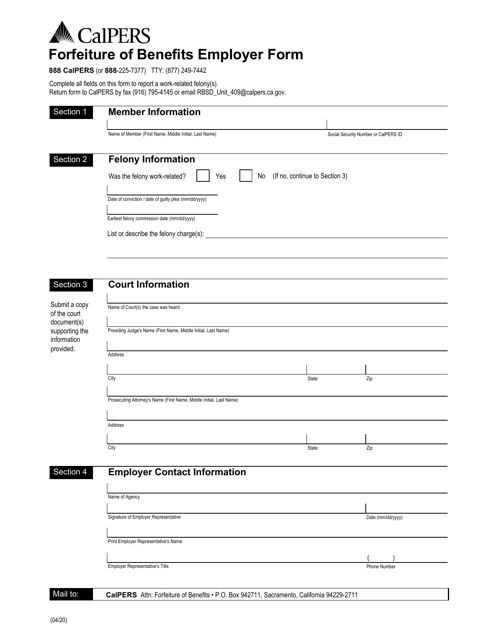

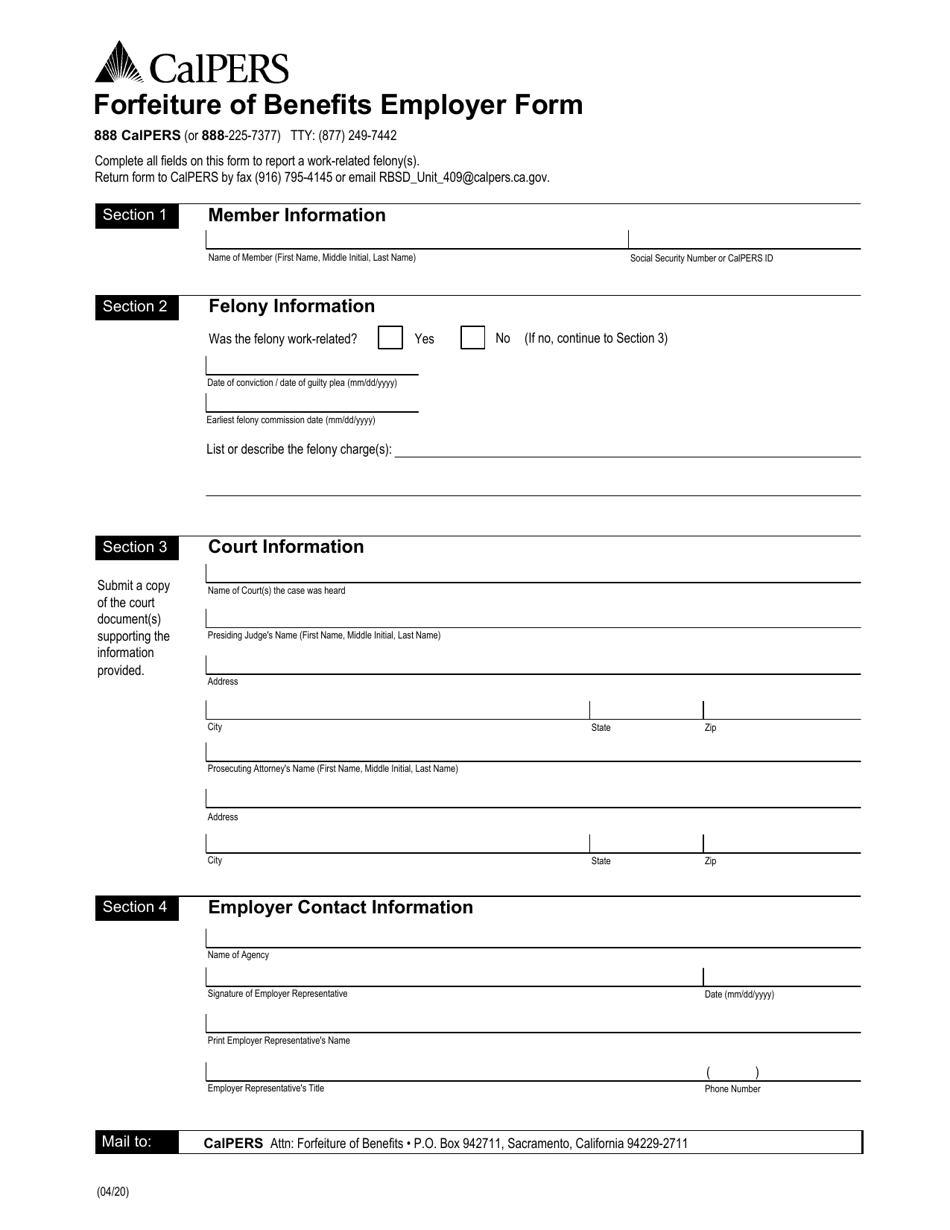

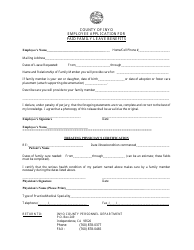

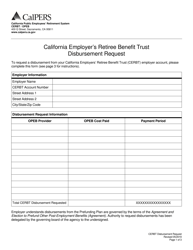

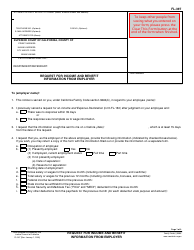

Forfeiture of Benefits Employer Form - California

Forfeiture of Benefits Employer Form is a legal document that was released by the California Public Employees' Retirement System - a government authority operating within California.

FAQ

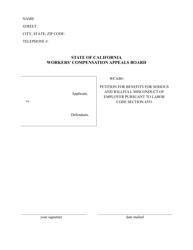

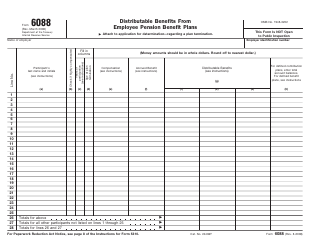

Q: What is the Forfeiture of Benefits Employer Form?

A: The Forfeiture of Benefits Employer Form is a document used by employers in California to report an employee's disqualification from receiving unemployment insurance benefits.

Q: When should the Forfeiture of Benefits Employer Form be used?

A: The form should be used when an employer believes that an employee has engaged in misconduct that would disqualify them from receiving unemployment benefits.

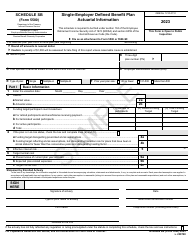

Q: What information is required on the Forfeiture of Benefits Employer Form?

A: The form requires information about the employee, including their name, Social Security number, and the reason for the disqualification.

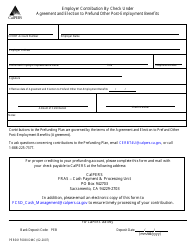

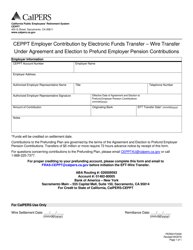

Q: How should the completed Forfeiture of Benefits Employer Form be submitted?

A: The completed form should be submitted to the EDD by mail or fax, as instructed on the form.

Q: What happens after the Forfeiture of Benefits Employer Form is submitted?

A: After the form is submitted, the EDD will review the information and make a determination regarding the employee's eligibility for benefits.

Q: Can an employer contest the decision made by the EDD?

A: Yes, an employer has the right to appeal the EDD's decision if they believe it is incorrect or unfair.

Q: Are there any penalties for providing false information on the Forfeiture of Benefits Employer Form?

A: Yes, providing false information on the form can result in penalties, including criminal prosecution and repayment of any benefits received by the employee.

Form Details:

- Released on April 1, 2020;

- The latest edition currently provided by the California Public Employees' Retirement System;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the California Public Employees' Retirement System.