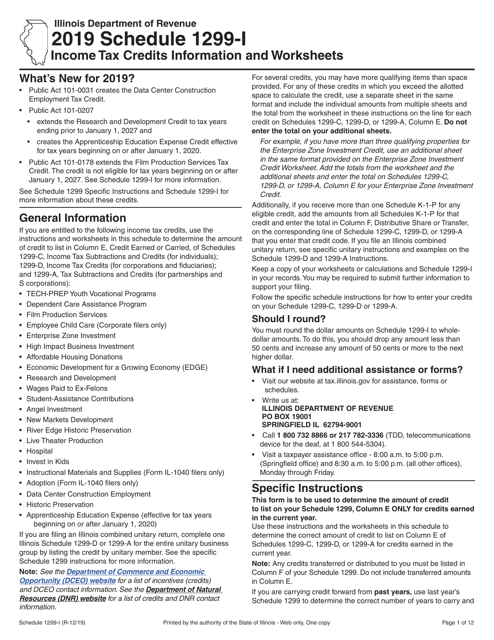

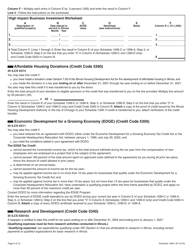

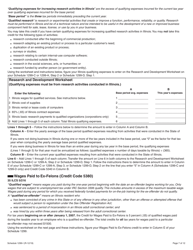

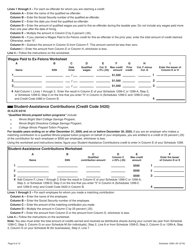

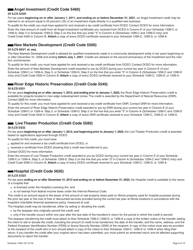

Schedule 1299-I Income Tax Credits Information and Worksheets - Illinois

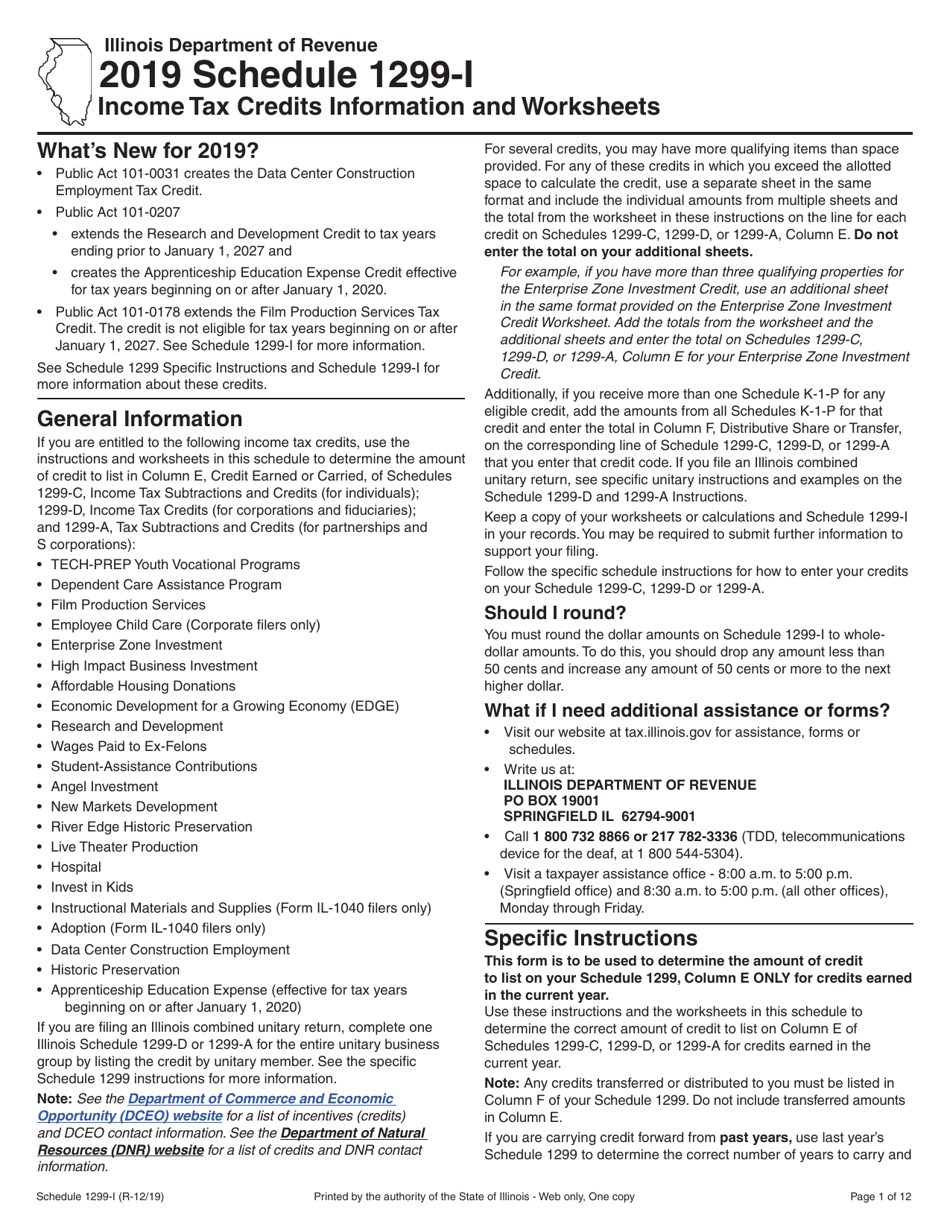

What Is Schedule 1299-I?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

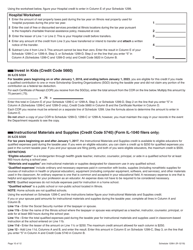

Q: What is Schedule 1299-I?

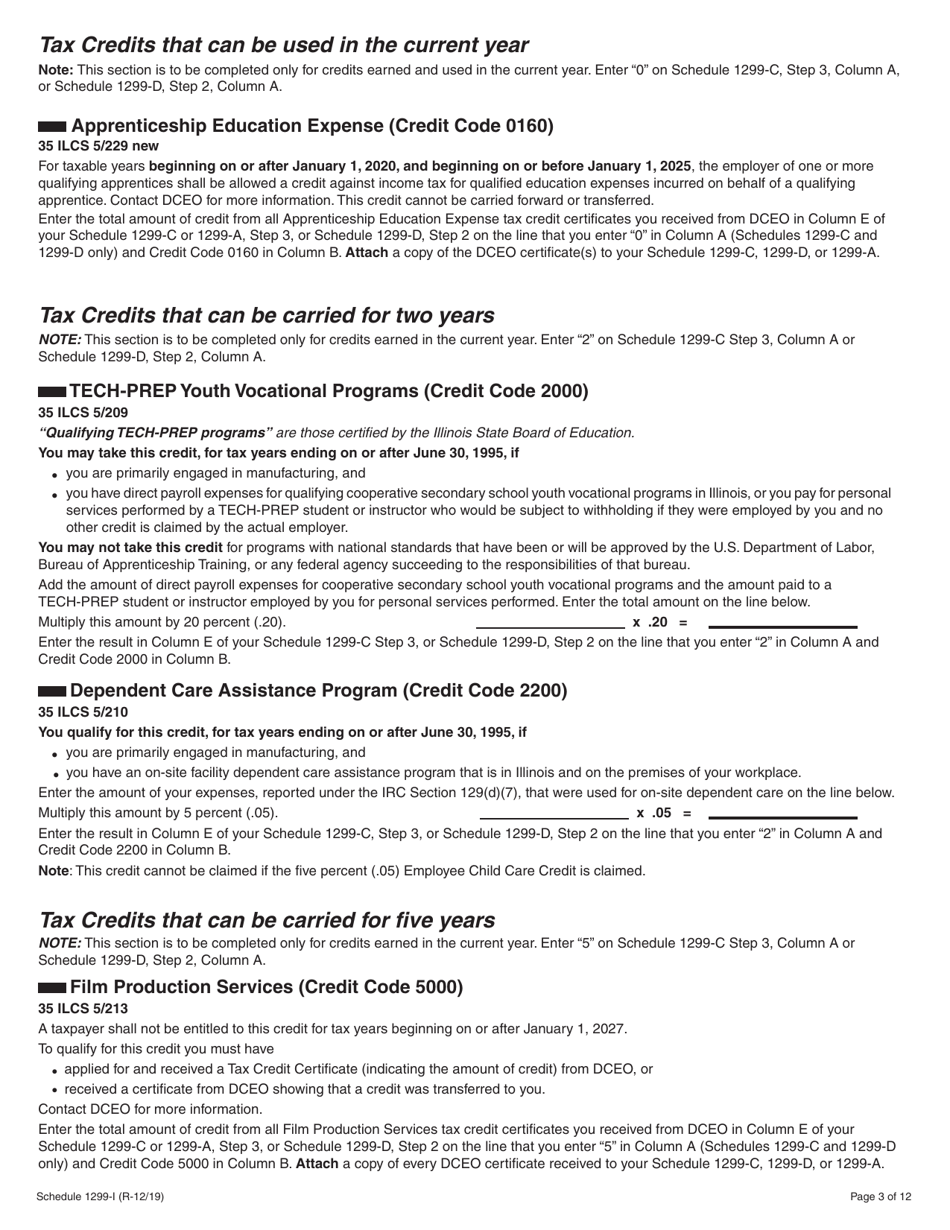

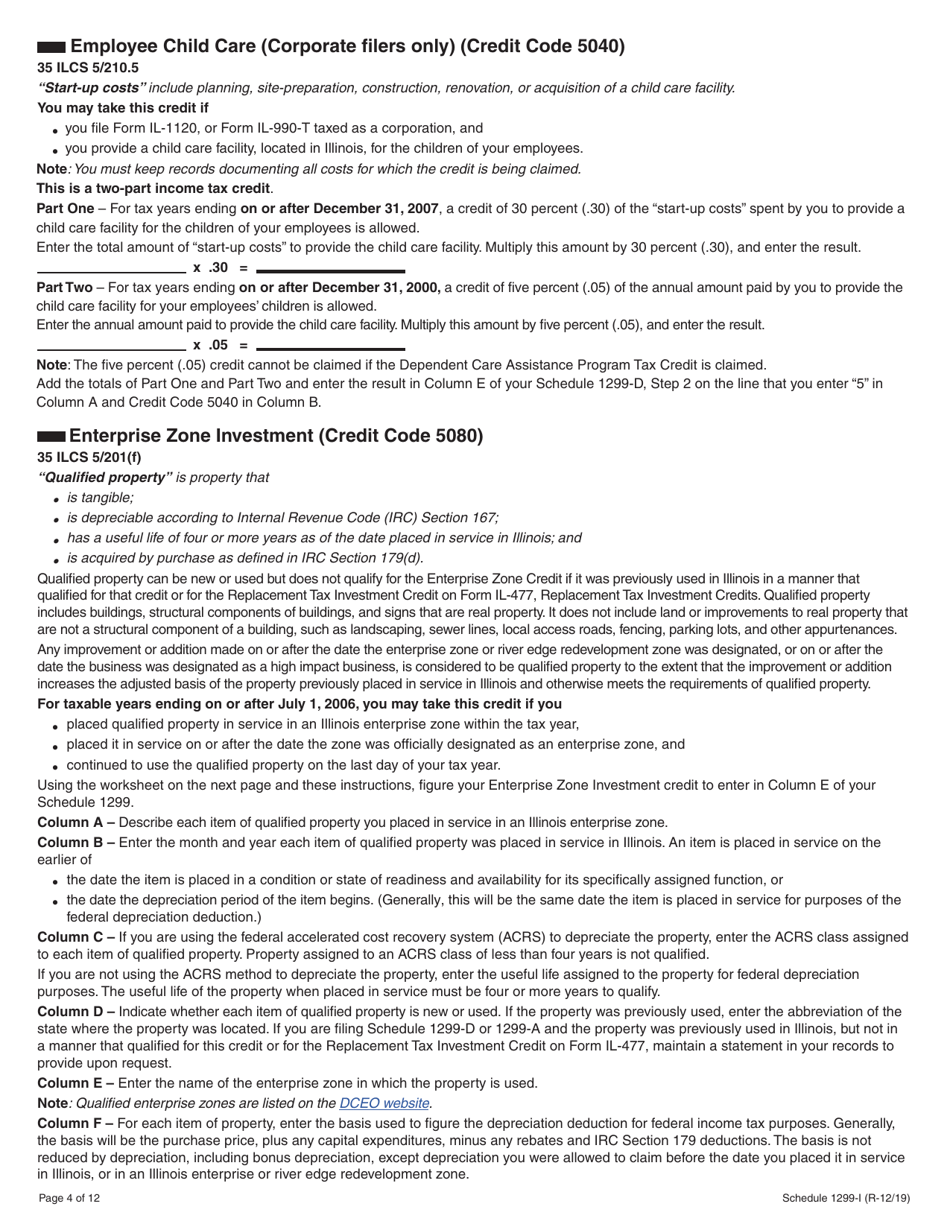

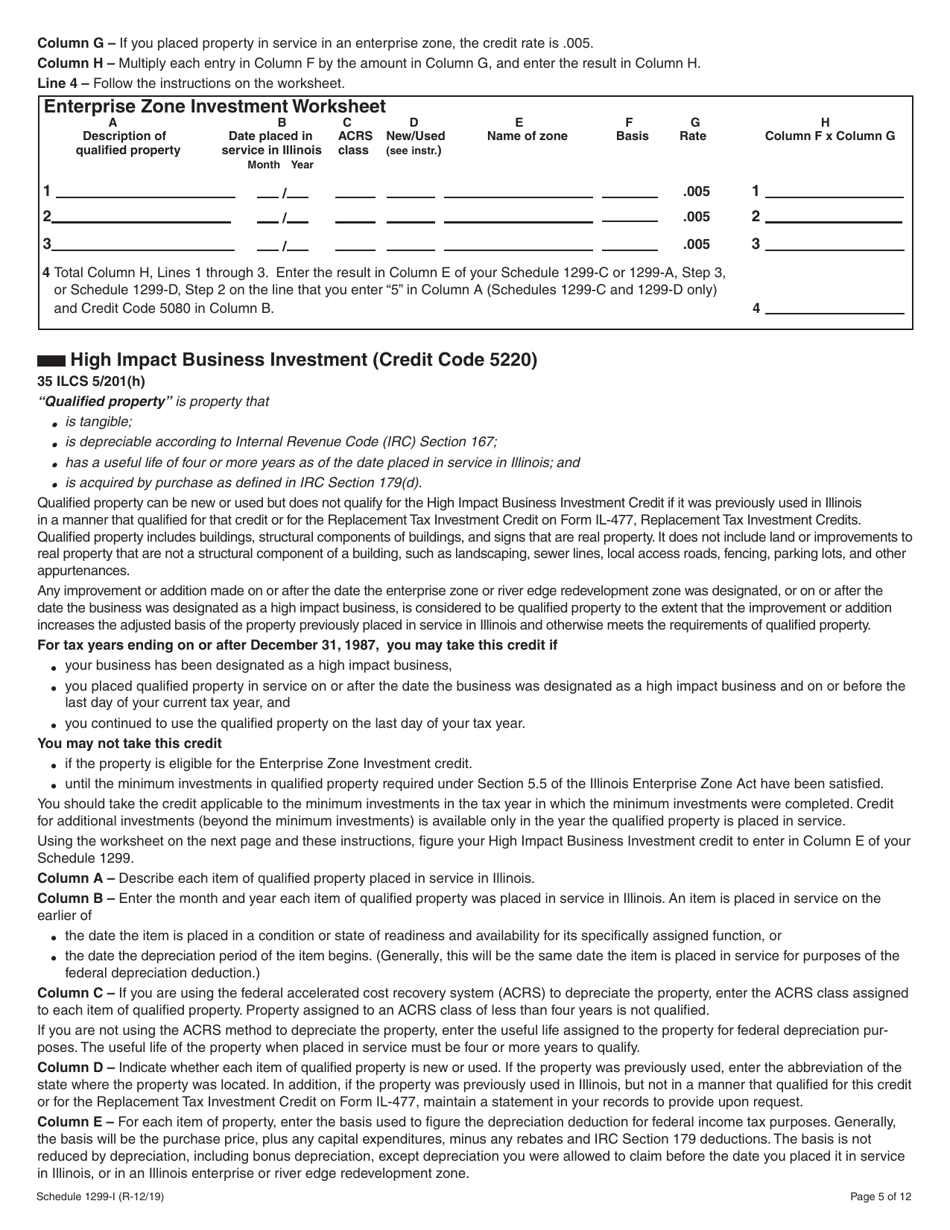

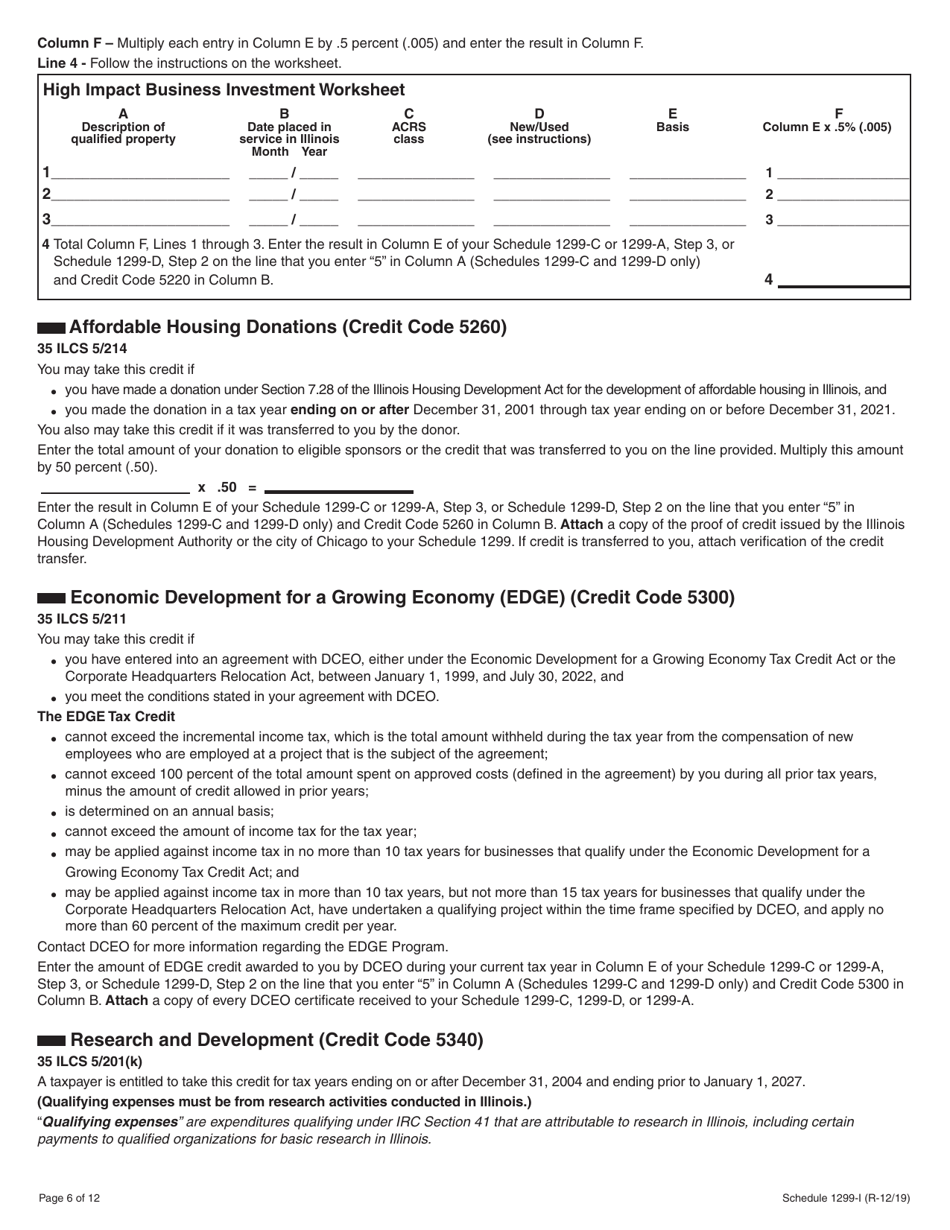

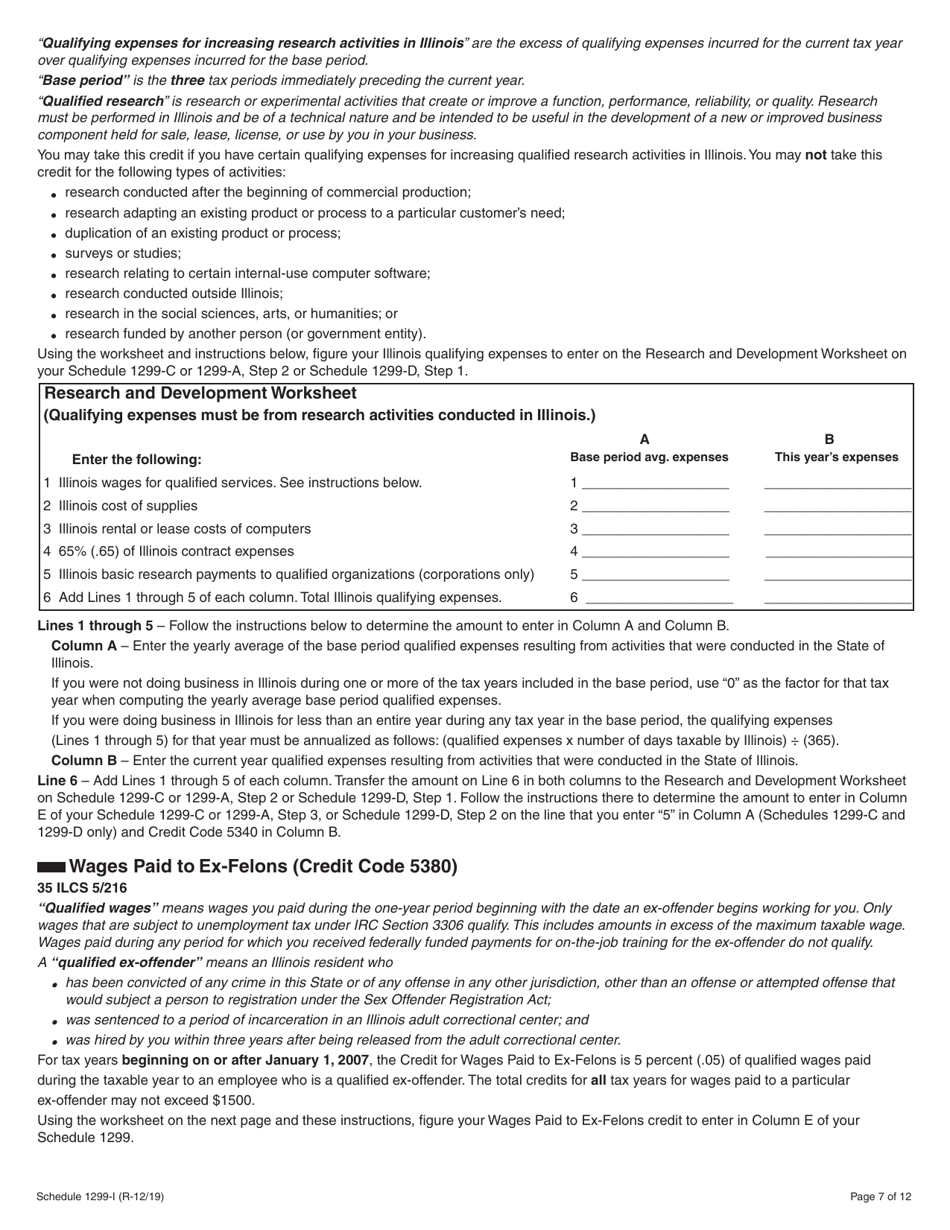

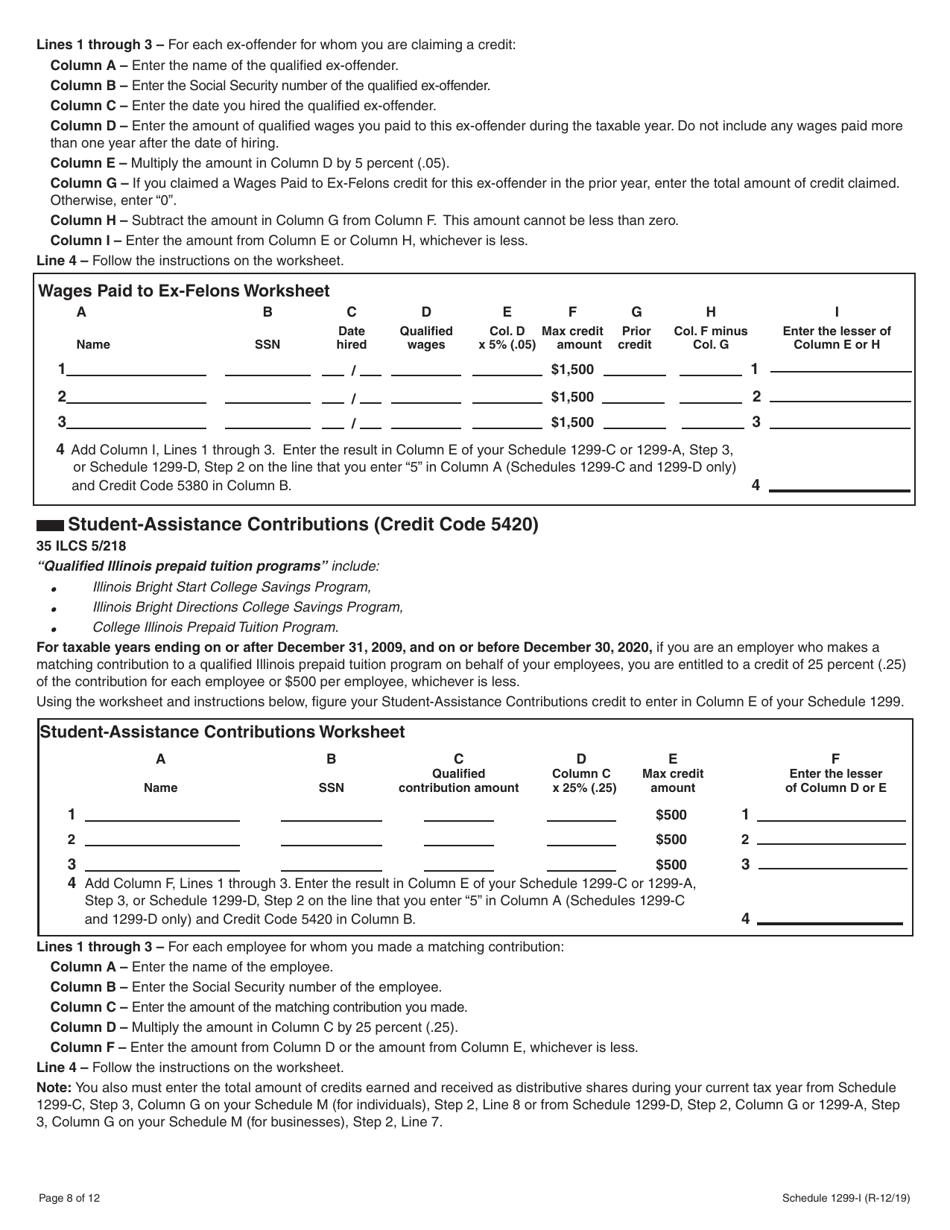

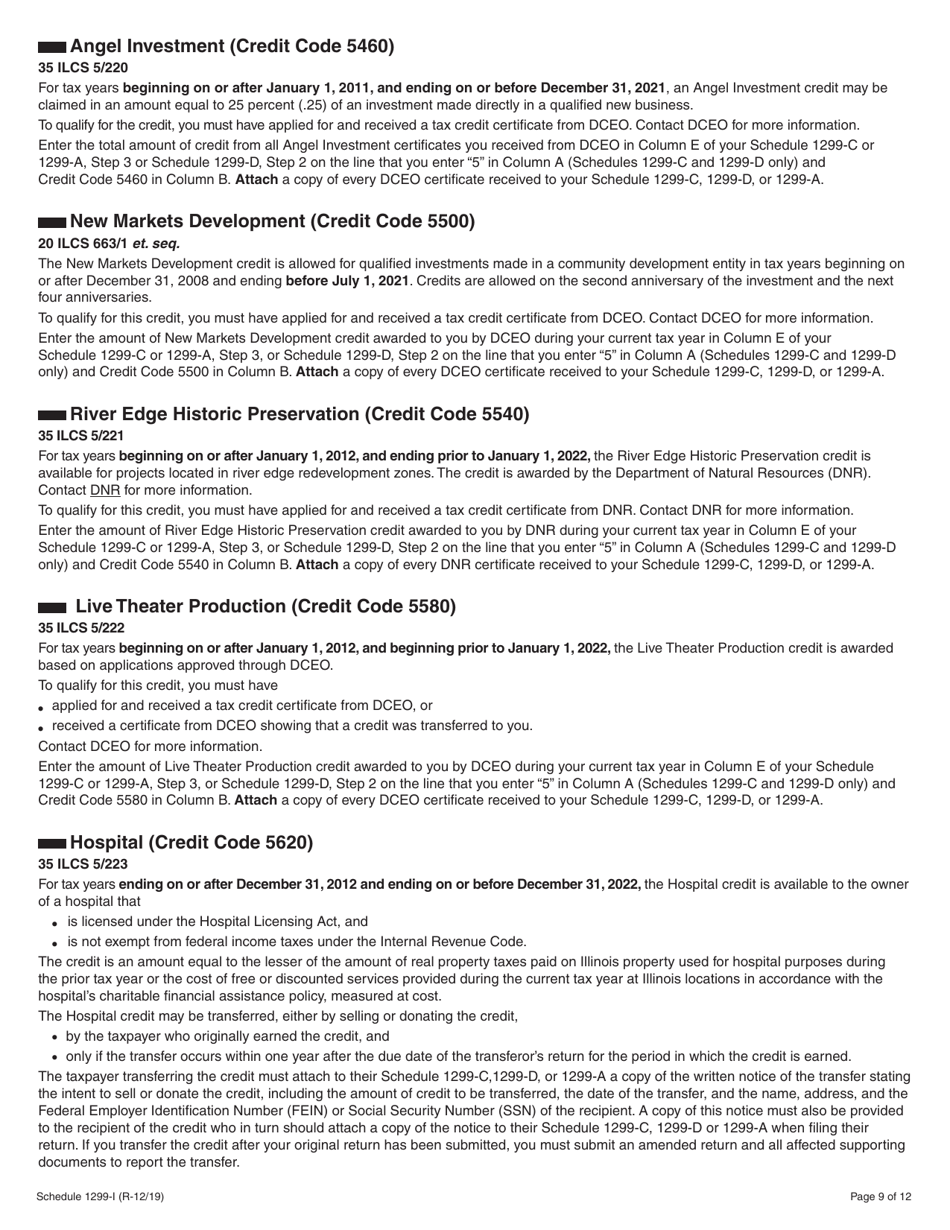

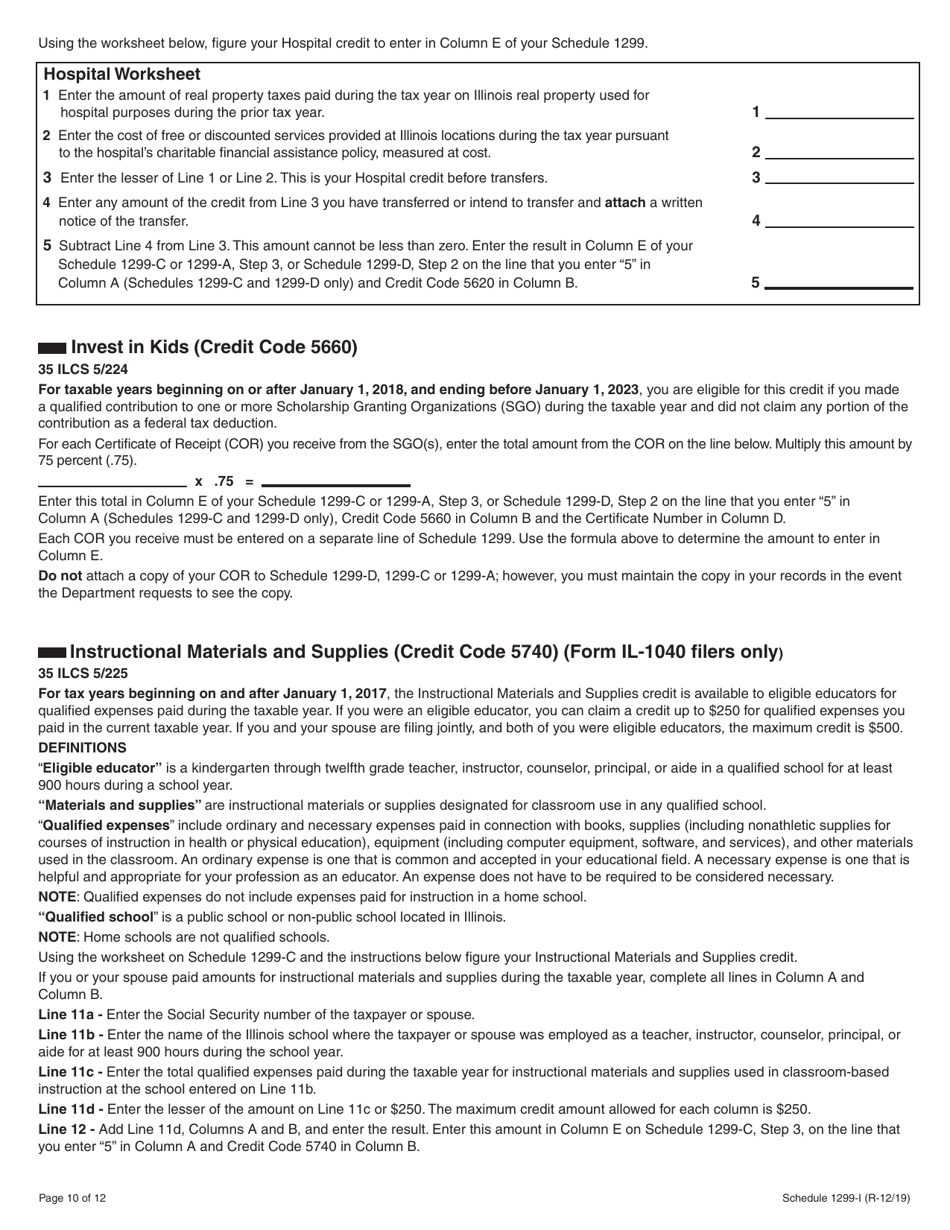

A: Schedule 1299-I is a form used to provide information and worksheets for income tax credits in the state of Illinois.

Q: Who needs to complete Schedule 1299-I?

A: Illinois residents who are claiming income tax credits on their state tax return may need to complete Schedule 1299-I.

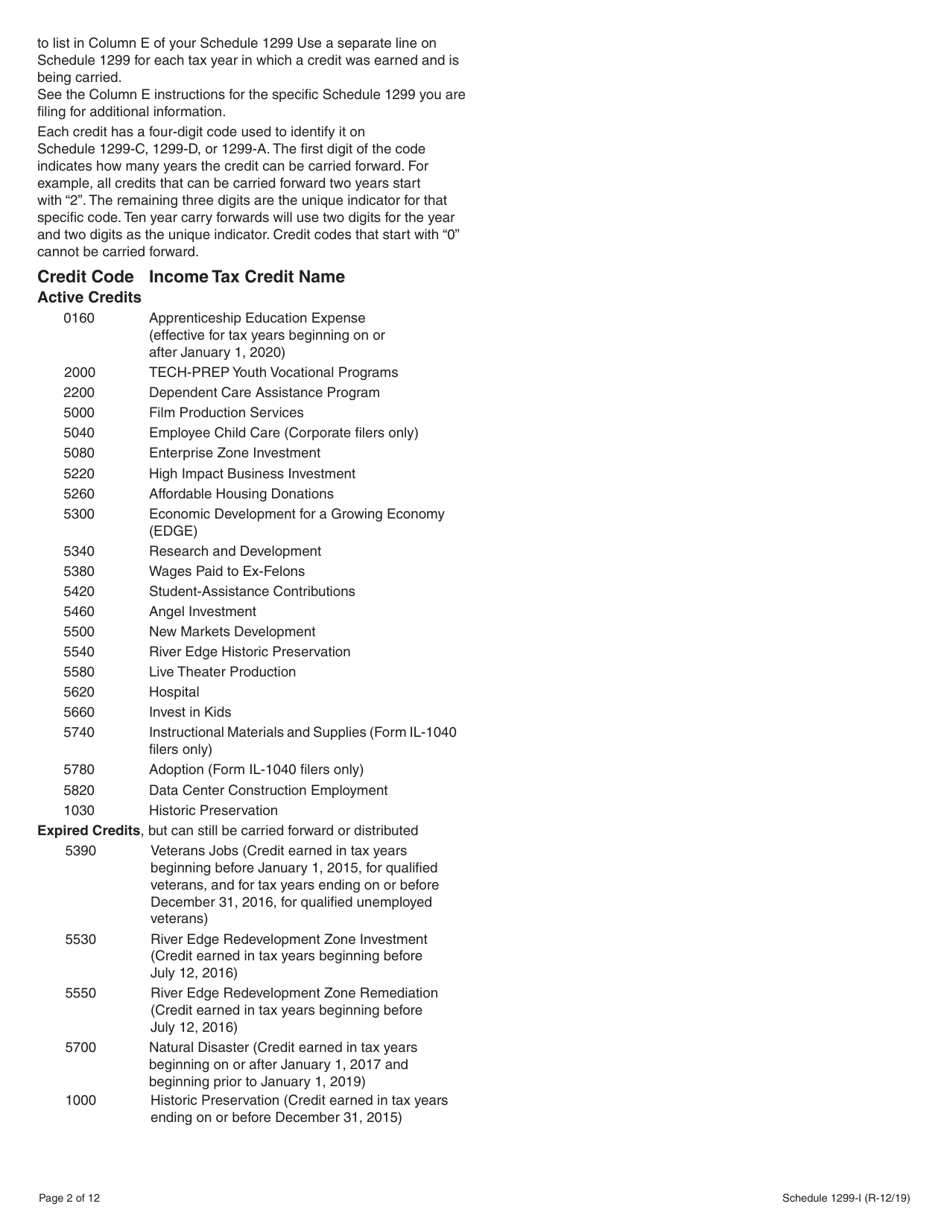

Q: What information is required on Schedule 1299-I?

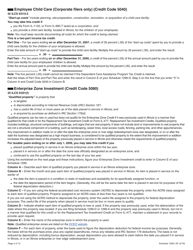

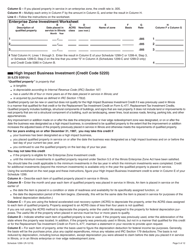

A: Schedule 1299-I requires information about the specific income tax credits being claimed, such as the credit name, amount, and any supporting documentation.

Q: Do I need to include Schedule 1299-I with my state tax return?

A: If you are claiming income tax credits in Illinois, you generally need to include Schedule 1299-I along with your state tax return.

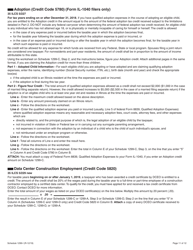

Q: Can I claim multiple income tax credits on Schedule 1299-I?

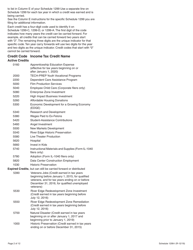

A: Yes, Schedule 1299-I allows you to claim multiple income tax credits by providing separate worksheets for each credit.

Q: Are there any special instructions for completing Schedule 1299-I?

A: Yes, the instructions for Schedule 1299-I provide details on how to complete each section of the form and what supporting documentation may be required.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule 1299-I by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.