This version of the form is not currently in use and is provided for reference only. Download this version of

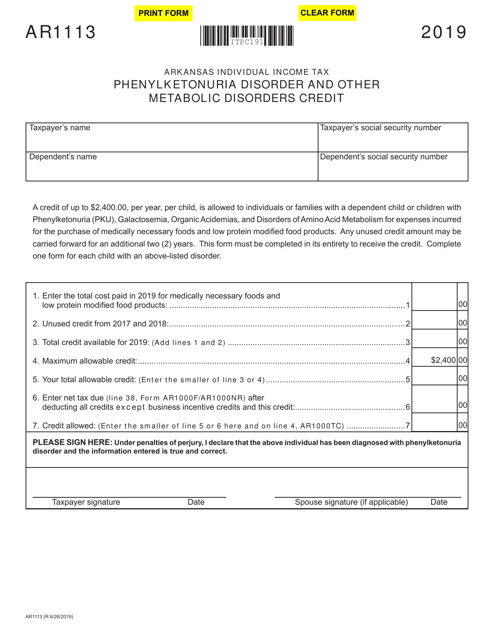

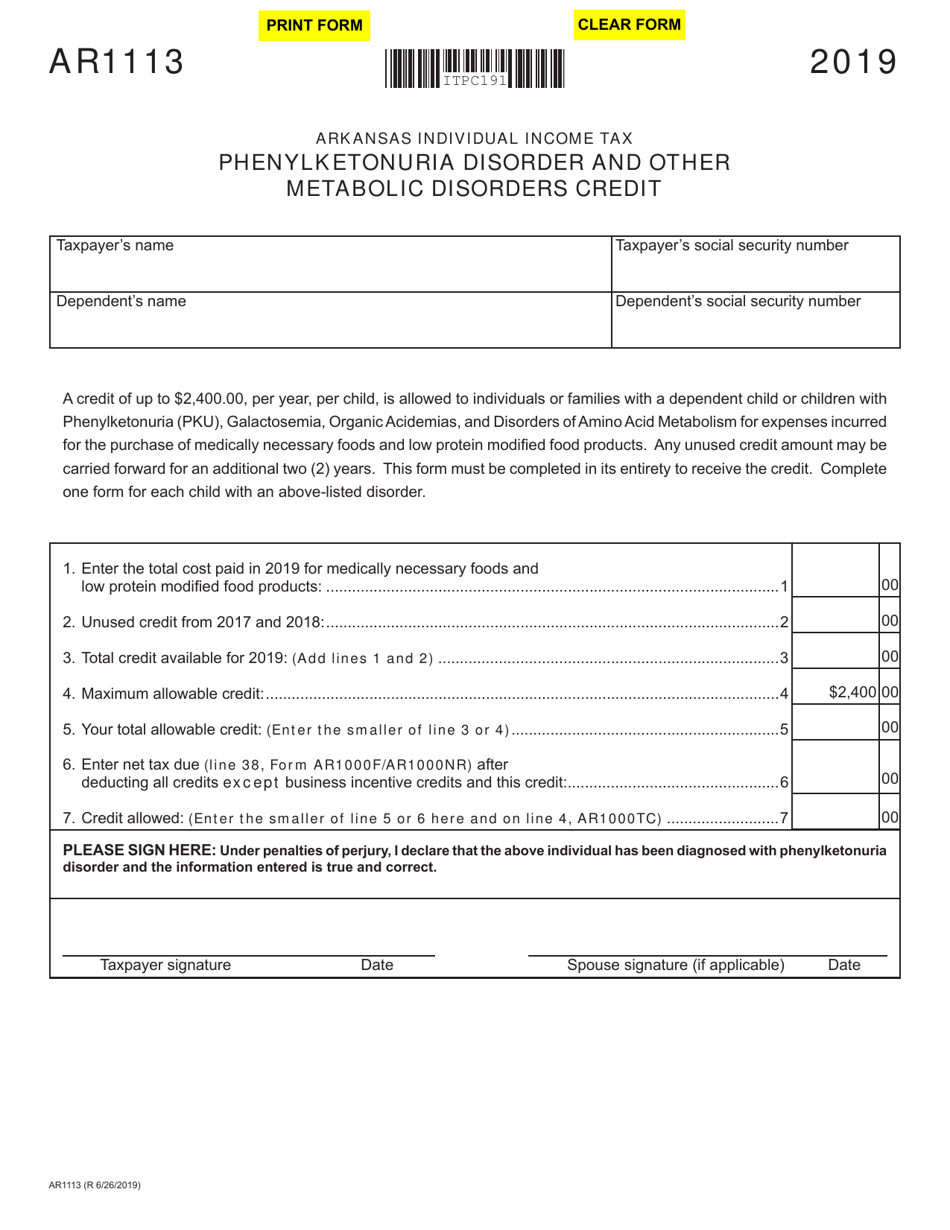

Form AR1113

for the current year.

Form AR1113 Phenylketonuria Disorder and Other Metabolic Disorders Credit - Arkansas

What Is Form AR1113?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR1113?

A: Form AR1113 is a tax credit form in Arkansas.

Q: What is Phenylketonuria?

A: Phenylketonuria (PKU) is a genetic disorder that prevents the body from processing the amino acid phenylalanine.

Q: What are metabolic disorders?

A: Metabolic disorders are conditions that affect the body's ability to convert food into energy.

Q: What is the purpose of the tax credit for Phenylketonuria disorder and other metabolic disorders in Arkansas?

A: The purpose of the tax credit is to provide financial assistance to individuals with PKU and other metabolic disorders for medical expenses.

Q: Who can claim the tax credit?

A: Individuals who have been diagnosed with PKU or other metabolic disorders and meet certain eligibility criteria can claim the tax credit.

Q: How much is the tax credit?

A: The amount of the tax credit varies and is based on the individual's qualified medical expenses.

Q: How do I claim the tax credit?

A: To claim the tax credit, you need to fill out Form AR1113 and provide documentation of your medical expenses.

Q: Is the tax credit refundable?

A: No, the tax credit is non-refundable, which means it can only be used to offset your tax liability.

Q: Are there any limitations or restrictions for claiming the tax credit?

A: Yes, there are eligibility criteria and limitations on expenses that can be claimed. It is advisable to consult with a tax professional for specific details.

Form Details:

- Released on June 26, 2019;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1113 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.