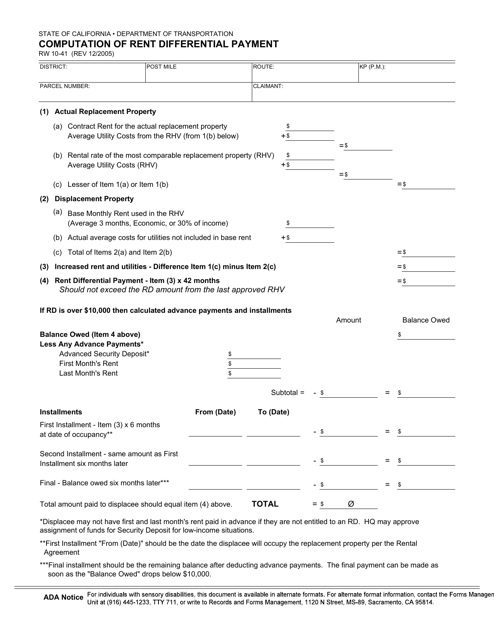

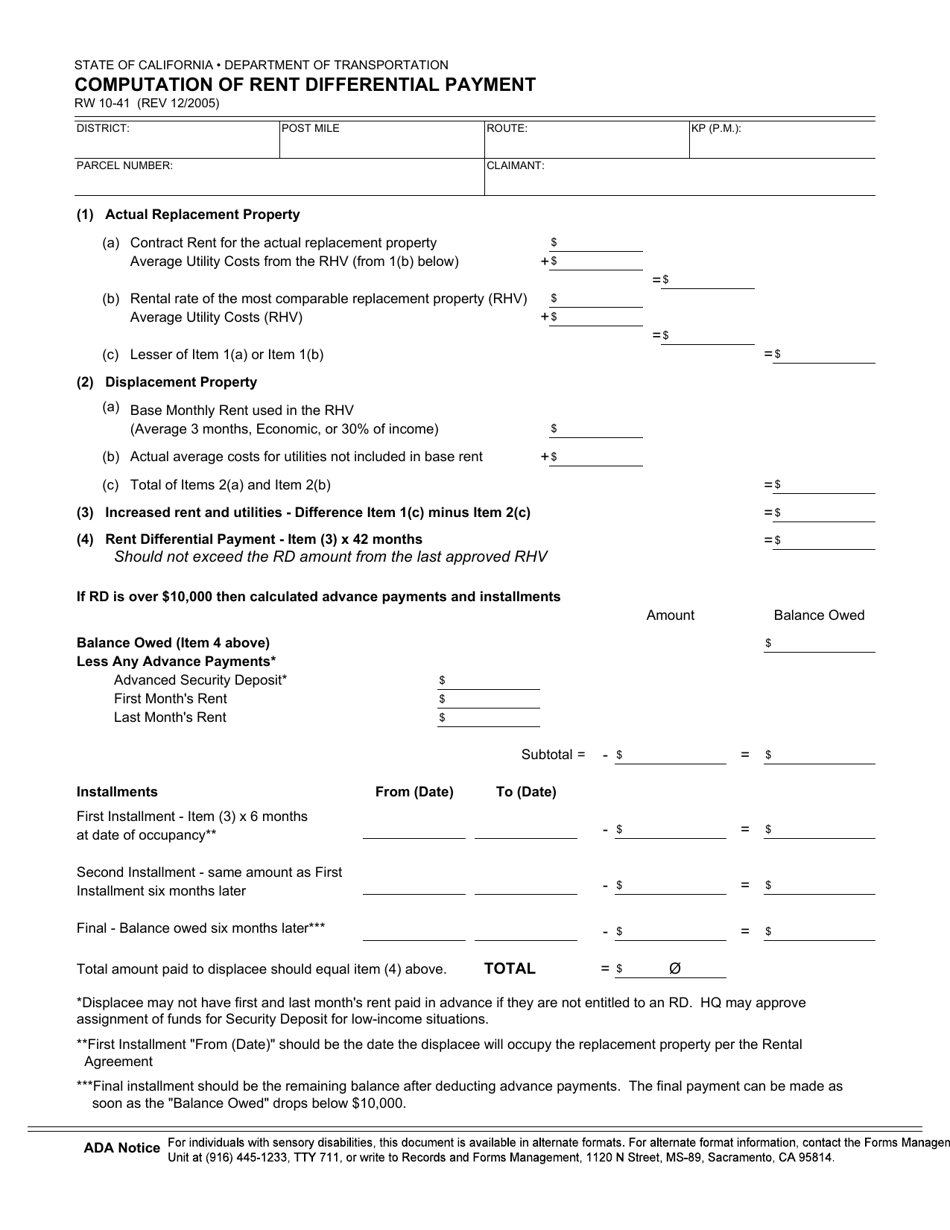

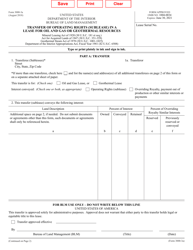

Form RW10-41 Computation of Rent Differential Payment - California

What Is Form RW10-41?

This is a legal form that was released by the California Department of Transportation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RW10-41?

A: Form RW10-41 is the Computation of Rent Differential Payment form in California.

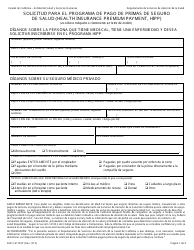

Q: What is a Rent Differential Payment?

A: Rent Differential Payment is the difference between the contract rent and the tenant's portion of the rent.

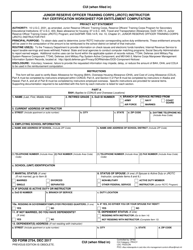

Q: Who needs to use Form RW10-41?

A: Form RW10-41 is used by landlords and tenants in California to calculate the rent differential payment.

Q: How do I fill out Form RW10-41?

A: You need to provide details about the contract rent, tenant's portion, and any applicable adjustments to calculate the rent differential payment.

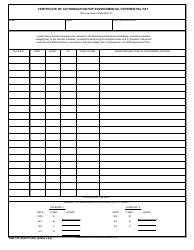

Q: When is Form RW10-41 used?

A: Form RW10-41 is used annually when there is a change in the tenant's income or other qualifying factors that affect the rent differential payment.

Q: Is there a deadline for submitting Form RW10-41?

A: Yes, the deadline for submitting Form RW10-41 is determined by the local housing agency or rental program.

Q: What happens after submitting Form RW10-41?

A: After submitting Form RW10-41, the rent differential payment will be recalculated based on the information provided.

Q: Are there any fees for submitting Form RW10-41?

A: There may be administrative fees associated with submitting Form RW10-41, which vary depending on the local housing agency or rental program.

Q: Can I make changes to Form RW10-41 after submission?

A: Changes to Form RW10-41 can be made within a specified timeframe, usually before the deadline for submission.

Form Details:

- Released on December 1, 2005;

- The latest edition provided by the California Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RW10-41 by clicking the link below or browse more documents and templates provided by the California Department of Transportation.